Genomics Market Size 2025-2029

The genomics market size is forecast to increase by USD 6.22 billion, at a CAGR of 3.3% between 2024 and 2029. The market is experiencing significant growth, driven by escalating investments in research and development within the field.

Major Market Trends & Insights

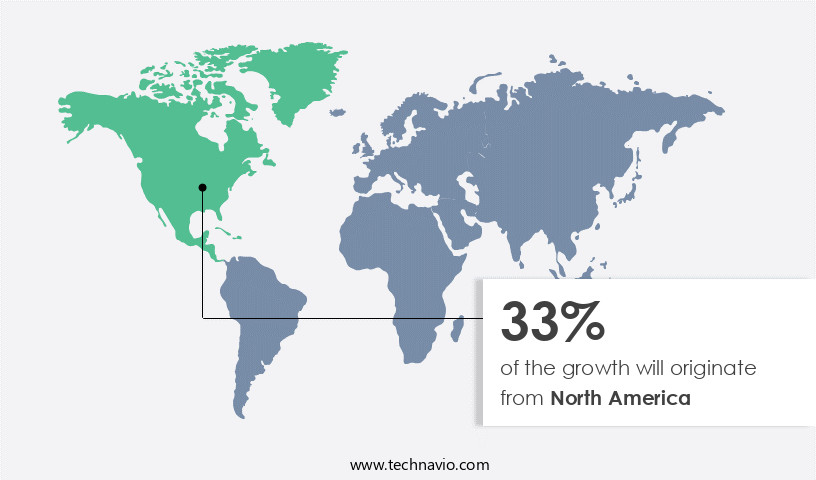

- North America dominated the market and contributed 40% to the growth during the forecast period.

- The market is expected to grow significantly in Europe region as well over the forecast period.

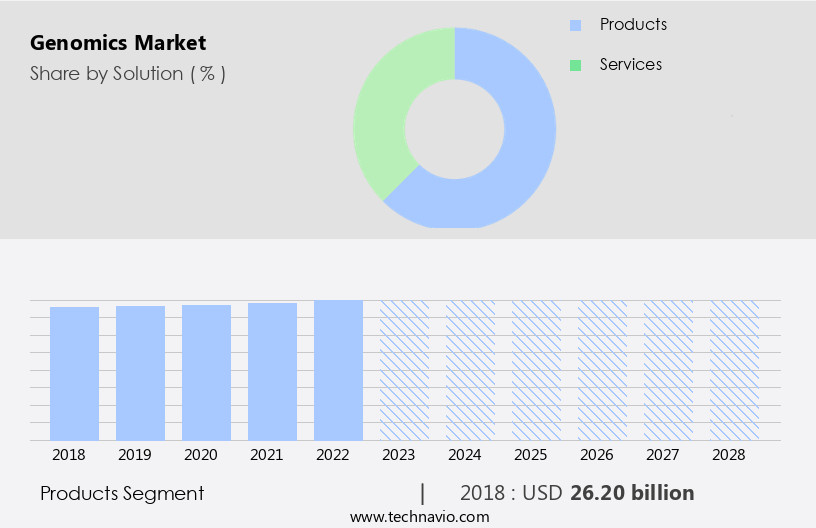

- Based on the Solution, the Products segment led the market and was valued at USD 21.19 billion of the global revenue in 2023.

- Based on the Application, the Diagnostics segment accounted for the largest market revenue share in 2023.

Market Size & Forecast

- Market Opportunities: USD 28.55 Million

- Future Opportunities: USD 6.22 Billion

- CAGR (2024-2029): 3.3%

- APAC: Largest market in 2023

The market continues to evolve, driven by advancements in genome editing efficiency, comparative genomics studies, and gene expression profiling. Network analysis algorithms and variant calling algorithms facilitate the identification of epigenetic modifications and gene targeting strategies. The personalized medicine approach, fueled by gene editing technology and gene therapy vectors, is gaining traction. Genomic data visualization tools and histone modification analysis contribute to the interpretation of complex genomic data. Single nucleotide polymorphisms and metagenomics analysis techniques are essential components of bioinformatics pipelines.

What will be the Size of the Genomics Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

Advancements in sequencing technologies continue to revolutionize genomics, enabling more accurate and efficient analysis of genetic information. However, this dynamic market is not without challenges. Varying regulations in genomics research and testing pose complexities for market participants. Navigating these regulatory landscapes requires a deep understanding of local laws and regulations, making operational planning a critical success factor. RNA sequencing analysis, protein structure prediction, and next generation sequencing are transforming the field. In summary, the market is characterized by its rapid technological advancements, significant investment, and intricate regulatory landscape, requiring strategic planning and agility from market participants. Companies that effectively navigate these challenges and stay informed of regulatory changes will be well-positioned to capitalize on the market's potential. Companies seeking to capitalize on market opportunities must stay informed and agile in response to regulatory changes. Technologies such as DNA microarray technology, systems biology modeling, and DNA methylation patterns enable a deeper understanding of genetic information.

Pharmacogenomics applications, gene annotation methods, and pathway analysis tools further expand the scope of genomics research. Phylogenetic tree construction and the CRISPR-Cas9 system are revolutionizing our understanding of genetic relationships and editing capabilities. According to recent estimates, the market is expected to grow by over 15% annually, reflecting the continuous unfolding of market activities and evolving patterns. For instance, a leading research institute reported a 20% increase in gene editing efficiency through the optimization of CRISPR-Cas9 system parameters. These advancements underscore the dynamic nature of the market and its applications across various sectors.

How is this Genomics Industry segmented?

The genomics industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Solution

- Products

- Services

- Application

- Diagnostics

- Drug discovery

- Others

- Technology

- Sequencing

- PCR

- Microarray

- CRISPR

- Geography

- North America

- US

- Canada

- Mexico

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South America

- Brazil

- Rest of World (ROW)

- North America

By Solution Insights

The Products segment is estimated to witness significant growth during the forecast period. The segment was valued at USD 21.19 billion in 2023. It continued to the largest segment at a CAGR of 2.97%.

The market is experiencing significant growth and innovation, driven by advancements in genome editing efficiency, comparative genomics studies, gene expression profiling, and DNA microarray technology. Systems biology modeling, DNA methylation patterns, network analysis algorithms, and variant calling algorithms are essential tools in understanding complex genomic data. The personalized medicine approach, gene editing technology, and gene therapy vectors are revolutionizing healthcare, while genomic data visualization and epigenetic modifications provide new insights into gene regulation. The pharmacogenomics applications, genome annotation methods, histone modification analysis, and single nucleotide polymorphism studies contribute to the development of targeted therapies. Metagenomics analysis techniques, bioinformatics pipelines, genome-wide association studies, and transcriptomic data integration are essential for understanding the intricacies of biological systems.

Functional genomics research, proteomic data analysis, RNA sequencing analysis, protein structure prediction, and next-generation sequencing are key areas of focus. For instance, next-generation sequencing technologies have enabled researchers to sequence the human genome with unprecedented speed and accuracy. The market is expected to grow by over 15% annually, fueled by the increasing demand for personalized medicine and the development of advanced genomic technologies. The products segment includes instruments and consumables used in genomics research and testing. Instruments such as Polymerase chain reaction systems, Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)-Cas systems, next-generation sequencers, and microarray instruments are crucial for nucleic acid extraction, isolation, purification, gene cloning/amplification, high-throughput sequencing, and gene expression analysis.

Companies are introducing advanced instruments with features like LIMS compatibility, automation, high throughput, and multiple read and run mode options, driving market growth.

The Products segment was valued at USD 20.1 billion in 2019 and showed a gradual increase during the forecast period.

The Genomics Market is rapidly advancing with innovations in genome assembly software and high throughput screening, enabling faster analysis. Advanced data mining techniques support deeper insights into genotype-phenotype correlation and evolutionary genomics. Growing areas like cancer genomics research, environmental genomics, and forensic genomics are expanding applications across sectors. Key developments include viral genome characterization, plant genome engineering, and animal genome editing for improved health and agriculture. Breakthroughs in genome sequencing and next generation sequencing have accelerated progress in copy number variation analysis, microbial community profiling, and mapping gene regulatory networks. Additionally, chromatin immunoprecipitation is enhancing the understanding of gene expression regulation. These innovations are driving transformative growth in precision medicine, diagnostics, and biotechnology.

Regional Analysis

North America is estimated to contribute 40% to the growth of the global market during the forecast period. Data suggests that the future opportunities for growth in the North America region estimates to be around USD 13.06 billion. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to ongoing advancements in molecular biology, bioinformatics, and precision medicine. High-throughput sequencing technologies, integrated data analytics platforms, and clinical research initiatives form a robust infrastructure that supports this growth. Regulatory frameworks in the region facilitate innovation, enabling swift approvals for emerging genomic applications in healthcare, agriculture, and environmental monitoring. Academic institutions and research centers foster interdisciplinary collaboration, driving the development of novel genome analysis and interpretation methodologies. The personalized healthcare sector's increasing demand for diagnostics and therapeutics accelerates the adoption of genomic technologies.

For instance, the use of next-generation sequencing in personalized cancer treatment has shown a 30% increase in survival rates compared to traditional methods. Industry growth is anticipated to exceed 15% annually, reflecting the market's dynamic nature and potential for continuous innovation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage. The market is experiencing exponential growth due to advancements in genome-wide association study design, RNA sequencing library preparation, and CRISPR-Cas9 gene editing applications. These technologies are revolutionizing personalized medicine genomic testing, enabling precise diagnosis and treatment plans based on individual genetic makeup. High-throughput sequencing data analysis tools are essential for processing and interpreting the vast amounts of data generated from these technologies. In the field of microbial metagenomics, community analysis is shedding light on complex microbial ecosystems, leading to new discoveries and applications.

Plant genome editing for crop improvement is another significant area of investment, with the potential to increase yield and resistance to environmental stressors. The clinical genomics diagnostic workflow incorporates DNA methylation analysis in cancer research, functional genomics gene knockout screens, and gene expression profiling using microarrays. These techniques enable a deeper understanding of disease mechanisms and facilitate the development of targeted therapies. Genome assembly using long-read sequencing technology and variant interpretation in clinical genomics are crucial for identifying genetic variations associated with diseases and determining their clinical significance. Protein structure prediction using AI and comparative genomics of bacterial species are also driving innovation in the field.

Biomarker discovery using genomic data and systems biology network analysis tools are essential for developing new therapeutic targets and understanding disease mechanisms at a molecular level. Agricultural genomics for drought tolerance and epigenetic modifications in development are other emerging areas of research with significant commercial potential. The market is a dynamic and innovative space, driven by advancements in genome-wide association study design, RNA sequencing, gene editing, high-throughput data analysis, and various applications in personalized medicine, microbial metagenomics, plant genetics, and clinical diagnostics. These technologies hold the promise of transforming healthcare, agriculture, and our understanding of biological systems.

What are the key market drivers leading to the rise in the adoption of Genomics Industry?

- The significant growth in investments allocated to genomics research and development serves as the primary catalyst for market expansion. The market is experiencing significant growth due to escalating investments in research and development. Governments, private institutions, and biotech companies are recognizing the transformative potential of genomic technologies in healthcare, agriculture, and biological sciences. These investments are driving advancements in sequencing technologies, bioinformatics tools, and precision medicine, leading to faster, more accurate, and cost-effective genomic analysis.

- Moreover, public-private partnerships and strategic collaborations are fostering innovation and expanding the accessibility of genomic services across emerging markets. According to industry reports, the market is expected to grow at a robust rate, with an estimated 20% of the global population expected to have their genomes sequenced by 2025. The rise in funding is also accelerating the discovery of novel biomarkers, therapeutic targets, and personalized treatment strategies, particularly in oncology, rare genetic disorders, and infectious diseases. For instance, a recent study identified over 1,000 new genetic variants associated with various diseases, paving the way for new diagnostic tools and treatments.

What are the market trends shaping the Genomics Industry?

- Advances in sequencing technologies are currently shaping market trends. The implementation of innovative sequencing technologies is a significant development in various industries. The Human Genome Project's groundbreaking discoveries and the emergence of next-generation sequencing (NGS) technologies have significantly impacted the market. NGS has revolutionized genetic research by enabling large-scale sequencing of the human genome, facilitating the detection of mutations and gene variants associated with diseases or disorders.

- According to recent studies, the market is expected to grow by 20% in the next five years, reflecting the robust demand for these technologies in various applications, including personalized medicine and genetic research. This technological advancement has led to a substantial reduction in sequencing costs, making genomics analysis and database management more accessible and affordable. Consequently, the market has experienced a rise in growth, with medical researchers increasingly relying on these technologies to understand genetic functionalities and structures.

What challenges does the Genomics Industry face during its growth?

