Airbag Systems Market Size 2024-2028

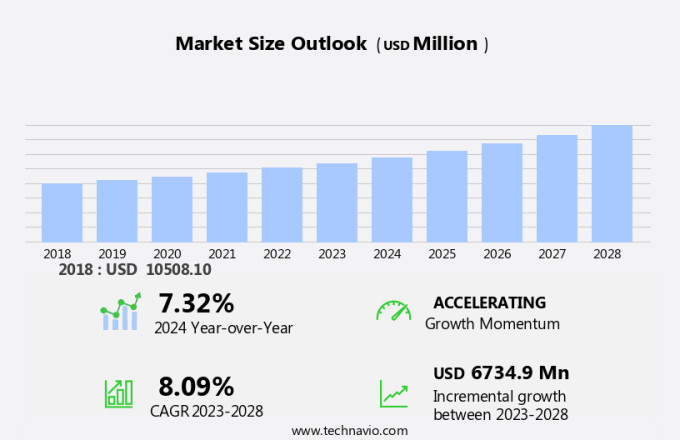

The airbag systems market size is forecast to increase by USD 6.73 billion at a CAGR of 8.09% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing emphasis on vehicle safety and advancements in technology. Key Safety Systems, a leading player in the market, is driving innovation through technological breakthroughs in airbag design and manufacturing. These include energy-absorbing surfaces, advanced sensors, and improved deployment systems. The vehicle occupant-restraint system market is expected to grow due to the failure of traditional airbag systems and the need for more advanced safety features.

- Collaborations mergers and acquisitions in the automotive industry are also contributing to the market's expansion. In particular, the development of airbags for steering wheels and device panels is gaining traction as manufacturers seek to provide comprehensive protection for vehicle occupants in the event of a collision. This trend is expected to continue as consumer demand for enhanced safety features grows.

Airbag Systems Market Analysis

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Passenger cars

- Commercial vehicles

- Type

- Front airbag

- Knee airbag

- Side airbag

- Curtain airbag

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- Japan

- South America

- Middle East and Africa

- North America

By Application Insights

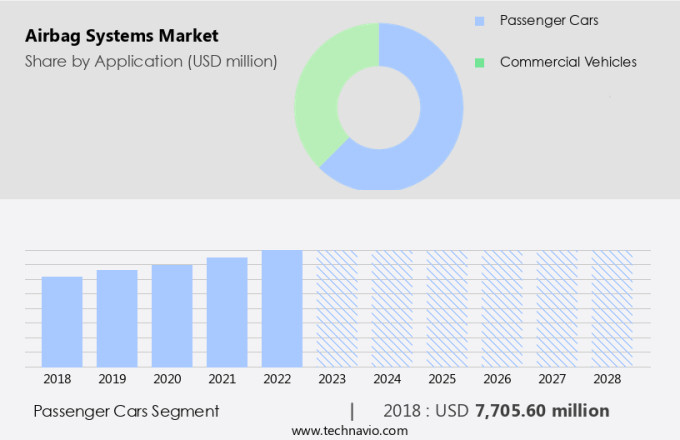

The passenger cars segment is estimated to witness significant growth during the forecast period. The market is experiencing significant growth due to the increasing prioritization of vehicle safety. Governments' safety regulations and consumer preferences for secure automobiles are driving this trend. Advanced safety features, such as airbag sensors, are being integrated into vehicles to enhance passenger protection during accidents. Side-curtain, knee, and exterior airbags are gaining popularity in the passenger car segment, significantly contributing to market expansion. The airbag system comprises various components, including body pillars, headliners, windshields, crash sensors, electronic controller units, igniting circuits, and airbag modules. These components work in unison to ensure passenger safety in the event of a collision.

Get a glance at the market share of various segments Request Free Sample

The passenger cars segment was valued at USD 7.71 billion in 2018 and showed a gradual increase during the forecast period.

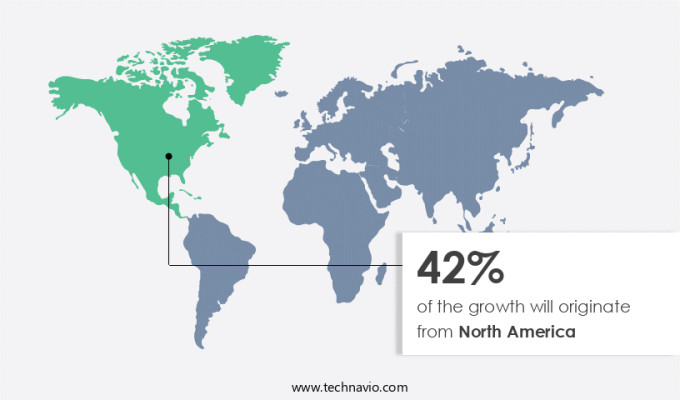

Will North America become the largest contributor to the Airbag Systems Market?

North America is estimated to contribute 42% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The North American market is projected to lead the global industry in 2023, with continued expansion during the forecast period. Additionally, stringent vehicle safety regulations are pushing the market forward. In Mexico, automobile production is experiencing significant growth, particularly in the central states of Aguascalientes and Guanajuato, where production costs are lower. US-based automakers are increasingly establishing manufacturing facilities in Mexico to reduce overall costs. Pyrotechnic devices, a crucial component of airbag systems, are subject to standardization issues due to varying environmental conditions.

Additionally, in the context of passenger vehicles, compact cars and luxury sedans are significant market segments. The increasing demand for safety features in vehicles, especially in North America, is expected to boost the market. These companies are investing in research and development to improve the performance and efficiency of their products.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Dynamics

- The market is a significant component of the automotive industry, playing a crucial role in vehicle production activities. These systems are integral to the vehicle occupant-restraint system, designed to protect passengers during collisions. However, the market faces various challenges, primarily due to disrupted supply chains and stringent safety standards. Vehicle sales have been on a steady rise, leading to an increased demand for airbag systems.

- Further, regulations and regulatory bodies, such as the NHTSA, have imposed stringent safety requirements to minimize these numbers. Automobile manufacturers and auto-component makers have responded by investing in advanced airbag technologies. These systems include side-curtain airbags, side-torso airbags, and various sensors and electronic controller units. These components are integrated into various parts of a vehicle, such as the steering wheel, device panel, body pillar, headliner, windshield, and crash sensors. The production of airbag modules involves intricate processes, including igniting circuits and energy-absorbing surfaces. These processes require low-cost skilled labor and efficient production plants to maintain profitability. However, the disrupted supply chain due to various factors, including the COVID-19 pandemic, has posed challenges to the market.

- Additionally, airbag systems consist of various components, including crash sensors, electronic controller units, and airbag modules. These components work in unison to detect collisions and deploy the airbags effectively. The airbags themselves are designed to absorb the impact of a collision, protecting the seat occupant from injury. In conclusion, the market plays a vital role in ensuring passenger safety in vehicles. Despite the challenges posed by disrupted supply chains and stringent safety standards, automobile manufacturers and auto component makers continue to invest in advanced airbag technologies to meet the growing demand for safer vehicles. The market is expected to grow, driven by the increasing focus on vehicle safety and the rising number of road accidents.

What are the key market drivers leading to the rise in adoption of Airbag Systems Market ?

The increased vehicle safety is the key driver of the market.

- Every year, over a million people suffer from road accidents resulting in injuries or fatalities. To mitigate this issue, vehicle production activities integrate safety systems, including airbags, into vehicles. Airbags are installed in various parts of a car, such as doors, instrument panels, and steering wheels, to protect passengers from injuries during collisions.

- Also, the curtain airbags, in particular, detect impacts and transmit signals to the Electronic Control Unit (ECU). Upon sensing an accident, the ECU deploys the airbag, preventing or reducing injuries. With stringent safety standards set by regulatory bodies, vehicle sales increasingly feature airbags as a mandatory safety feature. These regulations ensure that production plants adhere to safety guidelines, ultimately saving lives.

What are the trends shaping the Airbag Systems Market?

The M&A and partnerships in automotive airbag and its component markets is the upcoming trend in the market.

- The global automotive airbag market is experiencing significant changes due to strategic activities such as acquisitions among key players. These transactions are enhancing the brand image and technological capabilities of the companies involved. In the competitive automotive industry, firms are continually seeking ways to bolster their market position.

- Partnerships are also gaining traction in focus markets as a means of collaboration and innovation. This merger is expected to bring about technological breakthroughs and improved product offerings. Similarly, the collaboration between companies can lead to advancements in the vehicle occupant-restraint system, such as energy-absorbing surfaces integrated into the steering wheel and device panel.

What challenges does Airbag Systems Market face during the growth?

- The failure of airbag systems is a key challenge affecting the market growth. Airbags are essential safety features in vehicles, designed to shield drivers and passengers during collisions. However, malfunctions can occur, leading to unexpected deployments or failure to deploy when necessary. The proximity of occupants to deploying airbags can result in injuries, ranging from minor lacerations to severe ones, such as broken noses. Front airbags have demonstrated significant success in saving countless lives each year. Yet, there are instances where airbags may inflict harm instead. The causes of airbag-related injuries can stem from various factors, including improper deployment or the occupant's position at the time of deployment.

- However, manufacturers, including OEMs, invest in producing different types of airbags, such as driver airbags, passenger-side airbags, curtain airbags, and even pedestrian airbags, to enhance vehicle safety. Despite the importance of airbags, recalls have been issued due to defects in their manufacturing process, which may involve low-cost labor or steel production. To mitigate risks and ensure the effectiveness of airbags, it is crucial for manufacturers to maintain the highest production standards and rigorously test their products. By doing so, they can minimize the occurrence of malfunctions and provide safer vehicles for consumers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Hyundai Motor Co.- The company offers airbag systems such as Hyundai Mobis Roof airbags.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Airbag Systems Inc.

- Ashimori Industry Co. Ltd.

- Autoliv Inc.

- Continental AG

- Daicel Corp.

- DENSO Corp.

- Helite Sarl

- HELLA GmbH and Co. KGaA

- Joyson Safety Systems Aschaffenburg GmbH

- Kolon Industries Inc.

- Naugra Machines India

- Nihon Plast Co. Ltd.

- Rane Holdings Ltd.

- Robert Bosch GmbH

- Toray Industries Inc.

- Toyoda Gosei Co. Ltd.

- Weng fatt Spare Parts Pvt. Ltd.

- Yanfeng International Automotive Technology Co. Ltd.

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Airbag systems have become an essential component in vehicle safety, with their implementation becoming a necessity in production activities due to stringent safety standards. The disrupted supply chain in the automotive industry has not deterred the growth of this market, as the demand for airbags remains high in response to increasing road accidents and regulations from regulatory bodies. The market for airbag systems caters to various types, including driver airbags, passenger-side airbags, curtain airbags, and pedestrian airbags. OEMs are continually innovating, with technological breakthroughs leading to the development of multi-stage airbags and advanced safety features. Key safety systems, such as vehicle occupant-restraint systems, are designed to protect the seat occupant in the event of a collision.

In summary, the energy-absorbing surface of airbags, which can be found on the steering wheel, device panel, body pillar, headliner, windshield, and door panel, is critical in minimizing injuries during a crash. Crash sensors, electronic controller units, igniting circuits, and airbag modules are essential components of these systems. Side-curtain airbags and side-torso airbags protect the pelvic and lower abdomen areas of passengers. The environmental impact of pyrotechnic devices used in airbags is a concern, but advancements in sensor technologies are addressing this issue. The market for airbag systems is diverse, catering to passenger vehicles, compact cars, and luxury sedans, with production costs and vehicle architectures influencing design and placement. Standardization issues and compliance with safety regulations are ongoing challenges for the market, but the focus on vehicle safety, including electric vehicles, ensures its continued growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

170 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 6.73 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 42% |

|

Key countries |

US, China, Germany, Canada, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Airbag Systems Inc., Ashimori Industry Co. Ltd., Autoliv Inc., Continental AG, Daicel Corp., DENSO Corp., Helite Sarl, HELLA GmbH and Co. KGaA, Hyundai Motor Co., Joyson Safety Systems Aschaffenburg GmbH, Kolon Industries Inc., Naugra Machines India, Nihon Plast Co. Ltd., Rane Holdings Ltd., Robert Bosch GmbH, Toray Industries Inc., Toyoda Gosei Co. Ltd., Weng fatt Spare Parts Pvt. Ltd., Yanfeng International Automotive Technology Co. Ltd., and ZF Friedrichshafen AG |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch