NGS-Based Rna-Seq Market Size 2024-2028

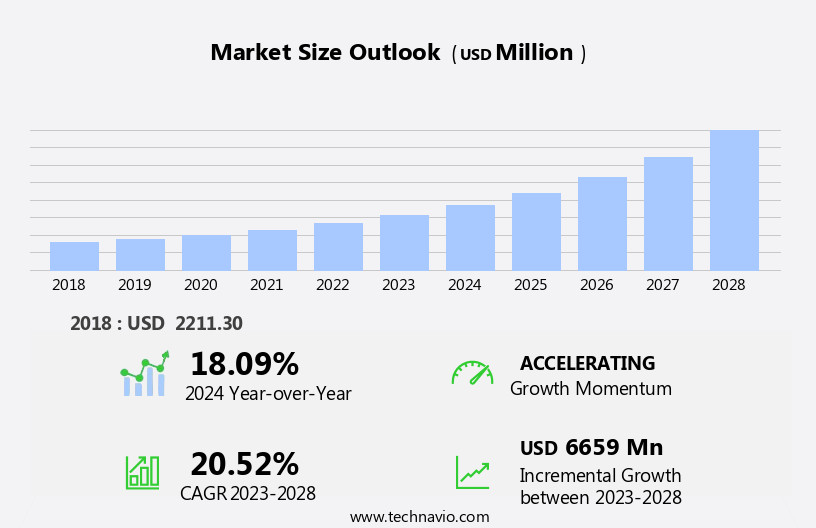

The NGS-based RNA-seq market size is forecast to increase by USD 6.66 billion, at a CAGR of 20.52% between 2023 and 2028.

- The market is witnessing significant growth, driven by the increased adoption of next-generation sequencing (NGS) methods for RNA-Seq analysis. The advanced capabilities of NGS techniques, such as high-throughput, cost-effectiveness, and improved accuracy, have made them the preferred choice for researchers and clinicians in various fields, including genomics, transcriptomics, and personalized medicine. However, the market faces challenges, primarily from the lack of clinical validation on direct-to-consumer genetic tests. As the use of NGS technology in consumer applications expands, ensuring the accuracy and reliability of results becomes crucial.

- The absence of standardized protocols and regulatory oversight in this area poses a significant challenge to market growth and trust. Companies seeking to capitalize on market opportunities must focus on addressing these challenges through collaborations, partnerships, and investments in research and development to ensure the clinical validity and reliability of their NGS-based RNA-Seq offerings.

What will be the Size of the NGS-based RNA-Seq market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, driven by advancements in NGS technology and its applications across various sectors. Spatial transcriptomics, a novel approach to studying gene expression in its spatial context, is gaining traction in disease research and precision medicine. Splice junction detection, a critical component of RNA-seq data analysis, enhances the accuracy of gene expression profiling and differential gene expression studies. Cloud computing plays a pivotal role in handling the massive amounts of data generated by NGS platforms, enabling real-time data analysis and storage. Enrichment analysis, gene ontology, and pathway analysis facilitate the interpretation of RNA-seq data, while data normalization and quality control ensure the reliability of results.

Precision medicine and personalized therapy are key applications of RNA-seq, with single-cell RNA-seq offering unprecedented insights into the complexities of gene expression at the single-cell level. Read alignment and variant calling are essential steps in RNA-seq data analysis, while bioinformatics pipelines and RNA-seq software streamline the process. NGS technology is revolutionizing drug discovery by enabling the identification of biomarkers and gene fusion detection in various diseases, including cancer and neurological disorders. RNA-seq is also finding applications in infectious diseases, microbiome analysis, environmental monitoring, agricultural genomics, and forensic science. Sequencing costs are decreasing, making RNA-seq more accessible to researchers and clinicians.

The ongoing development of sequencing platforms, library preparation, and sample preparation kits continues to drive innovation in the field. The dynamic nature of the market ensures that it remains a vibrant and evolving field, with ongoing research and development in areas such as data visualization, clinical trials, and sequencing depth.

How is this NGS-based RNA-Seq industry segmented?

The NGS-based RNA-seq industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Acamedic and research centers

- Clinical research

- Pharma companies

- Hospitals

- Technology

- Sequencing by synthesis

- Ion semiconductor sequencing

- Single-molecule real-time sequencing

- Others

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Singapore

- Rest of World (ROW)

- North America

.

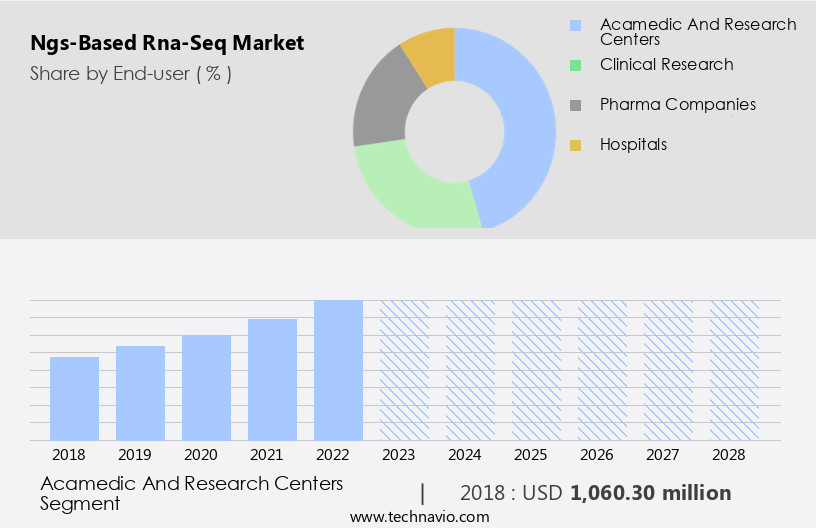

By End-user Insights

The acamedic and research centers segment is estimated to witness significant growth during the forecast period.

The global next-generation sequencing (NGS) market for RNA sequencing (RNA-Seq) is primarily driven by academic and research institutions, including those from universities, research institutes, government entities, biotechnology organizations, and pharmaceutical companies. These institutions utilize NGS technology for various research applications, such as whole-genome sequencing, epigenetics, and emerging fields like agrigenomics and animal research, to enhance crop yield and nutritional composition. NGS-based RNA-Seq plays a pivotal role in translational research, with significant investments from both private and public organizations fueling its growth. The technology is instrumental in disease research, enabling the identification of novel biomarkers and gene mutations, and contributing to drug discovery.

In the realm of precision medicine, NGS-based RNA-Seq facilitates personalized therapy development, while single-cell RNA-Seq offers insights into complex cellular processes. Cloud computing and bioinformatics pipelines have revolutionized RNA-Seq data analysis, making it more accessible and efficient. Enrichment analysis, gene ontology, and pathway analysis are essential tools in interpreting RNA-Seq data, while quality control, read alignment, and data normalization ensure accurate results. NGS platforms, such as Oxford Nanopore Technologies, offer unique advantages in long-read sequencing, enabling the detection of splice junctions, gene fusion, and isoform analysis. RNA-Seq is also making strides in clinical trials, forensic science, and infectious diseases research.

Neurological disorders and cancer research are significant areas of focus, with RNA-Seq providing valuable insights into the underlying mechanisms of these conditions. Microbiome analysis and gene expression profiling contribute to a better understanding of various biological processes and their role in health and disease. In summary, The market is experiencing significant growth, driven by the research sector's increasing adoption of the technology for various applications. From disease research and drug discovery to agrigenomics and environmental monitoring, NGS-based RNA-Seq is transforming the way we understand biological processes and develop innovative solutions.

The Acamedic and research centers segment was valued at USD 1.06 billion in 2018 and showed a gradual increase during the forecast period.

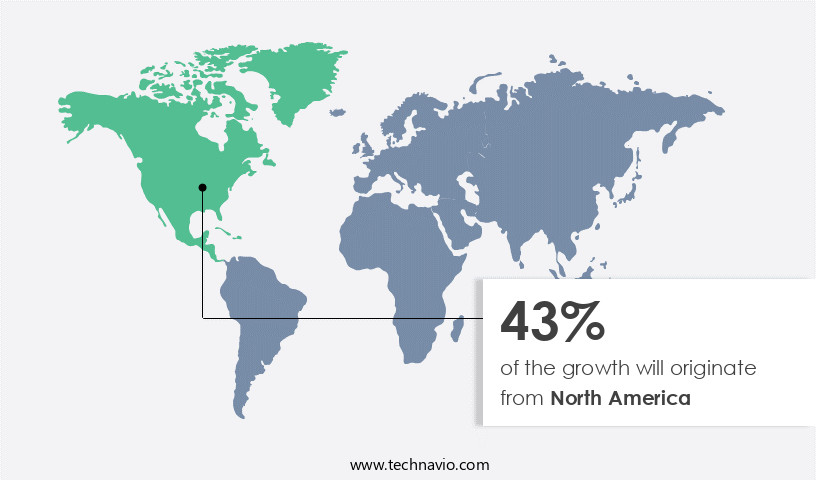

Regional Analysis

North America is estimated to contribute 43% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

Next-generation sequencing (NGS) technology, a game-changer in gene expression profiling, is experiencing significant growth in the US market. With North America leading global revenue contributions in 2023, the US, in particular, is at the forefront of this advancement. The decreasing costs of genome sequencing, a crucial step in gene expression studies, have fueled the demand for early disease diagnosis, especially in cancer research. Major players like Illumina, Thermo Fisher Scientific, and PerkinElmer, based in the US, are driving market growth through their innovative solutions and participation in genome mapping programs. The US market's focus on gene therapy and personalized medicine initiatives further boosts NGS adoption.

Single-cell RNA sequencing, an advanced application of NGS, is revolutionizing research in neurological disorders, cancer, and infectious diseases. Cloud computing and bioinformatics pipelines facilitate data storage, analysis, and visualization, ensuring efficient processing of RNA-seq data. Enrichment analysis, splice junction detection, and pathway analysis are essential components of RNA-seq data analysis, providing valuable insights into gene function and disease mechanisms. Oxford Nanopore Technologies' portable sequencing platforms and Thermo Fisher Scientific's library preparation kits have streamlined sample preparation processes, making NGS more accessible to researchers. The integration of NGS with drug discovery, forensic science, environmental monitoring, and agricultural genomics broadens its applications.

The market's future lies in addressing challenges such as data normalization, read alignment, variant calling, and quality control, which are being addressed by advanced RNA-seq software and bioinformatics tools. The potential of NGS in identifying biomarkers and gene fusions, as well as understanding alternative splicing, holds immense promise for clinical trials and precision medicine. As research applications continue to expand, NGS is poised to revolutionize various industries, ultimately contributing to a more comprehensive understanding of biological systems and advancing scientific discovery.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Ngs-Based Rna-Seq Industry?

- The significant rise in the implementation of next-generation sequencing techniques is the primary catalyst fueling market growth.

- Next-generation sequencing (NGS) technology has experienced significant growth in recent years, driven by advancements in bioinformatics pipelines and RNA-seq software. This technology, which enables the sequencing of millions of DNA fragments in parallel, has revolutionized various research applications, including transcriptome analysis, biomarker identification, alternative splicing, environmental monitoring, and agricultural genomics. Illumina and Roche are among the market leaders, offering cost-effective and efficient NGS solutions. The creation of extensive human genome databases has facilitated rapid diagnostic services, allowing for the identification of mutations and disorders in human gene sequences.

- The reduction in cost and time has attracted numerous service providers, increasing competition and driving innovation in the field. NGS technology's potential to provide comprehensive insights into gene structure, function, and organization has made it an essential tool for scientific discovery and innovation.

What are the market trends shaping the NGS-based RNA-Seq industry?

- Next-generation sequencing techniques are experiencing significant advances, making them the current market trend in the scientific community. This technological progression offers increased efficiency, accuracy, and cost-effectiveness in genetic analysis.

- Next-generation sequencing (NGS) technology, driven by the Human Genome Project (HGP), has revolutionized the field of genomics. This advanced technology has found extensive applications in clinical environments, including disease research and precision medicine. NGS enables the analysis of spatial transcriptomics, splice junction detection, and single-cell RNA-seq, providing insights into disease mechanisms and personalized therapy. Technological innovations have significantly reduced the cost of NGS, making it accessible to various research institutions and laboratories. Enrichment analysis, gene ontology, and read alignment are crucial components of NGS data analysis. Cloud computing facilitates efficient data storage and processing, ensuring quick turnaround times for researchers.

- Precision medicine, a burgeoning field, relies heavily on NGS technology for accurate diagnosis and treatment plans. Disease research benefits from NGS by providing insights into genetic variations causing disorders. In conclusion, NGS technology's impact on genomics is profound, with applications ranging from basic research to clinical settings. Its ability to provide comprehensive genetic information at an affordable cost makes it an essential tool for understanding the complexities of the human genome.

What challenges does the NGS-based RNA-Seq industry face during its growth?

- The lack of clinical validation poses a significant challenge to the growth of the direct-to-consumer genetic testing industry. This issue, which refers to the absence of rigorous scientific testing and validation by healthcare professionals, casts doubt on the accuracy and reliability of these tests, thereby hindering consumer trust and industry expansion.

- The market is experiencing significant growth due to its application in various fields, including drug discovery, gene expression profiling, and clinical trials. RNA-Seq data analysis plays a crucial role in identifying differential gene expression, which is essential for understanding disease mechanisms and developing new therapeutics. However, data normalization and quality control are essential steps in ensuring the accuracy and reliability of RNA-Seq data. Sequencing costs have been decreasing, making this technology more accessible to researchers and institutions. Oxford Nanopore Technologies' portable sequencing devices have further expanded the reach of RNA-Seq, enabling real-time analysis in various settings.

- Data visualization tools facilitate the interpretation of complex RNA-Seq data, making it easier for researchers to identify patterns and trends. Despite the advancements in RNA-Seq technology, challenges remain, such as ensuring data integrity and accuracy through rigorous quality control measures. Clinical trials require stringent data validation to ensure the reliability of RNA-Seq data for diagnostic and therapeutic applications. In forensic science, RNA-Seq is used for identifying genetic material, but data interpretation requires expertise and collaboration with forensic scientists and geneticists. In conclusion, the market is poised for continued growth due to its applications in drug discovery, gene expression profiling, and clinical trials.

- However, challenges related to data normalization, quality control, and data interpretation must be addressed to ensure the accuracy and reliability of RNA-Seq data. The integration of advanced data analysis tools and collaboration between experts in various fields will help overcome these challenges and unlock the full potential of RNA-Seq technology. Recent research has shown promising results in using RNA-Seq for disease diagnosis and prognosis, further emphasizing its importance in the healthcare industry.

Exclusive Customer Landscape

The NGS-based RNA-seq market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the NGS-based RNA-seq market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, NGS-based RNA-seq market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Agilent Technologies Inc. - The company specializes in next-generation sequencing (NGS) for RNA, providing advanced solutions such as Strand-Specific RNA Library Preparation for Whole-Transcriptome Sequencing via the SureSelect method.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Agilent Technologies Inc.

- Azenta Inc.

- BGI Genomics Co. Ltd.

- DNASTAR Inc.

- Eurofins Scientific SE

- F. Hoffmann La Roche Ltd.

- Hamilton Co.

- Illumina Inc.

- Pacific Biosciences of California Inc.

- Perkin Elmer Inc.

- PierianDx Inc.

- Precigen Inc.

- Psomagen Inc.

- QIAGEN NV

- Takara Bio Inc.

- Tecan Trading AG

- Thermo Fisher Scientific Inc.

- Zymo Research Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in NGS-Based RNA-Seq Market

- In February 2023, Illumina, a leading genomics company, introduced the Nova-Seq S4 System, which promises to deliver ultra-fast and cost-effective RNA sequencing (RNA-Seq) solutions, enabling researchers to generate high-quality data for large-scale transcriptomic studies (Illumina Press Release).

- In May 2024, Thermo Fisher Scientific and Google Cloud announced a strategic partnership to integrate Google Cloud's analytics capabilities with Thermo Fisher's NGS-based RNA-Seq solutions. This collaboration aims to accelerate genomic data analysis and facilitate faster discovery in the life sciences sector (Thermo Fisher Scientific Press Release).

- In October 2024, Qiagen and Genomics England signed a multi-year agreement to provide NGS-based RNA-Seq services for the UK National Health Service (NHS) Genomic Medicine Service. This partnership will help expand access to advanced RNA sequencing technologies for diagnosing and treating genetic diseases (Qiagen Press Release).

- In March 2025, Oxford Nanopore Technologies, a pioneer in long-read sequencing, secured a strategic investment of USD 175 million from Sequoia Capital China. The funding will support the development of new products and services in the market, strengthening Oxford Nanopore's position as a key player (Oxford Nanopore Technologies Press Release).

Research Analyst Overview

- In the market, advanced bioinformatic tools play a crucial role in facilitating data analysis. Coverage analysis and sequence alignment are essential steps in the RNA-seq workflow, ensuring accurate read mapping and data interpretation. The false discovery rate is a significant concern in differential expression analysis, necessitating stringent statistical analysis and quality score assessment. Microarray data continues to be a comparative benchmark, yet RNA-seq offers improved sensitivity and resolution. Gene interaction, fold change, and functional annotation are critical elements in data mining, enabling systems biology insights. Machine learning algorithms and network analysis further enhance the understanding of gene expression regulation.

- DNA methylation, chromatin accessibility, protein expression, and transcription factors are essential epigenetic and regulatory features that RNA-seq can address. Pathway enrichment and gene sets provide valuable context to gene expression data, while read counts and gene sets enable comparative analysis across samples. The RNA-seq market is evolving, with a growing emphasis on integrative analysis and data-driven insights. The application of RNA-seq in various fields, from oncology to neuroscience, underscores its transformative potential. As the market matures, the focus shifts towards improving data analysis pipelines, enhancing data interpretation, and refining machine learning algorithms to unlock the full potential of RNA-seq data.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Ngs-Based Rna-Seq Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

169 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 20.52% |

|

Market growth 2024-2028 |

USD 6659 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

18.09 |

|

Key countries |

US, UK, Germany, Singapore, and China |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Ngs-Based Rna-Seq Market Research and Growth Report?

- CAGR of the Ngs-Based Rna-Seq industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the ngs-based rna-seq market growth of industry companies

We can help! Our analysts can customize this ngs-based rna-seq market research report to meet your requirements.