Yoga Clothing Market Size 2025-2029

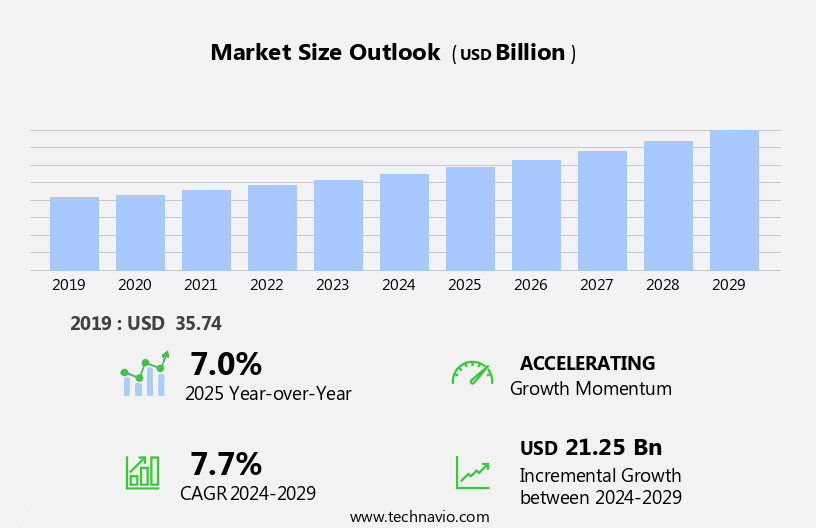

The yoga clothing market size is forecast to increase by USD 21.25 billion at a CAGR of 7.7% between 2024 and 2029.

- The market is experiencing significant growth, driven by the increasing number of yoga practitioners worldwide. According to recent estimates, the global yoga community is projected to reach over 300 million by 2025, fueling the demand for specialized clothing and yoga accessories. This trend is further amplified by the introduction of new technologies and features in yoga clothing, such as moisture-wicking fabrics, adjustable straps, and seamless construction, which cater to the unique needs of yoga practitioners. However, the market faces challenges as well. Unpredictable raw material prices pose a significant threat to the profitability of yoga clothing manufacturers.

- For instance, fluctuations in cotton prices can significantly impact the cost structure of basic yoga pants. Additionally, the market's competitiveness is increasing, with new players entering the market frequently, making it essential for established players to innovate and differentiate themselves to maintain their market share. Companies must navigate these challenges effectively by focusing on cost optimization, product differentiation, and strategic partnerships to capitalize on the growing opportunities in the market.

What will be the Size of the Yoga Clothing Market during the forecast period?

- The market continues to evolve, with dynamic trends and applications across various sectors. Compression wear and performance fabrics remain popular choices for advanced yogis and yoga practitioners, providing support and flexibility. Innovative designs, such as color blocking and seamless construction, cater to the preferences of beginner yogis and intermediate practitioners alike. Sports bras and yoga straps are essential accessories for women's yoga clothing, ensuring comfort and support during practice. Yoga instructors and yoga studios integrate eco-friendly clothing, including organic cotton and recycled polyester, into their offerings, aligning with ethical production practices. Yoga towels, yoga mats, and yoga bags are must-have accessories for yogis seeking convenience and functionality.

- Quick-drying fabrics and breathable materials, such as bamboo fabric, are increasingly popular choices for yoga pants and yoga shirts. Men's yoga clothing, unisex yoga clothing, and yoga fashion continue to gain traction, reflecting the expanding yoga community's diverse needs. Online retailers offer a wide range of yoga clothing trends and styles, from tank tops and yoga jackets to patterned prints and yoga bags. The yoga lifestyle encompasses more than just clothing; it's a holistic approach to wellness. Yoga wear brands prioritize sustainability, fair trade practices, and ethical production to cater to the evolving demands of the market.

How is this Yoga Clothing Industry segmented?

The yoga clothing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Bottom wear

- Top wear

- Accessories

- End-user

- Men

- Women

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Product Insights

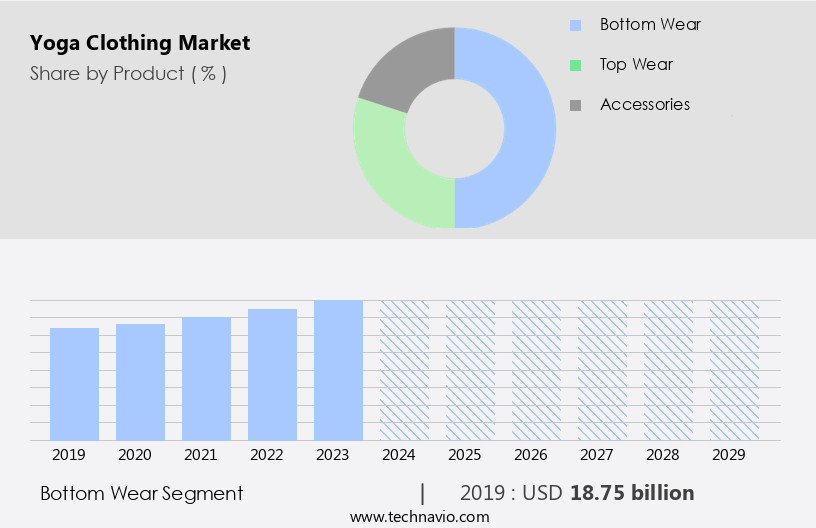

The bottom wear segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of apparel designed for practitioners of various skill levels. Compression wear and performance-enhancing fabrics, such as high-performance synthetics and quick-drying materials, cater to advanced yogis and those engaging in intense practices. Innovative designs, including seamless construction, color blocking, and patterned prints, add visual appeal to the functional clothing. Sustainable materials, like organic cotton and bamboo fabric, and ethical production practices are increasingly popular among yoga practitioners. Fitness centers and yoga studios stock a variety of yoga clothing styles, including yoga shorts, yoga jackets, yoga pants, and yoga shirts. Yoga clothing trends lean towards unisex designs, sports bras, and tank tops, ensuring comfort and versatility for all genders.

Yoga accessories, such as meditation cushions, yoga blocks, yoga straps, and yoga towels, complement the clothing in enhancing the overall yoga experience. Online retailers have made yoga clothing accessible to a wider audience, offering a vast selection of yoga wear brands and styles. Fair trade practices and eco-friendly clothing options have become essential considerations for many consumers. Yoga bags and yoga mats are also essential items for yogis, providing convenience and functionality during their practice. In the yoga community, yoga instructors and practitioners embrace the latest yoga clothing trends and styles, reflecting the evolving nature of the practice.

Yoga clothing is more than just apparel; it is a reflection of the yoga lifestyle and a testament to the commitment and dedication of its wearers.

The Bottom wear segment was valued at USD 18.75 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

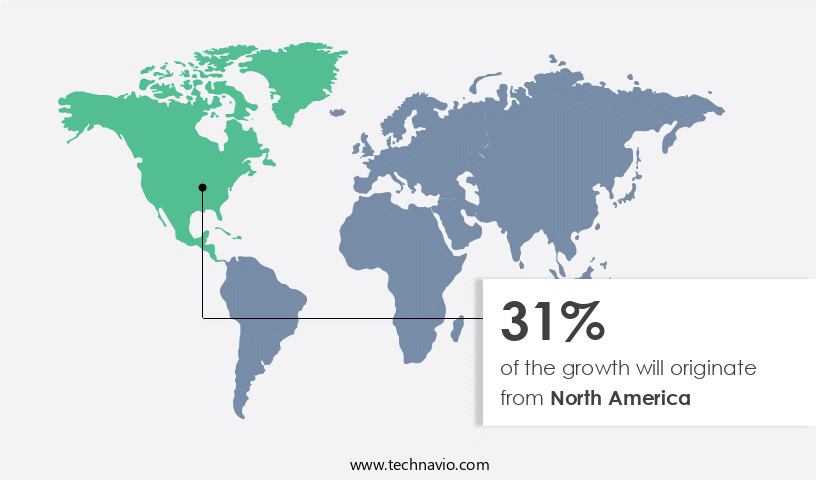

North America is estimated to contribute 31% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing popularity of yoga and fitness practices. This trend is driving competitors to introduce innovative designs, high-performance fabrics, and sustainable materials to cater to the needs of advanced yogis and beginner practitioners alike. Compression wear, yoga shorts, yoga jackets, sports bras, and yoga pants are among the most sought-after items. Yoga clothing trends include seamless construction, color blocking, and breathable fabrics. Fitness centers and yoga studios serve as key distribution channels, while online retailers offer convenience and a wider selection. The market is also embracing ethical production and fair trade practices, as well as eco-friendly clothing made from organic cotton, bamboo fabric, and recycled polyester.

Yoga accessories such as blocks, straps, towels, and bags are essential companions for practitioners. Brands are focusing on unisex and women's yoga clothing, offering tank tops, tankinis, and tank dresses, as well as men's yoga clothing in the form of shorts, pants, and tops. The yoga community is a significant influence on the market, with yoga instructors and practitioners setting fashion trends and promoting the benefits of yoga wear. The market is expected to face challenges from the growing popularity of other fitness activities, such as cycling, water sports, camping, and mountain climbing. Despite these challenges, the market in the US remains competitive and is the largest in the region.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Yoga Clothing Industry?

- The increasing prevalence of yoga practitioners serves as the primary catalyst for market growth.

- Yoga, an ancient practice originating in India, has witnessed a notable rise in popularity as a fitness activity in recent years, particularly in North America. The yoga community in the US and Canada has experienced significant growth, with an increasing number of individuals embracing this form of workout and meditation for stress relief, flexibility, general fitness, and overall health improvement. This trend is not limited to North America; yoga is also gaining traction in Europe and Asia Pacific countries, as people become more health-conscious. The yoga fashion industry has responded to this trend by offering a wide range of yoga clothing and accessories.

- Online retailers stock an array of women's yoga clothing, including tank tops, leggings, and shorts, often featuring patterned prints and flatlock seams for comfort and ease of movement. Yoga bags, designed to carry mats and other essentials, are also popular. Intermediate yogis appreciate yoga wear brands that cater to their needs, offering high-quality and functional clothing that aligns with the yoga lifestyle. Yoga studios play a crucial role in fostering this community, providing a space for people to practice and connect. As the popularity of yoga continues to grow, it's clear that this ancient practice is more than just a workout; it's a lifestyle choice that prioritizes harmony, mindfulness, and overall wellbeing.

What are the market trends shaping the Yoga Clothing Industry?

- The introduction of innovative technologies and features is currently shaping the trend in the market. This includes advancements such as moisture-wicking materials, adjustable straps, and built-in support structures, enhancing both functionality and comfort for practitioners.

- The market has witnessed significant advancements in the last decade and a half, with manufacturers prioritizing technology and customer satisfaction. Consumers are increasingly seeking high-quality yoga clothing that enhances their performance and comfort during practice. Compression wear, yoga shorts, jackets, shirts, blocks, and meditation cushions are popular choices, often made from high-performance fabrics and sustainable materials. Innovative designs, such as color blocking and seamless construction, add to the appeal.

- These products are evaluated based on wicking abilities, comfort, grip, stickiness, and eco-friendliness. The competitive landscape has driven the industry to create immersive and harmonious yoga clothing, focusing on user experience. Cost-effective and durable solutions are in high demand, making the market a dynamic and evolving space.

What challenges does the Yoga Clothing Industry face during its growth?

- The unpredictability of raw material prices poses a significant challenge to industry growth, requiring professionals to remain knowledgeable and adaptable in order to mitigate potential risks and ensure business success.

- The market is experiencing fluctuations in raw material prices, posing a significant challenge for market growth. For instance, the prices of synthetic fibers like Spandex, commonly used in sports bras and performance wear, can vary greatly. Similarly, the scarcity of high-quality polyester fibers used in yoga mats and towels has driven up their prices. These price volatilities impact the profit margins of major players in the market, including Adidas, Nike, PUMA, and lululemon athletica. As a result, yoga clothing trends and styles, such as those preferred by advanced yogis and men's yoga clothing, may become less affordable for some yoga practitioners.

- This situation emphasizes the importance of fair trade practices in the yoga clothing industry, ensuring ethical sourcing and stable pricing for consumers.

Exclusive Customer Landscape

The yoga clothing market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the yoga clothing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, yoga clothing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Adidas AG - This company specializes in providing high-quality yoga apparel, including the Versatile Windbreaker and Yoga Training Pants.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Adidas AG

- ANTA Sports Products Ltd.

- ASICS Corp.

- Authentic Brands Group LLC

- BasicNet Spa

- Columbia Sportswear Co.

- Frasers Group plc

- Hanesbrands Inc.

- Hugger Mugger Yoga Products LLC Inc.

- La Vie Boheme Yoga

- lululemon athletica Inc.

- Manduka LLC

- New Balance Athletics Inc.

- Nike Inc.

- PUMA SE

- Ralph Lauren Corp.

- Under Armour Inc.

- VF Corp.

- Yoga Direct LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Yoga Clothing Market

- In February 2024, Lululemon Athletica, a leading player in the market, introduced its new "We Made Too Much" program, which aims to reduce waste by selling discounted items from its overstock inventory (Lululemon Press Release). This initiative not only helps the environment but also caters to budget-conscious consumers, expanding the brand's reach.

- In May 2025, Adidas and Guess collaborated to launch a new yoga apparel line, combining Adidas' athletic expertise with Guess' fashion-forward designs (Adidas Press Release). This strategic partnership brings together two major brands, broadening their offerings in the market and potentially attracting new customers.

- In August 2025, Athleta, a Gap Inc. Brand, secured a significant investment of USD100 million from BlackRock Real Assets to expand its store footprint and enhance its omnichannel capabilities (Business Wire). This funding round will enable Athleta to strengthen its presence in the market, both online and offline.

- In November 2025, India's Textile Ministry announced the launch of the "Make in India" initiative for the yoga clothing sector, aiming to promote domestic manufacturing and create jobs (Textile Ministry Press Release). This government initiative will significantly impact the market, potentially reducing reliance on imports and boosting the Indian textile industry.

Research Analyst Overview

The market encompasses a diverse range of performance-focused apparel, from yoga outfits and attire to yoga wear and gear. Consumers prioritize both the durability and technology of their yoga clothing, seeking items that can withstand the demands of regular practice. Discounts and ethical considerations also influence purchasing decisions, with many seeking sustainable and eco-friendly options. As trends shift, innovation in yoga clothing continues to emerge, including advancements in comfort, style, and sustainability. In 2023, expect to see a focus on functional and eco-friendly yoga clothing, while 2024 may bring further advancements in technology and design. Reviews play a crucial role in guiding consumer choices, providing valuable insights into the quality and performance of various brands and styles.

Online sales dominate the market, offering convenience and a wide selection for busy consumers. Overall, the yoga clothing industry remains a dynamic and evolving sector, catering to the diverse needs and preferences of practitioners.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Yoga Clothing Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 7.7% |

|

Market growth 2025-2029 |

USD 21.25 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.0 |

|

Key countries |

US, Canada, China, UK, Japan, India, Germany, France, Brazil, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Yoga Clothing Market Research and Growth Report?

- CAGR of the Yoga Clothing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the yoga clothing market growth of industry companies

We can help! Our analysts can customize this yoga clothing market research report to meet your requirements.