Nephrostomy Devices Market Size 2024-2028

The nephrostomy devices market size is forecast to increase by USD 75.4 million, at a CAGR of 4.5% between 2023 and 2028.

- The market is driven by the rising incidence of kidney stone disease, which necessitates the use of nephrostomy tubes for drainage and treatment. This trend is expected to continue due to the increasing prevalence of obesity and sedentary lifestyles, leading to an increased risk of kidney stones. Miniaturized Percutaneous Nephrostolithotomy (PCNL) procedures represent a significant trend in the market, as they offer reduced bleeding and pain during kidney stone disease treatment. However, challenges persist, including the risk of complications associated with nephrostomy devices. These complications include infection, bleeding, and blockages, which can lead to patient discomfort and potential re-hospitalization.

- To capitalize on market opportunities, companies should focus on developing innovative solutions to mitigate these complications. This could include advanced materials for catheters, improved sterilization techniques, and enhanced patient education to reduce the risk of infection and other complications. By addressing these challenges, companies can differentiate themselves in the market and provide value to both healthcare providers and patients.

What will be the Size of the Nephrostomy Devices Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and growing applications across various sectors. Renal function monitoring is a key focus, with nephrostomy tubes enabling the continuous assessment of renal output and drainage volume. The market encompasses a range of tube sizes, each tailored to specific patient needs and surgical procedures. Post-operative infection signs are a significant concern, necessitating stringent infection control protocols and the development of new catheter materials, such as silicone and hydrophilic-coated options. Surgical nephrostomies and percutaneous nephrostomies each offer unique advantages, with the former typically used in open surgeries and the latter for minimally invasive procedures.

Tube occlusion prevention and ureteral stent removal are ongoing challenges, leading to the development of innovative catheter fixation methods and obstruction relief devices. Nephrostomy sets include various components, from drainage systems to pain management strategies, ensuring patient comfort and effective renal drainage. Urinary output monitoring and renal failure management are crucial aspects of nephrostomy care, with percutaneous nephrostomy complications requiring prompt attention. Nephrostomy access techniques, such as fluoroscopy-guided placement and ultrasonography-guided placement, continue to refine the procedure, enhancing accuracy and minimizing risks. Renal colic treatment and urinary diversion devices are additional applications for nephrostomy devices, further expanding the market's reach.

The ongoing dynamism of the market underscores its importance in the healthcare industry, as it continues to adapt and innovate to meet the evolving needs of patients and healthcare providers.

How is this Nephrostomy Devices Industry segmented?

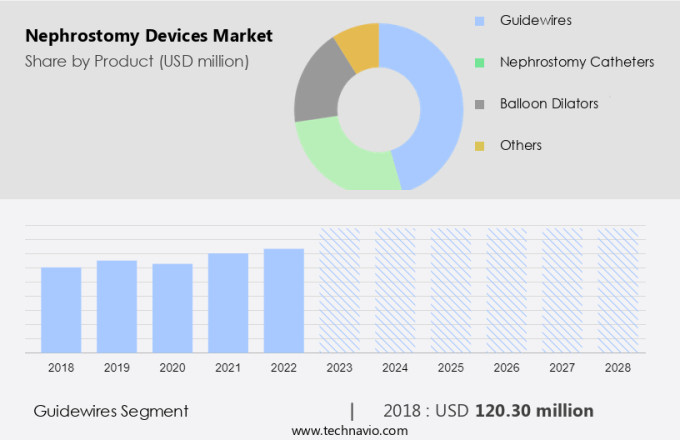

The nephrostomy devices industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- Guidewires

- Nephrostomy catheters

- Balloon dilators

- Others

- End-user

- Hospitals

- ASCs

- Others

- Geography

- North America

- US

- Canada

- Europe

- Denmark

- APAC

- China

- India

- Rest of World (ROW)

- North America

By Product Insights

The guidewires segment is estimated to witness significant growth during the forecast period.

Nephrostomy devices, including polyurethane catheters and obstruction relief devices, continue to evolve with advancements in technology. Fluoroscopy guided placement ensures accurate catheter positioning, while drainage volume measurement and catheter insertion guides facilitate efficient procedures. Drainage system maintenance and nephrostomy access techniques minimize complications, with management strategies addressing common issues such as tube occlusion, ureteral stent removal, and catheter fixation. Percutaneous nephrostomy catheters are commonly used for renal function monitoring and managing renal colic, with tube sizes and materials varying to accommodate individual patient needs.

Post-operative infection signs and renal failure management are critical considerations, as are percutaneous nephrostomy complications and risks. Hydrophilic coated catheters and infection control protocols enhance patient comfort and safety. Major companies offer a range of nephrostomy sets, including components for urinary output monitoring, pain management, and renal drainage system management. Ultrasonography guided placement and double-j stent placement are additional techniques used in nephrostomy procedures.

The Guidewires segment was valued at USD 120.30 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

North America is estimated to contribute 37% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market is witnessing significant growth, driven by advancements in technology and increasing incidences of renal diseases. In North America, the market is thriving due to well-equipped healthcare infrastructure and the presence of skilled professionals. Key players, such as B Braun Melsungen AG, Becton Dickinson and Co., and Cook Medical LLC, are expanding their product offerings and reorganizing their sales forces to boost market share. For instance, Cook Medical's Ultraxx Nephrostomy Balloon Catheter and Set is used to dilate the nephrostomy tract, facilitating catheter insertion. The US dominates the North American market due to its large geriatric population, rising incidence of renal diseases, and significant investment in research and development.

Nephrostomy devices used in this region include polyurethane catheters, obstruction relief devices, and percutaneous nephrostomy catheters. Fluoroscopy-guided placement and ultrasonography-guided placement are common access techniques. Drainage volume measurement, catheter insertion guides, and drainage system maintenance are essential components of nephrostomy sets. Complications, such as tube occlusion, infection, and renal colic, are managed through various strategies, including catheter fixation methods, pain management, and urinary output monitoring. Silicone and hydrophilic-coated catheters are popular tube materials due to their biocompatibility and ease of use. Infection control protocols and patient comfort measures are crucial aspects of post-operative care. Double-J stent placement and ureteral stent removal are common procedures.

Renal function monitoring and renal failure management are ongoing challenges in nephrostomy care. Percutaneous nephrostomy complications include bleeding, infection, and tube misplacement. Renal drainage systems and drainage bag management are essential for effective treatment.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The nephrostomy market continues to grow as percutaneous nephrostomy (PCN) procedures become increasingly common for managing various renal conditions. When selecting a nephrostomy tube size, criteria such as patient weight, tube length, and desired drainage rate should be considered. Proper tube size selection is crucial to ensure effective drainage and minimize complications. PCN complications include bleeding, infection, tube displacement, and occlusion. Occlusion can be managed by flushing the tube with saline solution or replacing the catheter. Infection prevention measures include sterile technique during insertion, maintaining aseptic care, and administering prophylactic antibiotics. Renal function monitoring is essential after PCN placement. Drainage system maintenance protocols include regular flushing, monitoring drainage output, and ensuring proper tube positioning. Fluoroscopy and ultrasonography can be used for tube placement to ensure accurate insertion and avoid complications. Biocompatibility assessment of nephrostomy tube materials is crucial to minimize adverse reactions. Patient selection factors and risk stratification are essential to optimize procedure success and reduce complications. Complication management strategies include timely intervention, communication with the healthcare team, and patient education. Post-procedural pain management is crucial for patient comfort. Patient education materials on nephrostomy catheter care should be provided to ensure proper tube maintenance and reduce the risk of complications. Nephrostomy tube removal complications can be managed with proper technique and communication with the healthcare team. Infection control measures should be strictly adhered to during the procedure to minimize the risk of infection. Quality improvement initiatives for nephrostomy care include standardizing procedures, implementing checklists, and continuous monitoring and evaluation of outcomes. Adhering to market research report standards ensures the market remains innovative and effective in meeting patient needs.

What are the key market drivers leading to the rise in the adoption of Nephrostomy Devices Industry?

- The rising prevalence of kidney stone disease serves as the primary market driver.

- Nephrostomy devices are essential medical solutions for managing kidney stones and obstructing urinary tracts. These devices, including polyurethane nephrostomy catheters, provide relief from obstructions and facilitate drainage. The placement of nephrostomy catheters can be guided by fluoroscopy for precise insertion. Drainage volume measurement is crucial for monitoring the effectiveness of the catheter and ensuring proper kidney function. The market for nephrostomy devices is driven by the increasing prevalence of kidney stones, which affects approximately 120,000 people per million worldwide. The condition is more common in men than women and is a significant health concern in both developed and developing countries.

- Nephrostomy access techniques have evolved, with advancements in catheter insertion guides and drainage system maintenance. Effective management of nephrostomy complications is essential to ensure patient safety and well-being. The market for nephrostomy devices is expected to grow due to the increasing demand for minimally invasive procedures and the need for improved patient outcomes. The market dynamics are influenced by factors such as the rising prevalence of kidney stones, technological advancements, and the growing focus on minimally invasive procedures.

What are the market trends shaping the Nephrostomy Devices Industry?

- The miniaturization of Percutaneous Nephrolithotomy (PCNL) is an emerging trend in the treatment of kidney stone disease. This advanced approach aims to minimize bleeding and pain by using smaller incisions and specialized equipment. (Alternatively): The miniaturization of Percutaneous Nephrolithotomy (PCNL) is a significant development in the treatment of kidney stone disease, offering reduced bleeding and pain through the use of smaller incisions and advanced equipment.

- Nephrostomy devices play a crucial role in managing renal function following various urological procedures, including surgical nephrostomies. These procedures involve the insertion of a tube into the kidney to drain urine when the normal urinary pathway is obstructed. Mini PCNL, a less invasive alternative to Percutaneous Nephrolithotomy (PCNL), has gained popularity due to its advantages over standard PCNL. Mini PCNL procedures feature smaller incisions and instruments, leading to reduced procedural morbidity and complications such as trauma, pain, blood loss, and infection. This, in turn, shortens the hospital stay. Karl Storz SE & Co. KG, a leading medical technology company, introduced the MIP?M device, a miniaturized version of PCNL, for managing kidney stones up to 30 mm in diameter in any renal calyx or the renal pelvis.

- To prevent tube occlusion and ensure proper drainage, nephrostomy sets comprise various components, including catheters, fixation methods, and pain management strategies. Post-operative infection signs necessitate close monitoring of renal function. Ureteral stent removal and tube occlusion prevention are essential aspects of nephrostomy device management. Pain management strategies, such as local anesthesia and analgesics, contribute to enhancing patient comfort during the recovery process.

What challenges does the Nephrostomy Devices Industry face during its growth?

- The complexities linked to the use of nephrostomy devices represent a significant challenge to the industry's expansion. Incorporating advanced technologies and enhancing medical expertise are essential to mitigating these complications and fostering growth within the industry.

- Nephrostomy devices are essential medical tools used for urinary output monitoring and renal drainage system management in renal failure patients. However, these devices come with certain risks and complications. Complications such as hemorrhage, tube dislodgement, tube blockage, tube leakage, fever, damage to adjacent structures, vascular injury, and catheter-associated urinary tract infections (CAUTIs) are common. Septicemia and septic shock, allergic reactions, post-surgery infections, pneumothorax, retained stones, blockage of kidney arteries, and urine leakage in the tissues surrounding the kidney are also potential complications. Diabetes patients undergoing nephrostomy procedures are at a higher risk of postoperative complications. Improper reuse and reprocessing of nephrostomy tubes, particularly silicone nephrostomy catheters, can lead to infections.

- The Centers for Disease Control and Prevention (CDC) reports that approximately 75% of urinary tract infections acquired in US hospitals are associated with urinary catheters. Proper management of drainage bags and adherence to hygiene protocols are crucial in minimizing these risks.

Exclusive Customer Landscape

The nephrostomy devices market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nephrostomy devices market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nephrostomy devices market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amecath - The company specializes in providing nephrostomy devices, including Nephrofix and Nephrofix Certo, which facilitate drainage from the kidneys.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amecath

- AngioDynamics Inc.

- Argon Medical Devices Inc.

- B.Braun SE

- Balton Sp. z o.o.

- Becton Dickinson and Co.

- Blueneem Medical Devices Pvt. Ltd.

- Boston Scientific Corp.

- Cardinal Health Inc.

- Coloplast AS

- Cook Group Inc.

- Envaste Ltd.

- Meditech Devices Pvt. Ltd.

- Olympus Corp.

- ROCAMED

- Teleflex Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Nephrostomy Devices Market

- In January 2024, B. Braun Melsungen AG, a leading medical device manufacturer, announced the launch of their new single-use, sterile, and pre-connected nephrostomy catheter system, named Seldinger EasyFlow. This innovative product offers enhanced patient safety and ease of use (B. Braun press release).

- In March 2024, Fresenius Medical Care, a global leader in kidney care products and services, entered into a strategic partnership with Merit Medical to distribute Merit's nephrostomy devices in Europe, the Middle East, and Africa. This collaboration aims to expand Fresenius Medical Care's product portfolio and strengthen its presence in the nephrology market (Fresenius Medical Care press release).

- In April 2025, Cook Medical, a global medical technology company, completed the acquisition of Integra Medical S.A., a leading manufacturer of urological and nephrology devices. This acquisition is expected to bolster Cook Medical's portfolio and enhance its global market position in the market (Cook Medical press release).

- In May 2025, the U.S. Food and Drug Administration (FDA) granted 510(k) clearance to Teleflex Incorporated for its new, low-profile, and adjustable nephrostomy valve system, the Vesicare Valve. This approval marks a significant technological advancement in the market, offering improved patient comfort and ease of use (Teleflex Incorporated press release).

Research Analyst Overview

- The market encompasses a range of urology surgical devices used for the management of urinary tract obstructions, renal calculi, and post-urological procedure care. Nephrostomy care instructions are essential for ensuring proper catheter patency maintenance and infection prevention measures. Complication management strategies, including drainage system troubleshooting and nephrostomy tube insertion techniques, are crucial for procedural success rates. Urological procedures, such as nephrostomy catheter removal and renal pelvis drainage, require precise anatomical landmarks identification and fluoroscopic guidance techniques. Patient selection criteria, risk factor assessment, and quality improvement measures are vital for optimizing procedures and minimizing post-operative recovery time. Ureteral stricture treatment and nephrostomy tract dilation are essential components of nephrostomy care.

- Proper renal function assessment and infection prevention measures are crucial for managing complications, such as drainage tube occlusion and urinary tract obstruction. Surgical technique refinement and post-procedural monitoring are necessary for minimizing complications and enhancing patient outcomes. Catheter patency maintenance and infection prevention are ongoing concerns for healthcare providers. Nephrostomy care instructions and infection prevention measures are essential for managing complications and ensuring optimal patient outcomes. Procedural success rates depend on proper catheter placement, drainage system function, and post-procedural monitoring. Renal calculi management and urinary tract obstruction treatment often involve nephrostomy tubes. Proper patient education materials and infection prevention measures are essential for minimizing complications and ensuring successful outcomes.

- Nephrostomy care instructions and complication management strategies are crucial for managing post-procedural care and enhancing patient outcomes. Infection prevention measures, drainage system troubleshooting, and quality improvement measures are essential for managing nephrostomy complications and optimizing patient care. Proper patient selection criteria and risk factor assessment are crucial for minimizing complications and ensuring procedural success. Nephrostomy care instructions and catheter patency maintenance are essential for managing post-procedural care and enhancing patient outcomes. The market is driven by the increasing prevalence of urinary tract obstructions and the need for effective renal calculi management. Procedural optimization and infection prevention measures are essential for minimizing complications and ensuring optimal patient outcomes.

- Nephrostomy care instructions and complication management strategies are crucial for managing post-procedural care and enhancing patient outcomes.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Nephrostomy Devices Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 75.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.24 |

|

Key countries |

US, Denmark, China, Canada, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nephrostomy Devices Market Research and Growth Report?

- CAGR of the Nephrostomy Devices industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nephrostomy devices market growth of industry companies

We can help! Our analysts can customize this nephrostomy devices market research report to meet your requirements.