Mobile Accelerator Market Size 2024-2028

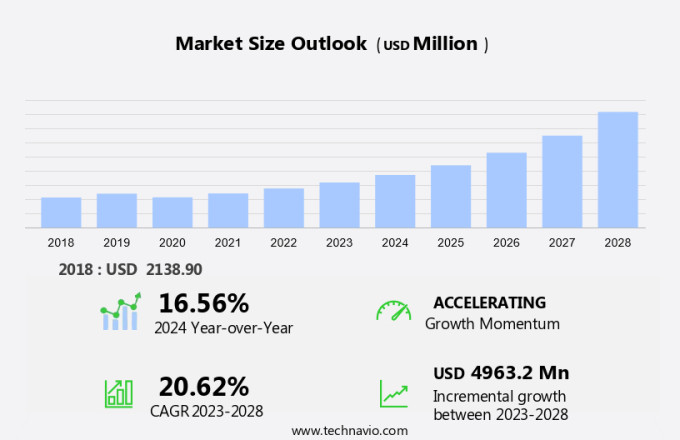

The mobile accelerator market size is estimated to grow by USD 4.96 billion at a CAGR of 20.62% between 2023 and 2028. In today's digital age, businesses are increasingly recognizing the importance of mobile applications to engage with customers and expand their reach. However, the complexities involved in mobile application development can be a significant barrier. To address this challenge, low-code and no-code development platforms have emerged, enabling faster and more cost-effective mobile app creation. Furthermore, with the growing trend of mobile traffic and the significant time spent on social media, having a mobile presence is no longer an option but a necessity. These platforms provide user-friendly interfaces and pre-built components, allowing developers to focus on customizing the application to meet their unique business needs, without requiring extensive coding knowledge. By leveraging these solutions, businesses can streamline their mobile app development process, stay ahead of the competition, and effectively engage with their audience in the digital space.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market is witnessing significant growth due to the increasing usage of smartphones and the rise of web applications. Mobile accelerators are essential tools that optimize the delivery of web content to mobile devices, improving the user experience. They employ various techniques such as WAN optimization, source optimization, and device acceleration to enhance the performance of business applications, gaming applications, M Commerce applications, and social networking applications in the digital environment. Mobile accelerators are crucial for businesses to provide customized solutions for their customers in the competitive digital marketplace. Programming and network infrastructure optimization are key factors driving the market's growth. Mobile marketing and digital ads budgets are also significant contributors to the market's expansion. Third-party vendors offer mobile acceleration services, enabling businesses to integrate cloud solutions and network infrastructure optimization. App developers and network providers are key stakeholders in the mobile accelerator market, collaborating to provide optimal solutions for businesses and end-users. Overall, mobile accelerators are essential for delivering high-performing applications and enhancing the customer experience in the digital world. Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Key Market Driver

The rising need to reduce complexities in mobile application development is notably driving market growth. Mobile accelerators streamline the process of developing and designing mobile applications by eliminating the need for developers to create their own backend systems for server communication. Companies providing mobile accelerator solutions offer customized, cloud-integrated services, which reduce the need for intricate coding for server hosting. This, in turn, minimizes application development time and enhances frontend tasks, such as application design and user interface (UI) creation. The result is an improved customer experience. In the current digital environment, the demand for application development is significant. Mobile accelerators provide businesses with the flexibility and scalability required to meet this demand. They facilitate the automatic generation of APIs for reading and writing external data, and offer network infrastructure optimization for various applications, including music and messaging, business, gaming, travel, entertainment, social networking, banking, health and fitness, e-commerce, and more. Multinationals and small businesses alike benefit from mobile accelerators, as they enable the delivery of high-performing applications on smartphones and tablets, even in areas with limited internet penetration and smartphone penetration. Mobile accelerators optimize source optimization, network, and device acceleration, ensuring seamless delivery of web content, mobile video usage, and auto-upgrades. App developers and network providers rely on mobile accelerators to address glitches and manage data consumption, making them an essential tool in the mobile application development industry. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The growing popularity of mobile analytics technology is the key trend in the market. Mobile analytics solutions are gaining popularity among businesses as they offer real-time insights into customer behavior and market trends. These solutions, often integrated with mobile applications, enable users to analyze data on their devices. According to Technavio, the adoption of mobile analytics is expected to increase significantly as organizations seek to enhance interaction with consumers, employees, and partners for informed decision-making. Cloud-based mobile analytics solutions provide customized, real-time data processing and integration with various applications such as music, messaging, business, gaming, travel, entertainment, social networking, banking, health and fitness, e-commerce, and more. This integration requires optimization of network infrastructure and device acceleration to ensure seamless user experience and efficient data consumption. Mobile accelerator solutions address these challenges by optimizing source optimization, network, and application development for smartphones and tablets. App developers and network providers benefit from these solutions by reducing glitches and enhancing the overall performance of mobile applications. With the increasing penetration of internet and smartphones, mobile analytics solutions are becoming essential for multinationals to stay competitive in the digital environment. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

IT systems complicacy and latency problems is the major challenge that affects the growth of the market. In today's digital environment, mobile accelerators play a crucial role in enhancing the user experience of various applications, including music and messaging, business, gaming, travel, entertainment, social networking, banking, health and fitness, e-commerce, and more. However, the complexity of IT systems and varying legal, infrastructure, and content restrictions across regions necessitate customized solutions. Cloud integration and network infrastructure optimization are essential for delivering seamless experiences. Businesses, particularly multinationals, require mobile accelerators to reach a global audience, mitigate network latency, and ensure the availability of their applications. Mobile marketing and digital ads budgets depend on the efficient delivery of content to smartphones and tablets. Third-party vendors offer customized solutions for device and content acceleration, source optimization, and auto-upgrade. Addressing glitches and optimizing data consumption are ongoing challenges for app developers and network providers. The increasing penetration of internet and smartphone usage further underscores the importance of mobile accelerators in delivering high-quality applications and web content. Hence, the above factors will impede the growth of the market during the forecast period.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Akamai Technologies Inc. - The company offers mobile accelerator that helps online businesses deliver improved performance for mobile web sites and applications,under the brand name of Cision.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Akamai Technologies Inc.

- Ascom Holding AG

- Citrix Systems Inc.

- Cloudflare Inc.

- Edgio Inc.

- Equinix Inc.

- F5 Inc.

- Huawei Technologies Co. Ltd.

- International Business Machines Corp.

- Oracle Corp.

- Qualcomm Inc.

- Salesforce Inc.

- Telefonaktiebolaget LM Ericsson

- Volaris Group Inc.

- Yotta Data Services Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

By Type

The cloud deployment segment is estimated to witness significant growth during the forecast period. In today's digital environment, mobile accelerator solutions have become essential for businesses to enhance the performance of cloud-based applications, particularly in sectors such as music and messaging. These solutions optimize network infrastructure and provide customized, cloud-integrated services for business applications, programming, and mobile marketing. Third-party vendors offer customized solutions for various industries, including gaming, business, travel, entertainment, social networking, banking, health and fitness, e-commerce, and multinationals.

Get a glance at the market share of various regions Download the PDF Sample

The cloud deployment segment accounted for USD 1.5 billion in 2018. The increasing internet and smartphone penetration have led to an escalating demand for application development and web content delivery. Mobile phone and tablet users expect seamless experiences, and mobile video usage continues to rise. To meet these expectations, mobile accelerators provide device and content acceleration, source optimization, and auto-upgrade features. Network providers and app developers benefit from these solutions by reducing glitches, minimizing data consumption, and improving customer experience. Mobile ads budgets are also growing, making mobile acceleration a crucial investment for businesses.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

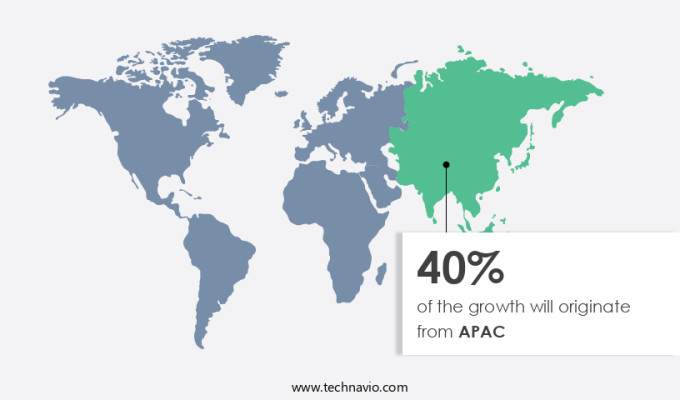

APAC is estimated to contribute 40% to the growth of the global market during the market forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is a significant segment of the digital technology industry, focusing on enhancing the performance of mobile applications, particularly on smartphones. With the increasing usage of web applications, gaming applications, M Commerce applications, and social networking applications, the need for faster app performance and efficient data usage has become crucial. Mobile devices, including smartphones, generate a substantial amount of mobile traffic, which is expected to surpass desktop traffic in the near future. Mobile marketing strategies rely heavily on user experience, and network operators face challenges in managing the latency and round trip time of mobile data. Security challenges are also prevalent due to the increasing number of mobile users and digital devices. To address these issues, various software tools such as WAN optimization, data compression, content optimization, caching, and virtual support from third-party vendors have emerged. These tools help improve app performance, reduce data plans, and enhance the user experience. Mobile technologies like 5G networks and advanced CPU, memory, and battery management are essential for delivering high-quality mobile experiences. Digital marketing strategies, including mobile advertising, social media, and mobile technologies, are becoming increasingly important for businesses to reach their audiences effectively. Startups and established companies alike are investing in mobile accelerator solutions to meet the evolving demands of mobile users and stay competitive in the digital marketplace.

Segment Overview

The market report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD Billion " for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type Outlook

- Cloud deployment

- Local deployment

- Region Outlook

- North America

- The U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- South America

- Argentina

- Brazil

- Chile

- North America

You may also be interested in:

- Artificial Intelligence (AI) Chips Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, UK, Germany, Taiwan - Size and Forecast

- Software Testing Services Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, UK, Germany, Japan - Size and Forecast

- Data Center Market Analysis North America, APAC, Europe, South America, Middle East and Africa - US, Germany, UK, China, Canada - Size and Forecast

Market Analyst Overview

Boosting App Performance for Smartphones Mobile devices have become an integral part of our daily lives, with an increasing number of users relying on them for various activities, from web browsing and social media to m-commerce and gaming. However, the growing usage of mobile applications puts pressure on network operators to ensure seamless user experience, especially when it comes to app performance. Mobile accelerators come into play, offering solutions like data compression, content optimization, caching, and WAN optimization to enhance app performance on mobile devices. These software tools are essential for mobile marketing strategies, as they help improve user experience, reduce latency and round trip time, and address security challenges. The market for mobile accelerators is thriving, with numerous startups and digital technology companies offering innovative solutions.

Moreover, mobile users, particularly those with limited data plans, benefit significantly from these tools, as they enable faster loading times and improved network efficiency. Digital marketing strategies, such as mobile advertising, rely heavily on mobile apps, making app performance a critical factor. Network operators and third-party vendors are partnering to provide virtual support and ensure a harmonious user experience across various mobile applications. The advent of digital devices, social media, and mobile technologies has led to an increase in mobile traffic, surpassing desktop traffic. As mobile phone subscribers continue to grow, the demand for mobile accelerators will only increase. With the rollout of 5G networks, faster CPU, larger memory, and improved battery life, the future of mobile accelerators looks bright.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

140 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.62% |

|

Market growth 2024-2028 |

USD 4.96 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

16.56 |

|

Regional analysis |

APAC, Europe, North America, South America, and Middle East and Africa |

|

Performing market contribution |

APAC at 40% |

|

Key countries |

US, China, Russia, India, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Akamai Technologies Inc., Ascom Holding AG, Citrix Systems Inc., Cloudflare Inc., Edgio Inc., Equinix Inc., F5 Inc., Huawei Technologies Co. Ltd., International Business Machines Corp., Oracle Corp., Qualcomm Inc., Salesforce Inc., Telefonaktiebolaget LM Ericsson, Volaris Group Inc., and Yotta Data Services Pvt. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for forecast period |

|

Customization purview |

If our report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies