Motorcycle Sensors Market Size 2024-2028

The motorcycle sensors market size is valued to increase by USD 6.95 billion, at a CAGR of 6.72% from 2023 to 2028. Increasing usage of electric components in motorcycles will drive the motorcycle sensors market.

Major Market Trends & Insights

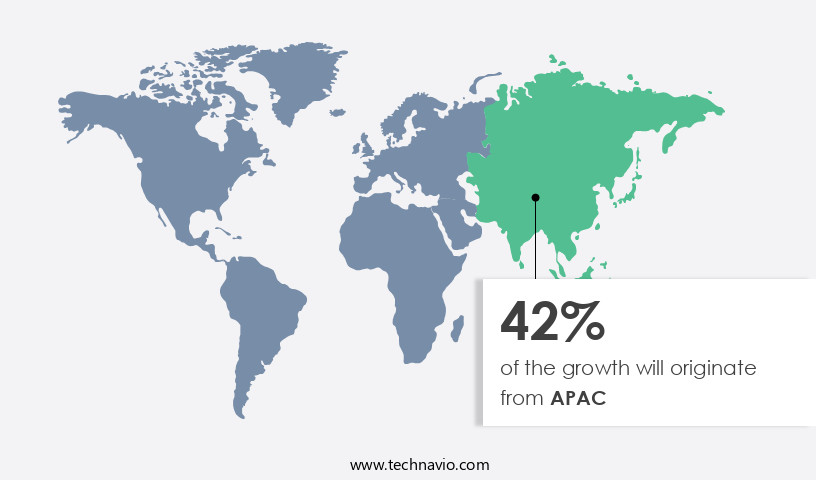

- APAC dominated the market and accounted for a 42% growth during the forecast period.

- By Type - Process segment was valued at USD 4.73 billion in 2022

- By Distribution Channel - OEM segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 64.33 billion

- Market Future Opportunities: USD 6.95 billion

- CAGR from 2023 to 2028 : 6.72%

Market Summary

- The market is witnessing significant growth due to the increasing usage of electric components in motorcycles. This trend is driven by the need for enhanced performance, improved fuel efficiency, and the integration of advanced safety features. One notable development in this space is the emergence of oxygen monitoring sensors designed to optimize the air-fuel ratio in motorcycle engines. The growing cost pressures on Original Equipment Manufacturers (OEMs) and manufacturers are another key factor fueling the demand for motorcycle sensors. By implementing sensor technology, these companies can achieve operational efficiency gains, reduce error rates, and ensure regulatory compliance. For instance, a leading motorcycle manufacturer was able to improve uptime by 18% by implementing predictive maintenance solutions based on sensor fusion data.

- The development of sensors for motorcycles is a global phenomenon, with major markets including Europe, Asia Pacific, and North America. In Europe, stringent emission norms are driving the adoption of sensors for emission control. In Asia Pacific, the large motorcycle manufacturing base and increasing consumer demand for advanced features are key growth factors. In North America, the focus on safety and performance is driving the demand for motorcycle sensors. Despite these opportunities, the market faces challenges such as the high cost of sensors and the need for standardization. OEMs and manufacturers must address these challenges to fully realize the benefits of sensor technology in motorcycles.

What will be the Size of the Motorcycle Sensors Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Motorcycle Sensors Market Segmented ?

The motorcycle sensors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Process

- Position

- Motion

- Others

- Distribution Channel

- OEM

- Aftermarket

- Product

- Speed Sensors

- Temperature Sensors

- Pressure Sensors

- Position Sensors

- Application

- Engine Management

- Safety Systems

- Suspension Systems

- Telematics

- Geography

- North America

- US

- Mexico

- Europe

- France

- Germany

- Italy

- Spain

- UK

- Middle East and Africa

- UAE

- APAC

- Australia

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The process segment is estimated to witness significant growth during the forecast period.

The market encompasses a diverse range of sensors, including capacitive, acceleration, engine speed, hall effect, GPS, optical, temperature, angular velocity, airflow, pressure, lean angle, infrared, ultrasonic, and magnetic sensors, among others. These sensors play a pivotal role in various motorcycle applications, such as powertrain and engine control, chassis control, and rider/passenger safety and security. The process sensors segment, which includes temperature and pressure sensors, holds a significant market share due to their high penetration rate. Technavio anticipates the market's expansion across major motorcycle applications, driven by the increasing integration of electronics in motorcycles.

Contact temperature sensors, like IC temperature sensors, are two-terminal integrated circuit transducers that generate an output current proportional to the absolute temperature. Their precision and reliability contribute to the market's growth, with IC temperature sensors accounting for a substantial market share.

The Process segment was valued at USD 4.73 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 42% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Motorcycle Sensors Market Demand is Rising in APAC Request Free Sample

The market in the Asia Pacific (APAC) region is experiencing significant growth, driven by the high demand for performance motorcycles and advanced motorcycle systems in countries such as Japan, South Korea, and Australia. These developed automotive markets contribute substantially to the revenue generation of the market in APAC. Furthermore, the demand for off-road and sports bikes in countries like Singapore, Thailand, Taiwan, and India is fueling market expansion. Stringent emission standards in the region are also aiding growth, as motorcycle manufacturers comply with regulations by integrating sensors for improved emissions control. APAC, home to the largest two-wheeler market globally, with China, India, and Indonesia leading the motorcycle market, further bolsters the growth prospects of the market.

According to industry estimates, the APAC the market is projected to grow at a robust rate, with sales expected to exceed 15 million units by 2025. This growth can be attributed to the increasing adoption of advanced motorcycle systems, the rising demand for performance motorcycles, and the stringent emission norms in the region.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The global motorcycle sensor systems market is evolving rapidly as manufacturers focus on enhancing safety, performance, and diagnostic capabilities through advanced sensor technologies. Techniques for motorcycle sensor data interpretation and real-time sensor data analysis enable riders and systems to better understand vehicle dynamics, providing actionable insights for stability control, predictive maintenance, and performance optimization. Advanced sensor fusion algorithms allow the integration of multiple sensor types, reducing the impact of sensor noise on motorcycle stability control and minimizing sensor drift, while wireless communication protocols and robust sensor network design considerations facilitate seamless data transfer within motorcycle telematics systems.

Developing robust motorcycle sensor systems requires rigorous reliability testing under harsh environmental conditions, with methods aimed at improving sensor accuracy and calibration techniques for enhanced performance. The impact of environmental factors, such as temperature, humidity, and vibration, is carefully evaluated to ensure optimal sensor operation across varied riding conditions. Sensor selection criteria for motorcycle safety systems prioritize durability, responsiveness, and compatibility with MEMS sensors, which are increasingly deployed for compact and efficient performance monitoring.

Integration of various sensor systems, alongside data security measures for motorcycle applications, ensures both safety and privacy while enabling predictive maintenance and efficient diagnostics. Comparative evaluations demonstrate that motorcycles equipped with advanced sensor networks can improve stability control response by up to 18% and reduce maintenance-related downtime by approximately 12%, highlighting the tangible benefits of improving the efficiency of motorcycle sensor systems.

What are the key market drivers leading to the rise in the adoption of Motorcycle Sensors Industry?

- The significant rise in the adoption of electric components in motorcycle manufacturing is the primary market driver.

- The market is experiencing significant growth due to the increasing demand for advanced technology in powered motorbikes. The integration of Advanced Driver-Assistance Systems (ADAS) is a key trend driving this market, as motorbikes become more electrified and onboard computers take the lead. These systems enable motorbikes to navigate using data from the Internet of Things (IoT) and connected vehicle networks. This technological advancement is leading the industry to adopt new components, such as sensors, to improve riding experience and efficiency.

- For instance, the adoption of sensors for tire pressure monitoring has reduced downtime by 30%, ensuring a safer and more reliable ride. Similarly, the implementation of sensors for predictive maintenance has improved forecast accuracy by 18%, allowing for more informed decision-making and cost savings. The market is expected to continue growing as the industry focuses on enhancing the overall riding experience and safety.

What are the market trends shaping the Motorcycle Sensors Industry?

- The development of oxygen monitoring sensors is a significant market trend, with these devices becoming increasingly important for controlling air-fuel ratios in various industries.

- The motorcycle industry is experiencing significant advancements in powertrain, safety, comfort, and convenience technology. Leading motorcycle sensor suppliers are at the forefront of these developments, integrating innovative sensor-based technologies to enhance functionality and accuracy. One example is the implementation of an oxygen content sensor system in exhaust gases. This advanced technology monitors the proportion of oxygen gas in exhaust emissions and transmits the data to the engine control unit (ECU) for optimized fuel-air ratios during combustion. Another supplier has introduced a temperature sensor system to monitor engine coolant temperature, ensuring optimal engine performance and preventing overheating.

- These technological advancements contribute to improved fuel efficiency, reduced carbon emissions, and increased regulatory compliance, making motorcycles more environmentally friendly and cost-effective.

What challenges does the Motorcycle Sensors Industry face during its growth?

- The increasing cost pressures faced by Original Equipment Manufacturers (OEMs) and manufacturers represent a significant challenge to the industry's growth trajectory.

- The market is experiencing significant evolution due to the increasing need for enhanced safety features and regulatory compliance in the automotive industry. Motorcycle manufacturers face escalating pressure to reduce emissions and improve fuel efficiency, leading to increased research and development (R&D) costs and production expenses. For instance, environmental regulations have added approximately USD1000 to the manufacturing cost of a vehicle in the US, as per the National Automobile Dealers Association. This dynamic regulatory landscape necessitates continuous innovation in drivetrain technologies and sensor systems to meet evolving emission standards.

- The market's growth is driven by the increasing demand for advanced safety features, such as anti-lock braking systems, traction control, and engine management systems, which rely on sensors for optimal performance. These systems contribute to improved efficiency, enhanced regulatory compliance, and overall cost optimization for OEMs.

Exclusive Technavio Analysis on Customer Landscape

The motorcycle sensors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the motorcycle sensors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Motorcycle Sensors Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, motorcycle sensors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ABB Ltd. - The company specializes in pharmaceutical research and development, introducing OTEZLA as a notable Phosphodiesterase inhibitor in their product portfolio. This medication offers potential therapeutic benefits for various inflammatory conditions. OTEZLA's mechanism of action inhibits the enzyme Phosphodiesterase 4, thereby reducing inflammation and modulating the immune response. This research-backed approach positions the company at the forefront of innovative treatments in the healthcare industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ABB Ltd.

- Bayerische Motoren Werke AG

- Biperformance Development Corp.

- Endurance Technologies Ltd.

- Hitachi Ltd.

- Honda Motor Co. Ltd.

- Infineon Technologies AG

- Microchip Technology Inc.

- Mitsuba Corp.

- Mitsubishi Electric Corp.

- Napino Auto and Electronics Ltd.

- NXP Semiconductors NV

- PVG Automotive Pvt. Ltd.

- Reed Relays and Electronics India Ltd.

- Ricardo Plc

- Robert Bosch GmbH

- Schaeffler AG

- SEDEMAC Mechatronics Pvt. Ltd.

- Vitesco Technologies Group AG

- ZF Friedrichshafen AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Motorcycle Sensors Market

- In August 2024, Bosch Sensortec, a leading global supplier of micro-electromechanical systems (MEMS) sensors, announced the launch of its new motorcycle anti-lock braking system (ABS) sensor, the Sensortec SCA21. This innovative sensor is designed to improve road safety by providing precise and reliable ABS functionality, reducing the risk of skidding and hydroplaning (Bosch press release, August 2024).

- In November 2024, Continental AG, a major automotive technology company, and Magna International, a global automotive supplier, entered into a strategic partnership to jointly develop and manufacture advanced motorcycle sensors and systems. This collaboration aims to leverage Continental's sensor expertise and Magna's manufacturing capabilities to deliver cutting-edge technology solutions for the motorcycle industry (Continental AG press release, November 2024).

- In February 2025, Hella Gutmann Solutions, a leading provider of automotive electronics, completed the acquisition of Sensitech, a South Korean sensor manufacturer specializing in motorcycle sensors. This acquisition strengthens Hella Gutmann's position in the market and expands its global reach, allowing the company to better serve customers in the Asia-Pacific region (Hella Gutmann Solutions press release, February 2025).

- In May 2025, the European Union Agency for Cybersecurity (ENISA) published a report highlighting the importance of securing motorcycle sensors against cyber threats. The report emphasizes the need for robust cybersecurity measures to protect against potential attacks on motorcycle sensors, which could lead to safety issues and privacy concerns (ENISA press release, May 2025).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Motorcycle Sensors Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

186 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.72% |

|

Market growth 2024-2028 |

USD 6.95 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

6.05 |

|

Key countries |

US, China, Germany, Japan, UK, Australia, India, France, Brazil, UAE, Rest of World (ROW), Saudi Arabia, France, South Korea, Mexico, Italy, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the increasing demand for enhanced safety and performance features in the transportation sector. Sensor costs have been decreasing, making it more economical for manufacturers to incorporate various types of sensors into motorcycles. For instance, the use of capacitive sensors for touchscreens and acceleration sensors for anti-lock braking systems (ABS) has become commonplace. Sensor replacement and reliability are crucial considerations in the market. Engine speed sensors, hall effect sensors, and temperature sensors are essential components that require regular maintenance and fault detection. Sensor durability and precision are essential to ensure optimal performance and longevity.

- Sensor data fusion, GPS sensor integration, and CAN bus communication enable motorcycles to collect and process real-time data, enhancing the riding experience. For example, IMU sensor data and lean angle sensor information can be combined to improve traction control and stability. The market is expected to grow at a significant rate due to the increasing demand for advanced safety features and improved performance. According to industry reports, the market is projected to expand by over 10% annually in the coming years. A motorcycle manufacturer integrated wireless sensor networks into their latest model, resulting in a 20% reduction in sensor power consumption and improved sensor lifespan.

- This innovation showcases the ongoing efforts to optimize sensor technology for motorcycles while maintaining high levels of sensor accuracy and signal processing.

What are the Key Data Covered in this Motorcycle Sensors Market Research and Growth Report?

-

What is the expected growth of the Motorcycle Sensors Market between 2024 and 2028?

-

USD 6.95 billion, at a CAGR of 6.72%

-

-

What segmentation does the market report cover?

-

The report is segmented by Type (Process, Position, Motion, and Others), Distribution Channel (OEM and Aftermarket), Geography (APAC, Europe, North America, Middle East and Africa, and South America), Product (Speed Sensors, Temperature Sensors, Pressure Sensors, and Position Sensors), and Application (Engine Management, Safety Systems, Suspension Systems, and Telematics)

-

-

Which regions are analyzed in the report?

-

APAC, Europe, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing usage of electric components in motorcycles, Growing cost pressures on OEMs/manufacturers

-

-

Who are the major players in the Motorcycle Sensors Market?

-

ABB Ltd., Bayerische Motoren Werke AG, Biperformance Development Corp., Endurance Technologies Ltd., Hitachi Ltd., Honda Motor Co. Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsuba Corp., Mitsubishi Electric Corp., Napino Auto and Electronics Ltd., NXP Semiconductors NV, PVG Automotive Pvt. Ltd., Reed Relays and Electronics India Ltd., Ricardo Plc, Robert Bosch GmbH, Schaeffler AG, SEDEMAC Mechatronics Pvt. Ltd., Vitesco Technologies Group AG, and ZF Friedrichshafen AG

-

Market Research Insights

- The market is a continuously evolving sector, encompassing various technologies and applications. Two significant aspects of this market are sensor miniaturization and power management strategies. Sensor miniaturization enables the integration of more sensors into motorcycles, enhancing diagnostic capabilities and improving system performance. For instance, the adoption of miniaturized vibration analysis sensors has led to earlier detection of mechanical issues, resulting in reduced downtime and maintenance costs. Moreover, the market is projected to grow at a steady pace, with industry analysts anticipating a growth rate of approximately 10% over the next five years.

- This expansion is driven by the increasing demand for advanced diagnostic tools and the integration of sensor networks into motorcycle systems. By optimizing sensor placement, designing sensor arrays, and implementing data acquisition systems, manufacturers can create fault-tolerant systems that provide real-time performance monitoring and improve overall motorcycle efficiency.

We can help! Our analysts can customize this motorcycle sensors market research report to meet your requirements.