Marine Power Systems Market Size 2024-2028

The marine power systems market size is forecast to increase by USD 3.42 billion, at a CAGR of 3.49% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the surge in commercial shipping and the expanding marine hybrid propulsion market. These trends reflect the increasing demand for more fuel-efficient and environmentally friendly solutions in the maritime industry. However, the collapse of the Greek shipbuilding industry poses a considerable challenge. This obstacle, as stated, could potentially impact the market's growth trajectory due to the industry's historical significance as a major player in marine power systems production. Companies seeking to capitalize on market opportunities must navigate this challenge by exploring alternative production hubs and partnerships.

- Additionally, investing in research and development of advanced, cost-effective marine power systems will be crucial for long-term success. Overall, the market presents a dynamic and promising landscape, with opportunities for innovation and growth in the face of industry challenges. Companies that effectively address these challenges and capitalize on market trends will be well-positioned to succeed.

What will be the Size of the Marine Power Systems Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and shifting market dynamics. Recreational marine applications, for instance, are witnessing significant growth as consumers seek more efficient and eco-friendly propulsion options. Sterndrive units and inboard engines are being gradually replaced by electric propulsion systems, which offer improved fuel efficiency and reduced emissions. Simultaneously, the commercial marine sector is exploring hybrid propulsion solutions to optimize performance and reduce operational costs. Hull design innovations are also gaining traction, with autonomous navigation and remote control systems becoming increasingly common. Control systems, marine electronics, and engine management systems are essential components of modern marine propulsion systems.

Fuel injection systems play a crucial role in enhancing fuel efficiency, while emissions regulations drive the demand for advanced emissions reduction technologies. Marine insurance, finance, and services are integral to the marine industry, providing essential support to boat dealerships and marine engineering firms. Spare parts and marine technology are also key areas of focus, as the industry strives to maintain optimal performance and ensure the longevity of marine assets. Fishing vessels and diesel engines continue to dominate the commercial marine sector, with ongoing research and development efforts aimed at enhancing their efficiency and sustainability. The market for marine power systems is characterized by continuous innovation and adaptation to meet the evolving needs of various sectors.

How is this Marine Power Systems Industry segmented?

The marine power systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Internal lighting

- Navigation lighting

- Surveillance systems

- Engine control

- Others

- End-user

- Commercial ships

- Military vessel

- Underwater vehicle

- Leisure ships

- Small recreational boats

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Type Insights

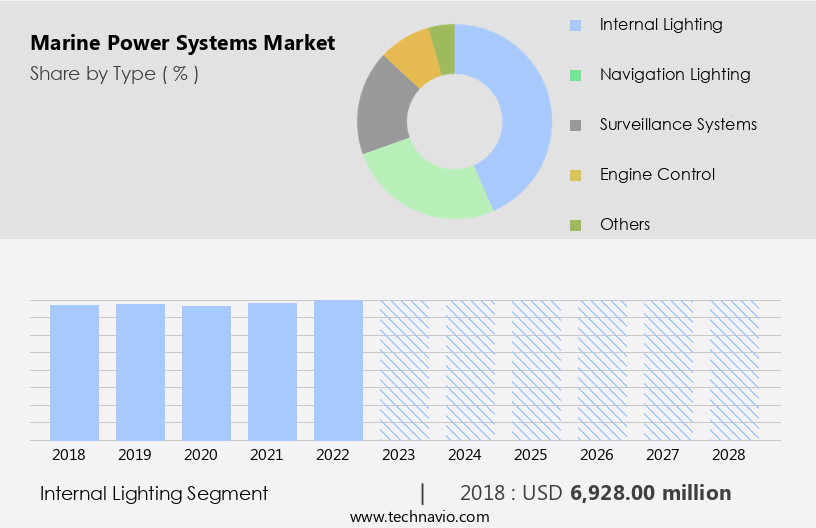

The internal lighting segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various segments contribute to the industry's growth and innovation. One such segment is the internal lighting systems, which play a crucial role in enhancing the functionality and aesthetics of marine vessels. These systems are integral to illuminating the interiors of ships, boats, and marine structures, catering to diverse lighting needs. LED lighting is a prominent technology in marine applications due to its energy efficiency, durability, and extended lifespan. It is used extensively for general illumination, task lighting, accent lighting, and decorative purposes within marine vessels. Navigation systems, marine electronics, and engine management systems often rely on LED lighting for clear visibility and optimal performance.

Marine construction companies integrate these lighting systems during the building process, ensuring compliance with emissions regulations and enhancing fuel efficiency. Marine insurance providers consider well-lit interiors as a safety feature, potentially impacting insurance premiums. Fishing vessels, commercial marine, and recreational marine applications all benefit from advanced internal lighting systems. Furthermore, performance optimization and hybrid propulsion systems can be complemented by intelligent data analytics and remote control capabilities, which can be integrated into internal lighting systems for added functionality. Spare parts suppliers and boat dealerships offer replacement and maintenance services for these lighting systems, ensuring the longevity and reliability of marine vessels.

In summary, the internal lighting segment in the market showcases the integration of various technologies and applications, driving innovation and growth within the industry.

The Internal lighting segment was valued at USD 6.93 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 52% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The maritime industry, a key facilitator of global trade, has seen significant growth due to the increasing demand for transporting raw materials and finished goods between Asia and Europe. This long-standing shipping route has witnessed the evolution of larger container ships, enabling mass production to shift towards Asia due to cost advantages. However, this growth has led to an escalating demand for new marine vessels, particularly container ships and tankers, to transport oil, natural gas, and mineral ores. Control systems, outboard motors, and navigation systems are essential components in the construction of these new marine vessels. Marine insurance, a crucial aspect of maritime commerce, ensures financial protection against potential risks.

Marine electronics, including performance optimization systems and fuel efficiency technologies, contribute to enhancing the efficiency and productivity of these vessels. Marine finance, emissions regulations, and marine services facilitate the acquisition and operation of these new vessels. Hybrid propulsion systems, marine engineering, and spare parts are integral to the maintenance and upkeep of these vessels. Fuel injection systems, marine propulsion systems, and engine management systems ensure optimal performance and fuel efficiency. Fishing vessels, diesel engines, and marine technology are essential components of the recreational marine sector, while commercial marine operations rely on sterndrive units, inboard engines, electric propulsion, and gasoline engines.

Hull design, autonomous navigation, and remote control systems are the latest advancements in marine technology, revolutionizing the industry. Marine construction, marine engineering, and boat dealerships are integral to the maritime industry's growth, providing the necessary infrastructure and services for the design, manufacturing, and sale of marine vessels. Data analytics and steering systems enable efficient operations and improved safety, while emissions regulations ensure environmental sustainability.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Marine Power Systems Industry?

- The surge in commercial shipping activity serves as the primary market driver.

- The marine industry is experiencing growth due to the expanding global economy and increasing global trade volumes. Maritime transportation plays a significant role in the transportation of goods between different regions, primarily in the form of containers. This trend is driven by the global demand and supply of commodities and manufactured goods. Marine technology, including engine management systems for diesel engines, is essential to the efficient operation of fishing vessels and commercial marine applications. The marine engineering sector is focused on the design, development, and implementation of advanced technology to enhance the performance and reduce the environmental impact of marine vessels.

- Spare parts and maintenance are critical components of the marine industry, ensuring the continuous operation of boats and ship fleets. Boat dealerships play a vital role in the distribution and sales of marine technology and vessels. The marine industry's growth is expected to continue as global economic expansion and development create new opportunities for marine technology and commercial marine applications.

What are the market trends shaping the Marine Power Systems Industry?

- The marine hybrid propulsion market is experiencing significant growth and is currently a notable trend in the maritime industry. This market's expansion is driven by the increasing demand for more fuel-efficient and environmentally friendly solutions for marine transportation.

- The market is experiencing significant growth due to the increasing adoption of advanced propulsion systems in both recreational and commercial marine applications. Traditional gasoline engines and inboard engines are being replaced by more efficient and eco-friendly options, such as electric propulsion and hybrid systems. This shift is driven by stricter emission regulations, with authorities and major ports worldwide implementing guidelines to reduce pollution from marine vessels. For instance, the International Maritime Organization (IMO) introduced new regulations on ships' emissions in 2015, primarily affecting coastal regions in Europe and North America.

- These areas are witnessing substantial developments in the market as shipping operators comply with the new emission standards. Another trend gaining traction is the integration of autonomous navigation and remote control systems, which enhance the overall efficiency and safety of marine vessels. In conclusion, the market is undergoing transformative changes, with a focus on sustainable and technologically advanced solutions.

What challenges does the Marine Power Systems Industry face during its growth?

- The collapse of Greece's shipbuilding industry poses a significant challenge to the industry's growth trajectory.

- The Eurozone crisis of 2009 significantly affected the European shipbuilding industry, particularly in Greece, which has historically been a major player in the global shipping trade. The sector was hit hard by the crisis, with surging borrowing costs and austerity measures resulting in a profound and long-term economic impact. For instance, Perama, a city on the Saronic Gulf in Greece, which relies heavily on the adjacent shipping port of Piraeus, experienced significant economic downturn. Despite these challenges, the marine industry is making a comeback, driven by advancements in technology and changing market dynamics. Control systems, outboard motors, navigation systems, marine insurance, marine electronics, marine construction, performance optimization, and hybrid propulsion are some of the key areas witnessing growth.

- These technologies are enabling better efficiency, safety, and sustainability in marine operations. Moreover, the increasing demand for marine transportation and the need for cost-effective and eco-friendly solutions are further fueling the growth of the marine industry. The market is expected to continue its upward trajectory, driven by these trends and the gradual recovery of the global economy.

Exclusive Customer Landscape

The marine power systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the marine power systems market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, marine power systems market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

AB Volvo - Volvo Penta, a leading marine power systems subsidiary, delivers innovative solutions through its D1 Inboard Engine, D2 Saildrive, and D6 Inboard Engine product lines. These engines are renowned for their efficiency, reliability, and low emissions. Volvo Penta's commitment to advanced technology and sustainable power systems sets it apart in the marine industry. By continuously pushing the boundaries of engineering, Volvo Penta empowers customers to explore the world with confidence and minimal environmental impact.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Volvo

- Atlas Marine Systems

- Caterpillar Inc.

- Cummins Inc.

- Daihatsu Diesel Mfg. Co. Ltd.

- ENAG SAS

- EnerSys

- Enpro Inc.

- General Electric Co.

- Hydraulic Marine Systems Inc.

- Hyundai Electric and Energy Systems Co. Ltd.

- Ingeteam Corp. S.A.

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries Ltd.

- NEWMAR

- Perkins Engines Co. Ltd.

- Rolls Royce Holdings Plc

- Siemens AG

- Wartsila Corp.

- Yamaha Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Marine Power Systems Market

- In February 2023, Wave Energy Technologies, a leading marine power systems provider, announced the launch of their new WaveStar 1000, a next-generation wave energy converter. This innovative device is designed to deliver up to 1 MW of continuous power, making it one of the most powerful wave energy systems in the market (Wave Energy Technologies Press Release).

- In March 2024, Siemens Gamesa Renewable Energy and Mitsui & Co. Ltd. Formed a strategic partnership to jointly develop floating wind and wave energy projects. This collaboration combines Siemens Gamesa's expertise in renewable energy technology with Mitsui's experience in project development and financing (Siemens Gamesa Renewable Energy Press Release).

- In May 2024, Carbon Clean Solutions, an Indian clean technology company, raised USD50 million in a Series C funding round. A significant portion of the investment will be allocated towards the development of their marine carbon capture, utilization, and storage (CCUS) technology (Business Wire).

- In October 2025, the European Union approved the Horizon Europe research and innovation program, which includes a â¬2.4 billion investment in ocean energy technologies. This funding will support the development and deployment of marine power systems, including wave, tidal, and offshore wind energy technologies (European Commission Press Release).

Research Analyst Overview

- The market encompasses various technologies and components, including fuel cell technology, exhaust systems, hull materials, marine robotics, engine cooling systems, radar systems, underwater vehicles, propeller design, composite materials, sonar systems, AIS transponders, marine batteries, fuel tank systems, corrosion protection, offshore wind power, marine lubricants, anti-fouling coatings, shaft materials, marine renewable energy, vibration damping, environmental impact, engine noise reduction, GPS navigation, and biodegradable fuels. Fuel cell technology is gaining traction as a clean energy alternative for marine applications. Exhaust systems are being redesigned to reduce emissions and improve fuel efficiency. Hull materials, such as composite materials, are being used to enhance durability and reduce weight.

- Marine robotics and underwater vehicles are revolutionizing underwater inspections and maintenance, while radar systems and sonar systems provide enhanced situational awareness. Propeller design and engine cooling systems optimize performance and reduce fuel consumption. Corrosion protection and anti-fouling coatings extend the life of marine structures and reduce maintenance costs. Offshore wind power and marine renewable energy are growing sectors, with fuel tank systems and marine batteries essential for energy storage. Vibration damping and environmental impact reduction are key considerations in marine engineering. Engine noise reduction and GPS navigation enhance safety and comfort. Biodegradable fuels are a sustainable alternative to traditional fossil fuels.

- Marine lubricants and shaft materials ensure efficient and reliable power transmission, while AIS transponders and GPS navigation enable real-time tracking and communication. Overall, the market is dynamic, with ongoing innovation and trends focused on sustainability, efficiency, and safety.

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Marine Power Systems Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.49% |

|

Market growth 2024-2028 |

USD 3417.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.32 |

|

Key countries |

China, US, Germany, South Korea, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Marine Power Systems Market Research and Growth Report?

- CAGR of the Marine Power Systems industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the marine power systems market growth of industry companies

We can help! Our analysts can customize this marine power systems market research report to meet your requirements.