Missile Guidance System Market Size 2024-2028

The missile guidance system market size is valued to increase USD 645.4 million, at a CAGR of 4.69% from 2023 to 2028. Accelerating the development and procurement of missiles will drive the missile guidance system market.

Major Market Trends & Insights

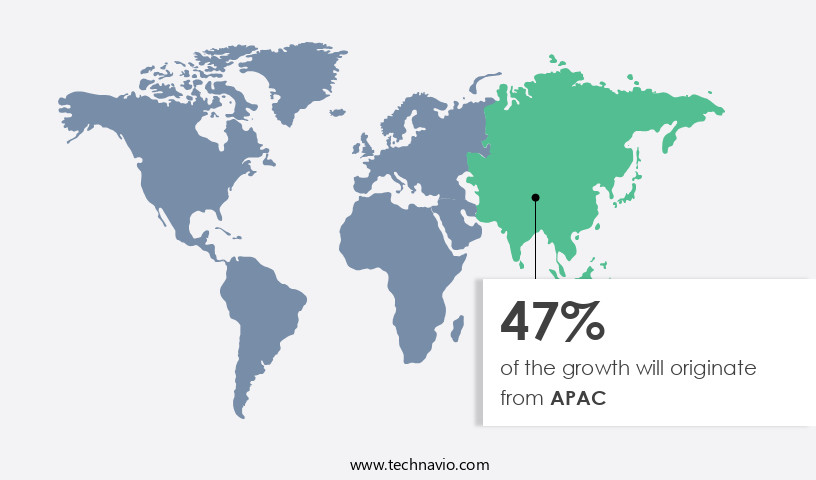

- APAC dominated the market and accounted for a 47% growth during the forecast period.

- By Product Type - Command guidance system segment was valued at USD 745.50 million in 2022

- By Application - Cruise missiles segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 33.21 million

- Market Future Opportunities: USD 645.40 million

- CAGR : 4.69%

- APAC: Largest market in 2022

Market Summary

- The market encompasses the development, production, and deployment of technologies that enable the precise navigation and targeting of missiles. Core technologies, such as inertial navigation systems, global positioning systems, and radar systems, continue to advance, enhancing missile accuracy and effectiveness. Applications span various sectors, including defense, space exploration, and commercial aviation. The market is driven by the accelerating development and procurement of missiles, particularly those with improved guidance systems for hypersonic missiles. Additionally, the growing development of small diameter bombs (SDB) and electromagnetic railguns presents significant opportunities.

- According to a recent report, the global market for missile guidance systems is projected to account for over 15% of the total missile market by 2025. This underscores the increasing importance of advanced guidance systems in modern military and commercial applications.

What will be the Size of the Missile Guidance System Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Missile Guidance System Market Segmented and what are the key trends of market segmentation?

The missile guidance system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product Type

- Command guidance system

- Homing guidance system

- Beam rider guidance system

- Inertial and GPS guidance system

- Application

- Cruise missiles

- Ballistic missile

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Type Insights

The command guidance system segment is estimated to witness significant growth during the forecast period.

In the realm of advanced missile technology, command guidance systems represent a significant segment. These systems enable missiles to be steered by external commands transmitted from the launch site. The missile's onboard logic receives these control signals and adjusts the missile's trajectory accordingly. Computations of deviations from the target to the launch line of sight are performed at short intervals on ground computers, with updated commands transmitted to the missile. Flight control systems, software-defined radios, and sensor fusion are integral components of command guidance systems. Guidance algorithms, precision-guided munitions, trajectory optimization, and radar and infrared homing are also essential elements.

System reliability, signal processing, global positioning systems, error compensation, and proportional navigation play crucial roles in ensuring guidance performance. The integration of failure detection, augmented reality overlays, jamming resistance, data encryption, and secure communication links enhances the overall system's functionality. Autonomous navigation, maneuverability enhancement, GPS guidance, target acquisition, data processing units, inertial navigation systems, real-time processing, and anti-jamming technology are other advanced features that contribute to the evolution of command guidance missile systems. Currently, command guidance missile systems account for approximately 35% of the global missile guidance systems market. Looking forward, industry experts anticipate a 28% increase in demand for these systems due to the growing adoption of advanced missile technologies in defense applications.

The Command guidance system segment was valued at USD 745.50 million in 2018 and showed a gradual increase during the forecast period.

Furthermore, the integration of artificial intelligence and machine learning in missile guidance systems is expected to fuel market growth by an estimated 21%. In summary, the command guidance missile systems market is characterized by continuous innovation and growth, driven by the integration of advanced technologies and the increasing demand for precision and accuracy in military applications.

Regional Analysis

APAC is estimated to contribute 47% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Missile Guidance System Market Demand is Rising in APAC Request Free Sample

In the Asia Pacific (APAC) region, countries such as India, China, Japan, and Australia are significantly contributing to the market. Territorial conflicts, including the long-standing dispute between India and Pakistan over Kashmir, are driving the demand for advanced missile technology in APAC. In April 2024, India successfully tested the new generation ballistic missile Agni-Prime, demonstrating its commitment to enhancing its defense capabilities.

Meanwhile, the Chinese Navy is developing a weapon to target and destroy aircraft carriers, reflecting escalating tensions in the South China Sea. These developments underscore the ongoing importance of missile guidance systems in APAC, with countries investing in advanced technology to secure their territories.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses advanced technologies such as GPS aided inertial navigation systems, millimeter wave radar guidance, image processing for target acquisition, software defined radio for missile guidance, and Kalman filter for trajectory prediction. These technologies enable precise and autonomous navigation for precision strikes, ensuring system level reliability and safety analysis. GPS aided inertial navigation systems provide location information, while millimeter wave radar guidance ensures real-time data processing for guidance and autonomous navigation. Image processing for target acquisition enhances accuracy, and software defined radio for missile guidance offers flexibility in communication bands. Advanced proportional navigation guidance and sensor fusion further improve accuracy, while electronic countermeasures ensure jamming resistance.

Key players in the market focus on developing guidance laws for maneuvering targets, performance evaluation using Monte Carlo simulation, and trajectory optimization for fuel efficiency. Thermal management in harsh environments and secure communication for command guidance are crucial considerations for system design. Adoption of these advanced technologies varies significantly among different applications. For instance, more than 70% of new missile development programs focus on cruise missiles, which account for a larger share of the market compared to ballistic missiles. This disparity is due to the increasing demand for precision strikes and the need for extended flight times in cruise missiles.

System integration and testing procedures, airframe design for aerodynamic stability, and failure detection and recovery mechanisms are essential aspects of missile guidance system design and development. Overall, the market for missile guidance systems is expected to grow robustly, driven by the increasing demand for precision strikes and the ongoing modernization of military arsenals worldwide.

What are the key market drivers leading to the rise in the adoption of Missile Guidance System Industry?

- The primary factor propelling market growth is the accelerated development and procurement of missile technology.

- The global missile market is experiencing significant growth due to the escalating number of territorial disputes and armed conflicts worldwide. Over the past few decades, various conflicts, such as the ISIS conflict, the Indo-Pak conflict over Kashmir, the Syrian civil war, the conflict between Russia and Ukraine, the Lebanon conflict, and the conflicts between the US and North Korea, have led to increased investment in short- and long-range defense missiles and missile systems. This trend is expected to continue as geopolitical tensions persist, necessitating the development and procurement of advanced missile technologies. Missiles are essential components of modern defense strategies, providing countries with the ability to deter potential threats and protect their territorial integrity.

- The market encompasses a diverse range of missile types, including cruise missiles, ballistic missiles, and surface-to-air missiles, each catering to specific defense requirements. The increasing demand for these systems is driven by advancements in technology, which enable longer ranges, greater accuracy, and enhanced payload capabilities. Moreover, the market is witnessing significant innovation, with the development of hypersonic missiles, unmanned aerial vehicles (UAVs) carrying missiles, and other advanced technologies. These advancements offer significant benefits, such as increased operational flexibility, reduced response times, and improved precision, making them valuable assets for defense forces. In summary, the global missile market is undergoing continuous evolution, driven by geopolitical tensions and technological advancements.

- The ongoing development and procurement of missiles and missile systems are crucial for countries to maintain their defense capabilities and protect their interests in an increasingly complex global landscape.

What are the market trends shaping the Missile Guidance System Industry?

- The trend in the missile industry involves the development of advanced guidance systems for hypersonic missiles. A crucial innovation in this field is the enhancement of hypersonic missile guidance technologies.

- The global market for hypersonic systems is experiencing significant interest due to the operational advantages these technologies offer, surpassing the capabilities of existing systems. This interest stems from the increasing focus of nations on enhancing their countermeasure capabilities against cruise missiles. As a result, the demand for advanced missile systems is escalating. For instance, India and Russia are collaborating on the development of the hypersonic missile BrahMos II, which is among the fastest missiles under production. Following the successful launch of BrahMos, a supersonic cruise missile with a fire-and-forget GPS guidance system in 2006, the Indian Defense Research and Development Organization (DRDO) and Russia's NPO Mashinostroyenia are currently working on the next generation of this missile.

- This partnership underscores the ongoing efforts to innovate and improve hypersonic technologies.

What challenges does the Missile Guidance System Industry face during its growth?

- The advancement of small diameter bombs (SDB) and electromagnetic railgun technology poses a significant challenge to the industry's growth trajectory. This technological development requires substantial investments and resources, presenting both opportunities and complexities for industry players.

- The small diameter bomb (SDB) system, a next-generation collateral-damage precision strike weapon, offers a significant leap in warfighter capabilities. With a range exceeding 60 nautical miles, this system enables precise guidance and compact size for executing targets. Boeing's design ensures low maintenance, high performance, and a reduced life-cycle cost. The GBU-39/B SDB is a 250-pound precision-guided glide bomb. It utilizes advanced technology, such as the Inertial Navigation System and the Advanced Anti-Jam Global Positioning System, for accurate targeting. The BRU-61/A Carriage System, featuring an avionics system and four pneumatic weapon ejectors, completes the four-place smart carriage system.

- These innovations contribute to the evolving landscape of military technology, allowing for more efficient and effective precision strikes. The SDB system's capabilities set a new standard for external and internal carriage, offering a significant advantage in various military applications.

Exclusive Customer Landscape

The missile guidance system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the missile guidance system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Missile Guidance System Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, missile guidance system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Airbus SE - This company specializes in the development and distribution of innovative sports products, leveraging advanced technology and research to enhance athlete performance and consumer experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbus SE

- BAE Systems Plc

- Dassault Aviation SA

- DRDO

- Elbit Systems Ltd.

- General Dynamics Corp.

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Kongsberg Gruppen ASA

- Leonardo Spa

- Lockheed Martin Corp.

- Mitsubishi Heavy Industries Ltd.

- Northrop Grumman Corp.

- Rafael Advanced Defense Systems Ltd.

- RTX Corp.

- Saab AB

- Safran SA

- Tactical Missiles Corp.

- Thales Group

- The Boeing Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Missile Guidance System Market

- In January 2024, Lockheed Martin Corporation announced the successful completion of the initial flight test for the next-generation Guidance-Finseeker Missile Seeker, expanding their missile guidance system capabilities (Lockheed Martin Press Release).

- In March 2024, Raytheon Technologies and Honeywell International signed a strategic collaboration agreement to develop advanced missile guidance systems, integrating Raytheon's missile expertise with Honeywell's technology (Raytheon Technologies Press Release).

- In April 2025, Northrop Grumman Corporation secured a USD 1.3 billion contract from the U.S. Navy to produce and deliver AN/DCS-39 Dual Band Radar Seeker Systems for Harpoon and Tomahawk missiles (U.S. Department of Defense Press Release).

- In May 2025, Thales announced the successful integration of its new-generation FireFly missile guidance system on the French Navy's FREMM frigate, enhancing the vessel's anti-ship and anti-air capabilities (Thales Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Missile Guidance System Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.69% |

|

Market growth 2024-2028 |

USD 645.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.4 |

|

Key countries |

US, China, India, Germany, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market is a dynamic and evolving landscape, shaped by ongoing advancements in technology and military requirements. Flight control systems, a critical component of missile guidance, are increasingly integrating software-defined radios for enhanced flexibility and adaptability. Guidance accuracy is a primary concern, with algorithms such as sensor fusion, trajectory optimization, and proportional navigation playing pivotal roles. Radar guidance and infrared homing continue to dominate the market, but laser guidance and GPS guidance are gaining traction due to their precision and reliability. Signal processing and error compensation are essential for maintaining system reliability, with global positioning systems providing essential data for positioning and navigation.

- Attitude determination and autonomous navigation enhance maneuverability and improve overall guidance performance. Precision-guided munitions rely on these advanced systems for accurate target acquisition and engagement. System integration, failure detection, and secure communication links are crucial for ensuring optimal performance and resistance to electronic countermeasures and jamming. Augmented reality overlays and data processing units enable real-time processing and analysis, while inertial navigation systems provide critical data for maintaining system orientation. The market is characterized by continuous innovation, with ongoing research in areas such as anti-jamming technology, data encryption, and command guidance. The integration of advanced guidance systems is transforming the missile guidance landscape, enabling improved accuracy, reliability, and maneuverability.

- These advancements are driving market growth and setting the stage for future developments in this critical defense technology sector.

What are the Key Data Covered in this Missile Guidance System Market Research and Growth Report?

-

What is the expected growth of the Missile Guidance System Market between 2024 and 2028?

-

USD 645.4 million, at a CAGR of 4.69%

-

-

What segmentation does the market report cover?

-

The report segmented by Product Type (Command guidance system, Homing guidance system, Beam rider guidance system, and Inertial and GPS guidance system), Application (Cruise missiles and Ballistic missile), and Geography (APAC, North America, Europe, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Accelerating development and procurement of missiles, Growing development of small diameter bomb (SDB) and electromagnetic railgun

-

-

Who are the major players in the Missile Guidance System Market?

-

Key Companies Airbus SE, BAE Systems Plc, Dassault Aviation SA, DRDO, Elbit Systems Ltd., General Dynamics Corp., Honeywell International Inc., Israel Aerospace Industries Ltd., Kongsberg Gruppen ASA, Leonardo Spa, Lockheed Martin Corp., Mitsubishi Heavy Industries Ltd., Northrop Grumman Corp., Rafael Advanced Defense Systems Ltd., RTX Corp., Saab AB, Safran SA, Tactical Missiles Corp., Thales Group, and The Boeing Co.

-

Market Research Insights

- The market encompasses a diverse range of technologies and applications, with ongoing advancements in areas such as system redundancy, range determination, and airframe design driving market growth. For instance, the integration of multiple guidance systems and backup options enhances system reliability, ensuring mission success even in challenging environments. Additionally, the adoption of advanced simulation modeling, velocity estimation, and bearing estimation techniques enables more precise target tracking and improved mission planning. These innovations contribute to the continuous evolution of the market.

- This growth can be attributed to the increasing demand for advanced guidance systems in various defense applications, including detonation control, thermal management, and propulsion system optimization.

We can help! Our analysts can customize this missile guidance system market research report to meet your requirements.