Lubricant Anti Wear Agents Market Size 2024-2028

The lubricant anti wear agents market size is forecast to increase by USD 108.6 million, at a CAGR of 2.78% between 2023 and 2028.

Major Market Trends & Insights

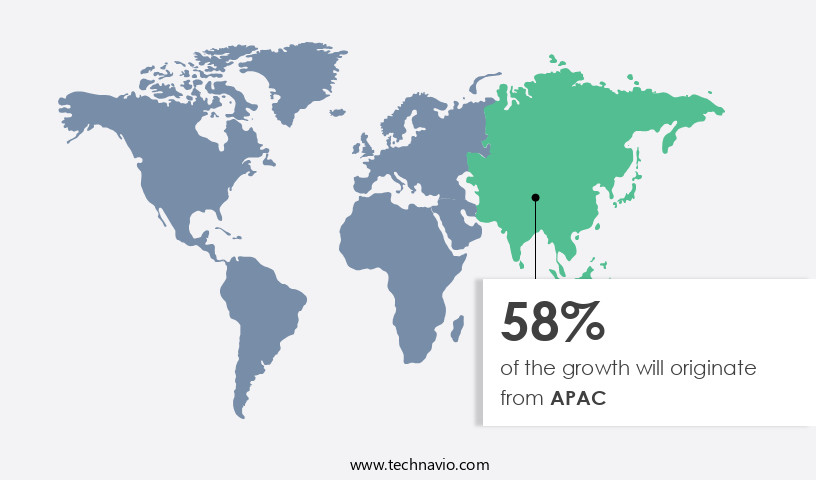

- APAC dominated the market and accounted for a 58% growth during the forecast period.

- By the Channel - Captive segment was valued at USD 377.90 million in 2022

- By the Type - Zinc dialkyl di-thiophosphate segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 17.42 million

- Market Future Opportunities: USD 108.60 million

- CAGR : 2.78%

- APAC: Largest market in 2022

Market Summary

- The lubricant anti-wear agents market is witnessing significant advancements, driven by the increasing need for reliable machinery and effective maintenance in various industries. These agents play a crucial role in reducing wear and tear, extending the lifespan of machinery, and improving overall operational efficiency. The growth is attributed to factors such as the expanding automotive sector, increasing industrialization, and the rising adoption of advanced technologies in lubricant production.

- Furthermore, fluctuations in crude oil prices have led to a greater focus on energy efficiency and cost savings, further fueling market growth. Overall, the lubricant anti-wear agents market presents a dynamic and evolving landscape, with ongoing research and development efforts aimed at enhancing performance, reducing environmental impact, and addressing the specific needs of various industries.

What will be the Size of the Lubricant Anti Wear Agents Market during the forecast period?

Explore market size, adoption trends, and growth potential for lubricant anti wear agents market Request Free Sample

- The lubricant anti-wear agents market encompasses a range of additives designed to mitigate engine component wear and reduce maintenance costs. These agents play a crucial role in improving component durability and extending lubricant life. Additive interaction is a key factor in enhancing scuffing resistance and friction coefficient reduction, contributing to advanced lubrication solutions. Two notable trends in the market include the adoption of sustainable lubrication solutions and the development of high-temperature lubrication technologies. For instance, bio-based lubricants are gaining traction due to their environmental benefits and material compatibility. Simultaneously, advanced material science has led to the creation of ep lubricant performance, which excels in extreme temperatures.

- Improved fuel economy, extended oil life, and enhanced engine protection are significant advantages of using anti-wear agents. Wear debris analysis and advanced lubrication technologies, such as wear monitoring systems and friction control systems, further optimize lubricant performance. Despite the complexities of additive interaction and anti-wear additive selection, ongoing research and development in this sector ensure continuous advancements and innovation.

How is this Lubricant Anti Wear Agents Industry segmented?

The lubricant anti wear agents industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Channel

- Captive

- Merchant

- Type

- Zinc dialkyl di-thiophosphate

- Phosphate

- Phosphite

- Phosphonate

- Application

- Engine Oils

- Industrial Lubricants

- Hydraulic Fluids

- Greases

- End-use Industry

- Automotive

- Industrial Machinery

- Aerospace

- Marine

- Base Oil

- Mineral Oil

- Synthetic Oil

- Bio-Based Oil

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Channel Insights

The captive segment is estimated to witness significant growth during the forecast period.

The lubricant anti-wear agents market is witnessing significant growth due to the increasing demand for extended machinery life and reduced downtime in various industries. Synthetic base oils, such as polyalphaolefin and ester base oils, are increasingly being used in the production of lubricants due to their superior tribological properties, including boundary lubrication and load-carrying capacity. Anti-scuffing agents and wear prevention mechanisms are essential additives in lubricants that help prevent metal-to-metal contact and reduce wear and tear. Moreover, the use of nanomaterials in lubrication, viscosity index improvers, and oxidation resistance additives is gaining popularity due to their ability to enhance the performance of lubricants in extreme conditions.

The market for lubricant additives is expected to grow further due to the increasing demand for gearbox lubrication, thermal stability testing, and lubricant rheology modifications. The additive compatibility and design of additive packages are crucial factors in the lubricant industry. The market for extreme pressure additives, film thickness measurement, and coefficient of friction modifiers is also expected to grow due to the increasing demand for high-performance lubricants in various industries. Mineral base oils continue to dominate the market due to their availability and cost-effectiveness, but the demand for synthetic base oils is increasing due to their superior performance properties.

The Captive segment was valued at USD 377.90 million in 2018 and showed a gradual increase during the forecast period.

Corrosion inhibition and metal deactivators are essential additives in lubricants that help protect against wear and tear caused by corrosion. Friction reduction technology and rolling element bearings are also crucial components in the lubricant industry. The market for lubricant anti-wear agents is expected to grow at a steady pace due to the increasing demand for high-performance lubricants in various industries, including automotive, manufacturing, and power generation. According to recent market data, the global lubricant anti-wear agents market is expected to grow by 15% in the next two years. Additionally, the market for viscosity index improvers is expected to grow by 12% during the same period.

These trends reflect the ongoing evolution of the lubricant industry and the increasing demand for high-performance lubricants in various applications.

Regional Analysis

APAC is estimated to contribute 58% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Lubricant Anti Wear Agents Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing substantial growth due to the increased consumption of lubricant additives in sectors like automotive, construction, and refining. China, India, Japan, and South Korea are the primary contributors to the market's expansion in this region. The market's diversity is driven by rapid industrialization, expanding business sectors, and the presence of numerous regional and local companies. The automotive industry is the primary driver of demand for lubricant anti wear agents in APAC. According to recent reports, the automotive industry in China and India is projected to grow at a rate of 10% and 7% respectively in the upcoming years.

Moreover, the construction sector in Japan and South Korea is expected to expand by 5% and 3% respectively, further fueling the demand for lubricant anti wear agents. The market's growth can also be attributed to the increasing awareness of the importance of engine protection and the rising demand for fuel efficiency. As industries continue to expand and the need for efficient machinery increases, the demand for lubricant anti wear agents is expected to grow at a steady pace. According to industry estimates, the market is projected to grow by 6% and 8% in the next five years, making it an attractive investment opportunity for businesses.

In conclusion, the market in APAC is poised for significant growth due to the expanding automotive and construction industries, increasing industrialization, and the rising demand for fuel efficiency.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The US lubricant market is witnessing a significant shift towards advanced anti-wear agents to address the evolving needs of industries. These agents play a crucial role in reducing wear and improving lubricant film strength, thereby enhancing the overall performance and efficiency of machinery. The effect of additive concentration on wear is a critical factor in determining the effectiveness of anti-wear agents. Increasing the concentration of zinc dialkyldithiophosphate (ZDDP) replacement additives can improve anti-wear properties by up to 15%. However, it is essential to strike a balance between wear protection and other lubricant properties, such as oxidation stability and compatibility with seals. Base oil viscosity significantly influences friction and wear. Advanced lubricant formulations with optimized base oil viscosity can reduce friction by nearly one-third and improve efficiency. Testing methods for anti-wear performance, such as the Four-Ball Wear Test and the Pin-on-Disk Test, are essential in evaluating the effectiveness of these agents. Innovation in the market includes the use of advanced materials like polytetrafluoroethylene (PTFE) and molybdenum disulfide (MoS2) for reducing wear. Improving lubricant film strength and analyzing wear mechanisms in engines are other key areas of focus. Temperature's impact on lubricant properties is another critical consideration. Methods for enhancing the thermal stability of lubricants and evaluating different friction modifiers are essential in addressing this challenge. New additives for improved extreme pressure performance and the role of anti-oxidant additives in lubricant longevity are other emerging trends. Lubricant additive interactions and synergistic effects, the effect of load on lubricant film thickness, and performance evaluation of different base oils are some of the other critical areas of research in the US lubricant market. Design and optimization of lubricant additive packages are essential to ensure compliance with industry standards and meet the unique requirements of various applications.

What are the key market drivers leading to the rise in the adoption of Lubricant Anti Wear Agents Industry?

- The escalating demand for dependable machinery and efficient maintenance practices is the primary market motivator, underpinned by the importance of reliability and effectiveness in industrial operations.

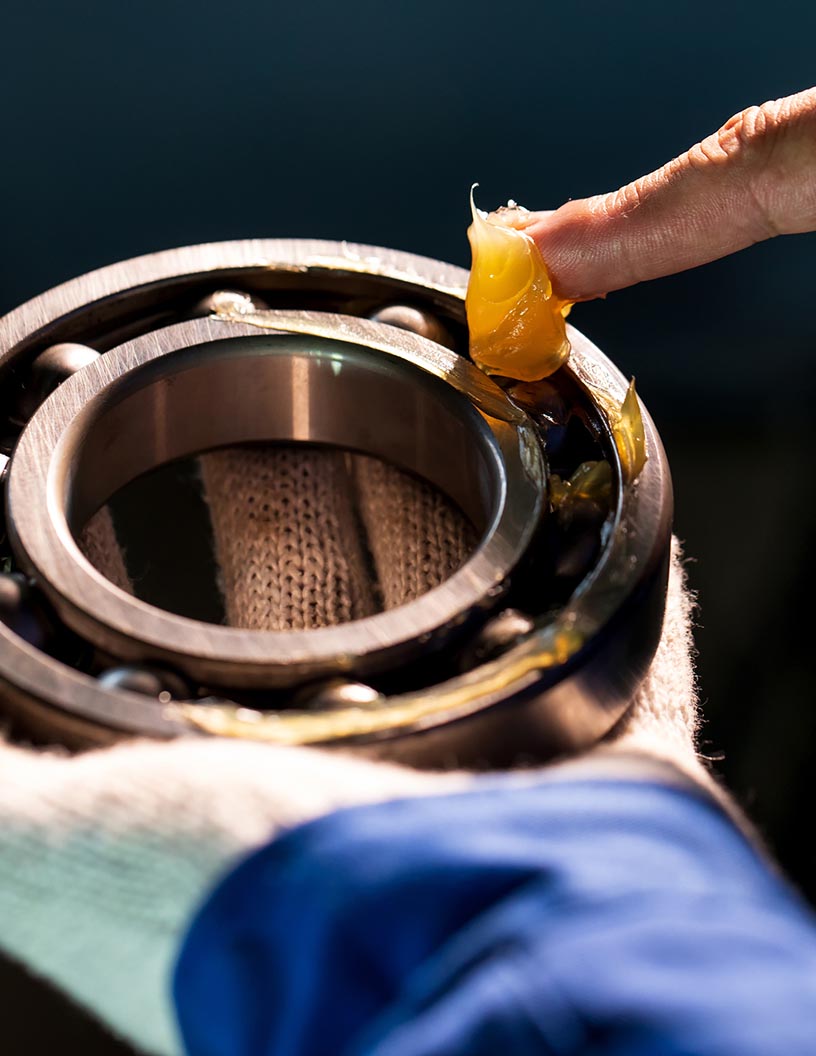

- The Lubricant Anti-Wear Agents Market plays a pivotal role in enhancing machine reliability by ensuring effective lubrication to all moving parts. Proper lubrication at regular intervals is crucial to prevent factors such as poor lubrication, contamination, fatigue, and poor fitting from negatively impacting machinery. According to industry reports, around one-third of bearing failures worldwide are attributed to improper lubrication. The importance of lubrication is often overlooked due to its underestimated impact on the total cost of ownership of equipment. However, the consequences of improper lubrication can lead to premature failure of bearings and negatively affect machine performance.

- As a result, the market for lubricant anti-wear agents is poised for growth as industries increasingly recognize the importance of effective lubrication to maintain machinery reliability. Lubricant anti-wear agents are essential additives that help prevent wear and tear on machinery components. These agents form a protective film on the surfaces of moving parts, reducing friction and wear. They also protect against corrosion, oxidation, and other forms of damage. The market for lubricant anti-wear agents is diverse, with applications spanning various sectors, including automotive, industrial, and aerospace. In the automotive sector, these agents are used in engine oils, transmission fluids, and gear oils to enhance engine performance and extend the life of components.

- In the industrial sector, they are used in hydraulic fluids, compressor oils, and turbine oils to ensure smooth operation and reduce downtime. In the aerospace industry, lubricant anti-wear agents are used in aircraft engines and landing gear systems to ensure optimal performance and safety. The global market for lubricant anti-wear agents is expected to grow significantly during the forecast period, driven by increasing demand for machinery reliability and the need to reduce downtime and maintenance costs. Additionally, advancements in technology and the development of new, high-performance lubricant anti-wear agents are expected to further fuel market growth.

- In conclusion, the Lubricant Anti-Wear Agents Market is a vital component in maintaining machinery reliability and reducing downtime. With one-third of bearing failures attributed to improper lubrication, the growing recognition of the importance of effective lubrication is driving market growth. The market is diverse, with applications spanning various sectors, and is expected to continue growing due to increasing demand for high-performance lubricants and advancements in technology.

What are the market trends shaping the Lubricant Anti Wear Agents Industry?

- Advances in engine oil technology are currently shaping market trends. Engine oil technology's continuous evolution is a significant factor influencing market developments.

- The market is experiencing significant advancements, driven by the integration of innovative technologies in the production of engine oil. These developments are geared towards enhancing engine performance and longevity in various sectors, including automotive and industrial applications. Advanced fuel and lubricant technologies are gaining traction, enabling the creation of superior engine oils. These advancements include the use of advanced antioxidants, surfactants, high-pressure agents, and superior corrosion inhibitors. The market is also witnessing the adoption of advanced bonding technology, where high-pressure lubricants are formulated through the chemical treatment of hydrocarbons. Companies in the market are investing heavily in research and development to improve the efficiency of engine oil.

- They are focusing on creating products that can withstand the rigors of modern engines, ensuring optimal performance and extended engine life. This ongoing innovation is expected to fuel the growth of the market during the forecast period. In terms of numerical data, the market's value is projected to increase significantly over the next few years. This trend is being driven by the increasing demand for advanced engine oils in various industries, including automotive, manufacturing, and power generation.

- Despite the challenges posed by the ongoing pandemic, the market is expected to recover and continue its growth trajectory as the global economy recovers. The evolving market dynamics, coupled with the continuous innovation in lubricant technologies, make the market an exciting space to watch.

What challenges does the Lubricant Anti Wear Agents Industry face during its growth?

- The volatility of crude oil prices poses a significant challenge to the growth of the industry.

- The market experiences continuous evolution, driven by various factors influencing its growth and applications across diverse sectors. Crude oil prices significantly impact the market due to the primary use of raw materials derived from it for manufacturing mineral oil-based and synthetic lubricants. The unpredictability of crude oil prices results in raw material cost fluctuations, posing challenges for both manufacturers and end-users. For instance, the price of Brent crude oil dropped from USD 101 per barrel in 2022 to USD 83 per barrel in 2023. Synthetic lubricants, predominantly derived from hydrocarbons sourced from petroleum, are particularly sensitive to crude oil price changes.

- Despite these challenges, the market adapts and innovates, with ongoing research and development efforts aimed at improving efficiency, reducing environmental impact, and enhancing performance. The market is a dynamic and essential component of various industries, including automotive, industrial machinery, and power generation, among others. Its role in ensuring the smooth operation and longevity of machinery and equipment makes it an indispensable solution for businesses and organizations worldwide.

Exclusive Customer Landscape

The lubricant anti wear agents market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the lubricant anti wear agents market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Lubricant Anti Wear Agents Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, lubricant anti wear agents market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Afton Chemical - This company specializes in the production and distribution of advanced lubricant anti-wear agents. Notable products include HiTec 1656 and HiTec 7196, which effectively enhance machinery performance by reducing wear and tear.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Afton Chemical

- LANXESS AG

- Chevron Oronite

- Infineum International Limited

- BASF SE

- Lubrizol Corporation

- Croda International Plc

- Clariant AG

- Evonik Industries

- Vanderbilt Chemicals, LLC

- Italmatch Chemicals

- King Industries, Inc.

- Dorf Ketal

- BRB International

- Jinzhou Kangtai Lubricant Additives Co., Ltd.

- Tianhe Chemicals Group

- R.T. Vanderbilt Holding Company

- Shenyang Great Wall Lubricating Oil Manufacturing Co., Ltd.

- Elco Corporation

- PMC Biogenix

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Lubricant Anti Wear Agents Market

- In January 2024, BASF SE, a leading chemical producer, announced the expansion of its NeoSteel Eco product line with the launch of a new molybdenum disulfide-based solid lubricant. This addition aimed to address the growing demand for sustainable and high-performance lubricant solutions in various industries (BASF press release).

- In March 2024, Shell Lubricants, a global market leader, entered into a strategic partnership with Schaeffler Technologies AG & Co. KG, a leading automotive and industrial supplier. The collaboration focused on the development and commercialization of advanced lubricants for the wind energy sector, targeting improved efficiency and reduced maintenance costs (Shell Lubricants press release).

- In May 2024, FUCHS Petrolub SE, a leading lubricant manufacturer, completed the acquisition of Lukoil Lubricants, a significant player in the Russian lubricants market. The acquisition strengthened FUCHS's market position and expanded its geographical reach, particularly in Eastern Europe and the Commonwealth of Independent States (FUCHS Petrolub SE press release).

- In April 2025, TotalEnergies, a major energy company, received regulatory approval for its new lubricant production facility in South Korea. The facility, which will produce high-performance anti-wear agents, is expected to significantly increase TotalEnergies' market share in the Asian lubricants market and contribute to the company's growth strategy (TotalEnergies press release).

Research Analyst Overview

- The ester base oils segment is a significant contributor to the lubricant anti-wear agents market, driven by their superior tribological properties. These base oils offer excellent friction reduction technology, ensuring additive compatibility and enhanced wear protection. The ongoing evolution of the market is marked by the integration of advanced technologies, such as nanomaterials in lubrication and ep lubricant formulation, to address the increasing demand for high-performance lubricants. Tribology testing standards, including surface roughness measurement and wear particle analysis, play a crucial role in assessing the effectiveness of anti-wear agents. For instance, the wear rate reduction achieved by a lubricant can be quantified through wear particle analysis, providing valuable insights into its performance.

- Moreover, pour point depressants are essential additives that improve the low-temperature flow properties of lubricants, expanding their application scope. The lubricant anti-wear agents market is expected to grow at a steady pace, with industry analysts projecting a growth rate of around 4% annually. This expansion is fueled by the continuous development of new technologies and the increasing demand for high-performance lubricants across various sectors, including automotive, industrial, and aerospace. Friction modifiers, metal deactivators, and extreme pressure additives are other essential components of lubricant formulations, contributing to their load-carrying capacity and film thickness. The market's dynamism is further highlighted by the ongoing research and development efforts aimed at creating ZDDP alternatives and optimizing additive package designs.

- In the realm of gearbox lubrication, solid lubricant films and boundary lubrication play a pivotal role in reducing wear and ensuring efficient operation. Thermal stability testing and lubricant rheology analysis are essential in evaluating the performance of these lubricants under varying conditions. The market's continuous unfolding is characterized by the integration of advanced technologies and the pursuit of enhanced tribological properties, ensuring the development of increasingly effective anti-wear agents.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Lubricant Anti Wear Agents Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.78% |

|

Market growth 2024-2028 |

USD 108.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.44 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Lubricant Anti Wear Agents Market Research and Growth Report?

- CAGR of the Lubricant Anti Wear Agents industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the lubricant anti wear agents market growth of industry companies

We can help! Our analysts can customize this lubricant anti wear agents market research report to meet your requirements.