Magneto Resistive RAM (MRAM) Market Size 2025-2029

The magneto resistive ram (mram) market size is forecast to increase by USD 2.55 billion at a CAGR of 37% between 2024 and 2029.

- The Magneto Resistive Random Access Memory (MRAM) market is experiencing significant growth due to its unique features, particularly its ultra-low power consumption, making it an attractive alternative to traditional volatile memory technologies. MRAM's integration into smartphones is a key trend driving market expansion, as manufacturers seek to address the memory density issue in their devices. However, the market is not without challenges. One significant hurdle is the high production costs associated with MRAM technology, which could limit its widespread adoption. Additionally, the market is still in its nascent stages, with a limited number of players and a relatively small addressable market size.

- Companies seeking to capitalize on this market opportunity must navigate these challenges by focusing on cost reduction strategies and collaborating with industry partners to drive technological advancements and expand the market's reach. Overall, the MRAM market presents a compelling investment opportunity for those willing to innovate and invest in the development of this promising technology.

What will be the Size of the Magneto Resistive RAM (MRAM) Market during the forecast period?

- The magnetoresistive random-access memory (MRAM) market is experiencing significant growth in various industries due to its energy efficiency and high performance. Low-power MRAM variants are gaining traction in enterprise storage applications, offering faster read and write speeds compared to traditional technologies like NAND and flash. In the automotive sector, MRAM is being explored for use in infotainment systems and advanced driver-assistance systems (ADAS), given its ability to retain data even without power. The Internet of Things (IoT) and 5G technologies are also driving demand for MRAM in edge computing and data processing applications. Beyond enterprise storage, MRAM is finding a place in dynamic random-access memory (DRAM) alternatives, such as spin-transfer torque MRAM and magnetic tunnel junction MRAM.

- These technologies are being adopted in aerospace, defense industries, robotics, workstations, and consumer electronics for high-temperature data storage and computing technologies. The industrial and commercial sectors are also embracing MRAM for smart robots, EEPROM replacements, and other applications requiring non-volatility and reliability. With the emergence of new technologies like toggle MRAM, the market is expected to expand further in the coming years. MRAM's potential use cases span across various industries, including computing technologies, aerospace, defense, and consumer electronics, making it an attractive alternative to traditional memory solutions.

How is this Magneto Resistive RAM (MRAM) Industry segmented?

The magneto resistive ram (mram) industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- End-user

- AAD

- Enterprise storage

- Consumer electronics

- Robotics

- Type

- STT MRAM

- T MRAM

- Geography

- APAC

- China

- India

- Japan

- South Korea

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- South America

- Middle East and Africa

- APAC

By End-user Insights

The aad segment is estimated to witness significant growth during the forecast period.

The Magneto Resistive Random Access Memory (MRAM) market encompasses various industries, including defense and automotive sectors. MRAM's adoption in defense systems is on the rise due to the increasing global tensions, leading to substantial growth in defense budgets. In the automotive sector, MRAM is utilized in engine control units, automotive powertrains, and in-car data logs. Furthermore, MRAM's integration in industrial systems, such as advanced sensors and monitoring temperature in laptops and smartphones, is expanding. Moreover, MRAM's non-volatility and tamper-resistant properties make it an attractive option for commercial systems and enterprise storage. The semiconductor technology behind MRAM is also being employed in next-generation sensors, medical devices, and robots.

MRAM's low power consumption and high memory capacity make it suitable for wearables, embedded magnetic RAM, and IoT applications. In the industrial IoT, MRAM is being used for mass producing consumer electronics, including televisions and computing technologies. MRAM's innovation extends to spin-transfer torque MRAM, which is used in advanced sensors, artificial intelligence chips, and virtualized storage solutions. MRAM's versatility is also evident in its application in extreme temperature conditions, such as in aerospace and defense, and in 5G technologies and low-power microcontrollers. MRAM's importance is further highlighted in military applications, where radiation-hardened microchips are essential. MRAM is also being used in automotive systems, such as engine control units and drones, and in cloud computing and virtualized desktop infrastructure.

MRAM's ability to write data quickly and efficiently makes it an ideal solution for various industries, including medical disorders, automotive systems, and industrial systems.

Get a glance at the market report of share of various segments Request Free Sample

The AAD segment was valued at USD 90.60 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

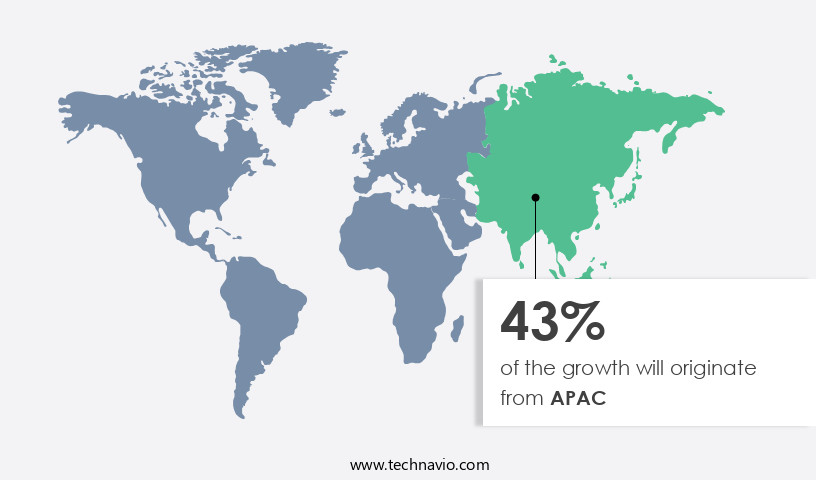

APAC is estimated to contribute 43% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The Magneto Resistive Random Access Memory (MRAM) market is witnessing significant growth, driven by its adoption in various sectors. In the industrial sector, MRAM's tamper-resistant and non-volatile properties make it an ideal solution for industrial IoT applications, advanced sensors, and automation technologies. In the automotive sector, MRAM is being integrated into engine control units, automotive systems, and in-car data logs for improved performance and reliability. Defense systems are also leveraging MRAM for military applications due to its resistance to extreme temperature conditions and high radiation. Enterprise Storage systems are another major market for MRAM, with its low power consumption and high memory capacity making it suitable for virtualized storage solutions and data centers.

The commercial sector, including consumer electronics, is also adopting MRAM for its low power requirements and fast write speeds, particularly in devices such as laptops, smartphones, and smart wearables. In the medical field, MRAM is being used in medical devices, robots, and assistive technologies for monitoring temperature and storing patient data. The aerospace and defense industry is also using MRAM in advanced transmission control systems, artificial intelligence chips, and radiation-hardened microchips. Moreover, MRAM is gaining popularity in the consumer electronics industry, with companies exploring the use of MRAM in gaming devices, multimedia systems, and virtualized desktop infrastructure.

The adoption of MRAM in the Internet of Things (IoT) is also expected to increase, particularly in the areas of in-memory computing and 5G technologies. MRAM is also being used in low-power microcontrollers and stand-alone designs for various applications, including drones, automobiles, and industrial systems. The market for MRAM is expected to grow further with the development of new variants, such as Spin-transfer Torque MRAM and Toggle MRAM. Overall, the MRAM market is experiencing significant growth due to its unique properties and wide range of applications across various industries. The increasing demand for advanced sensors, automation technologies, and low-power devices is expected to drive the market's growth in the coming years.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Magneto Resistive RAM (MRAM) Industry?

- Low-power consumption is the key driver of the market.

- MRAM technology, a type of non-volatile memory, offers several advantages over other memory technologies, making it an attractive option for various applications. Primarily used in battery-powered wireless sensors, MRAM consumes approximately half the power of other flash memories, thereby extending battery life significantly. This power-saving feature enables Original Equipment Manufacturers (OEMs) to integrate MRAM technology into their devices. Moreover, MRAM boasts faster access times and non-volatile data storage compared to SRAM, which retains data bits as long as power is supplied without the need for periodic refreshing.

- These unique features make MRAM a preferred choice for applications requiring high performance and low power consumption. By offering both advantages, MRAM technology sets itself apart from other RAMs.

What are the market trends shaping the Magneto Resistive RAM (MRAM) Industry?

- Integration of MRAM in the smartphone is the upcoming market trend.

- MRAM, or Magneto Resistive Random Access Memory, is a promising technology set to revolutionize the memory landscape in the coming years. This next-generation memory type offers several advantages that make it an attractive alternative to traditional memory technologies. In the forecast period, MRAM is expected to be integrated into various applications due to its unique features. Firstly, MRAM retains its data even when the power is removed, making it an ideal choice for ultra-low power applications. Secondly, MRAM offers a higher read-write speed compared to Flash and EEPROM. Moreover, MRAM data does not degrade over time, ensuring data integrity.

- These advantages make MRAM an appealing option for companies looking to enhance their products' performance and efficiency. Furthermore, next-generation MRAM is expected to support real-time vision processing and 3D mapping, making it a preferred choice for advanced applications such as autonomous vehicles and artificial intelligence. As a result, tech giants like Apple are expected to adopt MRAM chips during the forecast period to gain a competitive edge. Overall, MRAM's ability to offer high-speed, non-volatile, and energy-efficient memory solutions makes it a game-changer in the technology industry.

What challenges does the Magneto Resistive RAM (MRAM) Industry face during its growth?

- Memory density issue is a key challenge affecting the industry growth.

- Magneto Resistive Random Access Memory (MRAM) is a memory technology that utilizes magnetic fields to store data, setting it apart from traditional memory types like Dynamic Random Access Memory (DRAM) and Flash Memory. MRAM's unique data storage mechanism results in several advantages, including faster read and write speeds, lower power consumption, and greater endurance. However, these benefits come with trade-offs. MRAM has a lower memory density due to the larger size of its magnetic memory cells, which are more significant than those used in DRAM and Flash Memory.

- This space constraint makes MRAM more expensive to manufacture and limits the amount of memory that can be stored in a given area. Despite these challenges, ongoing research and advancements in MRAM technology continue to fuel interest in this promising memory solution.

Exclusive Customer Landscape

The magneto resistive ram (mram) market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the magneto resistive ram (mram) market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, magneto resistive ram (mram) market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ARCO INC. - The company specializes in Magnetoresistive Random Access Memory (MRAM) solutions, including Embedded Perpendicular MRAM and Tornado discrete MRAM, delivering advanced data storage technologies that enhance data reliability and performance. MRAM's non-volatility and fast read/write speeds distinguish it from traditional memory technologies, making it a preferred choice for applications requiring high data integrity and low power consumption. With a commitment to innovation and excellence, the company's MRAM offerings cater to diverse industries, enabling improved system efficiency and performance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ARCO INC.

- Avalanche Technology Inc.

- Crocus Nano Electronic LLC

- Everspin Technologies Inc.

- Fujitsu Ltd.

- Honeywell International Inc.

- IMEC Inc.

- KLA Corp.

- MEMTECH

- Numem Inc.

- NVE Corp.

- NXP Semiconductors NV

- Renesas Electronics Corp.

- Samsung Electronics Co. Ltd.

- SK hynix Co. Ltd.

- SPIN MEMORY INC.

- SRAM and MRAM Group

- Taiwan Semiconductor Manufacturing Co. Ltd.

- Teledyne Technologies Inc.

- Yole Developpement SA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Magneto-Resistive Random-Access Memory (MRAM) is an emerging non-volatile memory solution that is gaining traction in various industries due to its unique advantages over traditional volatile memory technologies. This next-generation memory technology utilizes the magnetization of magnetic tunnel junctions to store data, offering several benefits such as high endurance, fast read and write speeds, and low power consumption. The industrial sector is increasingly adopting MRAM for its ness and reliability in harsh environments. The technology's ability to retain data even in extreme temperature conditions makes it an ideal choice for industrial systems and defense systems. In the commercial sector, MRAM is being explored for use in enterprise storage systems and commercial systems, particularly in applications where data integrity and reliability are paramount.

MRAM's low power consumption and fast read and write speeds are also making it an attractive option for the automotive sector. Next-generation sensors in cars are generating vast amounts of data, and MRAM's ability to store data quickly and efficiently makes it an ideal solution for in-car data logs. Furthermore, MRAM's tamper-resistant nature makes it a suitable choice for automotive systems that require high security. The defense industry is another area where MRAM is gaining popularity due to its ability to function in extreme conditions and its high endurance. MRAM's resistance to radiation makes it an ideal choice for military applications, particularly in defense systems and automated technologies.

The semiconductor industry is also investing heavily in MRAM research and development. Innovations in MRAM technology include low-power MRAM variants, spin-transfer torque MRAM, and embedded magnetic RAM. These advancements are expected to drive the growth of the MRAM market in the coming years. The Internet of Things (IoT) is another area where MRAM is gaining traction. The technology's low power consumption and fast read and write speeds make it an ideal choice for wearables, robots, and other IoT devices. MRAM's ability to function in extreme temperatures and its high endurance make it an attractive option for industrial IoT applications.

In the computing technologies sector, MRAM is being explored for use in workstations, laptops, smartphones, and even gaming systems. The technology's ability to function in extreme temperatures and its fast read and write speeds make it an attractive option for high-performance computing applications. MRAM's potential applications are vast and diverse, ranging from medical devices and disinfect hospitals to automobiles, televisions, and virtualized storage solutions. The technology's ability to function in extreme conditions and its high endurance make it an ideal choice for applications where data integrity and reliability are paramount. In , the Magneto-Resistive Random-Access Memory (MRAM) market is expected to grow significantly in the coming years due to its unique advantages over traditional volatile memory technologies.

The technology's ability to function in extreme temperatures, its fast read and write speeds, and its low power consumption make it an attractive option for various industries, including the industrial sector, commercial systems, defense systems, automotive sector, and the semiconductor industry. The ongoing research and development in MRAM technology are expected to drive the growth of the market in the coming years.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

203 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 37% |

|

Market growth 2025-2029 |

USD 2550.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

27.4 |

|

Key countries |

US, Japan, Germany, UK, South Korea, Canada, China, Italy, France, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Magneto Resistive RAM (MRAM) Market Research and Growth Report?

- CAGR of the Magneto Resistive RAM (MRAM) industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the magneto resistive ram (mram) market growth of industry companies

We can help! Our analysts can customize this magneto resistive ram (mram) market research report to meet your requirements.