Neurological Biomarkers Market Size 2024-2028

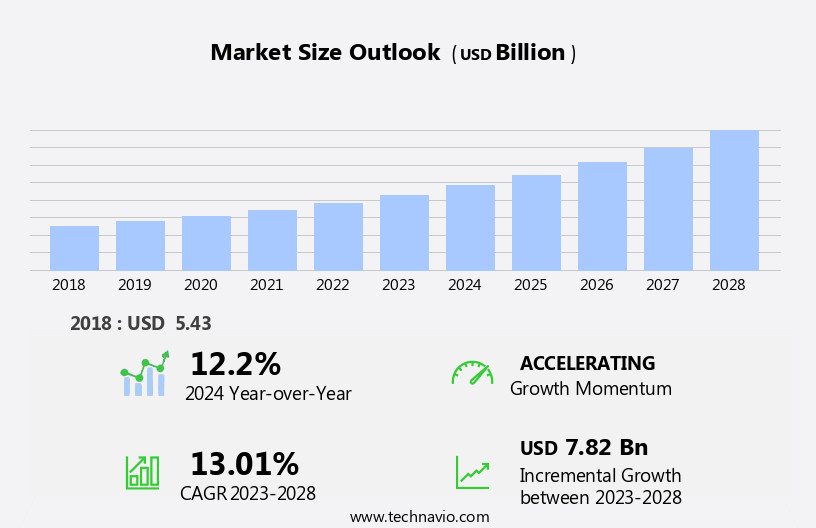

The neurological biomarkers market size is forecast to increase by USD 7.82 billion at a CAGR of 13.01% between 2023 and 2028.

- The rising incidence of neurological disorders is the key driver of the neurological biomarkers market. Abbott Laboratories is a key player, offering neurological biomarkers like I-STAT Alinity, an easy-to-use, portable blood analyzer that provides real-time, lab-quality diagnostic test results. This innovative technology supports early diagnosis and effective management of neurological conditions, driving growth in the market as healthcare providers seek reliable tools to detect and monitor neurological disorders.

- Biomarkers play a crucial role In the early detection and diagnosis of neurological disorders, enabling timely intervention and improving patient outcomes. This trend is driving the need for advanced diagnostic tools to accurately identify and monitor neurological conditions, enabling precision medicine and targeted therapies. Additionally, advancements in technology and research are facilitating the development of novel biomarkers, further fueling market growth. Additionally, the integration of Assistive Technology (AT) into neuro-diagnostics is improving patient care, providing greater independence and enhanced quality of life for individuals with neurological disorders.

What will be the Size of the Neurological Biomarkers Market During the Forecast Period?

- The market encompasses the science and technology behind identifying and measuring various indicators of brain function and injury, including those related to Parkinson's, Alzheimer's, cognitive decline, and other neurological disorders. This market is driven by the growing need for accurate and early diagnosis, effective treatment, and improved patient care. Neurological biomarkers play a crucial role in various applications, such as disease screening, assessment, rehabilitation, research, and advocacy. They are used by specialists in medicine, care providers, and researchers to aid In the management and prevention of neurological disorders. Blood-based biomarkers, CSF (cerebrospinal fluid) analysis, and imaging techniques are among the most common methods for identifying neurological biomarkers.

- Innovation in this field is fueled by funding, policy, and training initiatives, as well as the increasing impact of neurological disorders on global health and healthcare systems. Neurological biomarkers are also essential for the development of new treatments and therapies, and for supporting the recovery and rehabilitation of brain injury patients. The utilization of digital biomarkers and blood-based biomarkers, in particular, has gained significant attention due to their accessibility, ease of collection, and potential for rapid testing. The market is expected to continue growing as research advances and the importance of early diagnosis and effective treatment becomes increasingly recognized.

How is this Neurological Biomarkers Industry segmented and which is the largest segment?

The neurological biomarkers industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Hospitals

- Clinical diagnostic centers

- Research organizations and others

- Indication

- AD

- PD

- ASD

- MS

- Others

- Type

- Genomic

- Proteomic

- Metabolomic

- Imaging

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- France

- Asia

- China

- Rest of World (ROW)

- North America

By End-user Insights

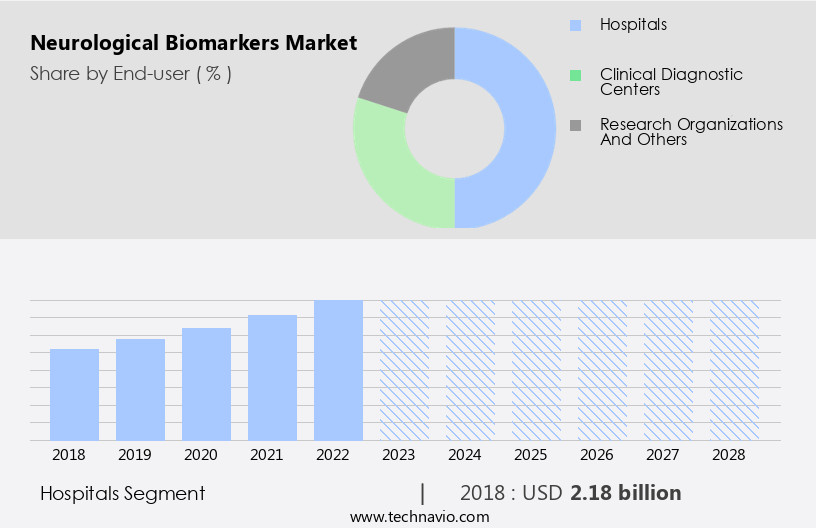

The hospitals segment is estimated to witness significant growth during the forecast period. Neurological biomarkers play a crucial role In the diagnosis, detection, and treatment of various neurological disorders, including major depressive disorder, sleep biomarkers for stroke and dementia, neurofilament light protein (NfL) for sports-related concussion, and protein tau181 for neurodegenerative diseases. Biomarkers are identified through techniques such as immunoblotting, antigen-antibody binding, and gene expression analysis in cerebrospinal fluid and brain imaging. Neurological biomarkers are essential in clinical research for the development of therapeutic targets and predictive biomarkers for disorders such as brain aging, traumatic brain injury, autism, brain tumors, and cardiovascular illnesses. Neurological biomarkers aid In the identification of genetic flaws and metabolic illnesses, providing valuable insights into the biological processes underlying these ailments.

Furthermore, hospitals, particularly large multispecialty hospitals and hospital groups, are the primary end-users of neurological biomarkers due to the high number of hospital admissions for neurological disorders. Medium-sized hospitals often require outsourced medical equipment and laboratory testing support for their healthcare services, further increasing the demand for neurological biomarkers.

Get a glance at the share of various segments. Request Free Sample

The hospitals segment was valued at USD 2.18 billion in 2018 and showed a gradual increase during the forecast period.

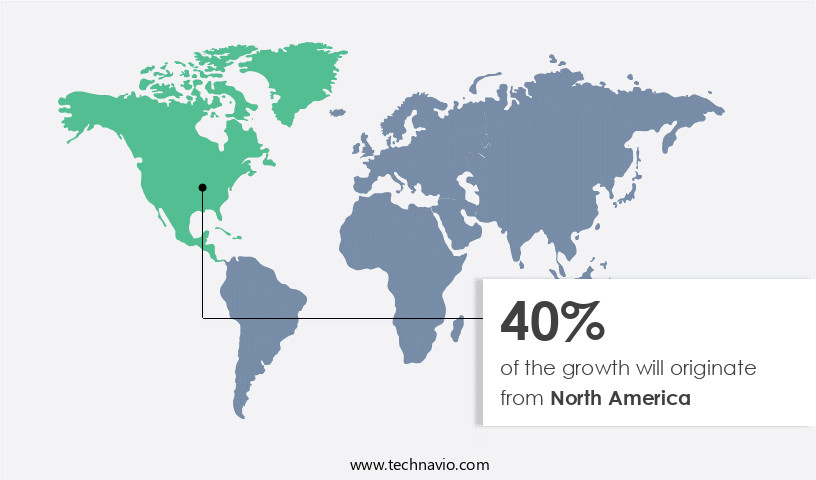

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Neurological biomarkers play a pivotal role In the diagnosis and treatment of various neurological disorders, including major depressive disorder, sleep biomarkers for stroke and dementia, neurofilament light protein (NfL) for sports-related concussion, and p-tau181 for neurodegenerative diseases. Biomarkers such as NfL and p-tau181 can be detected through spinal fluid tests, brain imaging, and gene expression analysis. Neurological biomarkers are also used In the investigation of brain aging, traumatic brain injury, autism, brain tumors, and cardiovascular illnesses. Techniques such as immunoblotting and antigen-antibody binding are employed for the detection of these biomarkers. The identification of genetic flaws through the human genome project and in-vitro investigation are crucial for therapeutic target development and predictive biomarkers.

Furthermore, the high prevalence of neurological disorders, the growing aging population, and healthcare expenditure on the treatment of neurological diseases, coupled with favorable reimbursement policies for neuro-diagnostic procedures, are expected to fuel market growth during the forecast period. Consequently, the development of neurological biomarkers and cardiac biomarkers has emerged as a promising solution. Neurological biomarkers are essential for clinical research and the development of new treatments for various neurological ailments.

Market Dynamics

Our neurological biomarkers market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Neurological Biomarkers Industry?

The rising incidence of neurological disorders is the key driver of the market.

- Neurological disorders, such as major depressive disorder, sleep biomarkers, traumatic brain injury including sports-related concussion, dementia, neurodegenerative diseases, autism, and brain tumors, pose significant health challenges. These disorders can lead to disabilities, impairments, and even death. Neurofilament Light Protein (NfL) and p-tau181 are emerging biomarkers used for detection and diagnosis of neurological disorders. Spinal fluid tests using immunoblotting and antigen-antibody binding techniques are utilized for NfL and p-tau181 measurement. Brain aging, metabolic illnesses, and genetic flaws are among the biological processes involved in neurological disorders. Clinical research focuses on the treatment of these disorders through therapeutic target development, predictive biomarkers, and gene expression studies.

- Neurofilament proteins, such as NfL, are valuable in understanding the biological mechanisms of neurological disorders. Real-time PCR and gene identification are essential in-vitro investigation techniques. Neurological disorders, including brain damage from disorders like stroke and brain imaging findings, can be indicative of various neurological ailments. Biomarkers play a crucial role in diagnosing and monitoring the progression of neurological disorders, enabling effective treatment strategies.

What are the market trends shaping the Neurological Biomarkers Industry?

Increasing focus on accurate neurological diagnostics is the upcoming market trend.

- Neurological disorders, including major depressive disorder, sleep biomarkers for various conditions, stroke, dementia, and traumatic brain injuries such as sports-related concussions, pose significant challenges in accurate detection and diagnosis. Traditional methods like brain imaging and spinal fluid tests using immunoblotting and antigen-antibody binding techniques have limitations. For instance, brain imaging may not provide clear results In the early stages of brain damage, while spinal fluid tests can be invasive and time-consuming. To address these challenges, researchers are focusing on identifying neurofilament proteins, such as Neurofilament Light Protein (NfL) and ptau181, as potential biomarkers. These proteins are released into the bloodstream during neurodegenerative processes and can be detected through real-time PCR and other metabolic assays like P450 inhibition assays.

- The identification of these biomarkers can lead to the development of predictive biomarkers for various neurological disorders, including brain aging, neurodegenerative diseases, and cardiovascular illnesses. Furthermore, understanding the underlying biological processes of these disorders can pave the way for the treatment of ailments and the development of therapeutic targets. Gene expression studies and in-vitro investigations are also crucial In the identification of genetic flaws associated with neurological disorders. These findings can provide valuable insights into the disease mechanisms and aid In the development of targeted therapies.

What challenges does the Neurological Biomarkers Industry face during its growth?

Unmet market needs for effective validation of biomarkers is a key challenge affecting the industry growth.

- Neurological biomarkers have gained significant attention in clinical research due to their potential role In the detection and treatment of various neurological disorders, including major depressive disorder, sleep biomarkers for stroke and dementia, traumatic brain injury from sports-related concussion, neurodegenerative diseases such as autism and brain tumors, and brain aging. Biomarkers like Neurofilament Light Protein (NfL) and p-tau181 are commonly used in spinal fluid tests for diagnosing these conditions. However, the validation of these biomarkers faces challenges, such as the need for convincing clinical and financial advantages, reproduction of positive clinical trial results, lack of early pre-analytical examinations, absence of autonomous result checks, and uncertainty about whether their use would improve clinical practice for neuro patients.

- Fluid-based proteomics, a promising approach for early detection, remains costly and requires innovative techniques for unlocking its full potential. Neurofilament proteins, gene expression, and metabolic changes are among the biological processes under investigation for developing predictive biomarkers. In-vitro investigation and gene identification play crucial roles In therapeutic target development. Despite these challenges, neurological biomarkers hold immense potential for improving the diagnosis and treatment of various neurological ailments.

Exclusive Customer Landscape

The neurological biomarkers market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the neurological biomarkers market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, neurological biomarkers market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- ACROBIOSYSTEMS INC.

- Advanced Brain Monitoring Inc.

- Alseres Pharmaceuticals Inc

- Bio Rad Laboratories Inc.

- bioMerieux SA

- Charles River Laboratories International Inc.

- EATRIS ERIC

- Eli Lilly and Co.

- Enzo Biochem Inc.

- F. Hoffmann La Roche Ltd.

- Fujirebio Holdings Inc.

- IQVIA Holdings Inc.

- Merck KGaA

- Metabolon Inc.

- PerkinElmer Inc

- Proteome Sciences plc

- QIAGEN NV

- Quanterix Corp.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Neurological biomarkers have emerged as crucial indicators of various neurological disorders and conditions, providing valuable insights into the biological processes underlying these ailments. These markers offer an objective and quantifiable means of detecting and monitoring neurological disorders, enabling more effective diagnosis and treatment. Neurofilament light protein (NFL) is one of the most extensively studied neurological biomarkers. NFL is a neuronal protein that is released into the cerebrospinal fluid (CSF) and blood following injury or damage to nerve axons. Elevated levels of NFL have been associated with major depressive disorder, sleep biomarkers, stroke, dementia, traumatic brain injury, sports-related concussion, brain aging, and neurodegenerative diseases.

Another promising area of research is the use of biomarkers for the detection of brain tumors. Ptau181, a tau protein isoform, has been identified as a potential biomarker for glioblastoma, the most common and aggressive primary brain tumor. Spinal fluid tests using immunoblotting and antigen-antibody binding techniques have been employed to detect Ptau181 in patients with glioblastoma. Biomarkers also play a crucial role In the diagnosis and monitoring of metabolic and cardiovascular illnesses. For instance, P450 inhibition assays have been used to identify genetic flaws In the metabolism of certain drugs, which can lead to adverse reactions and cardiovascular complications.

Moreover, real-time PCR (polymerase chain reaction) and gene expression analysis have been employed in clinical research to identify the underlying genetic causes of various neurological disorders. The use of neurological biomarkers In the treatment of disorders is an active area of research. For example, biomarkers can be used to identify therapeutic targets for the development of new treatments for neurological conditions. Predictive biomarkers can also be used to identify individuals at risk of developing certain neurological disorders, enabling early intervention and prevention. Immunological biomarkers have also gained significant attention In the field of neurology. For instance, the identification of specific antibodies In the CSF has been used to diagnose autoimmune disorders such as multiple sclerosis and Guillain-Barré syndrome.

|

Neurological Biomarkers Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

175 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 13.01% |

|

Market Growth 2024-2028 |

USD 7.82 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

12.2 |

|

Key countries |

US, Germany, UK, France, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Neurological Biomarkers Market Research and Growth Report?

- CAGR of the industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the market growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements.