Food Additives Market Size 2024-2028

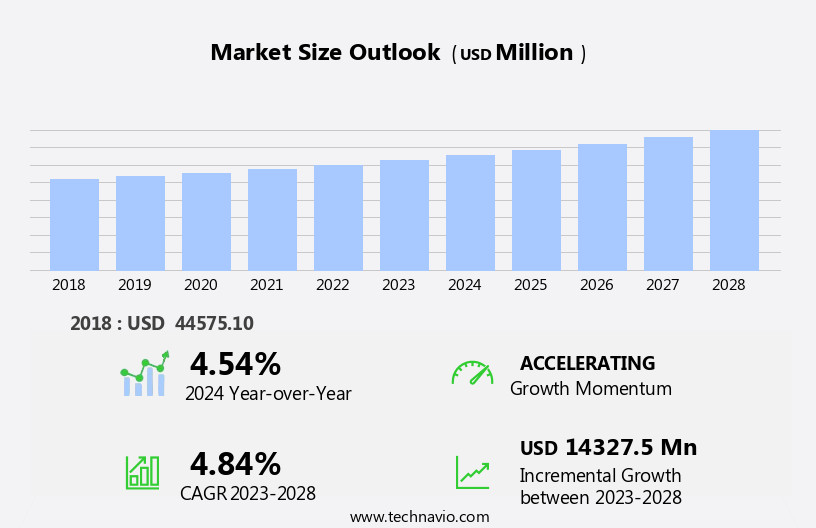

The food additives market size is forecast to increase by USD 14.33 billion, at a CAGR of 4.84% between 2023 and 2028.

- The market is driven by the increasing demand for processed food and the need for shelf-life extension in food products. Processed food has gained significant popularity due to its convenience and longer shelf life, leading to a surge in demand for food additives that ensure product safety, enhance taste, and prolong shelf life. Simultaneously, the growing preference for fresh foods and sustainable dietary choices, particularly plant-based options, is creating opportunities for the use of functional additives such as thickeners, texture enhancers, and plant-based alternatives. This trend necessitates the development of innovative, natural food additives to cater to the evolving consumer preferences while maintaining the required functional benefits.

- Effective navigation of these market dynamics requires companies to focus on research and development, innovation, and the adoption of sustainable and natural food additives to cater to the evolving consumer demands.

What will be the Size of the Food Additives Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic interplay of various factors. Entities such as gelling agents, texture modification technologies, and flavor enhancers, among others, play crucial roles in the food industry. The ongoing development of clean label products and adherence to labeling regulations necessitate continuous innovation in formulation development. Consumer preferences and perception shape market trends, with a growing demand for natural flavors, dietary fibers, and organic certification. Supply chain management and ingredient sourcing are critical aspects of food processing, influencing both cost and quality. Food technology advancements, including freeze drying, spray drying, and encapsulation technologies, enable the production of innovative, high-quality products.

Sensory evaluation and analytical methods ensure the safety and consistency of food additives, while food safety and allergen management are paramount in maintaining consumer trust. The market's continuous unfolding is reflected in the evolving applications of food additives across various sectors. Acidity regulators, protein hydrolysates, and fruit extracts, among others, contribute to the functional properties of food products. Vegetable extracts and essential oils add natural flavors and aromas, while botanical extracts offer health benefits. Packaging technologies and nutritional labeling are essential components of the food industry, influencing consumer choices and reducing food waste. The market's intricacies necessitate a comprehensive understanding of food chemistry and manufacturing processes.

The market's continuous dynamism is further highlighted by the ongoing research and development of new ingredients and applications. The integration of these factors creates a complex web of interrelated trends and challenges, requiring a holistic approach to market analysis.

How is this Food Additives Industry segmented?

The food additives industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Bakery and confectionery

- Beverages

- Convenience food

- Snacks

- Others

- Product

- Flavors and enhancers

- Acidulants

- Colorants

- Sweeteners

- Others

- Function

- Emulsifying

- Stabilizing

- Thickening

- Binding

- Preserving

- Coloring

- Sweetening

- Flavor Enhancing

- Source

- Natural

- Synthetic

- Form

- Dry

- Liquid

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

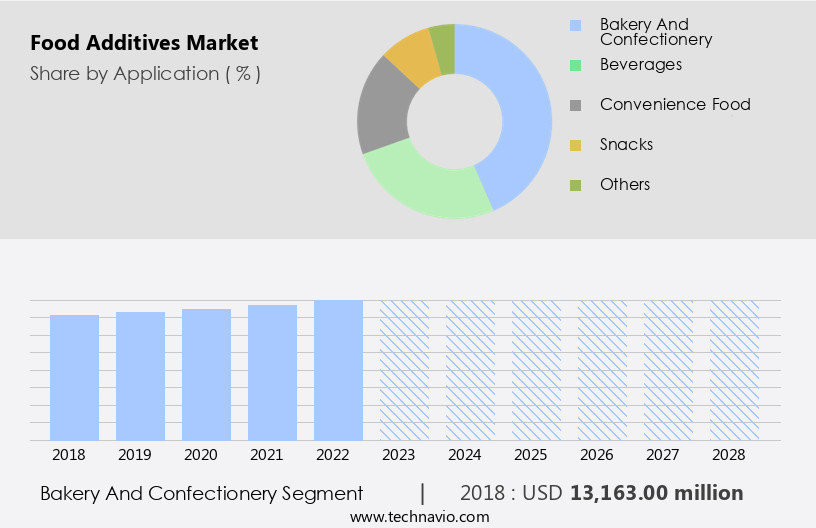

By Application Insights

The bakery and confectionery segment is estimated to witness significant growth during the forecast period.

Preservatives are essential in bakeries due to the perishable nature and short shelf life of baked goods. Colorants, sweeteners, and flavors are also in high demand. Supply chain management plays a crucial role in ensuring the availability and timely delivery of these additives. The market is also influenced by consumer preferences for clean label products, leading to the development of natural and organic alternatives. Regulations regarding labeling and food safety further impact the market dynamics. Food technology innovations, such as encapsulation and spray drying, offer opportunities for improved texture modification and longer shelf life. Food waste reduction is another emerging trend, driving the demand for additives that enhance the functionality and longevity of food products.

The Bakery and confectionery segment was valued at USD 13.16 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 28% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The North American market is experiencing consistent growth, driven by the increasing demand for health-conscious alternatives, such as gelling agents, dietary fibers, and texture modification agents. Strict labeling regulations necessitate the use of clean-label ingredients, leading to the rise of natural flavors, essential oils, and botanical extracts. Supply chain management and food safety are crucial aspects of the market, with toxicity testing and allergen management being key concerns. Manufacturers employ various extraction methods and encapsulation technologies to enhance the functional properties of food additives, including acidity regulators, amino acids, and protein hydrolysates. Food technology innovations, such as spray drying, freeze drying, and sensory evaluation, play a significant role in formulation development and consumer acceptance.

The market is further shaped by consumer preferences and perception, with organic certification and nutritional labeling influencing purchasing decisions. Ingredient sourcing and food processing techniques also impact the market dynamics. The market's evolution is characterized by the introduction of new manufacturing processes, such as those for fruit and vegetable extracts, and the increasing use of spice extracts and natural flavors. The market's growth is influenced by factors like ingredient cost, shelf life, and food waste reduction.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global food additives market is experiencing significant expansion, driven by evolving food additives market trends and rising consumer demand for processed and convenient foods. Flavors and enhancers food, along with sweeteners food additives and preservatives food additives, are crucial components contributing to the substantial food additives market size and robust food additives market growth.

The increasing use of emulsifiers food additives is vital for texture and stability. A notable shift towards natural food additives and clean label additives is evident, influencing segments like the bakery and confectionery food additives market and beverages food additives market. Key regions such as the Asia-Pacific food additives market and North America food additives market are major contributors. The demand from convenience foods additives is driving innovation in shelf-life extension technologies. Leading food additives manufacturers are navigating the complex regulatory landscape food additives while focusing on functional foods additives to meet growing health and wellness food additives demands.

What are the key market drivers leading to the rise in the adoption of Food Additives Industry?

- The surge in consumer preference for convenient and ready-to-eat options is the primary factor fueling the growth of the processed food market.

- The market has experienced significant growth due to the increasing demand for packaged and processed food products in both developed and developing countries. As urbanization advances and disposable income levels rise, consumers' preferences for convenient and longer-shelf-life food items have escalated. In response, food manufacturers focus on product differentiation, incorporating food additives such as gelling agents, texture modification agents (dietary fibers), flavor enhancers, leavening agents, and rheological property enhancers (hydrocolloids) into their offerings. These additives not only enhance the sensory qualities of food but also improve their stability during distribution channels and supply chain management. Moreover, there is a growing trend towards clean label products, necessitating the use of natural food additives.

- Labeling regulations have become increasingly stringent, prompting food manufacturers to invest in toxicity testing to ensure the safety and quality of their products. Technologies like spray drying are being employed to create stable, consistent food additive solutions. Overall, the market is driven by the evolving dietary habits and the demand for extended shelf life and enhanced sensory qualities in food products.

What are the market trends shaping the Food Additives Industry?

- The extension of shelf life for food products is an emerging market trend. This is a critical consideration for food manufacturers and retailers to ensure consumer satisfaction and minimize waste.

- Food additives play a crucial role in preserving the quality and extending the shelf life of packaged food products. Active packaging, a significant development in food technology, is gaining popularity in the global market due to its ability to maintain the flavor and freshness of food for extended periods. This trend is driven by consumers' preference for products with longer shelf lives, especially in regions where food waste is a significant issue. However, consumer perception varies in different parts of the world. European consumers, for instance, favor fresh, minimally processed food with no artificial additives. In the development of food additives, various methods are used for extraction and encapsulation technologies to ensure optimal efficacy and stability.

- Sensory evaluation and analytical methods are employed to assess the quality and safety of food additives. Health claims are also a critical factor in consumer decision-making, and food manufacturers are increasingly focusing on organic certification to cater to the growing demand for natural and organic products. Food safety is a top priority in the food industry, and food additives must meet stringent safety regulations. Freeze drying is a popular method used in food technology to preserve the nutritional value and texture of food products. Overall, the market is dynamic and constantly evolving to meet the changing preferences and demands of consumers.

What challenges does the Food Additives Industry face during its growth?

- The increasing demand for fresh foods poses a significant challenge to the industry's growth trajectory.

- The market faces significant competition from the growing demand for fresh food products worldwide. Consumers are increasingly aware of the health benefits associated with fresh foods, which are not frozen and do not contain preservatives. This trend is driving a shift from processed foods to fresh produce, leading to increased demand for natural flavors, fruit extracts, and vegetable extracts in food processing. In response, food manufacturers are focusing on sourcing high-quality ingredients and implementing rigorous quality control measures to meet consumer expectations. Functional properties, such as acidity regulators, play a crucial role in food processing to ensure product safety and consistency.

- Manufacturers are also prioritizing allergen management to cater to the growing number of consumers with food allergies. Food chemistry continues to evolve, with a focus on developing innovative solutions that enhance the sensory attributes of food products while maintaining their natural characteristics. Artificial flavors continue to be used in food processing, but there is a growing preference for natural alternatives. Natural flavors are derived from plant, animal, or microbial sources and offer a more authentic taste profile. The manufacturing processes used to extract and concentrate these flavors must be carefully controlled to maintain their quality and consistency.

- In conclusion, the market is undergoing significant changes as consumers demand fresher, healthier, and more natural food products. Manufacturers are responding by focusing on quality control, sourcing high-quality natural ingredients, and implementing innovative manufacturing processes to meet these demands. The market is expected to remain competitive during the forecast period, with a steady growth trajectory.

Exclusive Customer Landscape

The food additives market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the food additives market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, food additives market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Ajinomoto Co., Inc. - This company specializes in the development and distribution of innovative sports products.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Ajinomoto Co., Inc.

- Archer Daniels Midland Company (ADM)

- BASF SE

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- Corbion N.V.

- CP Kelco (J.M. Huber Corporation)

- DSM-Firmenich AG

- DuPont de Nemours, Inc.

- Givaudan SA

- Ingredion Incorporated

- International Flavors & Fragrances Inc. (IFF)

- Kerry Group plc

- Lonza Group AG

- Novozymes A/S

- Puratos Group

- Sensient Technologies Corporation

- Symrise AG

- Tate & Lyle PLC

- Univar Solutions Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Food Additives Market

- In January 2024, Danisco A/S, a leading global producer of food and industrial cultures and enzymes, announced the launch of its new line of clean-label emulsifiers, "Danisco Ferment Emulsifiers," to cater to the growing demand for natural food additives (Danisco A/S Press Release).

- In March 2024, Archer Daniels Midland Company (ADM) and DuPont Nutrition & Biosciences entered into a strategic partnership to co-develop and commercialize innovative food and beverage solutions using plant-based proteins and health ingredients (ADM Press Release).

- In May 2024, BASF SE, the world's largest chemical producer, completed the acquisition of Solvay's European specialty chemicals business, including its food additives division, for â¬5.2 billion, expanding BASF's presence in the market (BASF SE Press Release).

- In April 2025, The European Commission approved the use of Stevia as a sweetener in all types of foods and beverages, marking a significant regulatory milestone for the natural sweetener market and food additives industry (European Commission Press Release).

Research Analyst Overview

- The market is witnessing significant trends and dynamics, driven by the increasing demand for natural ingredients, food authentication, and consumer protection. Fair trade and ethical sourcing are becoming essential factors in food production, as consumers prioritize health benefits and environmental impact. Artificial intelligence (AI) and data analytics are revolutionizing quality assurance and process optimization, enabling predictive modeling and real-time risk management. Food regulations and compliance standards are evolving, with a focus on non-GMO verification, batch traceability, and ingredient standardization. Product differentiation is key, as brands leverage marketing strategies and sensory attributes to appeal to health-conscious consumers. Food security and food fraud are ongoing concerns, necessitating advanced food authentication technologies and supply chain visibility.

- Machine learning (ML) and AI are transforming food production by optimizing production processes, reducing costs, and improving waste management. International standards and circular economy principles are gaining traction, promoting sustainable agriculture and reducing the environmental impact of food production. Synthetic ingredients are under scrutiny, as consumers increasingly prefer natural alternatives. Food laws and regulations continue to evolve, reflecting the importance of food safety, ethical sourcing, and consumer protection. The product life cycle is a critical consideration for food companies, as they navigate the challenges of product differentiation, branding strategies, and cost reduction. In summary, the market is characterized by a focus on natural ingredients, consumer protection, and sustainable production methods.

- Advanced technologies, such as AI and ML, are driving process optimization and risk management, while food regulations and compliance standards continue to evolve to meet changing consumer demands and food security concerns.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Food Additives Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

199 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.84% |

|

Market growth 2024-2028 |

USD 14327.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.54 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Food Additives Market Research and Growth Report?

- CAGR of the Food Additives industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the food additives market growth of industry companies

We can help! Our analysts can customize this food additives market research report to meet your requirements.