Motorcycle Instrument Cluster Market Size 2024-2028

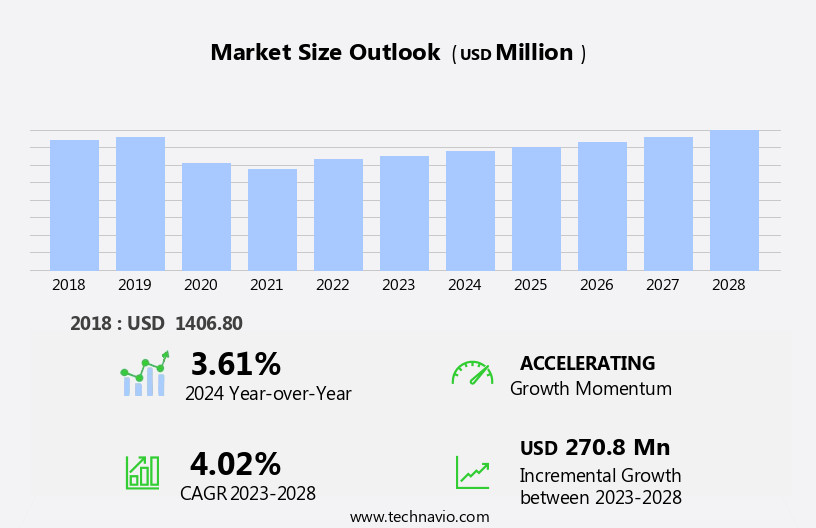

The motorcycle instrument cluster market size is forecast to increase by USD 270.8 million at a CAGR of 4.02% between 2023 and 2028.

- The market is experiencing significant growth, driven by economies of scale resulting from the declining prices of LCD and TFT displays. This cost reduction enables manufacturers to offer advanced digital instrument clusters at more affordable prices, making them increasingly popular among motorcycle buyers. Additionally, multilayer displays are enabling further developments in digital instrument clusters, offering enhanced functionality and customization options. However, the market faces a challenge in the form of the unpopularity of instrument clusters among some motorcycle enthusiasts who prefer traditional analog gauges.

- This preference may limit the market's growth potential, requiring manufacturers to balance innovation with consumer preferences to effectively capitalize on market opportunities and navigate challenges.

What will be the Size of the Motorcycle Instrument Cluster Market during the forecast period?

- The market continues to evolve, integrating advanced technologies that enhance the riding experience. Manufacturers are incorporating sensors for engine temperature and crash warning systems, transforming traditional motorbikes into connected motorcycles. LCD and touchscreen displays with high resolution and full color TFT technology are becoming standard, offering riders real-time information and personalized features. Electric motorcycle technology allows for smartphone apps, Bluetooth, Wi-Fi, and GPS navigation, enabling commuters to stay connected while on the go. Mid-premium and premium bike makers are focusing on ergonomic designs, state-of-the-art technology, and safety features, including adaptive cruise control and indicators. Digital instrument panels with OEM integration are gaining popularity, offering riders a more immersive experience.

- Fun to ride elements, such as tachometers, speedometers, fuel gauges, and odometers, are seamlessly integrated into these advanced dashboard-type devices. Electric motorcycles and hybrid instrument clusters are also emerging, reflecting the industry's commitment to innovation. Bike construction and comfort are also key considerations, with bike makers focusing on battery voltage indicators and screen malars to ensure optimal performance and rider experience. The market's continuous dynamism is driven by evolving consumer preferences, price sensitivity, and the ongoing development of automotive electronics. The future of motorcycle instrumentation promises a more connected, personalized, and safer riding experience.

How is this Motorcycle Instrument Cluster Industry segmented?

The motorcycle instrument cluster industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Automotive

- Construction and mining

- Others

- Type

- Hybrid

- Digital

- Analog

- Vehicle Types

- Commuter Bikes

- Sports Bikes

- Touring Bikes

- Product Feature

- Speedometer

- Fuel Gauge

- Connectivity

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

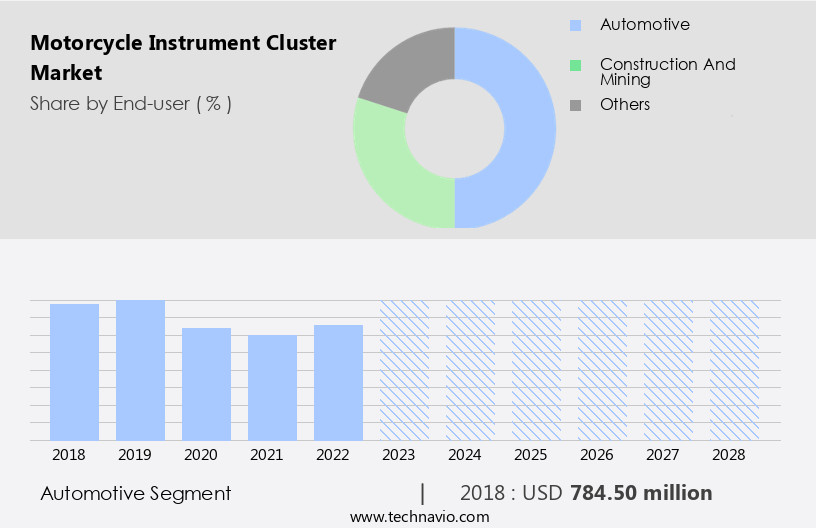

By End-user Insights

The automotive segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the automotive sector's increasing demand for advanced technologies. Manufacturers are responding by integrating sophisticated features such as GPS navigation, smartphone connectivity, and diagnostics into motorcycle instrument clusters. Yamaha and BMW Motorrad are among the leaders in this field, offering user-friendly and cutting-edge clusters. Riders are reaping the benefits of enhanced safety features, seamless communication, and real-time information. Additionally, stringent government regulations, including Bharat Stage VI norms in India and Euro 5 emission standards in Europe, are driving the adoption of advanced instrument clusters to meet emission requirements.

These clusters are not limited to premium motorcycles but are also being incorporated into commuter motorcycles to cater to a wider audience. The market is witnessing a shift towards high-resolution TFT displays, touchscreens, and personalized features, making the riding experience more enjoyable and fun. The integration of safety technologies like crash warning systems and adaptive cruise control further enhances the value proposition of these clusters. Motorcycle production volumes are on the rise, fueling the demand for instrument clusters. The market is also witnessing the emergence of connected motorcycle technology, enabling features like Wi-Fi and smartphone apps, and ergonomic designs to improve the overall riding experience.

The Automotive segment was valued at USD 784.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 69% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in APAC is driven by the demand for motorcycles in China and India, which are the largest markets for these vehicles. Motorcycles, particularly commuter and mid-segment models, are popular in growing economies due to their affordability, ease of maintenance, convenience, and small parking requirements. Motorcycles with engine displacements under 250 cc dominate this market. Motorcycle instrument clusters in APAC incorporate advanced features such as TFT displays, CPUs, full color graphics, sensors for temperature, engine temperature, and fuel level, as well as connectivity functions for phone calls, GPS navigation, and Bluetooth. Manufacturers offer personalized features through digital instrument panels and smartphone apps.

Safety technologies, such as crash warning systems and adaptive cruise control, are also integrated into these high-tech instrument panels. Ergonomic designs and state-of-the-art display technology enhance the riding experience. Electric motorcycles and hybrid instrument clusters are emerging trends in this market. Motorcycle production volumes are high in China, India, and Japan, making them significant contributors to the market. Price sensitivity remains a factor, but the premium segment is also growing as motorcyclists seek more comfort and advanced features in their bikes.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Motorcycle Instrument Cluster Industry?

- The significant cost savings from the decreasing prices of LCD/TFT displays serve as the primary driver for the market's growth.

- In the realm of motorcycle instrument clusters, price sensitivity is a significant factor for Original Equipment Manufacturers (OEMs) in the automotive and two-wheeler industries. The adoption of new technology in consumer electronics, such as displays, can drive down costs and benefit related industries. For instance, the cost reduction of LCD panels, initially popularized by smartphones, has enabled suppliers to offer more affordable prices for these components. This cost decrease translates to a less expensive human-machine interface (HMI) system for OEMs.

- Moreover, advanced technologies like graphics, haptics, and speech recognition, prevalent in smartphones, are incorporated into both display- and non-display-based HMI systems. Consequently, OEMs can integrate these technologies into their motorcycle instrument clusters in a cost-effective manner, enhancing comfort, connectivity, and safety features for the motorcyclist. Display technology, such as TFT, plays a crucial role in these high-tech instrument panels, offering ergonomic designs and safety technologies like GPS navigation.

What are the market trends shaping the Motorcycle Instrument Cluster Industry?

- The trend in the automotive industry is toward multilayer displays, which are expected to drive advancements in digital instrument clusters. These innovative displays offer significant potential for future developments.

- The motorbike instrument cluster market is experiencing significant growth due to the increasing demand for advanced features in two-wheeler vehicles. companies are integrating TFT displays, CPUs, and sensors to create more informative and interactive clusters. Full color displays are becoming the norm, offering higher resolution and improved readability. Moreover, the integration of features such as adaptive cruise control, navigation, phone calls, and GPS is driving the market. Commuter motorbikes are increasingly adopting these features to enhance the riding experience. Mid-Premium motorbikes are leading the way in this regard, as customers seek more connectivity and convenience.

- The latest trend in the market is the adoption of 3D graphics interfaces. These interfaces provide a more precise and engaging view of the cluster information. companies are focusing on creating realistic 3D graphics to enhance customer satisfaction. The multilayer display technology is a recent innovation, offering a 3D graphics experience without the need for glasses or complicated eye-tracking or detection. By layering two high-fidelity digital displays, this technology creates a sense of depth and depth perception.

What challenges does the Motorcycle Instrument Cluster Industry face during its growth?

- The unpopularity among motorcycle enthusiasts of instrument clusters, a key feature in modern motorcycles, poses a significant challenge to the industry's growth. This trend, which is increasingly influencing consumer preferences, necessitates a reevaluation of the industry's approach to motorcycle design and technology.

- Motorcycle instrument clusters have evolved significantly, integrating advanced technologies to enhance the riding experience. While some riders embrace these innovations, others value the traditional motorcycling essence. Engine temperature and crash warning systems are essential features that have become standard in modern motorcycle instrument clusters. Connected Motorcycle technology, including touchscreens and LCD displays, offers riders personalized features and connectivity functions. Digital instrument panels, with their crisp graphics and RPM readings, provide valuable real-time information. Manufacturers continue to invest in these technologies to cater to the growing demand for a fun and engaging riding experience.

- Advanced instrument clusters offer a multitude of benefits, including improved safety, convenience, and performance. However, some riders prefer the simplicity of analog gauges, arguing that they maintain the pure riding experience. Regardless, the market for motorcycle instrument clusters is expected to grow, driven by technological advancements and the evolving preferences of motorcycle enthusiasts.

Exclusive Customer Landscape

The motorcycle instrument cluster market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle instrument cluster market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, motorcycle instrument cluster market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bosch Limited (Germany)

- Continental AG (Germany)

- Visteon Corporation (United States)

- Nippon Seiki Co., Ltd. (Japan)

- Denso Corporation (Japan)

- Pricol Limited (India)

- Magneti Marelli S.p.A. (Italy)

- Yamaha Motor Co., Ltd. (Japan)

- Honda Motor Co., Ltd. (Japan)

- Suzuki Motor Corporation (Japan)

- Bajaj Auto Ltd. (India)

- Hero MotoCorp Ltd. (India)

- TVS Motor Company Ltd. (India)

- Harley-Davidson Inc. (United States)

- Kawasaki Heavy Industries Ltd. (Japan)

- Robert Bosch GmbH (Germany)

- Delphi Technologies (United Kingdom)

- Texas Instruments Inc. (United States)

- Mikuni Corporation (Japan)

- Keihin Corporation (Japan)

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motorcycle Instrument Cluster Market

- In February 2023, Bosch, a leading global technology company, announced the launch of its new Motorcycle Instrument Cluster, featuring an advanced Multi-Function Instrument with a 12.3-inch TFT display. This innovative product offers customizable layouts and real-time connectivity, enhancing the riding experience for motorcycle enthusiasts (Bosch press release).

- In October 2024, Magneti Marelli, an automotive technology company, entered into a strategic partnership with Harley-Davidson to develop and supply advanced instrument clusters for their motorcycles. This collaboration is expected to bring cutting-edge technology to Harley-Davidson's motorcycles, positioning them competitively in the market (Harley-Davidson press release).

- In March 2025, Continental AG, a prominent automotive supplier, completed the acquisition of VDO, a leading provider of instrument clusters and driver assistance systems. This acquisition will enable Continental to expand its product portfolio and strengthen its position in the market (Continental AG press release).

- In August 2025, the European Union announced the approval of new regulations for motorcycle instrument clusters, mandating the inclusion of advanced safety features such as lane departure warnings, forward collision warnings, and tire pressure monitoring systems. This regulatory push is expected to drive market growth and innovation in the motorcycle instrument cluster sector (European Union press release).

Research Analyst Overview

The market encompasses various features designed to enhance the riding experience for motorcyclists. Fuel level and engine temperature are essential analog gauges, while bike makers increasingly integrate touchscreen displays and digital ones offering personalized features, such as odometer readings, GPS navigation, and battery voltage indicators. High-tech instrument panels incorporate connectivity options like Bluetooth and GPS, enabling real-time data access. Motorcycle production volumes continue to rise, fueling the demand for advanced instrument clusters.

Motorcyclists appreciate the convenience of digital speedometers, tachometers, temperature gauges, and RPM indicators, all integrated into dashboard-type devices. These high-tech advancements contribute to the evolving landscape of the motorcycle industry.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motorcycle Instrument Cluster Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

180 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.02% |

|

Market growth 2024-2028 |

USD 270.8 million |

|

Market structure |

Concentrated |

|

YoY growth 2023-2024(%) |

3.61 |

|

Key countries |

US, China, Japan, Germany, France, Spain, Canada, India, South Korea, France, Japan, Italy, Brazil, UAE, UK, Spain, Rest of World (ROW), and Mexico |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Motorcycle Instrument Cluster Market Research and Growth Report?

- CAGR of the Motorcycle Instrument Cluster industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the motorcycle instrument cluster market growth of industry companies

We can help! Our analysts can customize this motorcycle instrument cluster market research report to meet your requirements.