Speakers Market Size 2024-2028

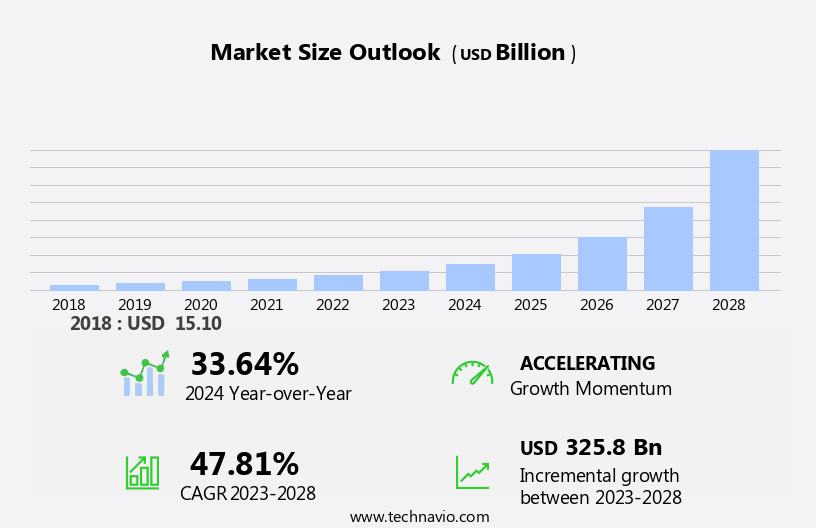

The speakers market size is forecast to increase by USD 325.8 billion at a CAGR of 47.81% between 2023 and 2028.

- The market is experiencing significant growth, driven primarily by the increasing adoption of smart speakers. These devices, which integrate voice recognition technology and offer a range of functionalities from playing music and setting alarms to controlling home automation systems, have gained immense popularity among consumers. As a result, companies operating in this space must prioritize transparency and security to build trust with their customers and mitigate any negative impact on their reputation. Additionally, the market is witnessing the rise of multi-room streaming speakers, which allow users to play music or other audio content in multiple rooms simultaneously. This trend is expected to drive innovation and competition in the market, creating opportunities for companies to differentiate themselves through unique features and value propositions. Companies seeking to capitalize on these opportunities must stay abreast of market trends and consumer preferences, while also addressing privacy concerns and ensuring the security of their offerings.

What will be the Size of the Speakers Market during the forecast period?

- The market encompasses a diverse range of devices that convert electrical signals into sound waves, catering to various applications in home entertainment, public address systems, telecommunications, and the professional speaker market. Speakers function as transducers, vibrating to produce audible sound. This market includes traditional wired and modern wireless-based audio devices, such as home theater systems, multi-room streaming speakers, headphones, sound bars, microphones, and even smartphones and tablets. The pro-av industry leverages advanced audio technology for communication purposes in sporting events, stadiums, and professional settings.

- Analog and digital mediums coexist, with the latter gaining traction due to its flexibility and versatility. Cabling solutions continue to evolve alongside these advancements, ensuring seamless connectivity. The market's growth is driven by the increasing demand for high-quality audio experiences across various industries and applications.

How is this Speakers Industry segmented?

The speakers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Stereo speakers

- Smart speakers

- Technology

- Wireless speakers

- Wired speakers

- Geography

- APAC

- China

- Japan

- North America

- US

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- APAC

By Product Insights

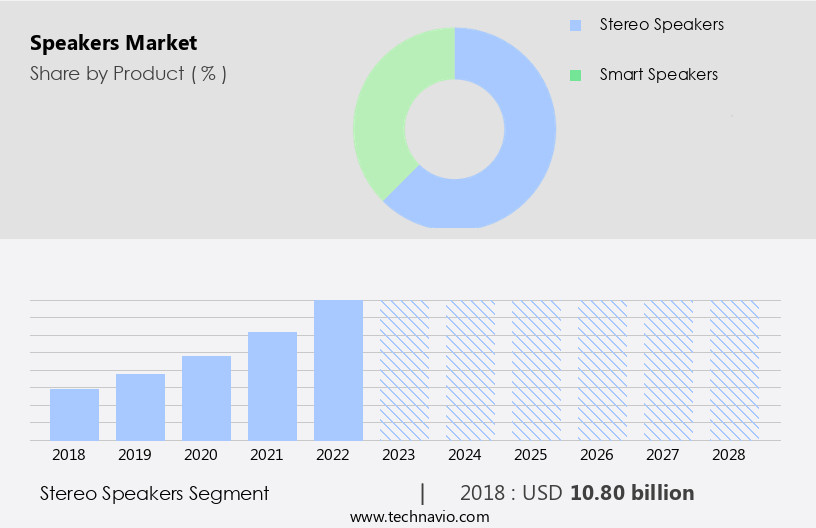

The stereo speakers segment is estimated to witness significant growth during the forecast period. A stereo speaker is a device comprised of two speakers integrated into a single system, each designed to reproduce a specific channel of stereo sound. The speakers are typically positioned left and right, creating a stereo effect. Stereo speakers may consist of multiple drivers and connections to accommodate both sides of a stereo audio signal, with each side reinforced by separate amplifiers. This technology is utilized in various applications, including home entertainment systems, public address systems, telecommunications, and multi-room streaming speakers.

Get a glance at the market report of share of various segments Request Free Sample

The stereo speakers segment was valued at USD 10.80 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

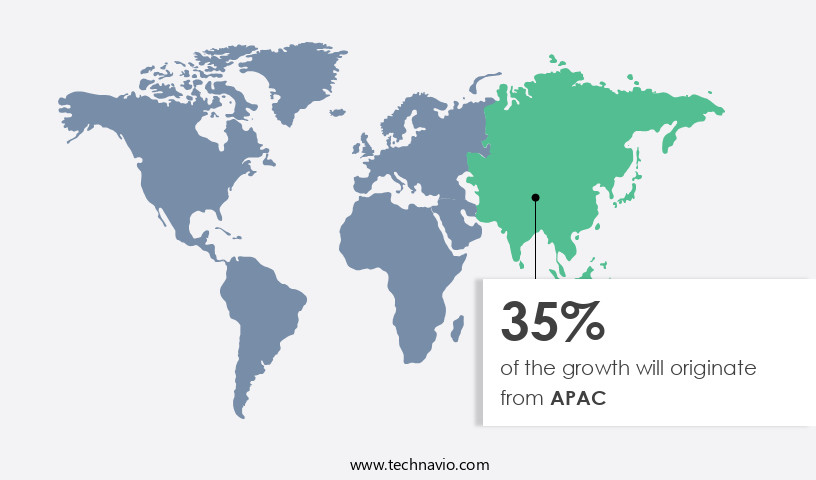

APAC is estimated to contribute 35% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in APAC is experiencing growth due to the expansion of communication infrastructure, including high-speed networks. End-user purchasing power is rising in countries like India and China, potentially driving demand for new technologies such as smart homes. The concept of smart homes is still in its infancy in APAC but is anticipated to gain traction during the forecast period. Integration of voice assistant technology with speakers will fuel the adoption of smart speakers and home automation devices. Leading companies, such as Amazon.Com and Xiaomi, are introducing innovative products with added features, like voice assistants, to boost speaker adoption.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Speakers Industry?

- Increasing adoption of smart speakers is the key driver of the market. Smart speakers have become essential devices in modern homes, enabling users to control various connected functionalities through voice commands. Equipped with advanced smart assistants, these devices offer features such as weather updates, news, meeting reminders, security alerts, and appliance notifications. The increasing demand for these conveniences has driven companies to introduce new products in the market.

- Smart speakers provide users with a hands-free experience, making them an integral part of home automation and the broader concept of smart homes. The smart assistants integrated into these devices are designed to understand and execute voice commands, enhancing user experience and convenience. This trend is expected to continue, as more users embrace the benefits of voice-controlled devices.

What are the market trends shaping the Speakers Industry?

- Popularity of multi-room streaming speakers is the upcoming market trend. Multi-room streaming speakers have gained significant traction in the market due to their ability to enhance the convenience of accessing music devices. Equipped with Wi-Fi connectivity, these speakers enable users to stream music from one speaker to another, creating a seamless audio experience. Networked audio devices eliminate the need for multiple wired connections, reducing efforts, expenses, and time.

- Technologies such as PlayFi, Bluetooth, Wi-Fi, and AirPlay facilitate the transmission of multiple channels over a single network. The increasing popularity of installing multiple speakers in a single residence is driving the adoption of multi-room streaming speakers. These devices require a master speaker for connection and can be added wirelessly to other speakers, offering users the flexibility to create a customized audio setup.

What challenges does the Speakers Industry face during its growth?

- Privacy concerns associated with smart speakers is a key challenge affecting the industry growth. The market faces challenges due to privacy concerns surrounding smart speakers. These devices, connected to Wi-Fi access points, are susceptible to cyber threats, potentially exposing users' personal information. Smart speakers record and send voice data to communication servers for processing.

- A faulty activation button could result in unwanted recordings and transmission. Hackers can breach the firewall protecting smart speakers, gaining access to users' passwords and smartphones. These privacy issues may hinder market growth. Thus, the misinterpretation of background conversations as voice commands by smart speakers can hamper the privacy of users and their vulnerability to hacking. Such incidents are expected to hinder the growth of the global speakers market during the forecast period.

Exclusive Customer Landscape

The speakers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the speakers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, speakers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AAC Technologies Holdings Ltd.

- Alphabet Inc.

- Altec Lansing Inc.

- Amazon.com Inc.

- Apple Inc.

- Bose Corp.

- Bowers and Wilkins

- Fortune Grand Technology Inc.

- Foster Electric Co. Ltd.

- Guangzhou Merry Audio Equipment Co. Ltd.

- Koninklijke Philips N.V.

- Lenovo Group Ltd.

- LG Electronics Inc.

- Panasonic Holdings Corp.

- Pioneer India Electronics Pvt. Ltd.

- Premier Sound Solutions

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Xiaomi Communications Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a diverse range of devices designed to convert electrical signals into sound waves. These transducers, which include home entertainment speakers, public address systems, telecommunications equipment, and multi-room streaming speakers, all function by vibrating to produce sound. The market for speakers is characterized by continuous innovation and development, driven by advancements in sound technology and consumer demand for wireless capabilities and smart integrations. Speakers are essential components in various applications, from home use for entertainment and ambiance to commercial settings for communication purposes. In recent years, the proliferation of smart home technologies and voice assistants has presented a revenue augmenting opportunity for manufacturers.

In addition, these devices offer features such as weather updates, security alerts, and appliance notifications, making them indispensable in modern living. The market is experiencing an unstable market dynamics due to the digital trend and the shift from physical music revenue to online streaming platforms. Music industry giants and independent artists alike have embraced digital mediums, leading to a increase in music production and recording using digital equipment such as sound mixers, audio signal processors, and audio power amplifiers. The pro-av industry, which includes cabling solutions, sporting events, and pro speakers used in stadiums and arenas, is a significant contributor to the market.

Furthermore, the demand for high-quality sound reinforcement equipment and video conferencing systems continues to grow, fueled by the need for effective communication and collaboration in various industries. The availability of raw materials and digital trends influence the market. For instance, the music industry's shift towards online streaming platforms has led to a decline in physical music revenue. However, this trend has also opened up new opportunities for innovation in wireless-based audio devices such as smart speakers, portable Bluetooth speakers, and headphones. The market is diverse, with various types of speakers catering to different needs and applications. These include stationary speakers for home use and portable speakers for on-the-go entertainment.

Moreover, the market also includes car speakers, pocket speakers, outdoor Bluetooth speakers, and conventional speakers. The environmental impact of speakers and other electronic waste is a growing concern among environmentally conscious consumers. Manufacturers are responding to this trend by producing eco-friendly speakers made from sustainable materials and designing devices with rechargeable batteries, such as lithium polymer batteries. The market includes various types of speakers catering to different applications and needs, from home entertainment to professional use. The market's future growth is influenced by digital trends, raw materials availability, and consumer spending power.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 47.81% |

|

Market growth 2024-2028 |

USD 325.8 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

33.64 |

|

Key countries |

China, US, Japan, Germany, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Speakers Market Research and Growth Report?

- CAGR of the Speakers industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the speakers market growth of industry companies

We can help! Our analysts can customize this speakers market research report to meet your requirements.