Mesh Fabric Market Size 2025-2029

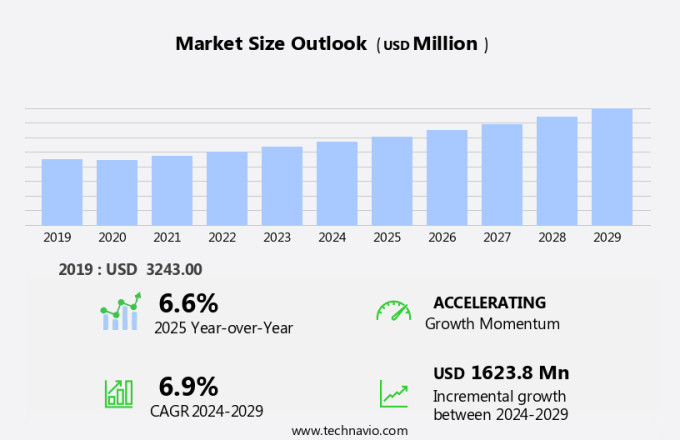

The mesh fabric market size is forecast to increase by USD 1.62 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the escalating demand for sportswear and activewear. Consumers' increasing preference for breathable, lightweight, and flexible clothing, such as activewear, is propelling the market forward. These fabrics are commonly used in medical textiles, seat covers, and structural stability applications. Moreover, advancements in fabric technology are enabling the production of mesh fabrics with enhanced features, such as moisture-wicking, UV protection, and improved durability. However, the high cost associated with mesh fabrics poses a substantial challenge for market growth.

- Manufacturers must navigate this obstacle by implementing cost-effective production methods or offering competitive pricing to attract price-sensitive consumers. To capitalize on market opportunities and navigate challenges effectively, companies should focus on innovation, cost optimization, and catering to the evolving consumer preferences for functional and stylish mesh fabrics.

What will be the Size of the Mesh Fabric Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in product development and technological innovations. Circular economy principles are increasingly shaping the industry, with a focus on sustainable sourcing and ethical production. Air permeability and moisture wicking remain key performance attributes, achieved through refined manufacturing processes and advanced material technologies. Production capacity expansion and optimization are ongoing priorities, as demand for protective fabrics in outdoor gear and home furnishings grows. Fair trade and sustainable practices are gaining traction, with a focus on reducing carbon footprint and improving supply chain management. Performance fabrics, such as those with oil repellency, heat resistance, and UV protection, are in high demand.

Technical fabrics, including non-woven and woven varieties, are being developed with enhanced properties like water resistance, tear strength, and chemical resistance. Innovations in manufacturing processes, such as 3D and digital printing, are transforming the industry. Quality control and inventory management are essential for maintaining consistency and meeting customer expectations. Protective fabrics are finding applications in various sectors, from outdoor gear and home furnishings to filter fabrics and protective clothing. The market is characterized by ongoing research and development, with a focus on creating high-performance, sustainable, and ethically-produced mesh fabrics.

How is this Mesh Fabric Industry segmented?

The mesh fabric industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Polyester mesh fabric

- Nylon mesh fabric

- Others

- Technology

- Knitted

- Woven

- Geography

- North America

- US

- Europe

- France

- Germany

- Spain

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Type Insights

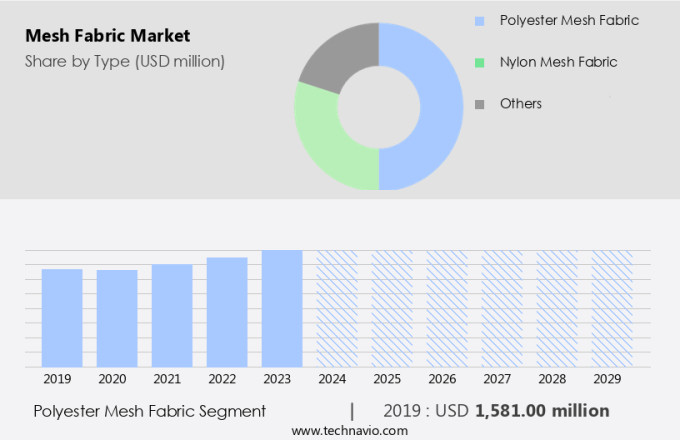

The polyester mesh fabric segment is estimated to witness significant growth during the forecast period.

The market showcases a diverse array of materials, with polyester mesh fabrics gaining significant traction due to their versatile properties and extensive applications. Distinguished by their unique mesh structure, crafted from interwoven polyester fibers, these fabrics offer several desirable characteristics. Breathability is a prominent attribute, enabling superior air circulation through the mesh structure. This feature is indispensable in sectors such as activewear and outdoor gear, as it facilitates temperature regulation and ensures user comfort during physical activities. Moreover, the manufacturing process for polyester mesh fabrics is increasingly embracing ethical production and sustainable sourcing. This ethical approach aligns with the circular economy, which prioritizes the reuse and recycling of materials, reducing the carbon footprint.

Polyester mesh fabrics also boast moisture-wicking capabilities, which help draw moisture away from the skin, enhancing comfort and performance. They can be engineered with various additives, such as oil repellency, UV protection, flame retardancy, tear strength, chemical resistance, and tensile strength, making them suitable for diverse applications. The production capacity for mesh fabrics is expanding, with advancements in technology driving the development of innovative manufacturing processes. These include 3D printing and digital printing, which enable customization and design flexibility. Additionally, the integration of non-woven fabrics and technical fabrics further broadens the market's scope. In the realm of home furnishings, mesh fabrics are valued for their dimensional stability, water resistance, and ease of maintenance.

Their woven and filter fabric counterparts cater to specific applications, such as filtration and protective gear. Quality control is a crucial aspect of the market, with manufacturers implementing rigorous testing and certification processes to ensure product consistency and reliability. Inventory management and supply chain optimization are also essential to maintain a steady flow of goods and meet the growing demand.

The Polyester mesh fabric segment was valued at USD 1.58 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

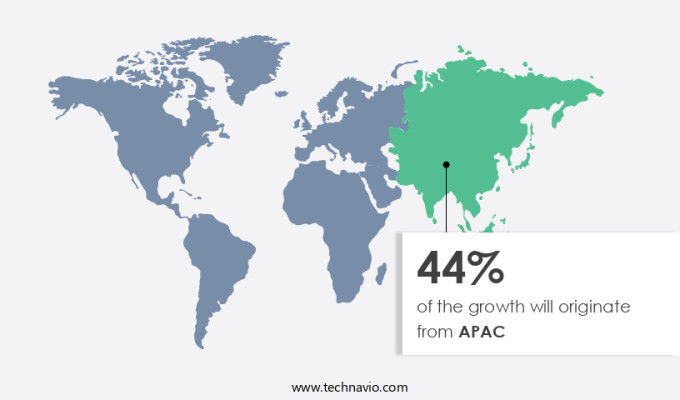

APAC is estimated to contribute 44% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is experiencing significant growth, with the Asia-Pacific (APAC) region leading the charge. Economic expansion, technological innovations in manufacturing, and rising demand across various sectors are key drivers. Notable markets within APAC include China, India, Japan, and Southeast Asian countries, each contributing uniquely to the industry's growth. In May 2024, Shahi, a leading textile manufacturer, announced a joint venture with Little King Global of Taiwan to produce synthetic performance fabrics in Delhi. This strategic move aims to boost production capabilities, catering to the increasing demand for high-performance fabrics. The collaboration leverages advanced manufacturing techniques and aims to scale production for both domestic and international markets.

Ethical production and sustainable sourcing are becoming increasingly important in the industry, with a growing emphasis on circular economy principles. Performance fabrics, such as those with moisture wicking, oil repellency, and heat resistance, continue to gain popularity in outdoor gear and home furnishings. Technical fabrics, including those with tear strength, chemical resistance, and tensile strength, are also in demand. The market is also witnessing advancements in fabric structures, such as mesh and woven, as well as production methods, including 3D printing and digital printing. Quality control, inventory management, and supply chain management remain crucial aspects of the industry, with a focus on reducing carbon footprint and enhancing research and development in areas like filter fabrics and flame retardancy.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Mesh Fabric Industry?

- The surge in demand for sportswear and activewear serves as the primary market driver.

- Mesh fabric, a type of non-woven fabric, has gained significant traction in the global textile industry due to its superior breathability and moisture-wicking properties. The increasing focus on health and wellness, leading to a rise in sportswear and activewear consumption, has propelled the demand for high-performance fabrics like mesh. This fabric's ability to facilitate airflow and manage moisture makes it an ideal choice for athletic apparel, enhancing comfort and improving athletic performance. Moreover, research and development initiatives in the textile sector have led to advancements in mesh fabric technology, resulting in enhanced abrasion resistance and stain resistance. These features make mesh fabric suitable for various applications, including filter fabrics and protective clothing.

- Innovative technologies such as 3D printing and digital printing have also revolutionized the production process of mesh fabric, offering customizable designs and patterns while reducing the carbon footprint. The continuous efforts to improve the fabric's properties and production methods are expected to further fuel the growth of the market.

What are the market trends shaping the Mesh Fabric Industry?

- Advancements in fabric technology are currently shaping market trends. The use of innovative materials and manufacturing processes is becoming increasingly prevalent in various industries.

- The market is experiencing notable progress in fabric technology, fueling product development and broadening applications. Recent innovations involve the integration of smart materials to improve functionality and performance across various industries. Researchers have successfully developed conductive fibers that are both flexible and electrically conductive, resembling traditional cotton. These fibers are suitable for incorporation into mesh textiles, enabling applications in wearable technology. Such garments offer health monitoring and environmental sensing capabilities, leveraging mesh fabric's breathability. This advancement in fiber technology is opening doors for real-time data collection and analysis, significantly enhancing the value of mesh fabrics in the health and fitness sectors.

- The circular economy is a growing focus in the manufacturing process, with an emphasis on ethical production, sustainable sourcing, and fair trade. Protective mesh fabrics find extensive use in outdoor gear, ensuring durability and moisture wicking properties. The market's production capacity continues to expand as technology advances, offering numerous opportunities for businesses in this sector.

What challenges does the Mesh Fabric Industry face during its growth?

- The high cost of mesh fabrics poses a significant challenge to the industry's growth, as this material's expense represents a substantial production and manufacturing expense for businesses in this sector.

- The market encompasses a wide range of performance textiles, characterized by their mesh structure, which offers benefits such as breathability, oil repellency, and heat resistance. These fabrics are increasingly popular in various industries, including home furnishings, due to their durability and versatility. However, the market is challenged by the high costs associated with these materials. The price of mesh fabrics can significantly vary based on factors like thread count, quality, and intended use. For instance, high-quality mesh fabrics, such as those made with carbon fiber, can cost upwards of USD30 per yard. On the other hand, standard mesh fabrics, like nylon or polyester, range from USD5 to USD20 per yard.

- These costs are influenced not only by the material itself but also by the production process, supply chain management, and the specific application, be it for athletic wear, outdoor gear, or industrial purposes. Quality control is a critical factor in ensuring the performance and longevity of mesh fabrics, with recycled materials and flame retardant properties becoming increasingly important considerations.

Exclusive Customer Landscape

The mesh fabric market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the mesh fabric market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, mesh fabric market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apex Mills - This company specializes in supplying high-quality mesh fabrics for various applications.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apex Mills

- Birdair Inc.

- Daikin Industries Ltd.

- DuPont de Nemours Inc.

- FIBERFLON GmbH and Co. KG

- Jason Mills LLC

- Milliken and Co.

- Naizil Srl

- Saati SpA

- Sefar AG

- Taconic

- TEIJIN FRONTIER CO LTD.

- W. L. Gore and Associates Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Mesh Fabric Market

- In March 2024, Honeywell International Inc. Announced the launch of its new Mesh Networked Sensing solution, expanding its portfolio in the market (Honeywell.Com). This innovative product allows for real-time monitoring and data analysis from various industrial sensors, enhancing operational efficiency and productivity.

- In July 2024, Cisco Systems and Google joined forces to collaborate on Wi-Fi 6E mesh networking technology, aiming to improve connectivity and reduce latency in large-scale networks (Cisco.Com). This strategic partnership is expected to significantly impact the market by driving advancements in wireless communication and increasing competition.

- In December 2024, Intel Corporation completed the acquisition of Envisage Technologies, a leading provider of mesh networking solutions for industrial IoT applications (Intel.Com). This strategic move is expected to strengthen Intel's position in the market by adding Envisage's expertise and expanding its offerings.

- In February 2025, the European Union announced the Horizon Europe program, which includes a focus on developing advanced mesh networking technologies for smart cities and industries (EU.Europa.Eu). This significant policy change is expected to drive substantial growth in the market, as Europe invests in the development and deployment of next-generation mesh networking solutions.

Research Analyst Overview

- The market is characterized by a focus on advanced textile technologies and sustainable practices. ISO standards play a crucial role in ensuring product quality and safety, while AATCC and ASTM standards guide performance testing for attributes such as abrasion resistance, tear strength, and colorfastness. Solvent and reactive dyeing techniques are commonly used for their vibrant color output, while water-based dyeing and printing processes, including screen printing and heat transfer, prioritize eco-friendly production. Sustainable textile practices, such as recycling textile waste through upcycling and recycled content standards, are gaining traction. Performance enhancing finishes, like anti-bacterial, UV protection, and moisture wicking, cater to various consumer needs.

- Textile certifications, such as those for organic and fair trade materials, further differentiate offerings. Finishing processes, including chemical resistance testing and flame retardancy testing, ensure durability and safety. Printing techniques, like sublimation and warp/weft knitting, expand design possibilities. Breathable finishes and tensile strength testing contribute to the overall functionality and appeal of mesh fabrics.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Mesh Fabric Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

193 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 1623.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.6 |

|

Key countries |

US, China, Germany, UK, France, Spain, Japan, India, South Korea, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Mesh Fabric Market Research and Growth Report?

- CAGR of the Mesh Fabric industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the mesh fabric market growth of industry companies

We can help! Our analysts can customize this mesh fabric market research report to meet your requirements.