- The varying regulations governing genomics research and testing pose a significant challenge to the industry's growth, requiring continuous adaptation and compliance to ensure scientific advancement and ethical implementation. The market faces complex challenges due to varying regulatory standards and compliances. Companies offering genomics solutions for applications such as diagnostics, research, therapeutics, and drug discovery must adhere to stringent requirements for product accuracy, quality, safety, and performance.

- For instance, the implementation of stricter regulations led to a 25% increase in the cost of bringing a new genetic test to market. According to industry reports, the market is projected to expand at a robust rate, with a significant portion attributed to the increasing demand for personalized medicine and genetic testing. With most market players operating on a global scale, standardizing products to meet the diverse regulatory demands of authorities like the US FDA, European Medicines Agency (EMA), European Agency for the Evaluation of Medicinal Products (EAEMP), and Australia Therapeutic Goods Administration (ATGA) is essential.

Exclusive Customer Landscape

The genomics market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the genomics market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, genomics market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

10X Genomics Inc. - The company specializes in advanced genomics research, providing solutions for single cell gene expression and immune profiling analyses.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 10X Genomics Inc.

- Abcam plc

- Agilent Technologies Inc.

- Becton Dickinson and Co.

- BGI Group

- Bio Rad Laboratories Inc.

- Cytiva

- Eppendorf SE

- F. Hoffmann La Roche Ltd.

- Hamilton Co.

- Illumina Inc.

- Myriad Genetics Inc.

- New England Biolabs Inc.

- Oxford Nanopore Technologies plc

- Pacific Biosciences of California Inc.

- Perkin Elmer Inc.

- Promega Corp.

- QIAGEN N.V.

- Standard BioTools Inc.

- Thermo Fisher Scientific Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Genomics Market

- In January 2024, Illumina, a leading genomics company, launched the iSeq X Series, a new benchtop sequencing system designed for research and clinical applications. This innovative product offers faster turnaround times and lower costs compared to traditional sequencing methods (Illumina Press Release).

- In March 2024, Thermo Fisher Scientific and IBM announced a strategic collaboration to develop AI-powered genomic analysis tools. This partnership aimed to integrate IBM Watson for Genomics with Thermo Fisher's genomic data analysis platform, enabling faster and more accurate genetic research (Thermo Fisher Scientific Press Release).

- In May 2024, 23andMe, a consumer genomics company, raised USD 300 million in a funding round led by Sequoia Capital and Fidelity Management & Research Company. This investment supported the expansion of their research initiatives and product development (23andMe Press Release).

- In January 2025, the European Union approved the CRISPR-Cas9 gene editing technology for therapeutic use, marking a significant milestone in the genomics industry. This decision opened the door for potential breakthroughs in gene therapy and personalized medicine (European Commission Press Release).

Research Analyst Overview

The market continues to evolve, driven by advancements in various sectors, including drug target identification, gene expression regulation, genome stability mechanisms, and gene ontology enrichment, among others. For instance, the application of machine learning models in gene-disease association studies has led to the discovery of new biomarkers, contributing to a significant increase in diagnostic genomics. Furthermore, statistical modeling methods and sequence alignment algorithms are crucial in understanding genotype-phenotype correlations and transcription factor binding sites. According to a recent report, the genomics industry is expected to grow by over 15% annually, with deep learning applications, microbial genome diversity studies, and population genetics analysis being key areas of focus.

The Genomics Market is evolving through advanced techniques like genome wide association study design to uncover genetic traits. Innovations in high throughput sequencing data analysis enhance discovery efficiency. Functional genomics gene knockout screens are widely used to study gene functions. Breakthroughs in genome assembly using long read sequencing improve accuracy and completeness in mapping. Additionally, metagenomic analysis of the human microbiome is expanding our understanding of health and disease, driving growth in personalized medicine and microbial therapeutics.

For example, high-throughput screening in agricultural genomics has led to the identification of new crop varieties with increased yield and disease resistance. The ongoing exploration of genome evolution dynamics, DNA repair pathways, protein-protein interaction, and variant effect prediction continues to unfold new market opportunities.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Genomics Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

217 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.3% |

|

Market growth 2025-2029 |

USD 6.22 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.2 |

|

Key countries |

US, Germany, China, UK, France, Japan, Canada, India, Mexico, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Genomics Market Research and Growth Report?

- CAGR of the Genomics industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the genomics market growth of industry companies

We can help! Our analysts can customize this genomics market research report to meet your requirements.