Macadamia Market Size 2025-2029

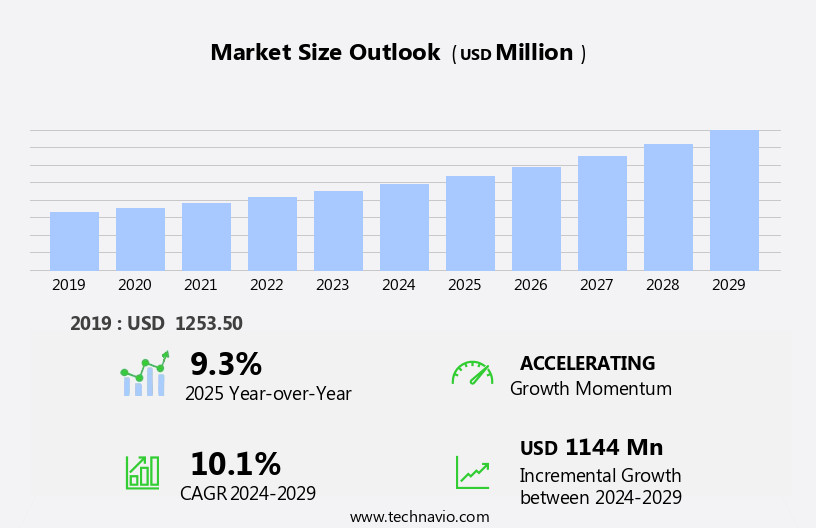

The macadamia market size is forecast to increase by USD 1.14 billion, at a CAGR of 10.1% between 2024 and 2029.

- The Macadamia nut market is experiencing significant growth, driven by the increasing preference for vegan snacks among the millennial demographic. This trend is leading to a surge in the number of macadamia nut-based snack launches, presenting new opportunities for market participants. However, this market is not without challenges. Macadamia nuts are known to be a potential source of allergens, which may limit their appeal to certain consumer segments and necessitate stringent production and labeling practices. Companies looking to capitalize on the market's potential must navigate these challenges effectively, ensuring the production of safe, high-quality products that cater to the evolving consumer preferences.

- By staying abreast of these trends and addressing the challenges head-on, market players can position themselves for long-term success in the dynamic and growing Macadamia nut market.

What will be the Size of the Macadamia Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities shaping its landscape. Value-added products, such as macadamia oil and butter, are gaining popularity, necessitating advancements in processing technology. Macadamia tree pruning and nutrient deficiency diagnosis are essential practices for optimizing yield and maintaining soil health. Shelf life extension techniques are crucial to ensure the stability of macadamia kernels. Water stress mitigation strategies, including yield mapping technology and irrigation scheduling, are increasingly important due to climate change. Frost protection methods are also vital for maintaining optimal growing conditions. Nut size uniformity and kernel grading systems are key factors in meeting food safety regulations and consumer expectations.

Organic macadamia production is on the rise, necessitating sustainable farming practices and disease resistance breeding. Pollination strategies and nutrient management are critical for optimizing crop yield. Macadamia oil extraction and oil content analysis are essential for maximizing the value of the harvest. Kernel moisture content and shell removal techniques are crucial for efficient processing and reducing waste. Precision agriculture techniques, such as remote sensing applications, are transforming macadamia farming by providing real-time data for crop yield optimization and climate change adaptation. Harvest mechanization and quality control protocols are also essential for ensuring efficient and consistent production. The ongoing development of macadamia farming practices reflects the continuous dynamism of the market.From tree pruning to processing technology, the industry is constantly evolving to meet the demands of consumers and the challenges of the global market.

How is this Macadamia Industry segmented?

The macadamia industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Conventional

- Organic

- Distribution Channel

- Offline

- Online

- Product Type

- Raw Macadamia

- Roasted Macadamia

- Macadamia Oil

- Macadamia-Based Products

- Application

- Food and Beverage (Snacks, Confectionery, Bakery)

- Cosmetics

- Nutraceuticals

- Form

- Whole Nuts

- Kernels

- Powder

- Oil

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- The Netherlands

- APAC

- Australia

- China

- India

- Japan

- Vietnam

- Rest of World (ROW)

- North America

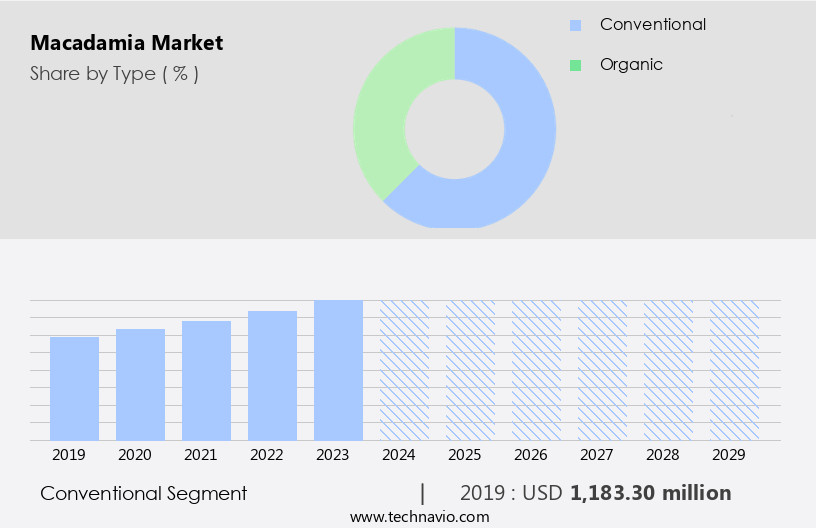

By Type Insights

The conventional segment is estimated to witness significant growth during the forecast period.

The market experienced notable growth in the conventional segment in 2024. Conventional macadamia nuts, known for their affordability and wide availability, are a popular choice for various applications. Their longer shelf life, often attributed to preservatives or chemical treatments, is a significant factor driving demand. Macadamia nuts find extensive use in producing edible oil, snacks, confectioneries, desserts, cosmetics, and bakery products. The increasing preference for healthy snacking and growing awareness of macadamia nuts' health benefits further boosts demand. Advanced processing technologies enable the creation of value-added products, such as macadamia oil and butter, extending the market's reach.

Farmers employ various strategies to ensure optimal crop yield, including frost protection methods, soil health assessments, nut size uniformity, and nutrient deficiency diagnosis. Macadamia tree pruning, precision agriculture techniques, and irrigation scheduling contribute to improved yield and drought tolerance. Climate change adaptation measures, such as water stress mitigation and yield mapping technology, help farmers adapt to environmental challenges. Food safety regulations, organic macadamia production, and sustainable farming practices are essential aspects of the market. Macadamia oil extraction and macadamia butter production adhere to stringent quality control protocols, ensuring product safety and consistency. Remote sensing applications and integrated pest management strategies further enhance the industry's efficiency and sustainability.

Macadamia nuts' nutrient-rich content, disease resistance breeding, and drought tolerance improvement make them a resilient and valuable crop. Processing technologies, such as shell removal techniques and oil content analysis, enable the production of high-quality macadamia products. The market's continued evolution reflects the industry's commitment to innovation and sustainability.

The Conventional segment was valued at USD 1.18 billion in 2019 and showed a gradual increase during the forecast period.

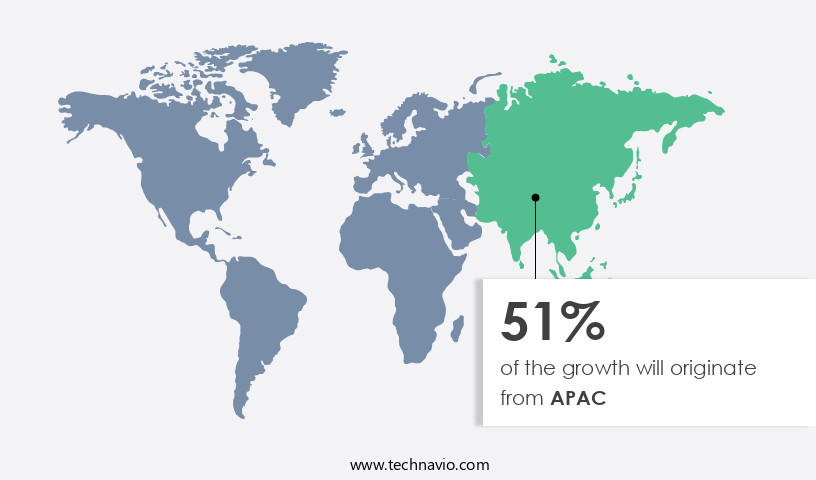

Regional Analysis

APAC is estimated to contribute 51% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth due to various factors, with a focus on supply chain management ensuring efficient production and delivery. In frost-prone regions, advanced frost protection methods are employed to safeguard crops, maintaining stability in the supply chain. Kernel grading systems and nut size uniformity are crucial for maintaining high-quality standards, while soil health assessment and nutrient deficiency diagnosis help optimize crop yield. Macadamia tree pruning and precision agriculture techniques enhance nut cracking efficiency and improve overall tree health. Food safety regulations are strictly adhered to in the production of organic macadamia nuts, which are increasingly popular due to their health benefits and value-added products like oil and butter.

Processing technology plays a vital role in extending shelf life and preserving the nut's natural flavor. Water stress mitigation and irrigation scheduling are essential practices to ensure crop sustainability, while yield mapping technology provides valuable insights into soil nutrient management. Disease resistance breeding and integrated pest management are crucial for maintaining optimal crop health, and drought tolerance improvement is a key focus area for macadamia farmers. Climate change adaptation and crop yield optimization are essential for long-term market sustainability. Harvest mechanization and kernel moisture content analysis are essential for efficient and effective post-harvest processes. Sustainable farming practices and remote sensing applications further enhance market transparency and ensure market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global macadamia market size and forecast projects growth, driven by macadamia market trends 2025-2029. B2B macadamia supply solutions leverage sustainable nut cultivation technologies for quality. Macadamia market growth opportunities 2025 include macadamias for snacks and organic macadamia products, meeting demand. Macadamia supply chain software optimizes operations, while macadamia market competitive analysis highlights key producers. Sustainable macadamia farming practices align with eco-friendly nut trends. Macadamia regulations 2025-2029 shapes macadamia demand in Europe 2025. Premium macadamia solutions and macadamia market insights boost adoption. Macadamias for confectionery and customized macadamia products target niches. Macadamia market challenges and solutions address supply, with direct procurement strategies for macadamias and macadamia pricing optimization enhancing profitability. Data-driven macadamia market analytics and healthy nut trends drive innovation.

What are the key market drivers leading to the rise in the adoption of Macadamia Industry?

- The surge in millennials' preference for vegan snacks is the primary factor fueling market growth in this sector.

- Macadamia nuts have gained significant popularity among consumers, particularly millennials, as a preferred snack option due to their health benefits and convenience. This trend is evident in various countries, including Australia, Germany, and China. The increasing purchasing power of millennials worldwide is driving the growth of the market. The nuts' rising demand can be attributed to their numerous health advantages and the consumers' preference for portable snacking solutions due to their active lifestyles. Effective supply chain management is crucial in the market to ensure nut uniformity, soil health assessment, and food safety regulations.

- Frost protection methods and nut cracking efficiency are essential for maintaining storage stability and kernel grading systems. Organic macadamia production is also gaining traction due to growing consumer awareness and preference for organic food products. Producers must adhere to stringent food safety regulations to cater to the evolving consumer demands and market dynamics.

What are the market trends shaping the Macadamia Industry?

- Macadamia nut-based snacks are experiencing an increasing number of launches, representing a notable market trend. This emerging trend reflects the growing consumer interest in healthier and premium snack options.

- Macadamia nuts are gaining popularity in various end-user applications, including bakery and confectionery products, breakfast cereals, snacks, flavored drinks, and dairy products. The rising trend of convenient and healthy foods, particularly in the context of keto and vegan diets, is driving the demand for macadamia-based snacks. New product innovations, such as macadamia milk, are being introduced to cater to this growing market. To maintain the quality and shelf life of macadamia products, advanced processing technologies are being employed. These include macadamia tree pruning, yield mapping technology for nutrient deficiency diagnosis, pollination strategies, and macadamia oil extraction.

- Water stress mitigation techniques are also being utilized to ensure optimal nut growth. The premium image of macadamia nuts and their increasing familiarity among consumers are additional factors contributing to the market growth. As a result, the demand for macadamia nuts is expected to continue rising, leading to the expansion of the market during the forecast period.

What challenges does the Macadamia Industry face during its growth?

- The presence of potential allergens poses a significant challenge to the growth of the industry, requiring rigorous management and adherence to stringent regulations to mitigate risks and ensure consumer safety.

- Macadamia butter production is a significant sector in the global nut industry, with increasing focus on optimizing crop yield and improving production techniques. One challenge in macadamia farming is the removal of hard shells, which can account for up to 40% of the nut's weight. Innovations in shell removal techniques, such as mechanical and thermal methods, are helping to address this issue. Another critical aspect of macadamia production is managing soil nutrients to ensure optimal growth. Oil content analysis is essential to assessing the nutritional value and market potential of macadamia crops. With climate change posing a threat to agricultural industries, adaptation strategies are being implemented to mitigate its impact on macadamia farming.

- Harvest mechanization and precision agriculture techniques, such as drones and sensors, are being employed to improve efficiency and reduce labor costs. Kernel moisture content is also a crucial factor in determining the quality of macadamia butter, and proper drying techniques are essential to prevent spoilage. Overall, the market is driven by increasing consumer awareness of the health benefits of macadamia nuts and the growing demand for plant-based alternatives to dairy products. However, the presence of allergens in macadamia nuts remains a significant challenge for the industry.

Exclusive Customer Landscape

The macadamia market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the macadamia market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, macadamia market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bardakcigroup - This company specializes in producing high-quality macadamia pastes, showcasing a medium roasted variant with a light beige hue and subtle, delicate flavors. The macadamias are freshly cracked and finely ground into a paste, offering a refined texture and taste experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bardakcigroup

- Barry Callebaut AG

- Buderim Ginger

- Dr Paulos Kona Coffee and Macadamia Nut Farms

- Eastern Produce

- Golden Macadamias Pty Ltd.

- Hamakua Macadamia Nut Co.

- Hawaiian Host Group

- Macadamias Direct

- Makua Coffee Co.

- Marquis Macadamias

- MWT Foods

- North Shore Macadamia Nut Co.

- Royal Macadamia Pty Ltd.

- Superior Nut Co. Inc.

- T M Ward Coffee Inc.

- Wondaree Macadamias Nuts

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Macadamia Market

- In January 2024, Macadamia Industries, a leading macadamia processor and marketer, announced the launch of a new line of macadamia milk and macadamia yogurt alternatives, expanding their product portfolio beyond traditional roasted nuts (PR Newswire).

- In March 2024, Archer Daniels Midland Company (ADM) and The Hawai'i Macadamia Nut Corporation entered into a strategic partnership to develop innovative macadamia-based food ingredients, aiming to strengthen their presence in the health-conscious food market (ADM press release).

- In May 2024, Australian macadamia producer, Macadamia Farming Co., secured a USD20 million investment from BlackRock, a global investment firm, to support the expansion of their production capacity and global market reach (BlackRock press release).

- In April 2025, the European Union (EU) granted approval for the importation of macadamias from Australia, opening a significant new market for Australian macadamia producers and processors (EU Commission press release).

Research Analyst Overview

- In the dynamic the market, various factors influence production and trends. Environmental impact assessments are crucial in implementing sustainable farming practices, such as rootstock grafting techniques and soil erosion control. Consumer preferences drive the need for machinery maintenance and energy efficiency measures in kernel processing. Fertilizer application strategies and labor productivity improvement are essential for optimizing planting density and reducing waste. Water usage efficiency and carbon footprint reduction are key concerns, with biodiversity conservation and ecosystem services gaining importance. Economic viability assessment and production cost analysis inform price forecasting models and land use planning.

- Pest monitoring systems and disease diagnosis tools ensure healthy crops, while risk management strategies mitigate production risks. Drying techniques and harvest timing optimization enhance post-harvest handling, and clonal propagation methods support long-term productivity. Weed control measures and storage conditions are crucial for maintaining macadamia quality.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Macadamia Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.1% |

|

Market growth 2025-2029 |

USD 1144 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.3 |

|

Key countries |

US, China, Japan, India, Canada, Australia, Vietnam, Germany, The Netherlands, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Macadamia Market Research and Growth Report?

- CAGR of the Macadamia industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the macadamia market growth of industry companies

We can help! Our analysts can customize this macadamia market research report to meet your requirements.