Motorcycle Advanced Driver Assistance System Market Size 2024-2028

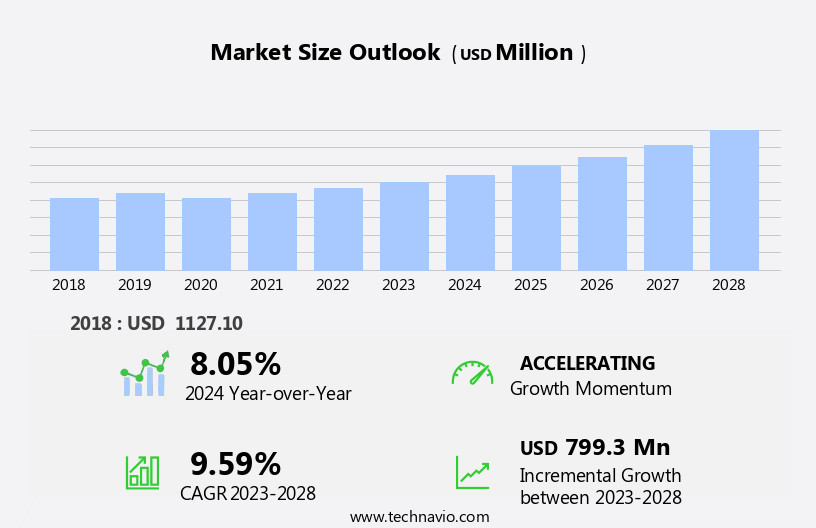

The motorcycle advanced driver assistance system market size is forecast to increase by USD 799.3 million at a CAGR of 9.59% between 2023 and 2028.

- The motorcycle advanced driver assistance system (ADAS) market is experiencing significant growth due to several key factors. The increasing number of road accidents is driving the demand for advanced safety technologies in motorcycles. Innovative products, such as collision avoidance systems and lane departure warnings, are being introduced to enhance rider safety. Furthermore, the dependence of ADAS systems on connectivity is leading to data security concerns, creating a need for robust cybersecurity solutions. Market trends also indicate that the integration of ADAS systems with other vehicle systems, such as infotainment and navigation, will become more prevalent. However, the implementation of these technologies comes with challenges, including high costs and the need for regulatory compliance. Overall, the motorcycle ADAS market is expected to grow steadily, driven by the need for enhanced safety and convenience features.

What will be the Size of the Motorcycle Advanced Driver Assistance System Market During the Forecast Period?

- The motorcycle advanced driver assistance system (ADAS) market is experiencing significant growth as electronic components, such as sensors including ultrasonic and image sensors, radar, and proprietary motorcycle ADAS technologies, become increasingly integrated into vehicles. These systems offer features like adaptive cruise control, traction control system, and anti-lock braking system, enhancing rider safety and convenience. Sales channels for these components extend beyond traditional automotive suppliers to include propulsion system manufacturers and motorcycle OEMs. Price range and innovation are key market dynamics, with start-ups and established players like Valeo introducing competitive offerings. Motorcycle segments, such as sport bikes, cruiser bikes, and touring bikes, are adopting these technologies to cater to diverse customer needs.

- Innovative products In the market include adaptive headlights, influencing the market's future growth trajectory. The integration of these advanced technologies into motorcycles is expected to reshape the motorbike industry landscape.

How is this Motorcycle Advanced Driver Assistance System Industry segmented and which is the largest segment?

The motorcycle advanced driver assistance system industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- ABS

- ACC

- TCS

- Others

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Europe

- Germany

- South America

- Middle East and Africa

- North America

By Product Insights

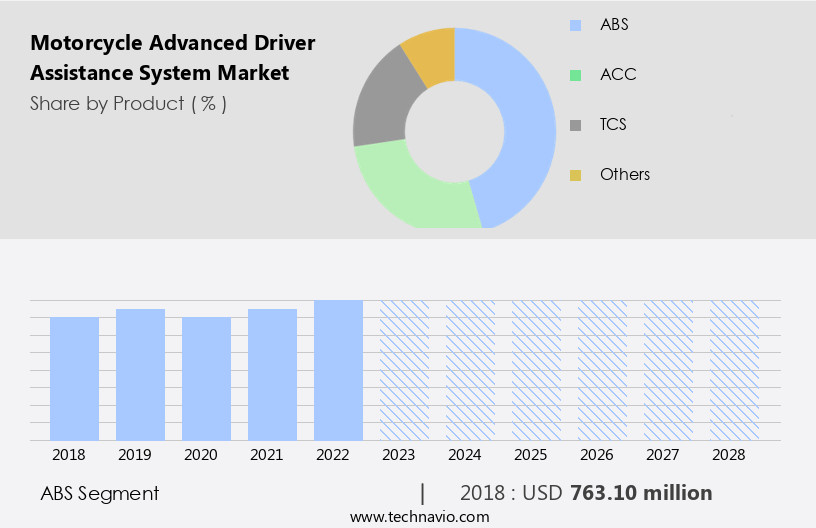

- The abs segment is estimated to witness significant growth during the forecast period.

Motorcycle Advanced Driver Assistance Systems (ADAS) integrate electronic components, including ultrasonic sensors, image sensors, and radar, to enhance rider safety. The core elements of an ADAS include an Electronic Control Unit (ECU), sensors, and propulsion components, such as adaptive cruise control, traction control system, and anti-lock braking system (ABS). Sensors attached to the motorcycle's wheels transmit data on speed and acceleration to the ECU, which processes this information and communicates any unusual readings to the hydraulic unit. In response, the hydraulic unit pumps brake fluid to the tires, ensuring optimal stopping power. Motorcycle ADAS systems are available for various motorbike types, including sport bikes, cruiser bikes, and touring bikes.

The European Commission and ride-hailing services are increasingly focusing on positioning ADAS as essential safety features. Innovative products from leading component manufacturers, such as Valeo, are priced within a reasonable range. Sales channels include auto parts stores, motorcycle dealerships, and online marketplaces. Key features include adaptive headlights, traction control, and adaptive cruise control, making ADAS a valuable investment for motorcycle enthusiasts.

Get a glance at the Motorcycle Advanced Driver Assistance System Industry report of share of various segments Request Free Sample

The ABS segment was valued at USD 763.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

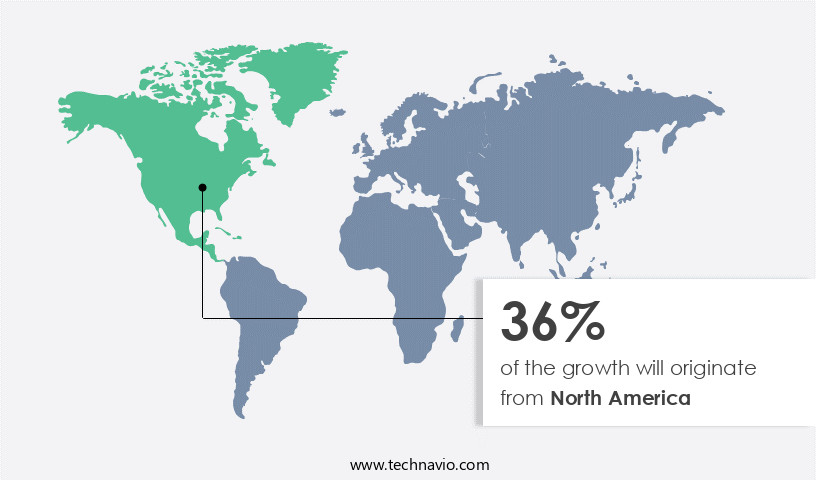

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The motorcycle Advanced Driver Assistance System (ADAS) market in North America is experiencing growth due to the increasing demand for heavyweight motorcycles among mature consumers. This trend is driven by rising disposable income and a strong desire for motorcycle riding. The US dominates the market, with Canada and Mexico also contributing significantly. Household final consumption is on the rise, leading to increased spending power and demand for advanced safety features in motorcycles. Motorcycle ADAS components, including ultrasonic sensors, image sensors, radar, and traction control systems, are in demand for both aftermarket sales and original equipment manufacturer (OEM) installations. Innovative products such as adaptive cruise control and adaptive headlights are gaining popularity.

Sales channels, including auto parts stores, motorcycle dealerships, and e-commerce platforms, are capitalizing on this trend. The price range for motorcycle ADAS varies depending on the specific components and motorcycle type, such as sport bikes, cruiser bikes, and touring bikes. The European Commission's focus on road safety and the emergence of ride-hailing services are also positioning motorcycle ADAS as a necessary feature for the industry.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Motorcycle Advanced Driver Assistance System Industry?

Increasing number of road accidents is the key driver of the market.

- Motorcycle Advanced Driver Assistance Systems (ADAS) have gained significant traction In the automotive industry as a means to enhance road safety for motorbike riders. These systems utilize electronic components such as sensors, including ultrasonic sensors, image sensors, and radar, to provide features like adaptive cruise control, traction control system, and anti-lock braking system. Motorcycle ADAS components are integrated into various types of motorbikes, including sport bikes, cruiser bikes, and touring bikes. The Motorcycle ADAS market is experiencing growth due to the increasing number of road accidents and the European Commission's push for safer transportation. Innovative products from start-ups and established component manufacturers like Valeo are gaining popularity in this market.

- Adaptive headlights, a key feature of Motorcycle ADAS, provide enhanced visibility on the road, reducing the risk of accidents. Sales channels for Motorcycle ADAS components include auto manufacturers, motorbike dealerships, and aftermarket suppliers. The price range for these components varies based on the features and the specific motorbike model. Adaptive cruise control, for instance, is a premium feature that may come at a higher cost. Motorcycle ADAS components play a crucial role in ensuring rider safety by providing real-time positioning information and warning systems for potential hazards on the road. These systems can prevent or mitigate the severity of accidents, resulting in fewer injuries and fatalities.

- As the demand for safer motorbikes grows, the Motorcycle ADAS market is poised for significant growth In the coming years. Price promotions and innovative marketing strategies are expected to drive sales in this market. For instance, influencers and industry experts can help promote Motorcycle ADAS components to their followers, increasing awareness and driving demand. Overall, the Motorcycle ADAS market represents a profitable opportunity for component manufacturers and suppliers, as well as a significant step forward in motorbike safety.

What are the market trends shaping the Motorcycle Advanced Driver Assistance System Industry?

Introduction of innovative products is the upcoming market trend.

- The motorcycle Advanced Driver Assistance System (ADAS) market is witnessing significant growth due to the integration of electronic components such as sensors, including ultrasonic sensors, image sensors, and radar, into motorcycles. Motorcycle ADAS systems offer features like adaptive cruise control, traction control system, and anti-lock braking system, enhancing vehicle safety and convenience. Sales channels, such as auto manufacturers and aftermarket suppliers, are driving the market's profitability. Innovative products like Curve Speed Warning, an infrastructure-based intelligent communication system, are gaining popularity. This safety system uses vehicle-based technologies like maps, road geometry, and vehicle dynamics to provide the correct speed for negotiating a curve.

- It compares the present speed and real-time position of the motorcycle to the required speed, alerting the rider of an approaching curve. European Commission regulations and the increasing adoption of motorcycle ADAS in ride-hailing services are further propelling market growth. Valeo, Motorbikes, Sport bikes, Cruiser bikes, and Touring bikes are all incorporating these advanced systems. Pricing, promotions, and positioning are crucial factors influencing market trends. Adaptive headlights, a motorcycle ADAS feature, automatically adjusts to the surrounding light conditions, enhancing visibility and safety. Start-ups are also entering the market with advanced technologies, adding to the competition. The motorcycle ADAS market is poised for continued growth, driven by these trends and the increasing demand for safety and convenience in motorcycle travel.

What challenges does the Motorcycle Advanced Driver Assistance System Industry face during its growth?

Dependence of ADAS system on connectivity leading to data security concerns is a key challenge affecting the industry growth.

- Motorcycle Advanced Driver Assistance Systems (ADAS) incorporate electronic components such as sensors, including ultrasonic sensors, image sensors, and radar, to enhance vehicle safety. These systems offer features like adaptive cruise control, traction control system, and anti-lock braking system. Motorcycle ADAS components are available in various sales channels, with prices ranging from affordable to premium. Valeo, a leading automotive supplier, has introduced innovative products like adaptive headlights for motorbikes. The European Commission is encouraging the adoption of ADAS in motorcycles to reduce road accidents. Start-ups and established players are developing advanced motorcycle ADAS systems. However, the dependence of these systems on connectivity and data sharing poses data security concerns, which may hinder their adoption.

- The trend of ride-hailing services and increasing demand for safety features in motorbikes are driving the growth of the motorcycle ADAS market. The market for motorcycle ADAS is expected to witness significant growth due to the development of innovative products and increasing consumer awareness about safety. The motorcycle ADAS market includes various types of motorbikes, such as sport bikes, cruiser bikes, and touring bikes. The market dynamics are influenced by factors like pricing, promotions, and profit margins. As the market evolves, it is essential to stay updated on the latest trends and developments to remain competitive.

Exclusive Customer Landscape

The motorcycle advanced driver assistance system market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle advanced driver assistance system market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle advanced driver assistance system market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Bayerische Motoren Werke AG - The advanced driver assistance systems (ADAS) market encompasses technologies such as Anti-lock Braking System (ABS) and Automatic Cruise Control. These innovations enhance motorcycle safety and riding experience by providing real-time assistance for braking and speed maintenance. ABS prevents wheel locking during hard braking, ensuring stability and control, while Automatic Cruise Control maintains a consistent speed, reducing rider fatigue and improving overall ride quality. These systems contribute significantly to the evolution of motorcycle technology, aiming to provide a safer and more efficient riding experience.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bayerische Motoren Werke AG

- Brakes India Pvt. Ltd.

- BWI Group

- Continental AG

- Ducati Motor Holding S.p.A

- GUBELLINI s.a.s. di Diego Gubellini and C.

- Hitachi Ltd.

- Honda Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Nissin Kogyo Co. Ltd.

- Piaggio and C. Spa

- PIERER Mobility AG

- Ride Vision Ltd.

- Rider Dome

- Robert Bosch GmbH

- Suzuki Motor Corp.

- TVS Motor Co. Ltd.

- Yamaha Motor Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The motorcycle advanced driver assistance system (ADAS) market represents a significant growth opportunity In the global automotive industry. This market is driven by various factors, including the increasing demand for safety and convenience features in motorcycles, advancements in sensor technology, and the growing adoption of electronics in two-wheelers. Motorcycle ADAS systems incorporate various sensors, such as ultrasonic and image sensors, as well as radar technology, to provide riders with real-time information and enhance safety. These systems offer features like adaptive cruise control, traction control, and anti-lock braking, which help prevent accidents and improve overall riding experience. The market for motorcycle ADAS is expected to witness robust growth In the coming years, driven by the increasing popularity of motorcycles as a mode of transportation and the rising demand for advanced safety features.

The market dynamics are influenced by several factors, including consumer preferences, regulatory requirements, and technological advancements. Consumer preferences for safety and convenience are driving the demand for motorcycle ADAS systems. Riders are increasingly looking for features that make their riding experience safer and more comfortable. ADAS systems offer a range of benefits, including improved stability, enhanced visibility, and better control, making them an attractive proposition for motorcycle buyers. Regulatory requirements are also playing a role In the growth of the motorcycle ADAS market. Governments and regulatory bodies are increasingly focusing on road safety, and the implementation of stricter regulations is expected to drive the adoption of advanced safety features in motorcycles.

Technological advancements are another key factor driving the growth of the motorcycle ADAS market. The development of new sensors and other components is making it possible to create innovative products that offer enhanced safety and convenience features. Start-ups and established players alike are investing in research and development to bring new products to market. The sales channel for motorcycle ADAS systems is evolving, with a shift towards e-commerce and direct-to-consumer sales. This trend is being driven by the increasing popularity of online sales channels and the convenience they offer to consumers. Despite the growth opportunities, the motorcycle ADAS market faces challenges, including pricing and profit margins.

The cost of developing and manufacturing these systems can be high, and profit margins can be thin. This is particularly true for start-ups and smaller players In the market. Promotions and partnerships are key strategies being used by companies to differentiate themselves In the market. For example, some motorcycle manufacturers are partnering with ride-hailing services to offer ADAS-equipped motorcycles to their drivers. Influencers and industry experts are also playing a role in promoting the adoption of motorcycle ADAS systems. In conclusion, the motorcycle ADAS market represents a significant growth opportunity In the global automotive industry. The market is driven by various factors, including consumer preferences, regulatory requirements, and technological advancements.

Despite challenges, companies are investing in research and development to bring innovative products to market and differentiate themselves from competitors. The future of motorcycle ADAS looks bright, with continued growth expected In the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

152 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 9.59% |

|

Market growth 2024-2028 |

USD 799.3 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

8.05 |

|

Key countries |

US, China, India, Canada, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorcycle Advanced Driver Assistance System Market Research and Growth Report?

- CAGR of the Motorcycle Advanced Driver Assistance System industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorcycle advanced driver assistance system market growth of industry companies

We can help! Our analysts can customize this motorcycle advanced driver assistance system market research report to meet your requirements.