Motorcycle Apparel Market Size 2024-2028

The motorcycle apparel market size is forecast to increase by USD 4.39 billion at a CAGR of 6.73% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing preference for customized and personalized clothing among riders. This trend is driven by the desire for comfort, safety, and style during recreational riding and bike racing competitions. The emergence of smart helmets with integrated technology such as Bluetooth connectivity and GPS tracking is another key trend shaping the market. Technology applications in motorcycle apparel, such as reflective strips and airbag systems, further enhance rider safety. However, challenges such as chronic health issues related to long-term exposure to harsh weather conditions and fluctuating raw material prices pose a threat to market growth. To cater to the evolving needs of consumers, both store-based and non-store-based retailers are focusing on offering a wide range of motorcycle clothing options. Incorporating smart technology into motorcycle apparel is also a growing trend, providing riders with enhanced safety and convenience features. To stay competitive, market players must continuously innovate and offer high-quality, functional, and stylish motorcycle clothing to meet the demands of consumers.

What will be the Size of the Market During the Forecast Period?

- The market is a significant segment within the larger personal transportation industry. This market caters to the demand for protective clothing and accessories designed specifically for motorcycle riders. Motorcycle safety is a critical concern, given the potential risks associated with riding, including traffic accidents, spinal injuries, and chronic health issues. Safety is a primary driver of demand in the market. Motorcycle jackets and shoes, made from advanced materials, provide essential protection against impact and abrasion.

- The tourism industry also plays a significant role in the market. Affluent tourists, particularly those who enjoy premium motorcycles, seek high-quality riding gear and accessories to complement their bikes. Iconic bike brands and bike racing events further fuel demand for motorcycle protective products. The supply chain for motorcycle apparel involves various stakeholders, including manufacturers, distributors, retailers, and consumers. Luxury brands dominate the market, offering a wide range of stylish and functional motorcycle apparel and accessories. Social media platforms have become essential marketing tools for these brands, enabling them to reach a global audience and engage with customers. The market is not limited to jackets and shoes. It also includes a diverse range of accessories, such as helmets, gloves, and protective pants. High-capacity performance bikes and motorcycles for personal transportation further expand the market's potential. Road safety is a key consideration for motorcycle riders and manufacturers alike. Motorcycle protective products are designed to minimize the risk of injury in the event of an accident. The use of advanced materials and technology in motorcycle apparel contributes to overall road safety, making it an essential investment for motorcycle enthusiasts.

How is this market segmented and which is the largest segment?

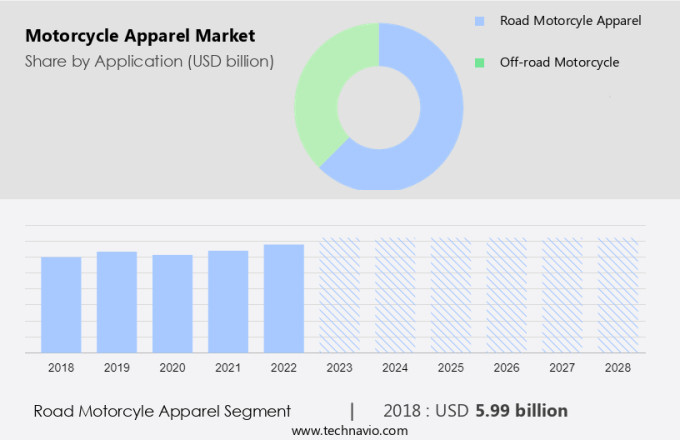

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Road motorcyle apparel

- Off-road motorcycle

- Distribution Channel

- Offline

- Online

- Geography

- North America

- US

- Europe

- Germany

- Italy

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Application Insights

- The road motorcyle apparel segment is estimated to witness significant growth during the forecast period.

The market encompasses a range of protective clothing, including full-body suits, jackets, jerseys, pants, socks, and vests. The demand for motorcycle apparel is particularly high in North America and Europe, where the tourism industry attracts affluent tourists who enjoy riding bikes and prioritize their safety. In Europe, mandatory regulations on protective motorcycle gear usage in various countries have contributed to the market's growth. However, the market in developing regions like South America and MEA is expected to expand due to the increasing awareness of rider safety. Motorcycle apparel, especially professional or luxury brands, is popular among riders who make motorcycling a career and participate in competitions such as MotoGP.

Furthermore, the supply chain for motorcycle apparel involves various stakeholders, including manufacturers, distributors, retailers, and consumers. These stakeholders work together to ensure the timely delivery of high-quality riding gear and accessories to meet the growing demand.

Get a glance at the market report of share of various segments Request Free Sample

The Road motorcyle apparel segment was valued at USD 5.99 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

In the North American market, the United States is a significant player in the motorcycle apparel sector. Canada and Mexico are also key contributors to this industry in the region. Motorcycle apparel is popular among individuals who choose motorcycles for various reasons, including commuting, recreational rides, and motorcycle sports. The increasing disposable income in North America is boosting household final consumption, thereby enhancing the purchasing power of the population. This trend is expected to fuel the demand for motorcycles and related equipment, including motorcycle apparel. Mexico has gained prominence as a manufacturing hub for motorcycle manufacturers, which could further influence the growth of the market in the region.

With safety being a top priority for motorcycle riders, the demand for protective riding gears is also on the rise. Motorcycle apparel not only ensures safety but also adds to the rider's style and comfort during long rides. The growing popularity of motorcycles as a mode of transportation and the increasing traffic congestion in urban areas are additional factors driving the demand for motorcycle apparel in North America.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Apparel Market?

Increasing demand for customized and personalized motorcycle apparel is the key driver of the market.

- The market is experiencing significant growth due to the rising demand for customized and personalized clothing items among motorcyclists. This trend reflects a shift in consumer preferences towards unique and expressive riding gear. Motorcyclists value the ability to customize designs, colors, and features to align with their individual style and identity. Motorcycle apparel is no longer just viewed as a safety necessity but also as a form of self-expression and personal branding. Riders use personalized jackets, helmets, shoes, and gloves to convey their individuality and affiliations within the motorcycle community. This cultural shift towards customization and rejection of one-size-fits-all solutions is driving the demand for motorcycle apparel as a means of exclusivity and connection.

- Safety remains a crucial consideration in the market, with an increasing focus on protective gear that offers both functionality and style. Spinal injuries and traffic accidents continue to be major concerns for motorcyclists, making the need for high-quality, protective gear a priority. The market is expected to continue growing as consumers seek out distinctive and personalized riding gear that meets their safety needs while allowing them to express their unique style and identity.

What are the market trends shaping the Motorcycle Apparel Market?

The emergence of airbag jackets is the upcoming trend in the market.

- The market is witnessing a significant shift with the introduction of Original Equipment Manufacturer (OEM) airbag jackets. These innovative jackets feature integrated airbag systems, which are triggered by sensors that detect sudden deceleration or acceleration. This development signifies a pivotal change from conventional protective clothing, underscoring the industry's commitment to enhancing rider safety.

- Airbag jackets are designed to deploy instantaneously upon impact, safeguarding crucial areas such as the chest, back, and neck. For example, these jackets are engineered with electrical systems that wirelessly connect to the motorcycle and activate the airbag in the event of an imminent collision. The airbag jacket's rapid deployment significantly reduces the impact force on the rider, ensuring their safety during a crash.

What challenges does Motorcycle Apparel Market face during the growth?

Fluctuations in raw material prices of motorcycle apparel is a key challenge affecting the market growth.

- The market encompasses a range of clothing designed for various motorbike riding activities, including recreational riding and bike racing competitions. Motorcycle clothing, such as suits, knee guards, elbow guards, and boots, are essential for ensuring rider safety during these activities. Leather remains a popular choice for protective motorbike suits due to its durability and ability to absorb impact. However, technological advances in materials have led to an increasing demand for synthetic leather riding suits, which offer comparable safety features at lower prices and lighter weights. The cost of raw materials for motorcycle apparel, including leather and synthetic leather, can be volatile due to fluctuations in petroleum prices and additional expenses for transportation and supplier services.

- The ability to secure consistent and timely delivery of raw materials is crucial for motorcycle apparel manufacturers to meet consumer demand. Smart technology is also revolutionizing the motorcycle apparel industry with the development of smart helmets. These helmets incorporate advanced features such as Bluetooth connectivity, built-in speakers, and GPS tracking, providing riders with enhanced safety and convenience. Both store-based and non-store-based retailers are capitalizing on this trend, offering a wide range of motorcycle apparel options to cater to the diverse needs of riders. The market is expected to continue growing as more riders prioritize safety and comfort in their riding gear.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AGV Sports Group Inc.

- Alpinestars

- Dainese Spa

- Dragon Rider

- Dunhams Sports

- Eicher Motors Ltd.

- FLY Racing

- Fox

- HKM Sports Equipment GmbH

- Khivraj Motors

- KIDO Sports Co. Ltd.

- KUSHITANI Co. Ltd.

- LeMans Corporation

- Polaris Inc.

- Rynox Gear

- SULLIVANS Inc.

- Vega Auto Accessories Pvt. Ltd.

- Venom Moto

- Zeus Motor Cycle Gear

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is witnessing significant growth due to the increasing demand for protective clothing as motorcycle riding gains popularity as a personal transportation and recreational activity. Motorcycle accidents can lead to severe injuries, including spinal injuries and chronic health issues, making safety a top priority for riders. Technology applications in motorcycle apparel, such as smart helmets with advanced safety features, are driving innovation in the market. Tourism and the affluent tourist segment are key contributors to the demand for motorcycle apparel, with premium brands catering to this market. Bikes, whether iconic or high-capacity performance models, require appropriate riding gear and accessories to ensure safety and comfort.

Furthermore, motorcycle manufacturers and original equipment manufacturers (OEMs) are integrating safety equipment into their offerings, further boosting the market. The motorcycle industry's shift towards fuel efficiency and lighter bikes has also influenced the market, with riders seeking lightweight, high-performance protective clothing. Social media platforms have become essential marketing channels for motorcycle apparel brands, enabling them to reach a wider audience and engage with customers. The market for motorcycle protective products, including jackets, shoes, gloves, and helmets, is expected to continue its growth trajectory in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

159 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.73% |

|

Market Growth 2024-2028 |

USD 4.39 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.24 |

|

Key countries |

US, China, India, Italy, and Germany |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch