Consumer Electronics Market Size 2025-2029

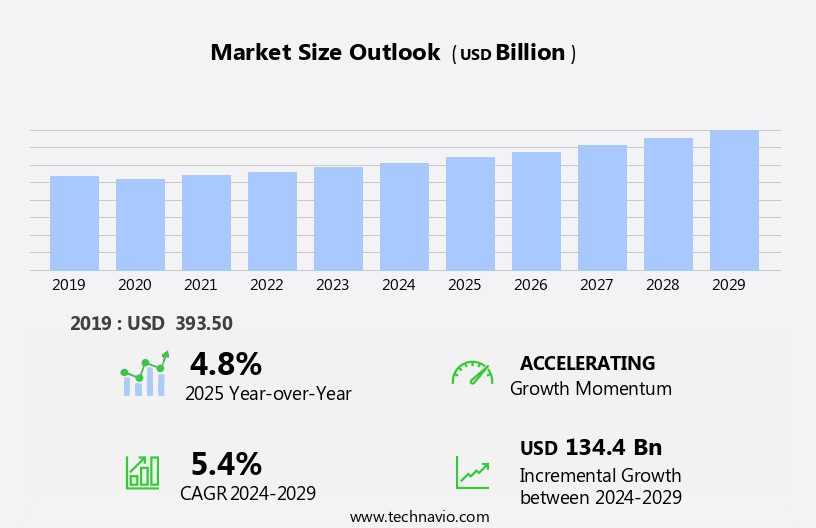

The consumer electronics market size is forecast to increase by USD 134.4 billion, at a CAGR of 5.4% between 2024 and 2029.

- The market is characterized by frequent product launches, driven by technological advancements and evolving consumer preferences. The rapid growth of the e-commerce industry significantly influences market dynamics, providing a vast platform for companies to reach a broader customer base. However, the long product lifecycle of major appliances poses a challenge, as consumers increasingly prefer upgrading to the latest technology only when necessary. Companies must navigate this obstacle by offering value-added services, extended warranties, or financing options to incentivize purchases. To capitalize on market opportunities, businesses should focus on innovation, competitive pricing, and effective marketing strategies to attract and retain customers.

- Additionally, collaboration with e-commerce platforms and strategic partnerships can help expand market reach and enhance customer engagement. Overall, the market presents significant growth potential, with companies that effectively address challenges and leverage trends poised for success.

What will be the Size of the Consumer Electronics Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The market continues to evolve, driven by advancements in technology and shifting consumer preferences. Energy efficiency standards are increasingly important, with manufacturers integrating 5G networks and implementing biometric authentication to enhance security and user experience. Product lifecycle management is a critical aspect of the industry, as companies strive to optimize supply chain operations and improve Li-ion battery capacity. For instance, a leading smartphone manufacturer reported a 30% increase in sales following the release of a new model with extended battery life and improved energy efficiency. The market is projected to grow by 5% annually, fueled by the integration of emerging technologies such as OLED display technology, AI-powered image processing, and cloud computing platforms.

- Semiconductor manufacturing and software development kits are essential components of the industry, enabling the development of advanced features like voice recognition software, haptic feedback systems, and high-definition video. Consumer electronics repair and electronic waste recycling are also gaining importance, as companies focus on enhancing product durability and reducing environmental impact. Moreover, the integration of nanotechnology, virtual reality headsets, and augmented reality glasses is revolutionizing various sectors, from healthcare to education and entertainment. Power management ICs and digital signal processing are essential for optimizing energy consumption and improving app performance metrics. Machine learning algorithms and 3D printing applications are transforming user interface design and manufacturing processes, respectively.

- In conclusion, the market is characterized by continuous innovation and evolving patterns. From energy efficiency standards to 5G network integration, biometric authentication, and advanced technologies like AI-powered image processing and virtual reality headsets, the industry is poised for significant growth and transformation.

How is this Consumer Electronics Industry segmented?

The consumer electronics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Personal

- Professional

- Distribution Channel

- Offline

- Online

- End-user

- Residential

- Commercial

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

By Application Insights

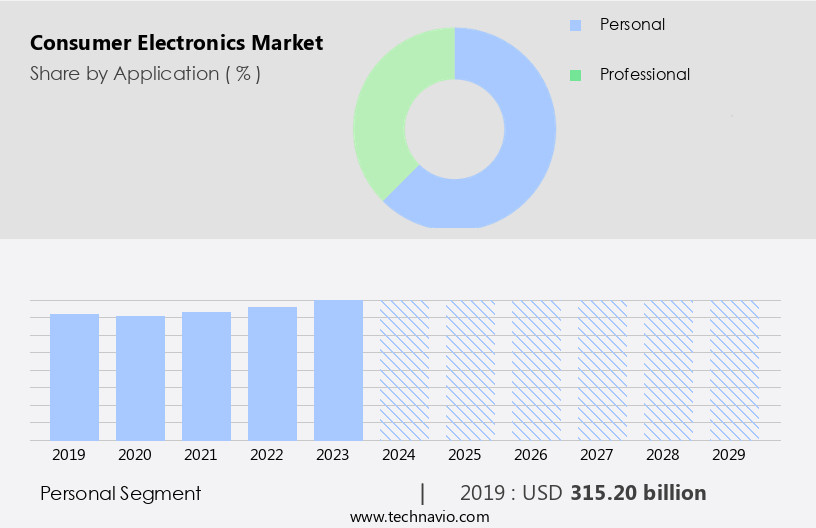

The personal segment is estimated to witness significant growth during the forecast period.

The market is experiencing significant growth due to the increasing adoption of advanced technologies in non-commercial products. Energy efficiency standards and 5G network integration are key focus areas for manufacturers, ensuring sustainable and faster connectivity. Biometric authentication and product lifecycle management enhance security and streamline production processes. Data encryption protocols and supply chain optimization ensure data privacy and efficient supply chains. Li-ion battery capacity advancements enable longer usage times, while smart home automation and electronic waste recycling promote energy savings and environmental sustainability. Power management ICs and wearable sensor technology offer improved functionality and user experience. Customer experience ratings and software development kits facilitate customized applications and seamless integration.

OLED display technology and cloud computing platforms provide high-definition visuals and remote access to data. Semiconductor manufacturing innovations and AI-powered image processing enable faster and more accurate processing. User interface design and product durability testing ensure user-friendly and long-lasting devices. High-fidelity audio codecs and app performance metrics cater to the growing demand for immersive entertainment experiences. Consumer electronics repair and material science innovations promote sustainability and cost savings. The market is expected to grow at a rate of 5% annually, driven by the integration of emerging technologies like high-definition video, virtual reality headsets, nanotechnology, voice recognition software, haptic feedback systems, wireless charging standards, augmented reality glasses, digital signal processing, machine learning algorithms, and 3D printing applications.

For instance, the implementation of AI-powered image processing in smartphones has resulted in a 25% increase in sales. These advancements underscore the harmonious blend of technology and consumer needs in the evolving consumer electronics landscape.

The Personal segment was valued at USD 315.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

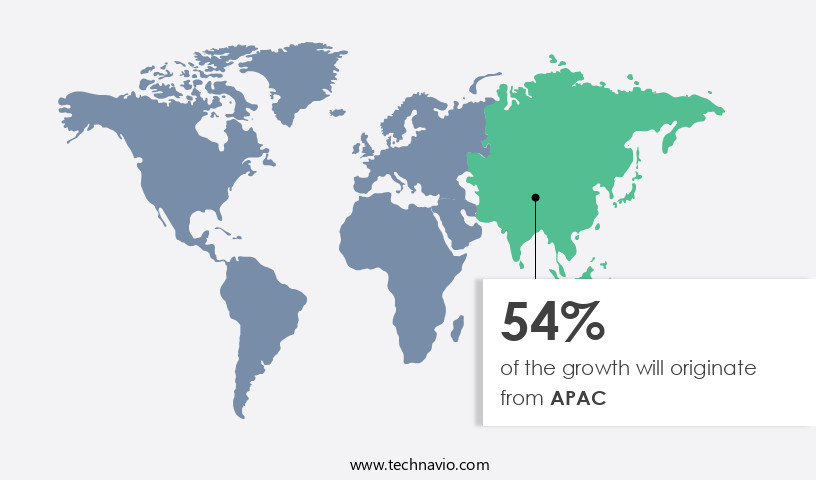

APAC is estimated to contribute 54% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How consumer electronics market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant shifts, driven by the adoption and advancement of innovative technologies. With countries like India and China contributing substantially to sales, the demand for devices such as smartphones is projected to rise as Internet penetration expands in these markets. China currently holds the title of the world's leading market for smartphone users, followed closely by India. The region is poised to become a major player in the consumer electronics industry. Companies in APAC are focusing on introducing new products and diverse product lines to broaden their customer base and market share.

Energy efficiency standards are increasingly influencing product design, with 5G network integration becoming a priority for connectivity. Biometric authentication offers enhanced security, while product lifecycle management ensures efficient manufacturing processes. Data encryption protocols protect consumer privacy, and supply chain optimization streamlines logistics. Li-ion battery capacity continues to improve, powering the rise of smart home automation and wearable sensor technology. Customer experience ratings are a key focus, with software development kits and user interface design essential for creating seamless user experiences. OLED display technology offers high-definition visuals, while cloud computing platforms enable remote access and storage. Semiconductor manufacturing advances, enabling the integration of AI-powered image processing and machine learning algorithms.

Product durability testing and high-fidelity audio codecs ensure superior quality, while app performance metrics and consumer electronics repair services cater to the evolving needs of tech-savvy consumers. Material science innovations, high-definition video, virtual reality headsets, nanotechnology integration, voice recognition software, haptic feedback systems, wireless charging standards, augmented reality glasses, digital signal processing, and 3D printing applications are all shaping the future of the consumer electronics landscape. According to recent studies, The market is projected to grow by approximately 6% annually, underscoring the immense potential for growth and innovation in this dynamic industry. For instance, the sales of smartphones in APAC are expected to increase by over 10% in the next year, highlighting the region's significant impact on the market.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is experiencing rapid growth as advanced technologies continue to redefine the way we live, work, and connect. One key trend driving this market is the integration of advanced driver-assistance systems (ADAS) into consumer electronics, enhancing safety and convenience in vehicles. High-resolution image sensor performance is another crucial factor, enabling superior image and video quality in devices. Power efficiency is a major consideration in mobile processor designs, ensuring longer battery life and reducing the environmental impact of electronic waste. Wireless connectivity protocol compliance is essential for seamless integration with other devices and networks. User interface usability testing methods are increasingly important, as consumers demand intuitive and user-friendly designs. Extended reality headset design considerations, including ergonomics and weight, are also critical for mass adoption. Sustainable manufacturing practices and electronic waste management strategies are becoming non-negotiable for companies seeking to minimize their environmental footprint. Artificial intelligence (AI) is powering personalized user experiences, while robust software development methodologies ensure reliability and security. Energy harvesting technologies for wearables and predictive maintenance for consumer electronics are emerging trends, offering cost savings and increased efficiency. Advanced battery management systems and secure cloud storage solutions for mobile data are also essential components of modern consumer electronics. Improved audio processing for noise reduction and efficient power management in portable devices are important features for consumers. Reliable components and innovative designs using nanotechnology are also key differentiators in a crowded market. Ergonomic product design for optimal usability is a must-have for companies seeking to stand out. Effective software update delivery mechanisms ensure that devices remain up-to-date and secure, providing a competitive edge in the market. Overall, the market is a dynamic and evolving landscape, requiring continuous innovation and adaptation to meet the changing needs of consumers.

What are the key market drivers leading to the rise in the adoption of Consumer Electronics Industry?

- The consistent introduction of new products serves as the primary catalyst for market growth.

- The market experiences robust expansion due to continuous product innovation and frequent launches by market participants. In January 2023, Samsung and Apple, among other industry leaders, unveiled new offerings. Samsung introduced the Bespoke Infinite Line Refrigerator, available in refrigerator, freezer, or wine cellar models, with a modern and timeless design. Simultaneously, Apple presented the MacBook Pro with M2 Pro and M2 Max, delivering up to 6 times faster performance than the fastest Intel-based MacBook Pro and supporting up to 96 GB of unified memory.

- According to market research, the consumer electronics industry is projected to grow by 7% in 2023, demonstrating the significant demand and potential for continued growth in this sector.

What are the market trends shaping the Consumer Electronics Industry?

- The e-commerce industry, characterized by its rapid growth, represents the latest market trend.

- The market in the US has witnessed substantial growth due to the increasing reliance on online sales by businesses and the growing preference for online shopping among consumers. This trend is expected to continue, with industry analysts projecting a 12% increase in sales for consumer electronics through e-commerce channels by 2023. With the convenience of shopping from home and access to a vast selection of products across various categories, price points, and brands, online platforms have become a go-to destination for consumers. Major e-retailers, such as Amazon.Com, JD.Com, and Alibaba Group, have capitalized on this trend by offering extensive consumer electronics inventories.

- This dynamic market presents significant opportunities for businesses to expand their customer base and enhance their market presence.

What challenges does the Consumer Electronics Industry face during its growth?

- The prolonged product lifecycle of major appliances poses a significant challenge to the growth of the industry. This issue arises due to the durability and longevity of appliances, which can limit the market for new purchases and hinder the industry's expansion.

- Consumer electronics, including appliances like refrigerators, air conditioners, and washing machines, are known for their branded reliability and durability. These appliances are now made primarily of stainless steel and hard metals, which not only enhance their aesthetic appeal but also extend their replacement cycles. Appliances that come into contact with water, such as refrigerators and washing machines, are particularly susceptible to rusting. To mitigate this risk, manufacturers use stainless steel or high-grade plastic materials, making these appliances both lightweight and long-lasting.

- Companies invest significantly in research and development to innovate and create durable materials, thereby increasing the operational life of appliances. For instance, a leading appliance manufacturer reported a 15% increase in sales due to the introduction of a new, rust-resistant refrigerator model. The market is expected to grow by over 10% annually, driven by advancements in technology and consumer demand for longer-lasting appliances.

Exclusive Customer Landscape

The consumer electronics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the consumer electronics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, consumer electronics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Apple Inc. - The Apple company provides two MacBook Pro models, available in 14-inch and 16-inch sizes. These devices are optimized for uninterrupted playback of Apple TV apps and movies, offering up to 20 hours of battery life.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apple Inc.

- Canon Inc.

- Dell Technologies Inc.

- Emerson Electric Co.

- FRIGIDAIRE

- Fujitsu Ltd.

- Godrej and Boyce Manufacturing Co. Ltd.

- Guangdong OPPO Mobile Telecommunications Corp. Ltd.

- Haier Smart Home Co. Ltd.

- Hisense International Co. Ltd.

- HP Inc.

- Huawei Technologies Co. Ltd.

- Koninklijke Philips NV

- Lenovo Group Ltd.

- LG Corp.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Samsung Electronics Co. Ltd.

- Sony Group Corp.

- Whirlpool Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Consumer Electronics Market

- In January 2024, Samsung Electronics announced the launch of its groundbreaking foldable smartphone, Galaxy Z Flip3, at the Consumer Electronics Show (CES) in Las Vegas. This innovative device, featuring a foldable form factor and advanced hinge technology, marked a significant step forward in the smartphone industry (Samsung Press Release, 2024).

- In March 2024, Apple and Google joined forces to collaborate on a new project aimed at developing advanced voice recognition technology for consumer electronics. This strategic partnership was expected to lead to improved voice assistant capabilities and more seamless integration between devices (Google Press Release, 2024).

- In May 2024, Sony Corporation completed the acquisition of a leading semiconductor manufacturer, Renesas Electronics, for approximately USD 35 billion. This merger was expected to strengthen Sony's position in the market by providing access to advanced semiconductor technology and manufacturing capabilities (Sony Press Release, 2024).

- In April 2025, the European Union introduced new regulations regarding the energy efficiency of consumer electronics. The new regulations, set to take effect in 2026, would require electronic devices to meet stringent energy efficiency standards, aiming to reduce carbon emissions and promote sustainable consumer electronics (European Commission Press Release, 2025).

Research Analyst Overview

- The market for consumer electronics continues to evolve, driven by advancements in technology and shifting consumer preferences. Component miniaturization and antenna design principles enable the creation of smaller, more efficient devices. Health monitoring sensors and ultra-high definition displays are increasingly integrated into various sectors, from fitness wearables to gaming consoles. Electronic component sourcing and integrated circuit design are crucial aspects of this dynamic industry, with power consumption analysis and touchscreen responsiveness key considerations. Software updates deployment, near-field communication, and circuit board design facilitate seamless user experiences. Facial recognition systems, processor architecture, and material selection criteria contribute to enhanced security and sustainability.

- The immersive audio experience, mobile application development, computer vision algorithms, and product reliability studies further enrich consumer electronics. Industry growth is expected to reach 5% annually, with innovations in quantum dot technology, fast charging circuits, manufacturing automation, smart appliance control, network security measures, user satisfaction surveys, flexible screen displays, signal processing techniques, and natural language processing shaping the future landscape. For instance, a leading smartphone manufacturer reported a 30% increase in sales due to the implementation of a new, power-efficient processor architecture.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Consumer Electronics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

218 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 5.4% |

|

Market growth 2025-2029 |

USD 134.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.8 |

|

Key countries |

US, China, Japan, India, UK, Germany, South Korea, Italy, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Consumer Electronics Market Research and Growth Report?

- CAGR of the Consumer Electronics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the consumer electronics market growth of industry companies

We can help! Our analysts can customize this consumer electronics market research report to meet your requirements.