Lupin Market Size 2024-2028

The lupin market size is forecast to increase by USD 7.31 billion and is estimated to grow at a CAGR of 4.83% between 2023 and 2028. Lupins, a type of legume, have gained increasing popularity due to their numerous health benefits. Rich in protein and fiber, lupins are an excellent addition to a low-fat and fiber-rich diet. They are also high in essential minerals such as iron, zinc, and magnesium. The food industry is recognizing the potential of lupins and is expanding their use in various sectors. In food services, lupins are being used to create innovative plant-based dishes, while in the manufacturing sector, they are being processed into flour, protein concentrates, and other value-added products. The health benefits, combined with the growing focus on plant-based and sustainable food sources, make lupins a smart and nutritious choice for consumers.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

Lupin, a leading global pharmaceutical company, is known for its reliability and credibility in the industry. With a strong focus on customers, Lupin ensures timely delivery and cost efficiencies, making it a preferred choice for many. The company's development in specialty pharmaceuticals, including generics and biosimilars, has been noteworthy. Lupin's product portfolio includes a wide range of formulations and drug delivery systems, such as Tiotropium and Darunavir. In the ever-evolving healthcare landscape, Lupin continues to enhance its offerings through product innovations and sustainability practices. The company is committed to complying with environmental regulations and addressing customer preferences. Lupin's alliances and collaborations have been instrumental in its growth, particularly in the areas of artificial intelligence, big data analytics, and digital health. The regulatory environment plays a crucial role in Lupin's operations, with a strong emphasis on patient safety and intellectual property protection. Overall, Lupin's commitment to quality, innovation, and customer satisfaction sets it apart in the pharmaceutical industry. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

Health benefits of lupins is notably driving market growth. The Global Lupin Market is driven by the nutritional benefits of Lupin beans, which belong to the Fabaceae family. These beans are rich in natural proteins, providing approximately 40% of the total content, and dietary fibers, contributing around 37%. Lupins are also a significant source of essential amino acids, including arginine, which plays a crucial role in lowering blood pressure, cholesterol, triglycerides, and blood sugar levels.

Moreover, lupins act as prebiotics, enhancing bowel health. As a gluten-free and vegan-friendly food, lupins cater to various dietary requirements. In the food industry, lupins are increasingly used as dairy alternatives and organic natural proteins. The livestock and poultry sectors also benefit from lupin production due to their high nutritional value. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

Rising awareness of vegan diet is the key trend in the market. The Market is experiencing significant growth due to the increasing preference for plant-based sources of nutrition, particularly among vegans and those with dietary restrictions. Lupin beans, a member of the Fabaceae family, are rich in nitrogen, dietary fibers, and amino acids, making them an excellent alternative to animal-derived proteins.

Moreover, the rising trend of veganism, driven by ethical, environmental, and health considerations, is fueling the demand for gluten-free, organic, natural protein sources. The rising trend of veganism, driven by ethical, environmental, and health considerations, is fueling the demand for gluten-free, organic, natural protein sources. As a result, lupin beans are gaining popularity as a key ingredient in various food applications, including dairy alternatives. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Wide availability of substitute products is the major challenge that affects the growth of the market. The Global lupin market is a significant segment of the Fabaceae family, recognized for its high Nitrogen content and nutritional benefits. Lupins are rich in Dietary fibres and Amino acids, making them an attractive alternative for Vegans and those with Gluten-intolerance. In the food industry, lupins find extensive applications as Dairy alternatives and as sources of Organic, natural proteins.

Moreover, the increasing preference for plant-based diets and ethical sourcing has fueled the demand for lupin-based products. Despite the growing popularity, the lupin market faces competition from other plant-based protein sources like soy, peas, potato, canola, rice, and chia. Pea protein, for instance, boasts a protein content of 85%, making it a formidable competitor. Hence, the above factors will impede the growth of the market during the forecast period

Exculsive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

ABS Food Srl: The company offers lupin that come from selected seeds, deamed and then thermally treated to eliminate the presence of alkaloids.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Barentz International BV

- Coorow Seeds

- DHAVAL AGRI EXPORT LLP

- Eagle Foods Australia

- Ethics Organic

- Golden West Foods Pty Ltd.

- HL Agro Products Pvt. Ltd.

- INVEJA SAS

- Just Organik

- KTC Edibles

- NOW Health Group Inc.

- Orienco SAS

- Raab Vitalfood GmbH

- Samruddhi Organic Farm I Pvt. Ltd.

- SHILOH FARMS

- Sresta Natural Bioproducts Pvt. Ltd.

- SunOpta Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Application

The animal feed segment is estimated to witness significant growth during the forecast period. Lupin, a leading global pharmaceutical company, is renowned for its reliability and credibility in the industry. With a strong focus on customers, Lupin ensures the timely delivery of high-quality products, including generics, biosimilars, drug delivery systems, and formulations.

Get a glance at the market share of various regions Download the PDF Sample

The animal feed segment was the largest segment and valued at USD 22.56 billion in 2018. The company's development efforts are centered around cost efficiencies, product enhancements, and sustainability practices, adhering to environmental regulations and customer preferences. Lupin's alliances with technology providers and strategic partnerships enable the implementation of advanced technologies such as artificial intelligence and big data analytics in their operations. Hence, such factors are fuelling the growth of this segment during the forecast period.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

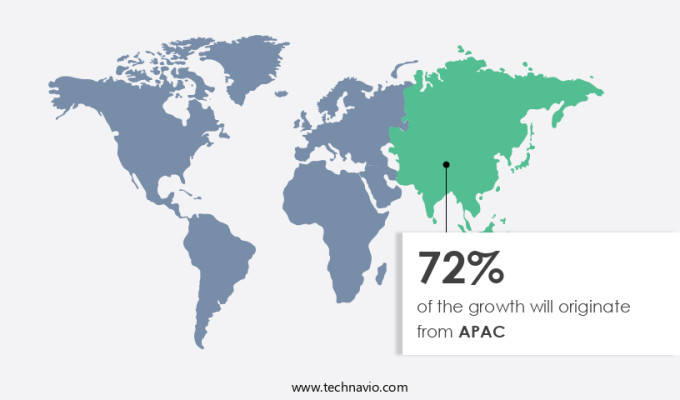

APAC is estimated to contribute 72% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. Lupin, a leading global pharmaceutical company, is renowned for its reliability and credibility in delivering high-quality products to customers across the world. With a strong distribution network, Lupin ensures timely delivery of its offerings, which include generics, biosimilars, drug delivery systems, formulations, and specialty pharmaceuticals. The company's commitment to development and cost efficiencies is reflected in its continuous product enhancements and sustainability practices. Lupin adheres to environmental regulations and customer preferences, forming alliances with technology providers to incorporate artificial intelligence, big data analytics, and digital health into its operations. Its capabilities extend beyond the realm of pharmaceuticals, encompassing a customer-centric approach that adds value and fosters customer loyalty. Competing in a dynamic regulatory environment, Lupin prioritizes patient safety and intellectual property protection. Its focus on emerging economies and research, coupled with adjunct services, reinforces its commitment to a patient-centric approach and sustainable practices. By minimizing environmental impact and promoting responsible manufacturing, Lupin is a competitive force in the pharmaceutical industry, offering Tiotropium, Darunavir, and other essential medications to improve patients' lives.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Application Outlook

- Animal feed

- Food and beverages

- Others

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

Active Pharmaceutical Ingredients (API) Market Analysis Asia, North America, Europe, Rest of World (ROW) - US, Germany, China, India, Japan - Size and Forecast

India Active Pharmaceutical Ingredient (API) Market by Manufacturing Type, Type, and Product Type - Forecast and Analysis

Antibiotics Market Analysis Asia, North America, Europe, Rest of World (ROW) - US, China, India, UK, Japan - Size and Forecast

Market Analyst Overview

Lupin, a leading global specialty pharmaceutical company, is renowned for its reliability and credibility in the pharmaceutical industry. The company's success is built on a customer-centric approach, focusing on timely delivery, cost efficiencies, and product enhancements. Lupin's capabilities extend to various therapeutic areas, including generics, biosimilars, drug delivery systems, and formulations. The company's commitment to sustainability practices and environmental regulations aligns with customer preferences. Lupin's alliances with technology providers have enabled the integration of artificial intelligence, big data analytics, and digital health into its operations. The market landscape depends on the Value added, Ukraine conflict, Patient-centric approach, Revenue generated, Investment in research, and Production capacities. These advancements have facilitated research and development, ensuring the company stays competitive in the rapidly evolving regulatory environment. Lupin's portfolio includes notable products such as Tiotropium and Darunavir. The company's patient-centric approach extends to adjunct services, ensuring patient safety and intellectual property protection. As Lupin expands its footprint in emerging economies, it continues to prioritize sustainable practices and environmental impact, while adhering to responsible manufacturing standards.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

145 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 7.31 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.37 |

|

Regional analysis |

APAC, Europe, North America, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 72% |

|

Key countries |

Australia, US, China, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

ABS Food Srl, Barentz International BV, Coorow Seeds, DHAVAL AGRI EXPORT LLP, Eagle Foods Australia, Ethics Organic, Golden West Foods Pty Ltd., HL Agro Products Pvt. Ltd., INVEJA SAS, Just Organik, KTC Edibles, NOW Health Group Inc., Orienco SAS, Raab Vitalfood GmbH, Samruddhi Organic Farm I Pvt. Ltd., SHILOH FARMS, Sresta Natural Bioproducts Pvt. Ltd., and SunOpta Inc. |

|

Market dynamics |

Parent market analysis, market report , market forecast , Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies