LED Lighting Market Size 2025-2029

The led lighting market size is forecast to increase by USD 47.3 billion, at a CAGR of 8.5% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the declining manufacturing costs of LED lights. This cost reduction has made LED lighting increasingly competitive with traditional lighting solutions, leading to widespread adoption across various industries. However, the market also faces challenges, including the limited thermal tolerance of LEDs when installed in industrial facilities. This issue can lead to reduced lifespan and performance, necessitating careful consideration in the design and implementation of LED lighting systems. Additionally, the emergence of smart cities is creating new opportunities for LED lighting, as energy efficiency and connectivity become key priorities for urban infrastructure development.

- Companies seeking to capitalize on these trends should focus on developing innovative LED lighting solutions that address thermal management challenges and offer advanced features such as energy savings, remote control, and integration with smart city infrastructure. By addressing these market dynamics effectively, businesses can position themselves for success in the evolving LED lighting landscape.

What will be the Size of the LED Lighting Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and its applications across various sectors. Residential lighting integrates energy management systems, LED assembly, and wireless lighting control to create efficient and customizable solutions. In industrial settings, LED high bays, heat sinks, reflectors, and smart lighting control systems enhance building automation and energy efficiency. LED regulations and standards shape the market, influencing the development of LED lenses, certifications, and manufacturing processes. Outdoor lighting applications, including LED streetlights, landscape lighting, and retrofit kits, contribute to energy savings and reduced light pollution. Indoor lighting, hospitality lighting, and retail environments utilize LED panels, color temperature adjustments, and dimmable options for enhanced user experiences.

LED chips and manufacturing processes improve lumen output, power consumption, and color-tunable capabilities. The integration of IoT connectivity, lighting design, and human-centric lighting further expands the market's potential. LED downlights, architectural lighting, and floodlights cater to diverse industries and applications, ensuring the market remains a dynamic and innovative force.

How is this LED Lighting Industry segmented?

The led lighting industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Residential

- Commercial

- Outdoor

- Industrial

- Others

- Product

- Luminaries

- Lamps

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

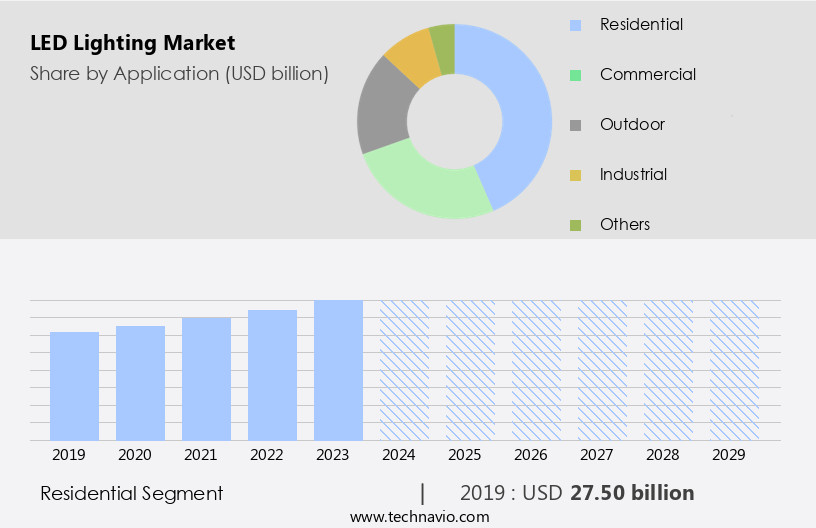

The residential segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption of energy-efficient lighting solutions across various applications. In 2024, the residential segment led the market, driven by urbanization and the trend towards energy efficiency. Consumers are now prioritizing trendy and personalized LED lighting systems for home decoration, leading to increased demand. Governments worldwide are also supporting this shift by offering subsidies on LED lighting, recognizing its energy efficiency advantages over traditional lighting. Industrial lighting, including LED high bays, is another major application segment, with the need for robust and long-lasting lighting solutions driving demand.

Smart lighting and lighting control systems are gaining popularity in commercial and industrial settings, with building automation and energy management playing crucial roles. LED regulations and standards ensure the quality and safety of these systems, while LED manufacturing continues to advance with innovations in LED chips, panels, and diffusers. Outdoor lighting, including LED floodlights and spotlights, is essential for safety and security, while LED retrofit kits offer cost-effective upgrades for existing lighting infrastructure. LED streetlights are becoming increasingly common due to their energy efficiency and longevity. Landscape lighting and architectural lighting applications are also growing, emphasizing the importance of aesthetics and design.

Color temperature, lumen output, and power consumption are key considerations for LED lighting systems, with color-tunable LEDs and dimmable LEDs offering flexibility and energy savings. Human-centric lighting and IoT connectivity are emerging trends, with smart home integration and wireless lighting control enhancing user experience. LED bulbs, drivers, and assemblies are essential components of LED lighting systems, with LED testing and certification ensuring their quality and performance. Energy efficiency remains a primary focus, with LEDs offering up to 80% energy savings compared to traditional lighting. In summary, The market is witnessing significant growth, driven by increasing urbanization, energy efficiency requirements, and advancements in LED technology.

Residential, industrial, and outdoor applications are the major segments, with smart lighting, energy management, and human-centric lighting emerging trends. Regulations, standards, and certifications ensure the quality and safety of these systems, making LED lighting a sustainable and cost-effective solution for the future.

The Residential segment was valued at USD 27.50 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

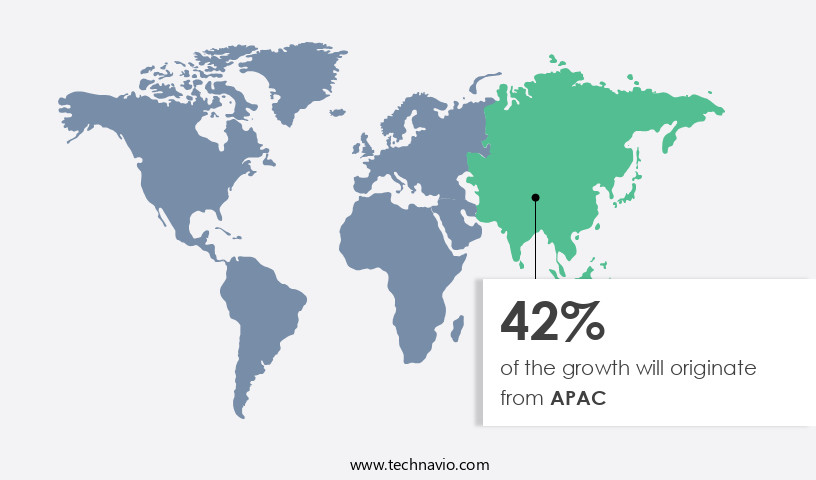

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is experiencing significant growth due to the increasing demand for energy-efficient solutions in both residential and commercial sectors. With the rise of retail, hospitality, and healthcare industries in the region, the need for advanced LED lighting systems is escalating. China, being the largest contributor to the regional market, hosts numerous LED manufacturing units and industries. Additionally, China's ongoing construction of over 450 smart city projects will significantly fuel the growth of the market in APAC during the forecast period. Smart lighting and lighting control systems are becoming increasingly popular, with industrial lighting and building automation integrating these technologies.

LED regulations and standards ensure energy efficiency and quality, while LED lens, reflector, and diffuser innovations enhance lighting design and color temperature. Lumen output and power consumption are crucial factors driving the market, with energy management systems and LED assembly solutions optimizing energy usage. Outdoor lighting, including LED retrofit kits and landscape lighting, cater to various applications, while indoor lighting solutions offer dimmable and color-tunable options. LED streetlights, floodlights, spotlights, and grow lights cater to diverse industries. Wireless lighting control and IoT connectivity enable seamless integration with smart home systems and energy management platforms. Innovations in LED manufacturing, such as LED chip technology, have led to advancements in lumen output and energy efficiency.

Human-centric lighting and color temperature adjustments cater to the needs of various applications, from retail to commercial lighting. The market is continually evolving, with a focus on reducing light pollution and improving energy efficiency through advanced LED technology.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to evolve, offering innovative solutions for residential, commercial, and industrial applications. Energy-efficient LED bulbs provide significant cost savings and longer lifespan compared to traditional lighting. LED technology offers customizable color temperatures, enabling adaptability for various settings. Smart LED lighting systems integrate with home automation and IoT devices, enhancing convenience and energy management. LED strip lights offer versatility for accentuating architectural features and creating unique designs. LED panels provide large-scale illumination for offices, retail spaces, and outdoor advertising. LED grow lights cater to horticulture, supporting plant growth and yield optimization. LED high bay lights illuminate warehouses and large industrial spaces. LED flood lights offer outdoor security and landscape lighting solutions. LED tube lights replace fluorescent tubes in offices and other commercial spaces. LED downlights provide directional illumination for targeted lighting needs. LED filament bulbs mimic the appearance of traditional incandescent bulbs. LED spotlights offer adjustable beam angles for accent lighting. The market's continuous advancements cater to diverse applications, delivering energy savings, customizable solutions, and innovative technology.

What are the key market drivers leading to the rise in the adoption of LED Lighting Industry?

- The declining manufacturing costs of LED lights serve as the primary driver for the market's growth.

- The market has experienced significant cost reductions since the last decade, primarily due to decreasing Average Selling Prices (ASPs) of chips and components used in LED manufacturing. This decline in manufacturing costs is driving down the initial installation cost of LED lamps and fixtures, leading to increased adoption across various applications. The reduction in manufacturing costs is attributed to government subsidies for semiconductor equipment, such as metal-organic chemical vapor deposition (MOCVD), which is essential for LED production. In addition to cost reductions, advanced technologies like smart lighting, lighting control systems, and building automation are gaining popularity in industrial lighting applications.

- LED reflector, high bay, and outdoor lighting are some of the popular LED product categories. LED regulations and standards, such as LED lens and heat sink requirements, ensure energy efficiency and longevity. The future of LED lighting lies in outdoor lighting, LED retrofit kits, and the integration of LED technology with other systems like building automation. In conclusion, the declining manufacturing cost of LEDs, coupled with technological advancements and regulatory support, is accelerating the adoption of LED lighting in various applications. This trend is expected to continue during the forecast period.

What are the market trends shaping the LED Lighting Industry?

- Smart cities are emerging as the next major market trend. This trend signifies the increasing adoption of advanced technologies to enhance urban living and improve infrastructure efficiency.

- LED lighting is a significant market segment in the realm of energy management and residential lighting, with innovations extending to various applications such as hospitality lighting, indoor lighting, landscape lighting, and LED streetlights. The global LED market encompasses the manufacturing of LED assemblies, LED chips, and LED certification. Smart city initiatives, driven by governmental support for energy conservation and resource management, are propelling the demand for LED lighting. This technology's energy efficiency, shorter switching times, and cost savings make it an essential component of smart city construction. Innovative LED solutions are being implemented in streetlights, which are ubiquitous in urban environments.

- These advanced streetlights offer features like automatic brightness adjustment based on traffic, remote lighting control, fault alerts, anti-theft protection, monitoring of streetlamp power cables, and remote meter reading. Furthermore, LED strips and wireless lighting control systems add to the market's versatility and convenience. Overall, the market's growth is fueled by its ability to contribute to energy savings, enhance safety, and create immersive, harmonious environments.

What challenges does the LED Lighting Industry face during its growth?

- The growth of the industrial sector faces a significant challenge due to the limited thermal tolerance of LEDs used in its facilities. This issue, which refers to the LEDs' inability to withstand high temperatures, necessitates the implementation of costly cooling systems or the replacement of LEDs more frequently than desired. This added expense can hinder the industry's overall progress and profitability.

- LED lighting has gained significant traction in the market due to its energy efficiency and long lifespan. However, the use of LED lighting in commercial and industrial settings presents unique challenges. One major issue is the impact of high temperatures on LED performance. LEDs convert a large portion of energy into light, but a considerable amount is lost as heat. In enclosed environments, such as industrial facilities and manufacturing plants, the temperature can rise, increasing the internal temperature of LED drivers beyond their case temperature (Tc) point. This can lead to reduced lumen output, decreased lifespan, and even premature failure of LED panels and diffusers.

- Moreover, high temperatures can also negatively affect color temperature consistency and color rendering index (CRI), impacting the quality of lighting design. Additionally, energy efficiency can be compromised due to increased power consumption in high-temperature conditions. To mitigate these challenges, considerations for proper lighting design, thermal management, and the use of color-tunable LEDs and human-centric lighting can help optimize performance and energy savings in commercial and industrial applications.

Exclusive Customer Landscape

The led lighting market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the led lighting market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, led lighting market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acuity Brands Inc. - The company introduces IP66-rated LED luminaires, ideal for both residential and commercial applications. These energy-efficient lights boast superior water and dust resistance, ensuring durability and reliability.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acuity Brands Inc.

- ams OSRAM AG

- Bridgelux Inc.

- Dialight PLC

- Digital Lumens Inc.

- Eaton Corp.

- Ennostar Inc.

- General Electric Co.

- GrowRay Lighting Technologies

- Hubbell Inc.

- Ideal Industries Inc.

- Koninklijke Philips NV

- LSI Industries Inc.

- Lumileds Holding BV

- OSRAM GmbH

- Panasonic Holdings Corp.

- Sharp Corp.

- Signify NV

- SMART Global Holdings Inc.

- Toyoda Gosei Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in LED Lighting Market

- In January 2024, Philips Hue, a leading player in the market, introduced its new line of smart bulbs, the Philips Hue Play HD, which offers enhanced color rendering and improved connectivity (Philips Hue Press Release).

- In March 2024, Osram and Signify, two major players, announced a strategic partnership to jointly develop and manufacture horticultural LED lighting solutions, aiming to strengthen their presence in the growing agricultural LED lighting sector (Osram Press Release).

- In April 2024, Cree, a significant LED lighting manufacturer, completed the acquisition of Ruud Lighting, a leading provider of LED lighting solutions for the commercial and industrial markets, expanding Cree's product portfolio and customer base (Cree Press Release).

- In May 2025, the European Union passed a new regulation mandating the use of LED lighting in all new public lighting projects, effective from 2026, further boosting the demand for LED lighting solutions in Europe (European Commission Press Release).

Research Analyst Overview

- The market is experiencing significant advancements, with a focus on sustainability, safety, and efficiency. LED lifespan prediction and thermal management are crucial factors in ensuring the reliability and longevity of LED luminaires and fixtures. LED color uniformity and dimming curve are essential for optimal lighting performance in various applications, including retail, healthcare, and education. Certifications, such as UL and Energy Star, play a vital role in LED lighting safety and regulatory compliance. LED driver efficiency and replacement are essential for minimizing energy consumption and reducing maintenance costs. LED lighting maintenance is another critical aspect, with innovative solutions emerging for predictive and preventive maintenance.

- LED array and retrofitting are popular trends in the market, offering cost-effective and energy-efficient alternatives to traditional lighting systems. LED lighting installation and simulation tools enable businesses to evaluate the ROI and optimize lighting designs. LED recycling is also gaining importance, with regulations and initiatives promoting the circular economy. Innovations in LED lighting, such as smart lighting and tunable white, are transforming the industry, providing customizable and energy-saving solutions for businesses. Overall, the market is dynamic and evolving, offering numerous opportunities for businesses to enhance their operations and reduce energy costs.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled LED Lighting Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

196 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 47.3 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Japan, Germany, India, UK, France, Canada, Italy, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this LED Lighting Market Research and Growth Report?

- CAGR of the LED Lighting industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the led lighting market growth of industry companies

We can help! Our analysts can customize this led lighting market research report to meet your requirements.