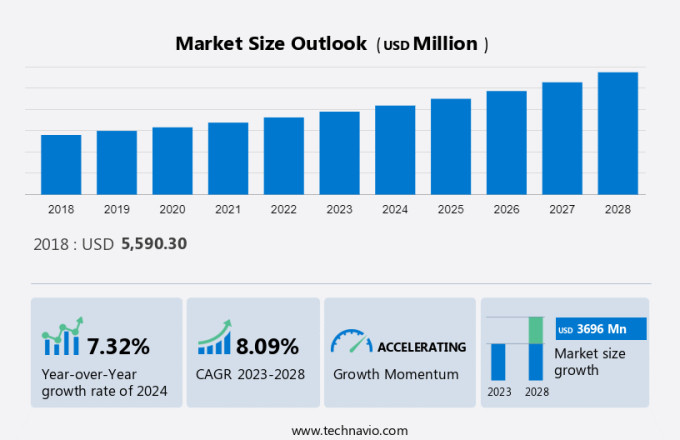

Malted Milk Market Size 2024-2028

The malted milk market size is forecast to increase by USD 3.7 billion, at a CAGR of 8.09% between 2023 and 2028. The expansion of the market hinges on various factors, notably the continual growth of retail space, providing greater accessibility to consumers. Additionally, the increasing preference for convenient and packaged food items drives market demand as consumers seek ready-to-eat solutions amidst busy lifestyles. Moreover, a rising trend toward health consciousness among consumers fuels the demand for healthier food options, including organic, natural, and functional foods. This shift in consumer preferences reflects a broader movement toward wellness and mindful eating habits. As the market evolves to cater to these demands, manufacturers and retailers alike are innovating to offer a diverse range of products that meet both convenience and health criteria, thereby driving market growth.

What will be the size of the Market During the Forecast Period?

To learn more about this report, View Report Sample

Market Dynamics and Customer Landscape

Key Market Driver

The expanding retail space is notably driving the market growth. Sales of malted milk products have been driven by the significant expansion of the organized retail sector, which has seen a rapid rise in the number of supermarkets, hypermarkets, and specialty shops. The majority of malted milk is sold through retail outlets like supermarkets, gas stations, and specialty shops. As a result, companies now have more opportunities to target customers at such retail locations due to the expansion of these channels. The trend of online retailing, whereby companies sell their goods through their web portals or e-commerce channels like Amazon and Alibaba, further supports the increase in sales.

Supermarkets and hypermarkets are retailers that carry a wide range of goods under one roof. As a result, they are gaining popularity as a preferred shopping location for customers, saving them time. Retailers are also expanding their selection to meet the rising demand for healthy foods in order to keep up with market trends. Thus, such factors are expected to drive market growth further during the forecast period.

Significant Market Trends

Plant-based alternatives are an emerging trend in market growth. The growing popularity of plant-based diets and environmental consciousness are the main factors fueling the demand for substitutes made from plants. As consumers become more aware of the negative environmental effects of animal agriculture, they search for plant-based options that are more environmentally friendly and have lower carbon footprints.

Plant-based malted milk substitutes made from soy, almond, oats, or other plant-based ingredients are becoming popular as a healthy alternative to traditional dairy-based products. These products will appeal to consumers who are concerned about their health because they frequently have lower fat and calorie counts. To capitalize on this trend, producers are investing in research and development to create cutting-edge plant-based malted milk products that appeal to a variety of consumers. Hence, such factors will fuel the growth of the market in focus during the forecast period.

Major Market Challenge

Competition from alternatives is a major challenge impeding market growth. As consumers become more health-conscious and seek out healthier options, alternatives like plant-based milk, protein shakes, and energy bars have grown in popularity. These alternatives frequently offer more flavor options and nutritional benefits, which appeal to consumers more. Additionally, due to dietary restrictions or preferences, some consumers might not be able to consume traditional malted milk products.

In addition, plant-based alternatives have been created as consumer awareness of environmental issues has increased, which may appeal to those who care about the environment. Therefore, manufacturers of traditional malted milk products will experience fierce competition from these alternatives, which will have an impact on sales and profitability and negatively affect the market's growth during the forecast period.

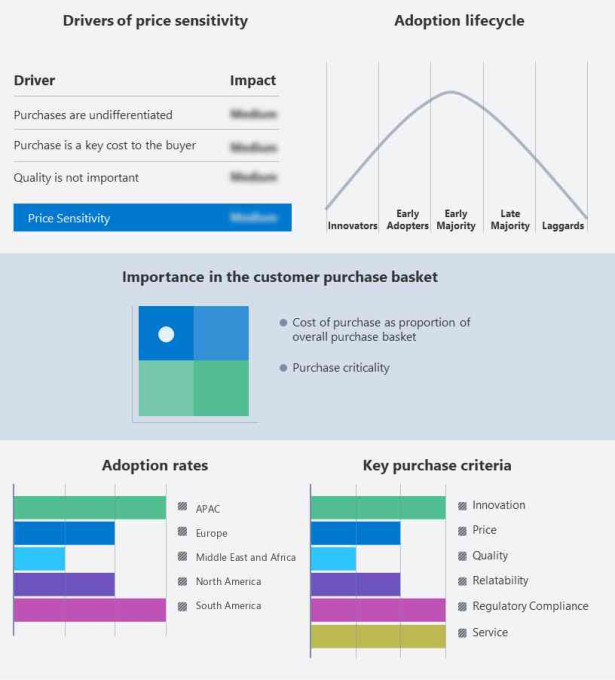

Customer Landscape

The market research report includes the adoption lifecycle of the market research and growth, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth and forecasting strategies.

Customer Landscape

Who are the Major Market Companies?

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Briess Industries Inc. - The company produces natural specialty ingredients for food and beer. The key offerings of the company include malted milk powder, which is used to make whipped cream, thus used as a topping on ice cream sundaes and pies.

The report also includes detailed analyses of the competitive landscape of the market and information about 15 market companies, including:

- Abbott Laboratories

- Crisp Malting Group Ltd.

- Continental Milkose India Ltd.

- Custom Food Group

- Food and Biotech Engineers India Pvt Ltd.

- Full Sail Brewing Inc.

- Hindustan Unilever Ltd.

- Imperial Malts Ltd.

- Insta Foods

- King Arthur Baking Co. Inc.

- Maplebear Inc.

- Muntons Plc

- Nestle SA

- SSP Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

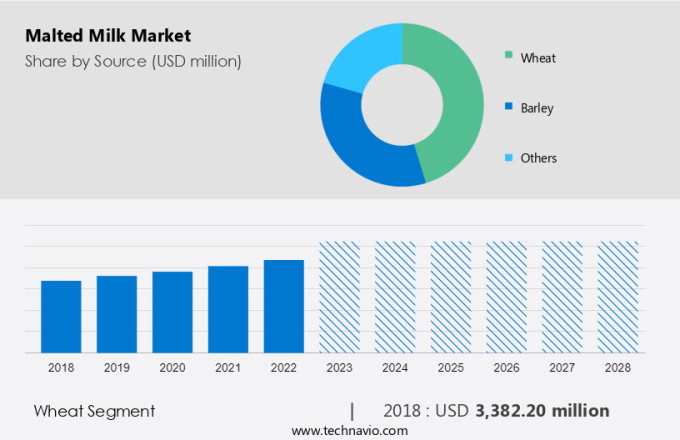

What is the Fastest-Growing Segment in the Market?

Get a glance at the market contribution of various segments View the PDF Sample

The wheat segment was valued at USD 3.38 billion in 2018. The wheat product segment is anticipated to grow steadily during the forecast period as a result of growing consumer awareness of the health benefits of products made from wheat. During the forecast period, it is anticipated that consumers will become more interested in wheat-based malted milk products, which are viewed as healthier and more environmentally friendly alternatives to conventional sweeteners. However, issues like changes in wheat prices and supply-chain disruptions caused by climatic or geopolitical factors may have an impact on the wheat segment of the market. The rising popularity of natural grains and plant-based sweeteners may also have a negative impact on future demand for goods made from malted milk derived from wheat. Irrespective of such challenges, this segment is expected to be the largest market share holder in the global market during the forecast period.

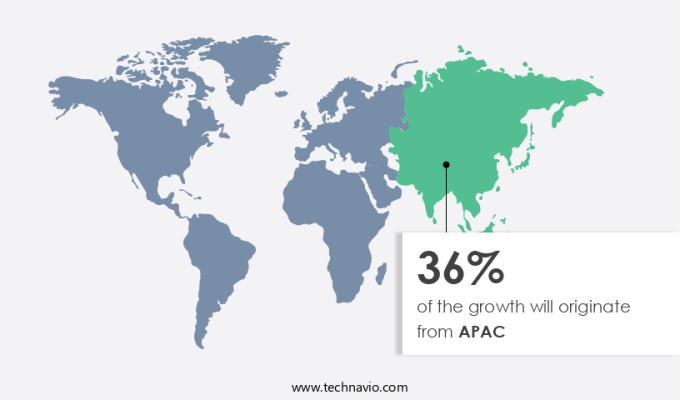

Which are the Key Regions for the Market?

For more insights on the market share of various regions Download PDF Sample now!

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The region's rising demand for processed foods and meat products, including malted milk, is largely due to the high rate of population growth and rapid urbanization. The output of wheat is predicted to reach 112.18 million tons during 2022–2023 based on the Second Advanced Estimates of Production of Major Crops provided by the Ministry of Agriculture and Farmers Welfare, India, which is 4.12% more than the 107.74 million tons recorded during 2021–2022. The rise in production suggests that the market's demand for Indian malted milk will be satisfied in 2023–2027 because rising production is anticipated to continue during the forecast period. The demand for malted milk in APAC is also anticipated to be influenced by health consciousness and awareness of the health benefits of malted milk during the forecast period. However, companies have been able to enter new markets using regional distribution channels due to marketing initiatives and the rapid expansion of retail channels. The availability and accessibility of malted milk products among consumers have increased as a result of an increase in the number of organized retailing outlets selling malted milk across platforms in the region. Additionally, the rising user preference for online retail platforms is anticipated to boost the region's malted milk sales, which will fuel the market's expansion during the forecast period.

Segment Overview

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Source Outlook

- Wheat

- Barley

- Others

- Distribution Channel Outlook

- Offline

- Online

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- The U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Chile

- Brazil

- Argentina

- North America

Market Analyst Overview

Malted milk is a versatile ingredient cherished for its role in enhancing various food and beverage products. Derived from high-quality cereals, it undergoes a process of distilling to produce a concentrated liquid known as malt syrup or liquid malt, prized for its solubility and aroma enhancement properties. With its ability to improve texture improvement, colour enhancement, and flavor, malted milk adds value to a wide range of products, from snacking items like bite sized snacks and malted milk powder cookies to baked goods and flavored milk. Recognized for its nutrient enrichment and caramelization attributes, it appeals to health-conscious consumers seeking natural ingredients and artisanal options. As the demand for healthy lifestyle choices grows, malted milk continues to enjoy steady value sales in the food and beverage industry. Further, it is not just a beverage; it's a culinary marvel with diverse applications across the food and beverage industry.

In addition, derived from malted grain flour and cereals like wheat and wheat flour malted barley, it adds depth and richness to various culinary uses. Its glucose content provides sweetness, while its ability to enhance texture and color elevates the visual and sensory experience of baked products and confections. Renowned for its binding capabilities, malted milk is a favorite ingredient among food and beverage manufacturers seeking to craft products with natural and health-conscious appeal. From snacking products such as bite-sized snacks to comforting malted food drinks, its versatility and contribution to health and wellness make it a staple in modern cuisine. The market is driven by the growing demand for malted milk powder among food and beverages manufacturers. Malting grade cereals and sugar are essential in creating this product, which is often used in beers and as a flavoring and fortification ingredient.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

157 |

|

Base year |

2023 |

|

Historic period |

2018 - 2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market Growth 2024-2028 |

USD 3.7 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 36% |

|

Key countries |

US, China, India, UK, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Abbott Laboratories, Briess Industries Inc., Crisp Malting Group Ltd., Continental Milkose India Ltd., Custom Food Group, Food and Biotech Engineers India Pvt Ltd., Full Sail Brewing Inc., Hindustan Unilever Ltd., Imperial Malts Ltd., Insta Foods, King Arthur Baking Co. Inc., Maplebear Inc., Muntons Plc, Nestle SA, SSP Pvt. Ltd., and The Kraft Heinz Co. |

|

Market dynamics |

Parent market growth analysis, Market Forecasting, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, and Market condition analysis for the market forecast period. |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the growth of the market between 2024 and 2028

- Precise estimation of the size of the market size and its contribution to the parent market

- Accurate predictions about upcoming trends and changes in consumer behavior

- Growth of the market industry across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch