Neurodiagnostics Market Size 2024-2028

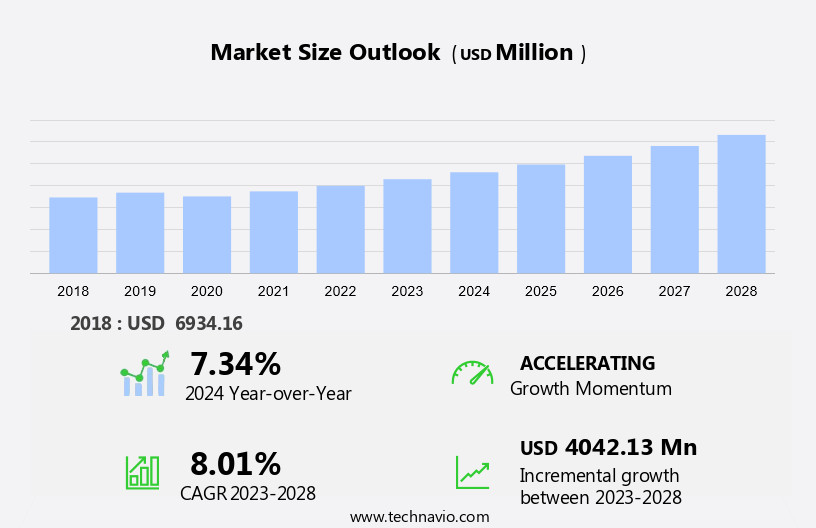

The neurodiagnostics market size is forecast to increase by USD 4.04 billion, at a CAGR of 8.01% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing prevalence of neurological disorders and the heightened focus on accurate neurological diagnostics. Neurological disorders, such as epilepsy, Parkinson's disease, and Alzheimer's disease, are on the rise, driving the demand for advanced diagnostic tools and techniques. These disorders often require precise diagnosis for effective treatment, making the accuracy and reliability of neurodiagnostic tests crucial. However, the high cost of neurology devices poses a considerable challenge for market growth. The expensive nature of these diagnostic tools can limit their accessibility, particularly in developing regions and low-income populations.

- Despite this obstacle, opportunities exist for companies to innovate and develop cost-effective solutions, addressing this challenge and expanding market reach. By focusing on technological advancements and cost reduction strategies, market players can capitalize on the growing demand for accurate neurological diagnostics and meet the evolving needs of healthcare providers and patients.

What will be the Size of the Neurodiagnostics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in technology and growing applications across various sectors. Neuromuscular junction disorders, once diagnosed primarily through manual testing methods, now benefit from electromyography techniques that provide objective and precise data. Evoked potential studies, including somatosensory and auditory, offer valuable insights into neural function and have expanded the diagnostic capabilities of clinical neurophysiology testing. Electroencephalography (EEG) signal processing, with techniques such as quantitative analysis and event-related potentials, enables the detection of cognitive changes and brain activity patterns associated with conditions like dementia. Neurodiagnostic imaging techniques, such as functional brain mapping and electroencephalography devices, provide visual representations of neural activity, enhancing diagnostic accuracy.

In the realm of epilepsy, seizure detection through advanced signal processing and machine learning algorithms is revolutionizing diagnosis and treatment. Neuroimaging techniques, like magnetic resonance imaging and positron emission tomography, offer improved visualization of brain structures and functions, aiding in the identification of epileptic foci. Multiple sclerosis biomarkers and neuroimaging techniques facilitate early and accurate diagnosis, while neurodiagnostic tools like transcranial magnetic stimulation and electrocorticography monitoring contribute to the development of personalized treatment plans. The ongoing research in this field, including the application of neural network algorithms and brain computer interfaces, further underscores the dynamic nature of the market.

Peripheral nerve stimulation, nerve conduction velocity assessment, and neuropathic pain assessment are other areas of neurodiagnostics that are continually advancing, providing valuable diagnostic and therapeutic solutions for patients. The integration of these techniques into clinical practice is transforming the landscape of healthcare and neurological assessment tools, ultimately improving patient outcomes.

How is this Neurodiagnostics Industry segmented?

The neurodiagnostics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Diagnostic and imaging solutions

- In-vitro diagnostics

- End-user

- Diagnostic laboratories and imaging centers

- Hospitals and surgery centers

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW)

- North America

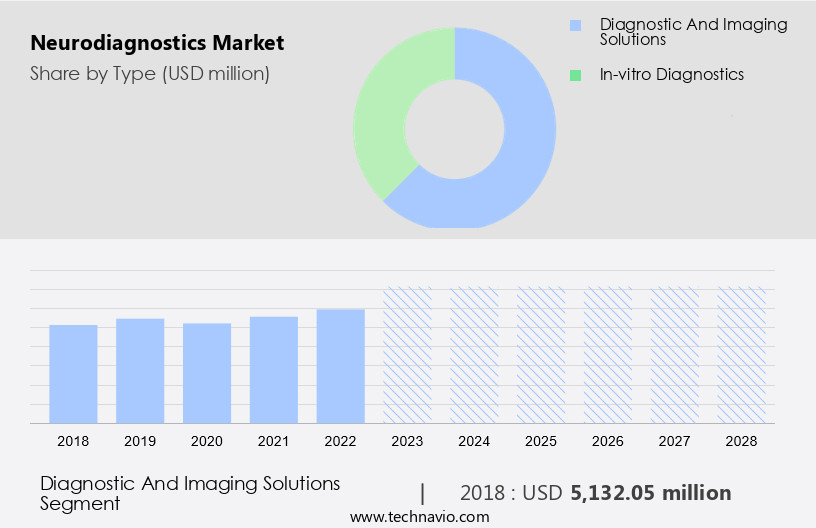

By Type Insights

The diagnostic and imaging solutions segment is estimated to witness significant growth during the forecast period.

Neurodiagnostics, encompassing patient monitoring systems, high-density EEG systems, cognitive assessment metrics, transcranial magnetic stimulation, quantitative EEG analysis, signal averaging techniques, functional brain mapping, sleep apnea detection, somatosensory evoked potentials, peripheral nerve stimulation, electrocorticography monitoring, clinical neurophysiology testing, brain computer interface, intraoperative neurophysiology, neuromuscular junction disorders, evoked potential studies, EEG signal processing, multiple sclerosis biomarkers, epilepsy seizure detection, neurodiagnostic imaging techniques, electromyography techniques, electroencephalography devices, EMG artifact reduction, nerve conduction velocity, neurological assessment tools, neural network algorithms, dementia diagnostic markers, event-related potentials, and neuropathic pain assessment, is experiencing significant growth. Fueled by a high per capita income and the increasing adoption of advanced neurology systems to diagnose and treat neurological disorders, this market segment is poised for expansion.

Neurological disorders, including brain tumors, pose serious and lasting damage to individuals. Traditional methods, such as computed tomography (CT) scans, while useful for detecting bleeding or swelling in the brain, often fail to provide accurate results. As a result, there is a growing demand for advanced neurodiagnostic solutions to deliver precise results and improve patient outcomes.

The Diagnostic and imaging solutions segment was valued at USD 5.13 billion in 2018 and showed a gradual increase during the forecast period.

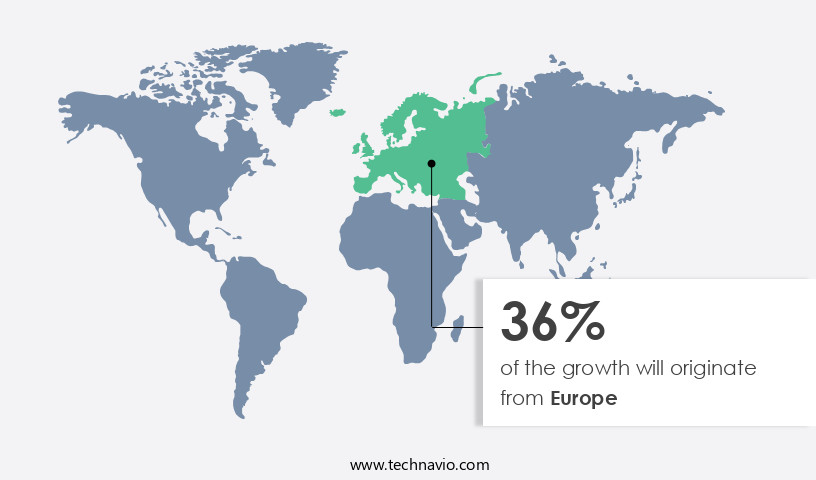

Regional Analysis

Europe is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The US the market in North America is experiencing significant growth due to the increasing burden of neurological disorders, such as epilepsy and dementia, on the healthcare system. According to the Annals of Neurology, neurological disorders account for approximately USD800 billion in annual costs in the US. This expenditure, coupled with the rising demand for advanced neurology devices, is driving market growth. Neurological disorders are a major cause of mortality, and the US, with its well-established healthcare infrastructure and highly skilled medical professionals, is at the forefront of addressing this challenge. Advanced neurodiagnostic tools, such as high-density EEG systems, cognitive assessment metrics, transcranial magnetic stimulation, quantitative EEG analysis, signal averaging techniques, functional brain mapping, sleep apnea detection, somatosensory evoked potentials, peripheral nerve stimulation, electrocorticography monitoring, clinical neurophysiology testing, brain computer interfaces, intraoperative neurophysiology, neuromuscular junction disorders, evoked potential studies, EEG signal processing, multiple sclerosis biomarkers, epilepsy seizure detection, neurodiagnostic imaging techniques, electromyography techniques, electroencephalography devices, EMG artifact reduction, nerve conduction velocity, neurological assessment tools, neural network algorithms, dementia diagnostic markers, event-related potentials, and neuropathic pain assessment, are all contributing to the market's evolution.

These technologies enable early and accurate diagnosis, improved treatment outcomes, and enhanced patient care. The US's commitment to research and development, coupled with its large patient population and significant healthcare expenditure, positions it as a key player in the market.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Neurodiagnostics Industry?

- The rising incidence of neurological disorders serves as the primary catalyst for market growth in this sector.

- Neurological disorders, which affect the central and peripheral nervous systems, are a growing health concern worldwide. These conditions, including brain tumors, brain stroke, epilepsy, brain aneurysm, sleep apnea, MS, and PD, are caused by genetic defects, chromosomal abnormalities, or lifestyle factors such as diabetes mellitus, obesity, high blood pressure, hypertension, and smoking. According to a 2020 Lancet paper, neurological disorders are the second leading cause of death globally, accounting for 9 million deaths annually. Patients with neurological disorders require continuous monitoring to manage their conditions effectively. Advanced neurodiagnostic tools, such as patient monitoring systems, high-density EEG systems, cognitive assessment metrics, transcranial magnetic stimulation, quantitative EEG analysis, signal averaging techniques, and functional brain mapping, are essential for accurate diagnosis and treatment.

- These technologies enable healthcare professionals to assess brain activity, identify abnormalities, and monitor the progression of neurological conditions. Moreover, the increasing prevalence of neurological disorders and the need for non-invasive, accurate, and reliable diagnostic tools are driving the growth of the market. The market is expected to witness significant advancements in the coming years due to ongoing research and development efforts. Neurological disorders are a major cause of disability, and the development of advanced neurodiagnostic tools can significantly improve patient outcomes and quality of life.

What are the market trends shaping the Neurodiagnostics Industry?

- The growing importance of precise neurological diagnoses is a notable trend in the current market. Accurately identifying neurological conditions is essential for effective treatment and patient care.

- Neurological disorders, such as Traumatic Brain Injuries (TBIs,) require precise diagnosis for effective treatment. Traditional methods like Computed Tomography (CT) scans have limitations in accurately detecting neurological damage. As a result, there is a growing need for advanced neurodiagnostic techniques to bridge this gap. Clinical neurophysiology testing, including sleep apnea detection, somatosensory evoked potentials, peripheral nerve stimulation, electrocorticography monitoring, and brain-computer interfaces, are increasingly utilized for more accurate diagnoses.

- Intraoperative neurophysiology is another promising area, ensuring patient safety during neurosurgical procedures. Pharmaceutical companies are investing in research and development of neurological biomarkers for blood tests, offering more precise results and earlier detection of neurological disorders. This innovative approach is revolutionizing the field of neurodiagnostics, ensuring better patient outcomes.

What challenges does the Neurodiagnostics Industry face during its growth?

- The escalating costs of neurology devices pose a significant challenge to the industry's growth trajectory.

- Neurology diagnoses and treatments for disorders such as neuromuscular junction disorders, multiple sclerosis, epilepsy, and others can be costly due to the expense of neurologists' fees, equipment, hospital stays, and diagnostic and surgical procedures. The advancement of neurology devices contributes to rising costs, with prices varying based on configuration and features. For instance, neurostimulation devices cost between USD8,820 and USD25,970, while an embolic coil averages USD1,750 and aneurysm clips USD60.28. Neurology procedures also carry significant costs, with an average of USD32,882 for Medicare patients and USD50,000 for uninsured patients for neurostimulator and implantation surgery.

- These expenses hinder access to essential neurological care and treatments for many individuals. Despite these challenges, ongoing research in areas like evoked potential studies, EEG signal processing, and neurodiagnostic imaging techniques offers hope for more accurate and cost-effective diagnoses and treatments for neurological disorders.

Exclusive Customer Landscape

The neurodiagnostics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the neurodiagnostics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neurodiagnostics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Advanced Brain Monitoring Inc. - This company specializes in neurodiagnostics, providing innovative tools for interpreting brain and physiological functions in relation to chronic diseases and neurodegeneration.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Advanced Brain Monitoring Inc.

- ANT Neuro

- Bio Signal Group Corp.

- Cadwell Industries Inc.

- Canon Inc.

- Compumedics Ltd.

- ELMIKO BIOSIGNALS sp. z o.o.

- F. Hoffmann La Roche Ltd.

- FUJIFILM Corp.

- General Electric Co.

- Jordan NeuroScience

- Koninklijke Philips N.V.

- Lifelines Neuro Company LLC

- Mitsar Co. Ltd.

- Natus Medical Inc.

- neurocare group AG

- Nihon Kohden Corp.

- NovaSignal Corp.

- QIAGEN NV

- Siemens Healthineers AG

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Neurodiagnostics Market

- In January 2024, Neurotechnology Corporation, a leading neurodiagnostics solutions provider, announced the launch of their new EEG system, "Star-NET," designed for remote patient monitoring and telehealth applications (Neurotechnology Corporation Press Release, 2024). This innovative product expansion aimed to cater to the growing demand for advanced neurodiagnostic tools in remote healthcare settings.

- In March 2024, Medtronic and Philips entered into a strategic partnership to integrate Philips' advanced neuroimaging technologies into Medtronic's neurosurgical navigation systems (Medtronic Press Release, 2024). This collaboration aimed to enhance the accuracy and efficiency of neurosurgical procedures, positioning both companies at the forefront of advanced neurodiagnostics.

- In May 2024, Natus Medical Incorporated completed the acquisition of NeuroWave Systems, a leading provider of digital EEG systems and software (Natus Medical Incorporated Press Release, 2024). This strategic move expanded Natus' product portfolio and strengthened their position in the market.

- In April 2025, the US Food and Drug Administration (FDA) approved the marketing of Siemens Healthineers' new Magnetom Prisma Fit MRI system, featuring advanced neuroimaging capabilities (Siemens Healthineers Press Release, 2025). This regulatory approval marked a significant milestone for Siemens Healthineers, enabling them to offer a more comprehensive neurodiagnostics solution to healthcare providers in the US.

Research Analyst Overview

- The market encompasses a range of technologies and techniques used to assess the function of the central and peripheral nervous systems. Motor evoked potentials (MEPs), nerve conduction studies (NCS), and electromyogram (EMG) interpretation are essential diagnostic tools in clinical neurophysiology labs. Neurological rehabilitation centers increasingly employ portable neurodiagnostic units for long-term monitoring solutions. Advancements in digital signal processing, artifact rejection algorithms, and neural network classifiers have enhanced the diagnostic accuracy of EEG data visualization and brainwave analysis methods. Repetitive nerve stimulation, nerve biopsy analysis, and single fiber EMG provide valuable insights into neuromuscular transmission disorders. Machine learning models and diagnostic accuracy metrics have revolutionized the interpretation of auditory and visual evoked potentials, enabling more precise treatment efficacy evaluations.

- Clinical neurophysiology labs utilize these advanced technologies to optimize patient outcome measures and improve overall healthcare delivery. Signal denoising methods are crucial for accurate interpretation of neurodiagnostic data, ensuring reliable results in clinical settings. The integration of digital technology and advanced algorithms continues to drive innovation in the market, transforming the field and enhancing patient care.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Neurodiagnostics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.01% |

|

Market growth 2024-2028 |

USD 4042.13 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.34 |

|

Key countries |

US, Germany, UK, China, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neurodiagnostics Market Research and Growth Report?

- CAGR of the Neurodiagnostics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the neurodiagnostics market growth of industry companies

We can help! Our analysts can customize this neurodiagnostics market research report to meet your requirements.