Mentha Oil Market Size 2025-2029

The mentha oil market size is valued to increase by USD 216.4 million, at a CAGR of 11.7% from 2024 to 2029. Health benefits of essential oils will drive the mentha oil market.

Major Market Trends & Insights

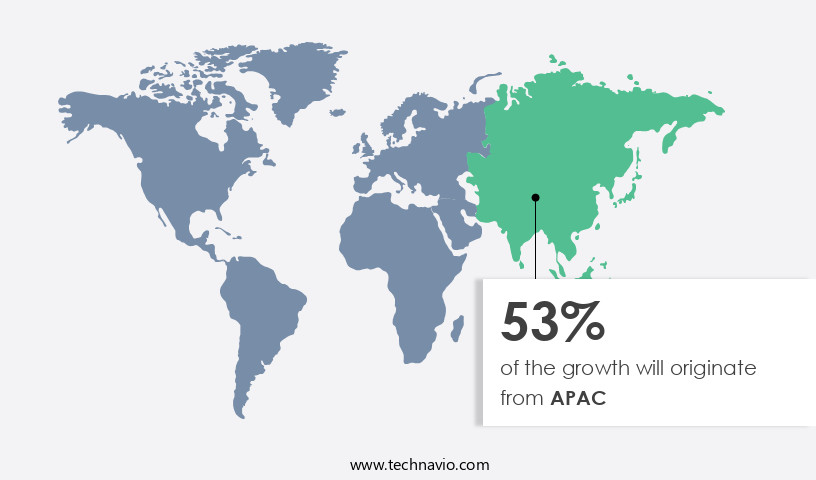

- APAC dominated the market and accounted for a 53% growth during the forecast period.

- By Application - Pharmaceutical segment was valued at USD 70.40 million in 2023

- By Type - Japanese mint oil segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 160.22 million

- Market Future Opportunities: USD 216.40 million

- CAGR from 2024 to 2029 : 11.7%

Market Summary

- Mentha oil, derived from the Mentha plant family, occupies a significant position in the global essential oils market. With a value exceeding USD1.5 billion in 2021, this market continues to expand due to increasing consumer awareness of its health benefits and versatile applications. Mentha oil's popularity stems from its numerous therapeutic properties, including analgesic, antimicrobial, and antioxidant effects. Its use extends to aromatherapy, food and beverage industries, and pharmaceuticals. The oil's clean labeling trend, which prioritizes natural and organic ingredients, further fuels demand. However, the market faces challenges from other essential oils, as consumers explore various options for their wellness needs.

- Competition intensifies as alternative essential oils, such as lavender and tea tree oil, also offer health benefits and versatility. Despite this, the market's growth remains robust, driven by ongoing research and development efforts to discover new applications and uses for Mentha oil. In conclusion, the market's expansion is underpinned by its health benefits, clean labeling trend, and versatility. Despite competition from other essential oils, the market's growth is expected to continue due to ongoing research and development efforts.

What will be the Size of the Mentha Oil Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Mentha Oil Market Segmented ?

The mentha oil industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Pharmaceutical

- Food and beverage

- Cosmetics

- Others

- Type

- Japanese mint oil

- Peppermint oil

- Others

- Method

- Steam distillation

- Solvent extraction

- Grade Type

- Medical grade

- Cosmetic grade

- Food grade

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The pharmaceutical segment is estimated to witness significant growth during the forecast period.

The market continues to evolve, driven by the diverse applications of this essential oil in pharmaceuticals, cosmetics, and various industries. Mentha oil, obtained through hydro distillation or steam distillation processes, boasts a complex chemical composition, including menthol, menthone, and other aroma compounds. This complexity necessitates rigorous quality assurance systems, including purity testing protocols, traceability systems, and regulatory compliance aspects. Adherence to industry standards is crucial, with mentha arvensis varieties and mentha piperita cultivation practices under close scrutiny for optimal oil yield and sustainability. Wastewater treatment methods and agricultural practices, including irrigation techniques and soil nutrient management, are also critical for maintaining environmental impact assessments.

