US Multiple Sclerosis Market Size 2025-2029

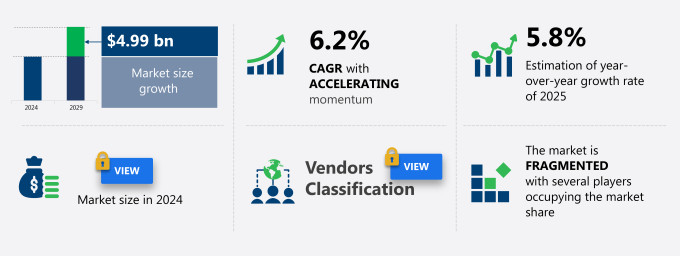

The US multiple sclerosis market size is forecast to increase by USD 4.99 billion at a CAGR of 6.2% between 2024 and 2029.

- The market is experiencing significant growth, driven by a strong pipeline of companies and rising strategic alliances and partnerships among them. This trend is expected to continue as companies invest in research and development to bring innovative treatments to market. However, the high cost of drugs remains a major challenge for both patients and payers, potentially limiting market growth. Additionally, biosimilars and generics are being introduced to increase accessibility and reduce healthcare spending. Despite this, the MS market is poised for expansion, with a growing number of diagnoses, advanced medical devices, and an aging population increasing the prevalence of the disease. companies are responding to these trends by developing new treatments and delivery methods to improve patient outcomes and reduce costs. This market analysis report provides an in-depth examination of these and other key factors influencing the MS market in North America.

What will be the Size of the Market During the Forecast Period?

- Multiple Sclerosis (MS) is a chronic and debilitating neurological disorder characterized by the immune system's attack on the central nervous system. The disease's unpredictable nature and varied symptoms pose significant challenges for patients and healthcare systems worldwide. In recent years, the MS market has witnessed notable advancements, driven by a combination of factors. The MS patient population continues to grow, fueled by rising prevalence and increasing awareness of the disease. According to neurological research, MS affects over two million people globally, with approximately 200 new cases diagnosed each week. This expanding patient base has created a significant demand for effective treatments and improved patient care.

- The MS market is undergoing substantial transformation, driven by advancements in clinical trial design and drug development. Immunostimulant therapy and immune system modulation have emerged as promising treatment approaches, offering hope to patients seeking relief from symptoms and disease progression. Clinical trials play a crucial role in the development of new MS treatments. These studies provide essential data on the safety, efficacy, and clinical outcomes of potential therapies. By analyzing clinical data, researchers can identify biomarkers that may predict disease progression and response to treatment, enabling more personalized care for MS patients.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

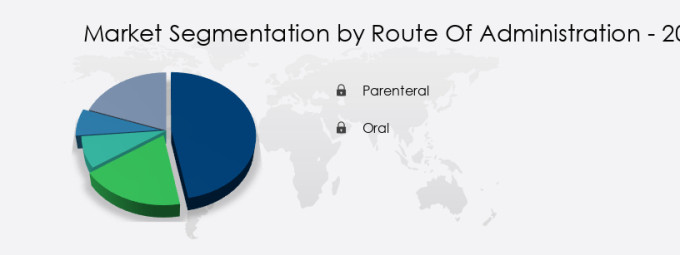

- Route Of Administration

- Parenteral

- Oral

- Type

- Biologics

- Small molecules

- Geography

- US

By Route Of Administration Insights

- The parenteral segment is estimated to witness significant growth during the forecast period.

The parenteral segment of the market is projected to experience moderate growth during the forecast period. Major parenteral drugs used for treating MS include AVONEX, OCREVUS, BETASERON, PLEGRIDY, and Rebif. Among these, OCREVUS holds the largest market share in the US, attributed to its high efficacy, good tolerability, and convenient six-month dosing regimen via intravenous (IV) infusion. However, the growth momentum of the parenteral segment is anticipated to decelerate due to several factors. Key challenges include increasing competition from generic drugs as patents for major branded medications expire, which could lead to reduced prices and market share for original manufacturers.

Additionally, the growing preference for oral medications among patients and healthcare providers may further constrain the demand for injectable therapies. Despite these challenges, ongoing advancements in drug formulations and delivery methods could provide new opportunities for growth within this segment, as companies seek to innovate and enhance patient adherence to treatment regimens. Thus, such factors will negatively affect the growth of the parenteral segment in the market in focus during the forecast period.

Get a glance at the market report of share of various segments Request Free Sample

Market Dynamics

Our US Multiple Sclerosis Market researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of the US Multiple Sclerosis Market?

A strong pipeline of companies is the key driver of the market.

- Multiple Sclerosis (MS) is an immune-mediated disease characterized by demyelination and neuroaxonal loss, leading to various disabilities. The prevalence of MS in the US population is substantial, resulting in a significant burden on healthcare resources and spending. The disease's complex pathogenesis requires effective therapeutics to manage its immune response and mitigate degenerative changes in the brain and spinal cord. Currently, there are various treatments available, including injectable drugs like interferons, glatiramer acetate, and natalizumab, immunostimulants like dimethyl fumarate and teriflunomide, and immunosuppressive drugs like alemtuzumab and ocrelizumab. However, these treatments have side effects, including voice commands and muscle relaxants, which impact patients' quality of life.

- To address these challenges, technological developments, such as transcranial direct current stimulation (tDCS) and assistive robotic arms, are being explored to complement neurotherapy treatments. Several pharmaceutical companies, including Biogen, are investing in research and development to launch novel molecules and advancements in MS treatment. The MS market is dynamic, with ongoing research and treatment advancements shaping the treatment algorithm for relapsing-remitting MS, primary-progressive MS, and secondary-progressive MS.

What are the market trends shaping the US Multiple Sclerosis Market?

Rising strategic alliances and partnerships among vendors is the upcoming trend in the market.

- Multiple Sclerosis (MS) is an immune-mediated disease characterized by demyelination and neuroaxonal loss in the brain and spinal cord. The prevalence of MS in the US population is estimated to be around 1 million, with relapsing-remitting MS being the most common form. The MS market is witnessing significant advancements, with companies focusing on the development of novel therapeutics, including biosimilars and immunostimulants, to enhance treatment efficacy. Side effects, such as injection site reactions and immune response, remain a concern for patients receiving injectable drugs like dimethyl fumarate, glatiramer acetate, and interferon beta. Neurotherapy treatments, such as transcranial direct current stimulation (tDCS), physical therapy, and voice commands, are also gaining popularity as adjunctive therapies.

- Healthcare spending on MS treatments is projected to increase due to the high cost of disease-modifying therapies, such as humanized monoclonal antibodies, including natalizumab, alemtuzumab, and ocrelizumab. Immunosuppressive drugs, such as teriflunomide and cladribine, are also gaining popularity due to their oral administration and potential for reducing disease progression. Strategic partnerships and acquisitions are becoming increasingly common in the MS market. Such collaborations enable companies to leverage complementary expertise, share resources, and accelerate innovation in therapeutic solutions.

- Technological developments, such as assistive robotic arms, are also transforming MS care by improving patient mobility and independence. Phase 3 clinical studies for novel molecules, such as siponimod and ponesimod, are underway, offering potential new treatment options for patients with primary-progressive and secondary-progressive MS. The MS market is expected to grow during the forecast period due to the increasing prevalence of the disease, the need for more effective and accessible treatments, and ongoing research and development efforts. However, accessibility to these treatments remains a challenge for some patients due to high healthcare expenditure and disabilities associated with the disease.

What challenges doesUS Multiple Sclerosis Market face during the growth?

The high cost of drugs is a key challenge affecting the market growth.

- Multiple Sclerosis (MS) is an immune-mediated disease characterized by the immune system's attack on the central nervous system, leading to demyelination and neuroaxonal loss. The disease affects communication between the brain and the rest of the body, resulting in various symptoms such as vision loss, pain, fatigue, and impaired coordination. The prevalence of MS in the US is estimated to be around 1 million, with relapsing-remitting MS being the most common form. Treatment for MS includes various therapeutics, including injectable drugs, immunostimulants, and immunosuppressive drugs. Monoclonal antibodies, such as natalizumab, alemtuzumab, and ocrelizumab, have shown efficacy in modifying the course of the disease.

- Disease-modifying drugs, like dimethyl fumarate, glatiramer acetate, teriflunomide, and cladribine, are infused or taken orally to reduce the frequency and severity of relapses. Neurotherapy treatments, such as transcranial direct current stimulation (tDCS), physical therapy, and assistive robotic arms, help manage symptoms and improve quality of life. However, the high cost of MS treatments, including medications and healthcare resources, contributes significantly to healthcare spending. Technological developments, such as voice commands and injectable drugs, aim to improve accessibility and patient convenience. Phase 3 clinical studies continue to explore novel molecules and treatment algorithms for MS, including humanized monoclonal antibodies and immunosuppressive drugs.

- The disease's complex pathogenesis necessitates ongoing research and development to address the disabilities caused by MS and its degenerative changes, such as axonal transection. The MS market is dynamic, with product launches and advancements in care continually evolving to meet the needs of the growing patient population. Despite the challenges, the commitment to improving MS care and reducing its impact on patients' lives remains a priority for healthcare providers and researchers.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast , partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

- Bayer AG: The company offers multiple sclerosis drugs such as BETASERON (interferon beta-1b), which is used to reduce the number of relapses in patients with relapsing forms of multiple sclerosis.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Science SA

- Astellas Pharma Inc.

- Biogen Inc.

- Bristol Myers Squibb Co.

- F. Hoffmann La Roche Ltd.

- GeNeuro SA

- Glenmark Pharmaceuticals Ltd.

- Inno BioScience LLC

- Johnson and Johnson Inc.

- Mapi Pharma Ltd.

- MediciNova Inc.

- Merck KGaA

- Novartis AG

- Opexa Therapeutics Inc.

- Pfizer Inc.

- Sanofi SA

- Sobel Network Shipping Co. Inc.

- Teva Pharmaceutical Industries Ltd.

- Viatris Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market in the US is expanding rapidly, driven by advancements in MS medication, neurological disorders treatment, and healthcare innovation. Multiple sclerosis patients benefit from improved generic drug availability and generic drug substitution, making MS drug therapy more accessible. The growing prevalence of multiple sclerosis has led to increased healthcare spending on MS management and multiple sclerosis care, with tDCS for neurological disorders and cognitive enhancement gaining attention for improving MS symptoms. The rise of assistive robotics in healthcare, such as robotic arm rehabilitation and voice-controlled healthcare devices, enhances MS patient support and mobility. New MS treatment options, including injectable medications and immunotherapy, address MS disease progression and brain atrophy. MS clinical trials, medical research, and biotechnology are driving breakthroughs, while healthcare policy and drug accessibility initiatives focus on cost containment and MS medication costs.

Further, multiple sclerosis (MS) is an immune-mediated disease characterized by demyelination and neuroaxonal loss in the central nervous system. Biosimilars have emerged as an alternative to branded MS drugs, offering cost savings without compromising efficacy. These biologically similar versions of original drugs have been shown to have comparable safety and efficacy profiles. Advancements in MS research and development continue to shape the market, with novel molecules and technological developments on the horizon. For instance, monoclonal antibodies, such as alemtuzumab, natalizumab, and ocrelizumab, have shown promising results in clinical trials, providing new treatment options for patients. The immune response plays a significant role in MS pathogenesis, and immunostimulants and immunosuppressive drugs are often used to modulate the immune system. These treatments, including dimethyl fumarate, teriflunomide, and cladribine, have demonstrated effectiveness in reducing disease activity and improving patient outcomes.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.2% |

|

Market growth 2025-2029 |

USD 4.99 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.8 |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across US

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch