Maternity Wear Market Size 2025-2029

The maternity wear market size is forecast to increase by USD 2.86 billion, at a CAGR of 3.4% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing demand from emerging economies. This trend is driven by cultural shifts and rising disposable income, enabling more women to prioritize comfort and style during pregnancy. Moreover, innovation in the maternity wear sector is a key driver, with companies focusing on enhancing both the appearance and quality of their offerings to cater to evolving consumer preferences. With an aging population and increasing focus on health and wellness, the demand for stylish and functional maternity clothing continues to expand. However, the market faces a notable challenge with the declining fertility rate in several regions.

- This demographic shift may impact the demand for maternity wear in the long term, necessitating strategic adaptations from industry players. To capitalize on market opportunities and navigate challenges effectively, companies must stay abreast of consumer trends and preferences while continuously innovating to meet evolving needs.

What will be the Size of the Maternity Wear Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, reflecting the dynamic needs of expectant mothers across various sectors. Zipper closures and button closures remain popular choices for ensuring a comfortable and practical fit. Social media marketing plays a significant role in reaching the expanding target audience, with soft fabrics, panel inserts, and adjustable straps being key design trends. Price point is a crucial consideration, with organic cotton and nursing access becoming increasingly important for many consumers. Sustainable maternity wear, including adjustable waistbands and postpartum recovery wear, is gaining traction as consumers prioritize comfort and ethical sourcing. Maternity activewear, maternity jeans, and maternity outerwear are popular retail channels, with seamless construction and moisture-wicking fabrics enhancing functionality and comfort.

Belly panels and nursing gowns made of breathable fabrics are essential for pregnant women, while maternity dresses, shoes, swimwear, and underwear offer stylish options for various occasions. Manufacturing processes prioritize comfort stretch, cotton fabrics, and size range, catering to the diverse needs of pregnant women. Sustainability practices, including ethical sourcing and bamboo fabric, are increasingly important for brands seeking to build customer loyalty. Maternity fashion extends beyond pregnancy, with postpartum recovery wear and belly bands providing support during the recovery period. Empire waist and body positivity designs celebrate the unique shapes and sizes of pregnant and postpartum women.

Maternity and postpartum fashion continue to adapt to the evolving needs of consumers, with maternity leggings, nursing bras, and maternity tops offering versatile and comfortable solutions. The market's ongoing dynamism is driven by consumer preferences, design trends, and innovative manufacturing processes.

How is this Maternity Wear Industry segmented?

The maternity wear industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- Type

- Tops

- Bottoms

- Dress and tunics

- Others

- Material

- Cotton

- Polyester

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

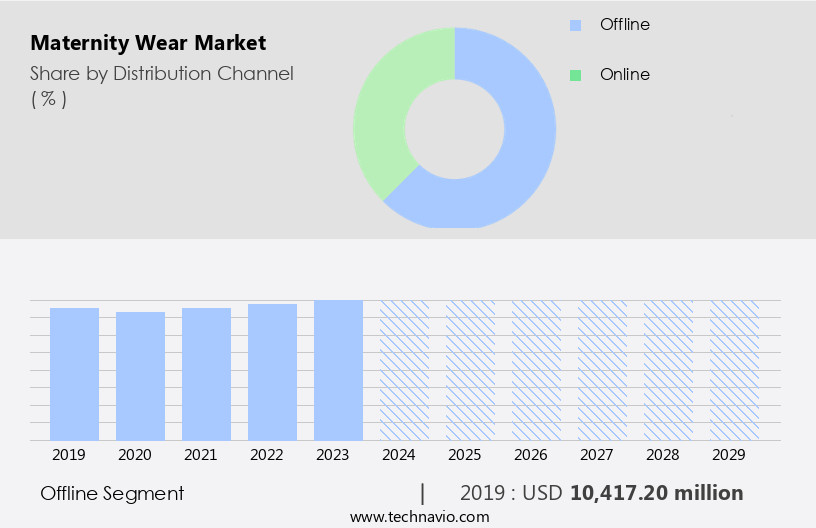

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

In The market, retail channels cater to expecting mothers through both online and offline platforms. Offline distribution includes physical retail outlets, where customers can engage in tangible shopping experiences. Specialty maternity stores, such as Motherhood Maternity and A Pea in the Pod, exclusively focus on maternity wear, offering expert assistance and extensive ranges of pregnancy-specific clothing. Large retail department stores, like Macys and Nordstrom, also incorporate maternity sections, providing a wide selection of maternity clothing within their premises. Maternity wear is characterized by soft fabrics, adjustable straps, and panel inserts for comfort and support. Design trends include petite maternity wear, plus-size maternity wear, and nursing gowns.

Hook-and-eye closures and adjustable waistbands facilitate ease of use. Maternity dresses, shoes, swimwear, and outerwear are popular choices, with comfort stretch, cotton fabrics, and seamless construction ensuring a snug fit. Manufacturing processes prioritize quality control and ethical sourcing, with sustainability practices and eco-friendly materials, such as bamboo fabric and moisture-wicking fabrics, gaining popularity. Maternity shapewear, nursing bras, and postpartum recovery wear cater to the various stages of pregnancy and postpartum recovery. Social media marketing and online sales contribute significantly to brand awareness and accessibility. Wholesale distribution enables retailers to offer a diverse range of maternity clothing to their customers. Maternity jeans, leggings, and tops are essential staples, with size ranges catering to body positivity and prenatal yoga clothing promoting fabric drape and comfort.

Maternity activewear and maternity sleepwear are essential categories, with focus on functionality and comfort. Postpartum fashion, including belly bands and empire waist designs, emphasizes body positivity and comfort during the recovery phase. Sustainable maternity wear, with organic cotton and silk fabrics, offers eco-conscious options for expecting mothers. In conclusion, the market prioritizes comfort, functionality, and support, with a focus on catering to the diverse needs of expecting mothers through various retail channels and design trends.

The Offline segment was valued at USD 10.42 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 35% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America, led by the US and Canada, holds a significant share due to the region's high disposable income, increasing fashion consciousness, and wide brand availability. Despite a decreasing birth rate, the demand for maternity wear is projected to increase in the US, fueled by these factors. The market's growth is driven by various entities. Retail channels offer diverse options, including adjustable straps, panel inserts, and petite and plus-size maternity wear, catering to different customer needs. Design trends favor soft fabrics, maternity support belts, and hook-and-eye closures for comfort and ease. Manufacturing processes prioritize quality control and seamless construction, ensuring the production of belly panels, nursing gowns, and maternity dresses made from breathable fabrics like cotton and silk.

Ethical sourcing and sustainability practices, such as organic cotton and bamboo fabric, are gaining popularity. Maternity shoes, maternity swimwear, maternity leggings, and maternity activewear also contribute to the market's growth. Postpartum recovery wear and nursing bras, available in various adjustable waistbands and closures, cater to the needs of new mothers. Maternity outerwear, maternity sleepwear, and maternity underwear, all designed with comfort stretch and fabric breathability, are essential components of the market. Social media marketing, online sales, and wholesale distribution expand brand awareness and reach. Maternity jeans, available in various fabric weights, remain a staple in maternity wear. The market's evolution reflects the importance of body positivity, size range, and prenatal yoga clothing, with fabric drape playing a crucial role in enhancing the overall look and feel.

Market Dynamics

The global maternity wear market is experiencing significant expansion, driven by evolving maternity wear market trends and strong maternity apparel market growth drivers. The increasing global maternity wear market size reflects a growing focus on pregnancy comfort and postpartum recovery. Key product categories include stylish maternity dresses, versatile maternity tops, and comfortable maternity bottoms such as jeans and leggings. Demand is also high for specialized items like maternity activewear, supportive maternity intimates, and cozy maternity sleepwear. A significant segment is nursing wear, providing crucial breastfeeding support. Innovations in materials like stretch fabrics and breathable fabrics, alongside the rise of sustainable maternity fabrics, are shaping product development. Emerging technologies, including smart maternity wear and virtual try-on (maternity) features, further cater to the evolving needs of expectant and new mothers.

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Maternity Wear Industry?

- The increasing demand for maternity wear is a significant market driver, particularly in emerging countries.

- The market is experiencing significant growth due to the increasing awareness of the importance of using specialized clothing during pregnancy and the rising disposable income of consumers. Fashion-conscious customers and the wide availability of maternity wear products are driving demand for these garments worldwide. To cater to the needs of pregnant women, companies are focusing on producing high-quality maternity wear with superior fabric performance and comfort. Maternity wear includes various categories such as maternity dresses, shoes, swimwear, shapewear, outerwear, sleepwear, and underwear. Comfort is a key consideration in the design of these garments, leading to the use of stretch fabrics like cotton and seamless construction.

- Ethical sourcing and fabric breathability are also important factors in the manufacturing process. Maternity dresses are available in various styles, from casual to formal, and are designed to accommodate the growing belly. Maternity shoes offer support and comfort, while maternity swimwear is made from quick-drying, chlorine-resistant fabrics. Maternity shapewear helps pregnant women maintain a comfortable and flattering silhouette, while maternity outerwear is often made from silk fabrics for a luxurious feel. Maternity sleepwear and underwear are essential for providing comfort during sleep and nursing. Nursing bras and pads are designed with zippers and double panels on both sides for easy access.

- Supply chain management is crucial in ensuring the timely delivery of these products to meet the increasing demand. Overall, the market is expected to continue growing as more women prioritize their comfort and well-being during pregnancy and beyond.

What are the market trends shaping the Maternity Wear Industry?

- Maternity wear is evolving to incorporate greater innovation in comfort, appearance, and quality, which is becoming a notable trend in the market. Enhancements in these areas are essential for meeting the unique needs of expectant mothers and catering to their evolving fashion preferences.

- Maternity wear holds significant importance for pregnant and postpartum women, serving as a crucial layer between the skin and outerwear. Comfort is a primary consideration for this intimate clothing, addressing issues such as mobility restrictions and thermal, aesthetic, and sensorial concerns. Fashion-conscious women, regardless of age or social status, seek maternity wear that aligns with current trends. Brands like Triumph cater to these needs by offering comfortable and stylish options. The fabric choice plays a crucial role, with moisture-wicking bamboo fabric and empire waist designs being popular.

- Additionally, size range, body positivity, and sustainability practices are essential factors influencing consumer decisions. Pre- and postnatal yoga clothing featuring fabric drape and nursing bras are also in demand. Brands prioritize these elements to ensure maternity wear not only feels comfortable but also aligns with evolving consumer preferences.

What challenges does the Maternity Wear Industry face during its growth?

- The declining fertility rate poses a significant challenge to the industry's growth trajectory.

- The market has witnessed notable growth in recent years, driven by various factors. With the global average fertility rate declining to approximately 2.4 children per woman in 2025, compared to 4.7 in 1970, the demand for maternity wear has remained steady. Factors such as age and the consumption of tobacco and alcohol contribute to the decline in fertility among women, thereby increasing the need for maternity clothing. In developed countries like the US, the UK, and others, the fertility rate has been declining for over two decades, while developing countries such as India have also experienced a similar trend.

- Maternity wear brands have responded to this trend by offering a range of products catering to different stages of pregnancy and postpartum recovery. Zipper closures and adjustable waistbands have become popular features in maternity clothing, ensuring ease and comfort for pregnant women. Sustainable maternity wear made from organic cotton and nursing access have also gained popularity among consumers. Brand awareness and online sales have been key drivers in the market. Social media marketing and wholesale distribution have enabled brands to reach a wider audience and expand their customer base. Maternity activewear has also emerged as a significant segment, catering to the fitness needs of pregnant women.

- As the market continues to evolve, brands are focusing on innovation and sustainability to meet the changing needs and preferences of their target audience. Adjustable waistbands and nursing access are no longer the only features that set maternity wear apart from regular clothing. The market is expected to continue its growth trajectory, driven by these trends and the increasing demand for comfortable and functional maternity clothing.

Exclusive Customer Landscape

The maternity wear market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the maternity wear market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, maternity wear market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A Mothers Boutique LLC - This company specializes in providing maternity clothing solutions, featuring a nursing bra with yoga-inspired support, a lightweight nursing sweatshirt, and versatile nursing tees. These essentials cater to expectant mothers' comfort and functionality needs during pregnancy and beyond.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A Mothers Boutique LLC

- Adidas AG

- Adore Me Inc.

- ASOS Plc

- Brainbees Solutions Pvt. Ltd.

- H and M Hennes and Mauritz GBC AB

- Hanesbrands Inc.

- Hotmilk Lingerie

- Ingrid and Isabel LLC

- JoJo Maman Bebe Ltd.

- Marquee Brands

- Medela

- Nike Inc.

- Nine and Co. BV

- Penney IP LLC

- SARL CacheCoeur

- Seraphine Ltd.

- Shaico Fashion Pvt. Ltd.

- The Gap Inc.

- Tytex AS

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Maternity Wear Market

- In January 2024, H&M, the global fashion retailer, introduced an extended size range for its maternity wear collection, catering to pregnant women with sizes up to 34 weeks (H&M Press Release, 2024). This expansion marked a significant step towards inclusivity and catering to the needs of a larger customer base.

- In March 2024, Serena Williams' fashion label, S by Serena, partnered with Amazon Fashion to sell its maternity and post-pregnancy apparel exclusively on Amazon (Amazon PR Newswire, 2024). This collaboration allowed the brand to reach a broader audience and expand its distribution network, while Amazon gained an exclusive partnership with a renowned fashion label.

- In May 2024, Thinx, a period-proof underwear brand, raised USD12 million in a Series C funding round, bringing its total funding to USD32 million (Crunchbase, 2025). The investment will be used to expand its product line and increase its presence in the market, addressing the need for period-proof underwear for pregnant and postpartum women.

- In April 2025, the European Union approved the Horizon 2020 project "Sustainable Maternity Wear," which aims to develop eco-friendly and sustainable maternity wear using recycled materials (European Commission, 2025). This initiative reflects the growing trend towards sustainable fashion and the increasing demand for eco-friendly maternity wear options.

Research Analyst Overview

- In the dynamic the market, retail analysis reveals a growing demand for versatile and comfortable clothing options. Tunic tops and A-line maternity dresses continue to be popular choices, while mini dresses and bodycon maternity dresses cater to those seeking fashionable yet practical attire. Fashion photography showcases maternity coats, wrap dresses, midi dresses, and maxi dresses, providing inspiration for expectant mothers. Customer reviews highlight the importance of maternity workwear, nursing covers, and nursing tank tops, ensuring productivity and comfort in the workplace. Brand positioning in the marketplace emphasizes fair labor practices, body diversity, and size inclusivity.

- Maternity bridal wear, maternity formal wear, and maternity shorts also gain traction, addressing the needs of diverse clientele. Sustainable materials, such as recycled fabrics and eco-friendly dyes, are increasingly used to appeal to socially-conscious consumers. Maternity accessories, including maternity belts, pregnancy pillows, diaper bags, and maternity skirts, are essential additions to a growing wardrobe. Influencer marketing and social media campaigns help expand reach and foster community among expectant mothers. Ethical manufacturing and product feedback are crucial elements in maintaining brand reputation and customer loyalty. Maternity jackets, shift dresses, and postpartum underwear cater to the unique needs of women during various stages of pregnancy and postpartum.

- Fit-and-flare dresses and maternity belts provide a flattering silhouette, while maternity formal wear ensures that women feel confident and elegant for special occasions. Overall, the market continues to evolve, addressing the diverse needs of expectant mothers with innovative designs, sustainable materials, and inclusive sizing.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Maternity Wear Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

223 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.4% |

|

Market growth 2025-2029 |

USD 2861.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, China, UK, India, Canada, Germany, Japan, France, Australia, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Maternity Wear Market Research and Growth Report?

- CAGR of the Maternity Wear industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the maternity wear market growth of industry companies

We can help! Our analysts can customize this maternity wear market research report to meet your requirements.