Mental Health Market Size 2025-2029

The mental health market size is forecast to increase by USD 153.3 billion at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth due to the increasing prevalence of mental health disorders worldwide. According to the World Health Organization, approximately 450 million people worldwide suffer from mental disorders, making it a major public health concern. This trend is driving demand for effective mental health solutions, leading to numerous opportunities for market participants. However, the market is not without challenges. Regulatory hurdles impact adoption, as mental health services are subject to strict regulations in many countries. For instance, approval processes for new mental health treatments can be lengthy and costly. Furthermore, supply chain inconsistencies temper growth potential, as mental health services often require specialized resources and skilled professionals. Technological developments, such as artificial intelligence and machine learning, are being integrated into mental health apps to provide personalized and effective treatments.

- Despite these challenges, the emergence of virtual behavioral and mental health services is revolutionizing the industry, offering more accessible and affordable solutions for individuals in need. Companies that can navigate these challenges and effectively capitalize on the growing demand for mental health services will be well-positioned for success in this dynamic market.

What will be the Size of the Mental Health Market during the forecast period?

- The mental health market is experiencing significant growth, driven by the increasing recognition of mental health recovery as a crucial component of overall well-being. Mental health analytics plays a pivotal role in identifying trends and insights to inform effective mental health treatment and policy. The mental health crisis necessitates innovative solutions, such as mental health technology and mental health programs, to address mental health challenges and disparities. Mental health equity is a pressing concern, with mental health resources and support often unequally distributed. Mental health training and advocacy are essential to building mental health resilience and reducing mental health stigma.

- Mental health interventions, from policy to self-management, require ongoing research and evidence-based practices to improve mental health outcomes. Mental health insights and education are vital for addressing mental health emergencies and promoting mental health awareness. Mental health initiatives, including mental health services and mental health innovation, must prioritize accessibility and affordability to meet the diverse needs of the population.

How is this Mental Health Industry segmented?

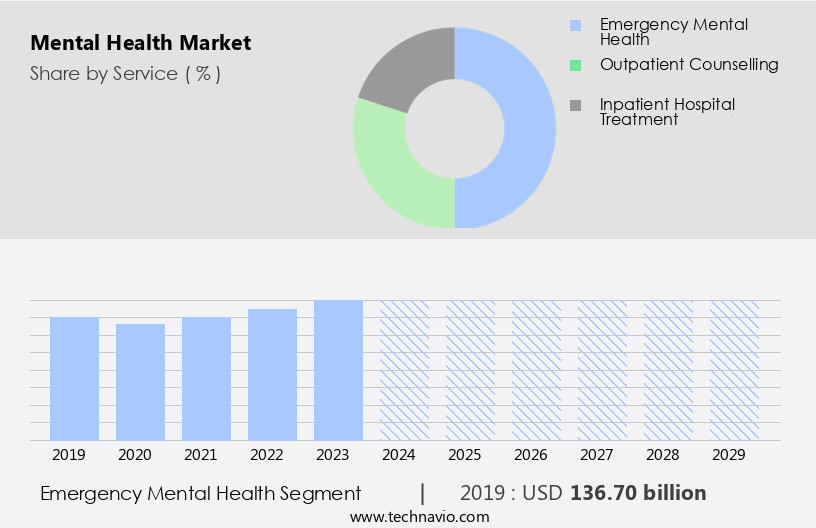

The mental health industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Service

- Emergency mental health

- Outpatient counselling

- Inpatient hospital treatment

- Age Group

- Adult

- Geriatric

- Pediatric

- Delivery Mode

- In-person services

- Telehealth and virtual care

- Mobile apps and digital platforms

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Service Insights

The emergency mental health segment is estimated to witness significant growth during the forecast period.

In the dynamic market, online therapy and depression management solutions have gained significant traction, offering accessible and convenient care for individuals dealing with mental health concerns. Mental health insurance policies continue to evolve, expanding coverage for mental health services and promoting affordability. The mental health workforce is expanding to meet the increasing demand, with a focus on personalized care and addressing substance abuse, anxiety management, and stress management. Artificial intelligence and machine learning are revolutionizing mental health care, enabling early intervention, stigma reduction, and improved patient engagement. Workplace wellness programs prioritize mental health awareness, integrating mental health professionals into primary care settings and offering digital therapeutics for sleep disorders and trauma therapy.

Community mental health and school mental health initiatives are crucial for addressing mental health needs at the grassroots level. Mental health apps and data analytics facilitate mental health literacy and patient self-management, while social workers and patient engagement strategies ensure access to care and reduce barriers to treatment. Virtual therapy and patient-provider collaboration are key to addressing mental health emergencies outside of regular counseling hours, ensuring timely and effective care for those in need.

The Emergency mental health segment was valued at USD 136.70 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. According to NCBI, digital health interventions have shown promising results in improving mental health outcomes. The market is experiencing significant growth, with North America leading the way in 2024. Advanced healthcare infrastructure, extensive mental health services, and robust research facilities in this region are driving its dominance. High awareness levels, effective mental health campaigns, and strong demand for services in countries like the US and Canada further bolster the market. Digital mental health platforms and telehealth services are enhancing accessibility and convenience, while government initiatives and policies are reducing stigma and improving care access. Mental health insurance, a crucial component of the market, is expanding to cover various mental health conditions, including depression management, anxiety, and substance abuse.

The mental health workforce is evolving with the integration of mental health professionals, social workers, and artificial intelligence (AI) in personalized care. Trauma therapy, stress management, and sleep disorders are among the many areas receiving attention. Mental health literacy is on the rise, with data analytics playing a significant role in early intervention and community mental health. Workplace wellness programs and school mental health initiatives are addressing mental health issues at their roots. Mental health apps and virtual therapy are increasingly popular, offering affordable care and engaging patients. Machine learning (ML) and AI are revolutionizing patient engagement and primary care integration.

Substance abuse treatment and mental health awareness are gaining importance, with a focus on reducing stigma and improving access to care. Digital therapeutics are emerging as effective alternatives to traditional treatments for various mental health conditions. The market is a dynamic and evolving landscape, with continuous innovation and collaboration shaping its future.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Mental Health market drivers leading to the rise in the adoption of Industry?

- The increasing prevalence of mental health disorders serves as the primary catalyst for market growth in this sector. The market is experiencing significant growth due to the increasing prevalence of mental health disorders, which affects nearly 900 million people worldwide, according to the World Health Organization. Anxiety and depression are the most common mental health conditions, with half of the world's population expected to experience one at some point in their lives. This trend is both a public health crisis and a major economic concern, as mental disorders account for one in every six years lived with disability. Online therapy and personalized care are becoming increasingly popular solutions for managing mental health conditions, including depression and substance abuse.

- Mental health insurance coverage is also expanding to include these services, making mental health care more accessible to a larger population. Moreover, workplace wellness programs are prioritizing mental wellness initiatives to support employee mental health and productivity. The mental health workforce is also growing to meet the increasing demand for mental health services, with a focus on providing empathetic care. The market is driven by the urgent need to address the growing prevalence of mental health disorders and the resulting economic and social impact. Innovations in mental health care, such as online therapy and personalized care, are making mental health services more accessible and effective.

What are the Mental Health market trends shaping the Industry?

- Virtual behavioral and mental health services are gaining increasing popularity in the market, representing an emerging trend. This shift towards virtual services is mandatory for many individuals seeking professional and convenient care. The market is undergoing significant transformation due to the integration of technology and innovation. Artificial intelligence (AI) is playing a pivotal role in mental health literacy through data analytics, enabling early intervention and personalized anxiety management. Telehealth platforms and AI-powered mental health apps are gaining popularity, offering accessible, stigma-free support from the comfort of one's home. These virtual solutions are not just addressing common mental health issues like anxiety, depression, and stress but are also expanding into corporate wellness, community mental health, and preventive care.

- Key trends include AI-driven personalization of therapy, gamification to enhance user engagement, and integration with wearable devices for real-time emotional tracking. This shift towards virtual mental health services is crucial in addressing the rising mental health awareness and the need for scalable, personalized care.

How does Mental Health market faces challenges during its growth?

- Government regulations pose a significant challenge to the industry's growth. In order to comply with various regulations, businesses must allocate significant resources towards ensuring compliance, which can hinder their ability to expand and innovate. Adhering to these rules is not only mandatory but also essential for maintaining a legitimate and ethical business operation. The market encompasses various mental health apps, stress management tools, social workers, and virtual therapy sessions aimed at providing accessible and affordable care for individuals dealing with mental health issues. Machine learning algorithms are increasingly being integrated into mental health services to enhance personalized treatment plans and improve patient outcomes. Mental health professionals must adhere to numerous regulations and standards to maintain eligibility for government healthcare programs and continue operating their facilities.

- These regulations include licensure and accreditation requirements, reimbursement guidelines, and patient health information privacy and security laws. Violations of these regulations may result in exclusion from government programs and potential loss of licenses, impacting the ability to provide essential mental health services.

Exclusive Customer Landscape

The mental health market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mental health market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mental health market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Acadia Healthcare Co. Inc. - This company specializes in delivering comprehensive mental health solutions, encompassing detoxification, inpatient, and residential treatment services.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Acadia Healthcare Co. Inc.

- CareTech Holdings Ltd.

- Crestwood Behavioral Health Inc.

- Promises Behavioral Health LLC

- Pyramid Healthcare Inc.

- REM Minnesota

- Sevita Health

- Strategic Behavioral Health

- TEAMCare Behavioral Health LLC

- The Cigna Group

- Unison Behavioral Health

- Universal Health Services Inc.

- Vita Health Group

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mental Health Market

- In February 2023, Pfizer Inc. announced the launch of its digital therapeutic platform, Pfizer NeuroBusiness, aimed at addressing mental health conditions through digital treatments. This new offering represents a significant shift towards digital solutions in the market (Pfizer Press Release, 2023).

- In June 2024, Merck KGaA and Siemens Healthineers entered into a strategic partnership to develop and commercialize a digital mental health platform. This collaboration combines Merck KGaA's expertise in mental health and Siemens Healthineers' digital health solutions, with the goal of improving access to mental health services (Merck KGaA Press Release, 2024).

- In October 2024, the U.S. Food and Drug Administration (FDA) granted approval to Pear Therapeutics for Somryst, a digital therapeutic for the treatment of chronic insomnia. This marks a major milestone in the recognition of digital therapeutics as effective alternatives to traditional treatments in mental health (FDA Press Release, 2024).

- In January 2025, Teladoc Health completed the acquisition of BetterHelp, a leading online counseling platform. This strategic move expands Teladoc Health's virtual care offerings, making mental health services more accessible to a larger population (Teladoc Health Press Release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market trends shaping its landscape. Artificial intelligence (AI) and data analytics are increasingly being integrated into mental health services, enabling personalized care for various conditions such as anxiety management, depression management, and substance abuse. Mental health literacy is gaining momentum as a crucial component of early intervention and stigma reduction efforts. Community mental health and school mental health initiatives are leveraging AI to improve access to care and affordability. Mental health insurance policies are evolving to cover digital therapeutics, including mental health apps and virtual therapy sessions. The mental health workforce is adapting to these changes, with mental health professionals incorporating AI and machine learning (ML) into their practices. According to Sensor Tower, mental health apps have seen a considerable rise in utilization, reflecting the importance of patient-centric, personalized care in mental health treatment.

Anxiety management and stress management are becoming priority areas, with workplace wellness programs integrating mental health services to boost productivity and employee engagement. Trauma therapy and sleep disorders are also receiving increased attention, with AI-powered solutions offering effective interventions. The ongoing unfolding of market activities in mental health is transforming the way mental health services are delivered, making them more accessible, personalized, and effective. The integration of AI, mental health literacy, data analytics, and community mental health initiatives is paving the way for a future where mental wellness is prioritized and stigma is reduced.

Dive into Technavio's strong research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mental Health Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

194 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 153.3 billion |

|

Market structure |

Concentrated |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

US, Canada, Germany, UK, China, France, Japan, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mental Health Market Research and Growth Report?

- CAGR of the Mental Health industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mental health market growth of industry companies

We can help! Our analysts can customize this mental health market research report to meet your requirements.