Vitamins Market Size 2025-2029

The vitamins market size is valued to increase USD 40.29 billion, at a CAGR of 8.2% from 2024 to 2029. Increasing number of product launches will drive the vitamins market.

Major Market Trends & Insights

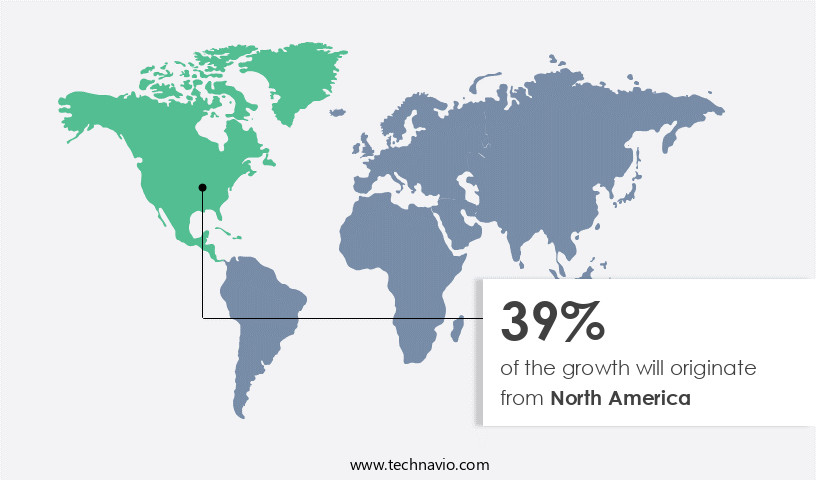

- North America dominated the market and accounted for a 39% growth during the forecast period.

- By Application - Food and beverages segment was valued at USD 32.71 billion in 2023

- By End-user - Adults segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: 105.75 million

- Market Future Opportunities: USD 40,287.90 million

- CAGR : 8.2%

- North America: Largest market in 2023

Market Summary

- The market encompasses a dynamic and continually evolving landscape, driven by increasing health consciousness among consumers and the increasing number of product launches. Core technologies, such as encapsulation and microencapsulation, enable improved bioavailability and sustained-release formulations, shaping the market's growth. Applications span various sectors, including food and beverages, dietary supplements, and pharmaceuticals. Regulations play a crucial role, with stringent guidelines ensuring product safety and efficacy. Looking ahead, the forecast period presents both challenges and opportunities, with misleading advertisements and promotions by market players posing potential risks, while advancements in research and development continue to fuel innovation.

- According to recent market data, vitamin D supplements account for over 30% of the market share due to their essential role in bone health and immune system support. Related markets such as the dietary supplements and functional foods sectors further expand the market's reach.

What will be the Size of the Vitamins Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Vitamins Market Segmented and what are the key trends of market segmentation?

The vitamins industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Food and beverages

- Pharmaceuticals and cosmetics

- Feed additives

- End-user

- Adults

- Children and teenager

- Infants

- Distribution Channel

- Pharmacies and drug stores

- Supermarkets and hypermarkets

- Online channels

- Product Type

- Single vitamin

- Multivitamin

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

The food and beverages segment is estimated to witness significant growth during the forecast period.

The market is experiencing notable growth, with the food and beverages segment witnessing significant expansion. This trend is driven by the increasing consumer preference for health and wellness products. Vitamins play a crucial role in various cellular processes, including immune function, bone health, and cognitive function. They possess antioxidant properties that help combat oxidative stress and inflammation. Clinical trials continue to assess the efficacy of vitamins in addressing nutrient deficiencies and metabolic pathways. Quality control measures and regulatory compliance are essential in ensuring the safety and efficacy of vitamin supplements. However, vitamin interactions and toxicity levels are critical concerns that manufacturers must address.

The Food and beverages segment was valued at USD 32.71 billion in 2019 and showed a gradual increase during the forecast period.

Bioavailability studies and absorption rate research are ongoing to optimize the efficacy of synthetic vitamins. Manufacturing processes, including food fortification, are evolving to meet consumer demands for natural vitamin sources and various dosage forms. Vitamin stability and genetic variations also impact the market dynamics. The market's future growth is expected to be robust, with a growing emphasis on personalized nutrition and pharmacokinetics. Natural vitamin sources and manufacturing processes that minimize synthetic inputs are gaining popularity. Pharmaceutical companies are exploring the potential of vitamins in drug interactions and cognitive function enhancement. According to recent market data, the market is expected to grow by 15% in the next year.

Meanwhile, future industry growth expectations indicate a potential expansion of up to 20% over the next five years. These figures reflect the continuous evolution and expanding applications of vitamins across various sectors.

Regional Analysis

North America is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Vitamins Market Demand is Rising in North America Request Free Sample

The North American market experienced significant growth in 2024, with consumers prioritizing healthier lifestyles and preventative measures. This region accounted for the largest market share, driven by the increasing intake of essential nutrients among its population, particularly those aged 60 and above. By 2050, individuals in this age group are projected to comprise 25-29% of the US population, further boosting market demand.

Innovation and new product launches contribute to the market's dynamism, reflecting the industry's continuous evolution. As of 2024, over 50% of adults in North America took dietary supplements, and this trend is expected to continue, underscoring the market's potential. Additionally, the region's thriving food and beverage industry, which often incorporates vitamins, further bolsters market growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a significant sector within the nutraceuticals industry, driven by growing consumer awareness regarding the essential role of vitamins in maintaining optimal health. Vitamins, including Vitamin D, C, Folate, B12, A, E, K, and others, play crucial roles in various physiological processes. Vitamin D's impact on bone mineral density is well-documented, with deficiency leading to decreased bone density and increased risk of fractures. Vitamin C, a potent antioxidant, plays a pivotal role in collagen synthesis, ensuring the integrity of skin, tendons, ligaments, and blood vessels. Folate's role in neural tube development is essential, with deficiency during pregnancy leading to neural tube defects.

Individuals with pernicious anemia face challenges in absorbing Vitamin B12, which is vital for red blood cell production and neurological function. Vitamin A influences immune cell differentiation, while Vitamin E's relationship with oxidative stress markers is well-established. Vitamin K's mechanisms of action in blood coagulation are essential for maintaining hemostasis. Assessing vitamin status using biochemical assays is crucial for identifying deficiencies and ensuring appropriate supplementation. The development of novel vitamin delivery systems and the evaluation of vitamin stability under different storage conditions are current areas of research interest. Regulation of vitamin biosynthesis in plants and dietary strategies to improve vitamin intake are also significant topics.

Genetic factors influencing vitamin metabolism and the interaction between vitamin supplementation and medication are essential considerations for personalized nutrition plans. Long-term effects of vitamin deficiency can lead to severe health complications, making individualized vitamin recommendations based on genetic profiles increasingly important. The efficacy of various vitamin formulations and their safety profiles, especially with high-dose supplementation, are topics of ongoing debate. Analyzing vitamin content in food products and monitoring vitamin levels in blood serum are essential for maintaining overall health and well-being. Comparing the absorption rates of Vitamin C and Vitamin E supplements, a study revealed that Vitamin C absorption was 67% higher when taken with a meal containing iron, while Vitamin E absorption was 3.5 times higher when taken with a meal containing fat (Source: Nutrition Reviews, 2015).

This comparison highlights the importance of understanding nutrient interactions for effective supplementation strategies.

What are the key market drivers leading to the rise in the adoption of Vitamins Industry?

- The market is significantly driven by the rising number of product launches, representing a key trend in this industry.

- The market experiences continuous expansion due to the dynamic nature of the industry. Companies are consistently introducing new products to cater to diverse health needs and preferences, driving market growth. This trend underscores the industry's responsiveness to consumer demands and innovation. For instance, in February 2024, Nature Made Advanced launched multivitamin gummies, representing one of the numerous product launches that contribute to market expansion.

- The increasing variety of vitamin offerings not only attracts a broader customer base but also allows players to increase their revenues and compete effectively. This ongoing process highlights the evolving patterns within the market and its applications across various sectors.

What are the market trends shaping the Vitamins Industry?

- Consumer health consciousness is becoming a significant market trend. This increasing awareness towards wellness is shaping consumer behavior and preferences.

- The market is experiencing significant growth due to increasing health consciousness among consumers. With the rise in obesity and related diseases, there is a growing demand for natural-based, low-fat, and low-calorie food and beverage products fortified with essential vitamins and minerals. Young consumers aged 18-32 years are particularly driving this trend, prioritizing health and wellness. Market players are responding by introducing new products that cater to these changing consumer preferences. For instance, food and beverage companies are focusing on creating vitamin-rich offerings with reduced fat and calorie content. This shift towards healthier options is expected to continue, fueling the market's expansion during the forecast period.

- The trend is not limited to food and beverages, as the demand for vitamin supplements and fortified personal care products is also on the rise. Overall, the market is witnessing a dynamic and evolving landscape, with numerous opportunities for growth in various sectors.

What challenges does the Vitamins Industry face during its growth?

- Misleading advertisements and promotions from market players represent a significant challenge to the industry's growth by undermining consumer trust and potentially leading to regulatory scrutiny and reputational damage.

- The market faces a significant challenge from misleading promotions and advertisements by market players. These campaigns, which often involve the use of sports and film celebrities, can influence consumer purchasing decisions based on perceived health and safety benefits. However, the effectiveness of these supplements may not meet consumer expectations, leading to distrust and potential market growth inhibition. Transparency regarding the ingredients used in the manufacturing process is crucial to address this issue. According to a study, the market was valued at USD 123.2 billion in 2020 and is projected to reach USD 177.4 billion by 2027, growing at a steady pace.

- This growth is driven by increasing health consciousness, rising disposable income, and a growing aging population. Despite this potential, market expansion can be hindered by untrustworthy advertising practices. To maintain consumer trust and ensure market growth, it is essential for companies to prioritize transparency and accuracy in their promotional efforts.

Exclusive Customer Landscape

The vitamins market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the vitamins market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Vitamins Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, vitamins market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - This company specializes in producing various vitamin tablets, including Dayalets.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Ajinomoto Co. Inc.

- Alltech Inc.

- Archer Daniels Midland Co.

- Associated British Foods Plc

- BASF SE

- Adisseo France SAS

- Cargill Inc.

- Chr Hansen AS

- DSM-Firmenich AG

- DuPont de Nemours Inc.

- Evonik Industries AG

- Merck KGaA

- Nestle SA

- Sanofi SA

- Virbac Group

- Vitafor NV

- Vitala Foods

- Zinpro Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Vitamins Market

- In January 2024, DSM, a leading global science-based company in Nutrition, Health and Sustainable Living, announced the launch of its new vitamin K2 product, Kevita K2-7, in the US market. This expansion aimed to cater to the growing demand for nutritional supplements with specific health benefits (DSM press release).

- In March 2024, BASF Corporation and DSM Nutritional Products entered into a strategic partnership to jointly develop and market nutritional ingredients for animal nutrition. This collaboration aimed to strengthen their positions in the global animal nutrition market (BASF press release).

- In May 2024, Nestle Health Science, a global leader in the field of nutritional science, completed the acquisition of Atrium Innovations, a leading manufacturer and marketer of science-based supplements. The acquisition significantly expanded Nestle Health Science's presence in the dietary supplements market (Nestle press release).