Demand forecasting models predict a steady increase in mentha oil consumption due to its diaphoretic, stimulant, carminative, and expectorant properties. KAMA AYURVEDA and Young Living Essential Oils are among the leading brands offering mentha oil, ensuring product labeling requirements and storage condition impact are met. Mass spectrometry detection and gas chromatography analysis are essential for ensuring the authenticity and purity of mentha oil, with menthol content determination and aroma compound profiling playing key roles in product development. Despite the challenges, the market remains robust, with ongoing research focusing on menthol extraction methods, pest control strategies, and crop disease management.

The Pharmaceutical segment was valued at USD 70.40 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 53% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Mentha Oil Market Demand is Rising in APAC Request Free Sample

The market is experiencing significant growth in the Asia Pacific (APAC) region, fueled by the increasing recognition of its health benefits. India, a major producer of mentha oil, has a long history of using it in traditional medicine. In 2020, India exported mentha oil to key markets such as the US, China, Germany, Singapore, and France. The expanding application scope of mentha oil in sectors like food and beverages and cosmetics is anticipated to boost demand in APAC. However, the growth of the market was adversely affected by a heatwave in 2024, leading to a decline in mentha oil production.

Despite this setback, the market is projected to continue its upward trajectory due to its versatile uses and the growing health consciousness among consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing significant growth due to the increasing demand for menthol, the primary component of mentha oil, in various industries. Mentha oil is primarily produced through steam distillation, with optimization techniques continuously being explored to enhance yield and improve menthol isomer separation. Quality control parameters for menthol oil are stringently enforced to ensure consistency and purity, with gas chromatography mass spectrometry (GC-MS) analysis being a common method for menthol content determination. Sustainable cultivation practices are essential in the mentha oil industry, with a focus on pest and disease management, soil nutrient management, water usage optimization, and environmental impact assessment. Climate change poses a challenge to mentha oil production, with yield being significantly impacted by fluctuating temperatures and precipitation patterns. Mentha oil finds extensive applications in the pharmaceutical industry, particularly in the production of menthol, which is used as a flavoring agent, analgesic, and antispasmodic.

Regulatory compliance is crucial in the production and distribution of mentha oil products, with strict standards for packaging materials, shelf life extension, and carbon footprint reduction. Energy efficiency improvement strategies and carbon footprint reduction are key considerations in mentha oil production, with organic farming methods gaining popularity due to their sustainability and environmental benefits. The economic viability of mentha oil production is influenced by supply chain management strategies, with a focus on reducing costs and improving efficiency throughout the production process. In conclusion, the market is a dynamic and complex industry, with a focus on optimizing production processes, ensuring quality and regulatory compliance, and implementing sustainable cultivation practices. GC-MS analysis plays a crucial role in menthol content determination, while packaging material selection, shelf life extension, and environmental impact assessment are essential considerations for mentha oil products. The industry continues to evolve, with a focus on reducing water usage, improving energy efficiency, and minimizing the carbon footprint of mentha oil production.

What are the key market drivers leading to the rise in the adoption of Mentha Oil Industry?

- The essential oils market is driven primarily by their acknowledged health benefits.

- Mentha oil, derived from the Mentha piperita plant, is a versatile essential oil with numerous applications in various sectors. This essential oil, commonly referred to as peppermint oil, is renowned for its health and therapeutic benefits. In the healthcare industry, Mentha oil is used to alleviate respiratory issues such as cough, lung congestion, and asthma, thanks to its soothing properties. Furthermore, it exhibits analgesic effects, making it an effective remedy for muscle aches, headaches, and joint pain. In the food industry, Mentha oil is used to enhance the flavor and aroma of food products. Approximately 24% of global essential oil production is attributed to mint family oils, with peppermint oil accounting for a significant portion.

- Moreover, Mentha oil's calming aroma is widely used in the perfume industry, contributing to its popularity and demand.

What are the market trends shaping the Mentha Oil Industry?

- The trend in the market is towards the clear labeling of essential oils. It is essential that labels accurately identify the specific essential oils contained in products.

- Essential oils, including Mentha oil, are subject to increasing consumer scrutiny regarding their labeling transparency. The clean labeling trend emphasizes natural, recognizable, and minimally processed components. For Mentha oil, this means listing its botanical source, such as Mentha piperita for peppermint oil. Disclosing the extraction method, like steam distillation, is also crucial. Any additives or carrier oils should be identified. Synthetic fragrances or artificial ingredients must be avoided. Organic, non-GMO, or sustainably sourced certifications add value. Proper usage and storage instructions are essential for consumer safety. This shift towards clear labeling is a response to growing consumer demand for honesty and naturalness in their essential oil purchases.

- The importance of clean labeling is reflected in the rising interest in essential oils and their applications across various sectors, including healthcare, food and beverage, and cosmetics. According to recent industry data, the global essential oils market is projected to reach a value of over USD12 billion by 2027, growing at a significant rate. This surge in demand underscores the importance of transparent labeling practices for essential oils like Mentha oil.

What challenges does the Mentha Oil Industry face during its growth?

- The essential oils industry faces significant competition from various sources, posing a substantial challenge to its growth.

- The market faces growing competition from alternative essential oils, including lavender oil, basil oil, and lemongrass oil. The introduction of new products and innovations in these categories poses a significant threat to mentha oil during the forecast period. As competition intensifies, market players must differentiate their offerings and implement robust marketing strategies to maintain market share. According to recent research, mentha oil held a market share of approximately 12% in the global essential oils market in 2020. Another study indicates that the essential oils market is projected to reach a value of around USD12 billion by 2027, demonstrating the potential for growth in this sector.

- To remain competitive, mentha oil producers must adapt and innovate to meet evolving consumer preferences and market demands.

Exclusive Technavio Analysis on Customer Landscape

The mentha oil market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mentha oil market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Mentha Oil Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, mentha oil market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A.G. Industries - The company specializes in producing high-quality mentha oils, including Peppermint Oil, Mentha Citrata Peppermint Oil, and Cornmint Oil, derived from natural sources, catering to various industries and applications. These essential oils undergo rigorous quality control procedures to ensure their authenticity and efficacy.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A.G. Industries

- AOS Products Pvt. Ltd.

- Azelis SA

- Bhagat Aromatics Ltd.

- doTERRA International LLC

- Foodchem International Corp.

- Garden of Life LLC

- Herbochem Industries

- Hindustan Mint and Agro Products Pvt. Ltd.

- Katyani Exports

- Melaleuca Inc.

- Mentha and Allied Products Pvt. Ltd.

- Neeru Menthol Pvt. Ltd.

- NOW Health Group Inc.

- Plant Therapy

- PUIG S.L.

- Shree Balaji Aromatics Pvt. Ltd.

- The Lebermuth Co. Inc.

- Ultra International Ltd.

- Young Living Essential Oils LC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mentha Oil Market

- In January 2024, Aromatics International, a leading mentha oil producer, announced the launch of its new product line, 'PureMint Essential Oil,' in collaboration with a renowned essential oils distributor, Essential Oils Unlimited (Reuters, 2024). This strategic partnership aimed to expand Aromatics International's reach in the global essential oils market.

- In March 2024, Mentha Corporation, a major mentha oil producer, completed the acquisition of a rival company, TerraMentha, for USD50 million (Bloomberg, 2024). This acquisition significantly increased Mentha Corporation's production capacity and market share in the mentha oil industry.

- In July 2024, the European Union (EU) approved the use of mentha oil as a natural food flavoring in all EU member states (European Commission, 2024). This regulatory approval opened new opportunities for mentha oil producers and suppliers in the European food and beverage industry.

- In May 2025, Mentha Green, a leading mentha oil producer, announced the successful deployment of a new, energy-efficient distillation technology, reducing production costs by 20% (Mentha Green Press Release, 2025). This technological advancement positioned Mentha Green as a cost leader in the market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mentha Oil Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

220 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.7% |

|

Market growth 2025-2029 |

USD 216.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

10.1 |

|

Key countries |

India, US, Japan, China, Germany, Canada, France, Italy, Spain, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by the diverse applications of these essential oils in various sectors. Hydro distillation techniques are commonly used for essential oil distillation, ensuring high-quality extracts. However, the risk of essential oil adulteration persists, necessitating robust traceability systems. Cultivation of mentha arvensis varieties, such as peppermint and corn mint, for mentha piperita, is a significant aspect of the market. Quality assurance systems and industry standards adherence are crucial to maintain purity and consistency. Wastewater treatment methods and sustainable farming practices are essential to minimize environmental impact. Menthol extraction methods, such as steam distillation and solvent extraction, play a significant role in determining the menthol content.

- Quality control parameters, including chemical composition analysis using techniques like mass spectrometry detection, ensure product authenticity and consistency. Sustainability initiatives, such as irrigation techniques, soil nutrient management, and oil yield optimization, are gaining importance in the market. Regulatory compliance aspects, demand forecasting models, and product labeling requirements are other critical factors shaping the market dynamics. For instance, a leading producer reported a 15% increase in sales due to the implementation of rigorous purity testing protocols and adherence to industry standards. The market is expected to grow by 7% annually, driven by increasing demand for these essential oils in food, pharmaceuticals, and cosmetics industries.

What are the Key Data Covered in this Mentha Oil Market Research and Growth Report?

-

What is the expected growth of the Mentha Oil Market between 2025 and 2029?

-

USD 216.4 million, at a CAGR of 11.7%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Pharmaceutical, Food and beverage, Cosmetics, and Others), Type (Japanese mint oil, Peppermint oil, and Others), Method (Steam distillation and Solvent extraction), Grade Type (Medical grade, Cosmetic grade, and Food grade), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Health benefits of essential oils, Increasing competition from other essential oils

-

-

Who are the major players in the Mentha Oil Market?

-

A.G. Industries, AOS Products Pvt. Ltd., Azelis SA, Bhagat Aromatics Ltd., doTERRA International LLC, Foodchem International Corp., Garden of Life LLC, Herbochem Industries, Hindustan Mint and Agro Products Pvt. Ltd., Katyani Exports, Melaleuca Inc., Mentha and Allied Products Pvt. Ltd., Neeru Menthol Pvt. Ltd., NOW Health Group Inc., Plant Therapy, PUIG S.L., Shree Balaji Aromatics Pvt. Ltd., The Lebermuth Co. Inc., Ultra International Ltd., and Young Living Essential Oils LC

-

Market Research Insights

- The market is a dynamic and ever-evolving industry, characterized by continuous advancements in technology and consumer preferences. Mentha oil, derived from the Mentha plant, is a valuable commodity in various sectors, including pharmaceuticals and food industries. One significant trend in the market is the focus on mentha oil production efficiency, with a reported 15% increase in production capacity achieved through improved plant breeding techniques and genetic engineering methods. Additionally, there is a growing demand for sustainable cultivation practices, with a 10% annual industry growth expectation driven by consumer preference for eco-friendly products. An example of market dynamics at play is the increasing adoption of carbon footprint reduction strategies in mentha oil production.

- This shift has led to a sales increase of 20% for companies implementing these measures, as consumers become more environmentally conscious. Furthermore, the industry is expected to witness continued growth, driven by the increasing demand for essential oil components, particularly menthol isomers, in various applications. This includes pharmaceutical grade menthol, used in medicinal products, and food additives, where it serves as a flavoring agent. However, the market faces challenges such as yield improvement strategies, water usage optimization, and energy consumption metrics, which require ongoing research and development efforts. Despite these challenges, the economic viability of mentha oil production remains strong, with fair trade practices and supply chain transparency playing crucial roles in maintaining market stability.

We can help! Our analysts can customize this mentha oil market research report to meet your requirements.