Polyester Staple Fiber (PSF) Market Size 2025-2029

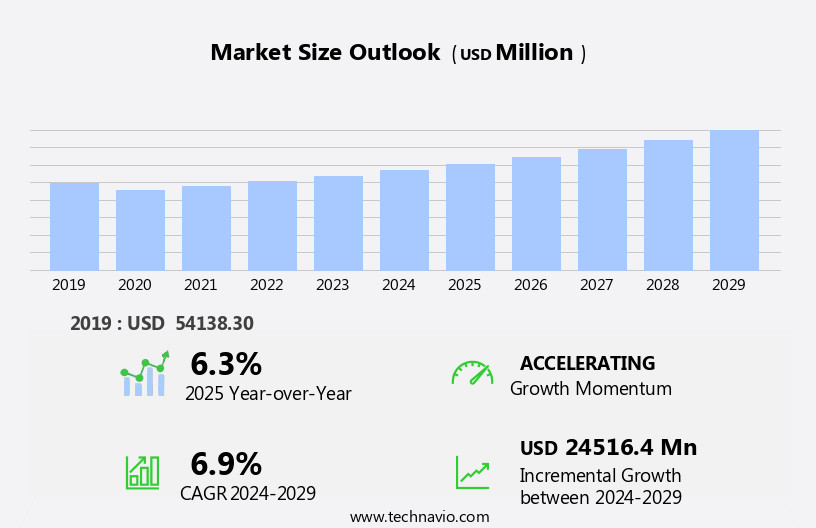

The polyester staple fiber (PSF) market size is forecast to increase by USD 24.52 billion, at a CAGR of 6.9% between 2024 and 2029.

- The market exhibits significant growth potential, particularly in the Asia-Pacific region, driven by increasing consumer demand for textiles and rising awareness of sustainable production methods. However, the market faces challenges due to fluctuations in prices of raw materials, such as crude oil and natural gas, which are essential inputs in the production of PSF. These price volatilities can impact the profitability of PSF manufacturers and necessitate effective supply chain management strategies.

- Companies in the PSF industry must closely monitor these trends and adapt to maintain competitiveness and capitalize on market opportunities. Strategic initiatives, including the adoption of advanced technologies and sustainable production methods, can help mitigate the challenges and position businesses for long-term success.

What will be the Size of the Polyester Staple Fiber (PSF) Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the ever-changing dynamics of various sectors. This versatile fiber finds extensive applications in industries such as textiles, apparel, home furnishings, and industrial fabrics. The continuous innovation in fiber properties, including fiber weight, length, density, fineness, elasticity, and colorfastness, fuels the demand for PSF. Manufacturers employ advanced technologies to produce high-quality PSF, ensuring consistency in fiber strength, resilience, and moisture absorption. Sustainability is a growing concern, leading to the increasing popularity of recycled PSF and the development of sustainable production methods. Regulations and certifications play a crucial role in the PSF market, influencing fiber sourcing, processing, and manufacturing.

The supply chain is intricately connected, with fiber cost, transportation, and handling impacting the overall production process. Textile blends, such as cotton-polyester and synthetic-polyester, are gaining traction due to their unique properties. Polyester/viscose blends offer enhanced comfort and durability, while filament yarn provides superior strength and flexibility. The PSF market is subject to price trends and environmental impact concerns. Fiber recycling initiatives aim to reduce the environmental footprint, while fiber safety and quality control measures ensure the production of superior PSF. The future of the PSF market lies in continuous innovation, sustainability, and meeting the evolving needs of various industries.

How is this Polyester Staple Fiber (PSF) Industry segmented?

The polyester staple fiber (PSF) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Solid

- Hollow

- Application

- Apparel

- Home furnishing

- Automotive

- Filtration

- Others

- Type

- Virgin

- Blended

- Recycled

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- Middle East and Africa

- Turkey

- APAC

- China

- India

- Indonesia

- Japan

- South Korea

- Rest of World (ROW)

- North America

.

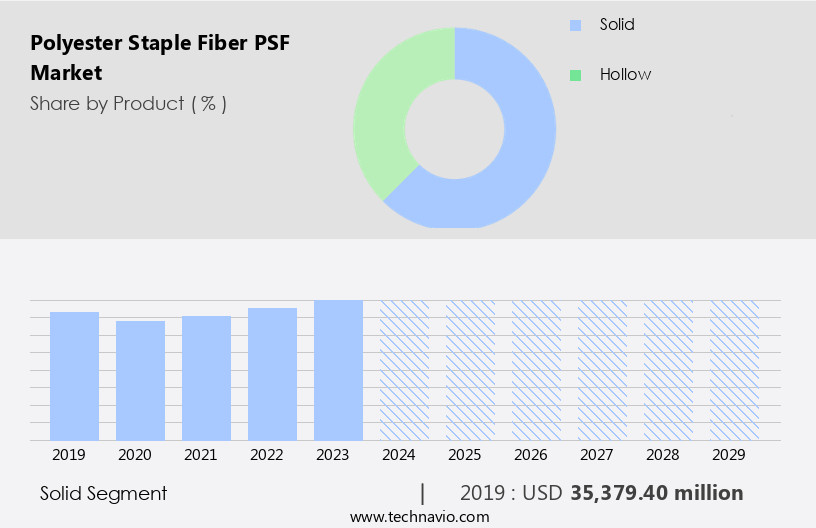

By Product Insights

The solid segment is estimated to witness significant growth during the forecast period.

Polyester staple fiber (PSF) is a versatile material widely used in various applications due to its desirable properties. In textile manufacturing, PSF is processed into filament yarn or staple yarn, depending on the end product. For insulation and padding, solid PSF is blended with a bicomponent low-melt or chemically bonded agent to create high-loft wadding, spun yarns, and interlining. Spun yarns, derived from both virgin and recycled PSF, are utilized in sewing and embroidery threads. For knitting fabrics, waxed yarns are employed, while unwaxed yarns are used for weaving. PSF yarns are available in both two-ply and single-ply, and can be raw-white or dyed.

Dyeing techniques include dope-dyeing, which produces optical white, black, and other colors by adding a color masterbatch. Polyester's fiber properties, such as high fiber density, resilience, elasticity, and strength, make it an ideal choice for industrial fabrics, apparel manufacturing, and home furnishings. The fiber's moisture absorption, shrinkage, and durability are also essential factors contributing to its popularity. Polyester's sustainability is a growing concern, with efforts being made to increase recycling and reduce its environmental impact. Regulations and certifications play a crucial role in ensuring the quality and safety of PSF, from fiber sourcing and manufacturing to yarn production and testing.

The demand for PSF continues to grow, driven by advancements in technology and the increasing popularity of textile blends, such as cotton-polyester and polyester-viscose. Bio-based PSF is an emerging trend, offering a more sustainable alternative to traditional PSF.

The Solid segment was valued at USD 35.38 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

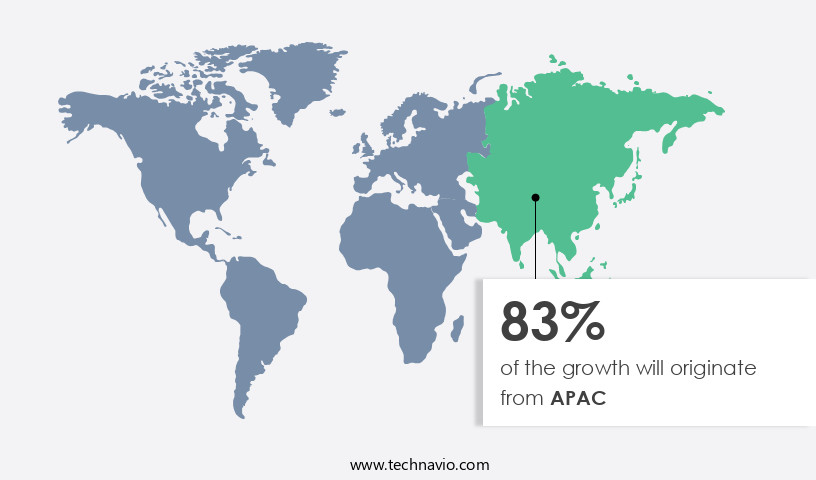

APAC is estimated to contribute 83% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is significantly influenced by various factors, with applications spanning textiles, industrial fabrics, home furnishings, and apparel manufacturing. PSF's popularity stems from its versatile properties, including fiber density, elasticity, resilience, and colorfastness. Fiber weight and length are crucial factors in determining the end-use applications. Innovations in PSF production, such as recycled polyester and bio-based polyester, contribute to its sustainability and eco-friendliness. Regulations and certifications ensure fiber quality through rigorous testing and quality control measures. Fiber fineness and crimp impact the handling and processing in fiber spinning and yarn production. The Asia Pacific (APAC) region dominates the PSF market due to its large textile industry, with China being the leading producer and consumer.

Japan and South Korea also contribute significantly to the demand for PSF due to their thriving exports of textiles and apparel. Safety, moisture absorption, and fiber strength are essential considerations in various industries, including automotive, construction, and filtration. The PSF market is expected to grow as industries continue to explore new applications for this synthetic fiber. Fiber cost, recycling, and social responsibility are essential aspects of the PSF supply chain, with ongoing efforts to minimize environmental impact and improve sustainability. The market trends reflect the continuous advancements in PSF technology and the evolving needs of various industries.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Polyester Staple Fiber (PSF) Industry?

- In the Asia-Pacific region, marked by significant market expansion, this area holds the primary growth driver for the industry.

- The global PSF market has experienced significant growth due to increasing demand, particularly in China. This growth can be attributed to several factors. First, China's urban population, which accounts for over 75% of apparel expenditures, has driven increased demand for clothing. Second, the country's infrastructure and construction sectors are expanding, leading to increased demand for industrial fabrics made from PSF. According to recent customs data, PSF exports from China increased by 28.6% in February 2024 compared to the previous year. Furthermore, the PSF industry is focusing on sustainability, with many manufacturers producing eco-friendly and recycled PSF.

- This trend is expected to continue, as consumers become more environmentally conscious. Additionally, advancements in fiber spinning technology have led to improvements in fiber fineness, elasticity, and colorfastness. These enhancements have made PSF more desirable for various applications, including textiles, automotive, and packaging. The PSF supply chain is also prioritizing safety and certification, ensuring that products meet industry standards. This focus on quality and compliance is essential for maintaining consumer trust and confidence in the PSF market. As the market continues to evolve, it is crucial for manufacturers to stay abreast of the latest trends and regulations to remain competitive.

- Overall, the PSF market is poised for continued growth, driven by increasing demand, technological advancements, and a focus on sustainability and safety.

What are the market trends shaping the Polyester Staple Fiber (PSF) Industry?

- The increasing importance of sustainable production methods is a notable trend in today's market. Professionals and consumers alike are prioritizing environmentally friendly practices in their business dealings and personal choices.

- The textile industry is experiencing a shift towards eco-friendly practices, driven by growing concerns over environmental sustainability and consumer health. Developing economies, with their rapid economic growth, have brought about increased awareness of the need for sustainable textile products. As a result, numerous companies are adopting eco-friendly manufacturing processes and producing textile blends, such as cotton and synthetic fiber, or polyester/viscose blends. These blends offer the benefits of both fiber types, including fiber strength and cost-effectiveness, while minimizing the environmental impact. Moreover, the focus on fiber processing and yarn production methods that reduce waste and water usage is gaining momentum.

- Fiber recycling is also becoming a priority, as it helps to reduce the demand for new raw materials and decrease the carbon footprint of textile production. The apparel and home furnishings industries are major consumers of textile products and are under pressure to demonstrate social responsibility. In conclusion, the demand for sustainable textile products is increasing as consumers and companies become more aware of the impact of non-sustainable practices on the environment and human health. The textile industry is responding by investing in eco-friendly manufacturing processes, producing textile blends, and focusing on sustainable fiber processing and recycling. This trend is expected to continue as the industry seeks to address environmental issues and meet the evolving needs of consumers.

What challenges does the Polyester Staple Fiber (PSF) Industry face during its growth?

- The volatile pricing of raw materials poses a significant challenge to the industry's growth trajectory.

- The market experiences price fluctuations due to the volatility of raw material costs, particularly crude oil-based feedstocks. Despite relatively stable supplies of crude oil and natural gas, the unpredictability of oil prices negatively impacts the growth of the PSF market. In response, market participants employ risk management strategies, such as hedging, to mitigate short-term commodity price fluctuations for ethane, propane, benzene, and natural gas. The environmental impact of polyester fibers, particularly in relation to polyester-cotton blends, is a significant concern.

- Fiber handling, crimp, durability, fiber transportation, and fiber storage are essential factors influencing the market trends. Advancements in PSF technology continue to improve fiber properties, including fiber strength, elasticity, and moisture management. The PSF market is expected to grow as consumer demand for sustainable and eco-friendly textiles increases, with the development of bio-based polyester being a key trend.

Exclusive Customer Landscape

The polyester staple fiber (PSF) market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyester staple fiber (PSF) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyester staple fiber (psf) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alfa Corporativo S.A. de C.V. - The company specializes in providing high-quality polyester staple fibers, including Terylene and Dacron.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alfa Corporativo S.A. de C.V.

- Atulit Impex Pvt. Ltd.

- Diyou Fibre M Sdn Bhd

- Eastman Chemical Co.

- Far Eastern New Century Corp.

- Green Group SA

- Huvis Corp.

- Indorama Corp.

- Jiangsu Sanfangxiang Group Co. Ltd.

- Kayavlon Impex Pvt. Ltd.

- Nirmal Fibres Pvt. Ltd.

- Reliance Industries Ltd.

- Shanghai Vico Industrial Co. Ltd.

- Stein Fibers Ltd.

- The Bombay Dyeing and Manufacturing Co. Ltd.

- Toray Industries Inc.

- Vishal Poly Fibres Pvt. Ltd.

- VNPOLYFIBER

- XINDA Corp.

- Zhejiang Anshun Pettechs Fibre Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polyester Staple Fiber (PSF) Market

- In February 2024, INVISTA, a global materials science company, introduced a new line of Sorona® Renewably Sourced Polyester Staple Fiber (PSF) in collaboration with DuPont Tate & Leland. This eco-friendly fiber, derived from 37% plant-based materials, is expected to reduce carbon emissions by up to 30% compared to conventional PSF, addressing the growing demand for sustainable textiles (INVISTA Press Release, 2024).

- In May 2024, Toray Industries, a leading global manufacturer of PSF, announced a strategic partnership with Adidas to develop high-performance, recycled PSF for use in athletic apparel. This collaboration aims to reduce Toray's environmental footprint and Adidas' reliance on virgin materials (Toray Industries Press Release, 2024).

- In August 2024, Hyundai Hynewa, a major PSF producer, completed a USD200 million expansion project, increasing its annual production capacity by 100,000 tons. This expansion will help the company meet the rising demand for PSF in the global textile industry (Hyundai Hynewa Press Release, 2024).

Research Analyst Overview

- The market encompasses a diverse range of applications, from garment manufacturing and technical textiles to industrial textiles and composites. Key components of the PSF production process include polyester resin, polyester laminates, polyester carding, and polyester blending. The resulting fibers find use in various sectors, such as nonwovens, garments, technical textiles, and coatings. Polyester recycling is a significant trend in the market, driven by the growing demand for sustainable textile solutions. Polyester recycling technology employs processes like polyester recycling process, polyester chips, and polyester pellets to convert textile waste into new fibers, thereby reducing the environmental impact of textile production.

- Polyester additives, such as polyester dyes and polyester monomer, enhance the functionality and performance of PSF in various applications. Polyester finishing, texturing, and drawing techniques further refine the fibers' properties, catering to the specific requirements of industries like automotive, construction, and healthcare. The market for PSF is marked by continuous innovation, with advancements in polyester polymer, polyester filament, and polyester tow leading to the development of new products and applications. Polyester composites and technical textiles, in particular, are gaining traction due to their superior strength, durability, and resistance to harsh environments. Industrial textiles, including polyester weaving and industrial coatings, are essential components of numerous industries, from construction and automotive to energy and transportation.

- Polyester coatings, for instance, provide protective layers for various surfaces, while polyester weaving produces strong, durable fabrics for use in heavy-duty applications. Polyester treatments, such as polyester finishes and polyester treatments, further enhance the performance and longevity of PSF products. The integration of these treatments into the production process results in fibers that exhibit enhanced properties, such as improved moisture management, UV protection, and flame retardancy. In summary, the PSF market is characterized by a dynamic and innovative landscape, driven by advancements in production technologies, recycling processes, and the development of new applications. The versatility of PSF makes it a preferred choice for industries seeking high-performance, sustainable, and cost-effective textile solutions.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polyester Staple Fiber (PSF) Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

226 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.9% |

|

Market growth 2025-2029 |

USD 24516.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

6.3 |

|

Key countries |

China, India, US, South Korea, Japan, Germany, Italy, Turkey, Indonesia, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyester Staple Fiber (PSF) Market Research and Growth Report?

- CAGR of the Polyester Staple Fiber (PSF) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyester staple fiber (psf) market growth of industry companies

We can help! Our analysts can customize this polyester staple fiber (psf) market research report to meet your requirements.