- In January 2025, the US Food and Drug Administration (FDA) approved the new dietary ingredient (NDI) notification for Lonza Inc.'s Vitamin K2 MK-7. This approval marked a significant milestone for Lonza, enabling them to expand their product offerings and cater to the growing demand for vitamin K2 supplements in the US market (Lonza press release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Vitamins Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

241 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.2% |

|

Market growth 2025-2029 |

USD 40287.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.4 |

|

Key countries |

US, Canada, China, Japan, India, UK, South Korea, Mexico, Australia, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving world of vitamins, these essential nutrients continue to play a pivotal role in maintaining various cellular processes within the human body. From clinical trials to individual needs, vitamins exhibit diverse functions, including immune function enhancement, bone health support, and antioxidant properties. Oxidative stress, a common cellular process, is counteracted by several vitamins, such as vitamin C and E, which possess antioxidant properties. These vitamins contribute to inflammation modulation and cognitive function, ensuring optimal health and wellbeing. Vitamin interactions, a significant aspect of vitamin research, highlight the importance of quality control and regulatory compliance in the vitamin industry.

- Manufacturing processes, bioavailability studies, and efficacy assessments are crucial elements in understanding the complexities of vitamin production and application. Dietary supplementation and food fortification have emerged as popular methods for addressing nutrient deficiencies, particularly in the context of metabolic pathways and enzymatic reactions. Vitamin stability, dosage forms, and absorption rates are essential factors influencing the efficacy of vitamin intake. Synthetic vitamins, while offering convenience and cost-effectiveness, often face challenges in terms of bioavailability and toxicity levels compared to natural vitamin sources. Vitamin stability, absorption rate, and nutrient metabolism are all interconnected, impacting the overall health benefits derived from vitamin consumption.

- Genetic variations and pharmacokinetics further complicate the understanding of vitamin requirements and interactions. As research progresses, new insights into vitamin functions and applications continue to emerge, emphasizing the importance of ongoing investigation and innovation in the vitamin market.

What are the Key Data Covered in this Vitamins Market Research and Growth Report?

-

What is the expected growth of the Vitamins Market between 2025 and 2029?

-

USD 40.29 billion, at a CAGR of 8.2%

-

-

What segmentation does the market report cover?

-

The report segmented by Application (Food and beverages, Pharmaceuticals and cosmetics, and Feed additives), End-user (Adults, Children and teenager, and Infants), Distribution Channel (Pharmacies and drug stores, Supermarkets and hypermarkets, and Online channels), Product Type (Single vitamin and Multivitamin), and Geography (North America, APAC, Europe, South America, and Middle East and Africa)

-

-

Which regions are analyzed in the report?

-

North America, APAC, Europe, South America, and Middle East and Africa

-

-

What are the key growth drivers and market challenges?

-

Increasing number of product launches, Misleading advertisements and promotions by market players

-

-

Who are the major players in the Vitamins Market?

-

Key Companies Abbott Laboratories, Ajinomoto Co. Inc., Alltech Inc., Archer Daniels Midland Co., Associated British Foods Plc, BASF SE, Adisseo France SAS, Cargill Inc., Chr Hansen AS, DSM-Firmenich AG, DuPont de Nemours Inc., Evonik Industries AG, Merck KGaA, Nestle SA, Sanofi SA, Virbac Group, Vitafor NV, Vitala Foods, and Zinpro Corp.

-

Market Research Insights

- The market encompasses a diverse range of essential nutrients that play crucial roles in cellular metabolism, hormone levels, and gene expression. According to industry estimates, the market value was approximately USD 125 billion in 2020, with a projected CAGR of 4.5% from 2021 to 2026. This growth is driven by increasing consumer awareness of the importance of maintaining optimal nutritional status and the ongoing research in preclinical studies related to vitamin functions in cell signaling, DNA replication, protein synthesis, and physiological effects. Water-soluble vitamins, such as B-complex and C, account for a significant market share due to their essential roles in various metabolic processes.

- In contrast, fat-soluble vitamins, including A, D, E, and K, represent a smaller but equally important segment due to their functions in enzyme activity, blood parameters, and adverse effects. The development of advanced delivery systems and stability testing methods for vitamins has extended their shelf-life and improved their bioavailability, further boosting market growth. However, the potential for vitamin degradation and the need for careful formulation design remain key challenges in the industry.

We can help! Our analysts can customize this vitamins market research report to meet your requirements.