Genetic Testing Market Size 2025-2029

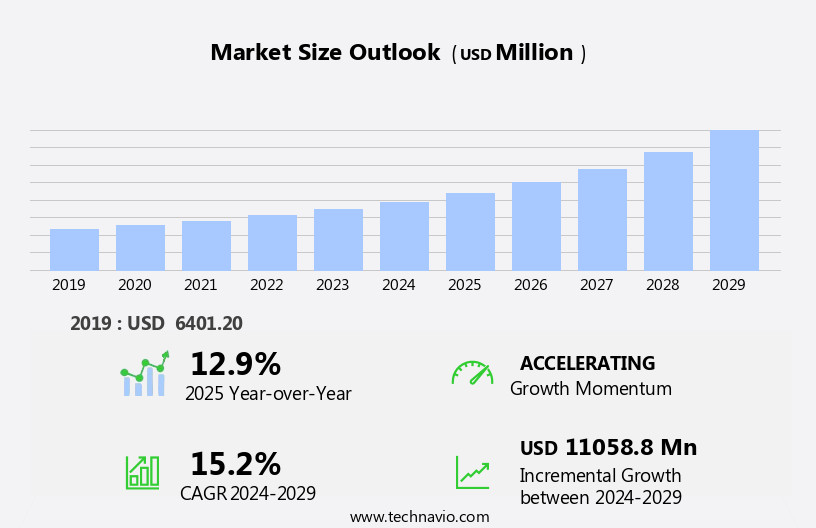

The genetic testing market size is forecast to increase by USD 11.06 billion at a CAGR of 15.2% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the rising prevalence of genetic diseases and disorders worldwide. According to various estimates, genetic disorders affect approximately 1 in 20 people, making it an increasingly pressing health concern. This trend is further fueled by advancements in next-generation sequencing technologies, which have made genetic testing more accessible, affordable, and accurate than ever before. However, the market's growth is not without challenges. Varying regulations on genetic testing and research globally present significant barriers to entry for new players and limit market expansion in certain regions.

- Additionally, the market is witnessing the emergence of consumer awareness, digital health, and artificial intelligence (AI) in genetic testing. Companies seeking to capitalize on market opportunities must navigate these regulatory complexities while staying abreast of technological advancements and evolving consumer preferences. Effective strategic planning and operational agility will be essential for success in this dynamic and rapidly evolving market.

What will be the Size of the Genetic Testing Market during the forecast period?

-

The market in the United States is experiencing significant growth due to the increasing demand for personalized healthcare and advancements in technology. The integration of big data and cloud computing in genetic research is facilitating the analysis of vast amounts of genetic information. Moreover, the market is witnessing a wave in areas such as animal genetics, forensic genetics, and plant genetics. The application of genetic testing in cardiovascular gene panels, neurological gene panels, and cancer gene panels is gaining traction, leading to improved disease diagnosis and treatment.

Genetic diversity, population genomics, and genetic epidemiology are also driving market growth. Technological advancements, such as gene silencing, SNP arrays, gene knockouts, and genome editing, are revolutionizing the field. Ethical guidelines and data privacy regulations are essential considerations in this market, ensuring the protection of individuals' genetic information. Additionally, the market is witnessing the emergence of consumer awareness, digital health, and artificial intelligence (AI) in genetic testing. These trends are transforming the industry, enabling more accessible and accurate genetic testing services.

Furthermore, clinical trials, genetic counseling services, and agricultural biotechnology are crucial components of the market's ecosystem. Market growth and forecasting indicate a trajectory over the coming years, fueled by continuous innovation and expanding applications across various sectors. Comprehensive market analysis and reports highlight the growing investment in research and development, strategic partnerships, and the increasing role of biotechnology in healthcare and agriculture. Market growth and trends suggest a steady rise in demand for advanced genetic solutions, with personalized medicine at the forefront. Overall, the US market is a dynamic and rapidly evolving industry, driven by technological progress, increasing consumer demand, and a growing awareness of the role of genetics in modern science. Its future direction is characterized by innovation, collaboration, and a commitment to ethical guidelines and data privacy.

How is this Genetic Testing Industry segmented?

The genetic testing industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Equipment

- Consumables

- Technology

- Molecular testing

- Cytogenetic testing

- Biochemical testing

- Application

- Cancer diagnosis

- Genetic disease diagnosis

- Cardiovascular disease diagnosis

- Others

- End-user

- Hospitals and clinics

- Diagnostic laboratories and centres

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Asia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

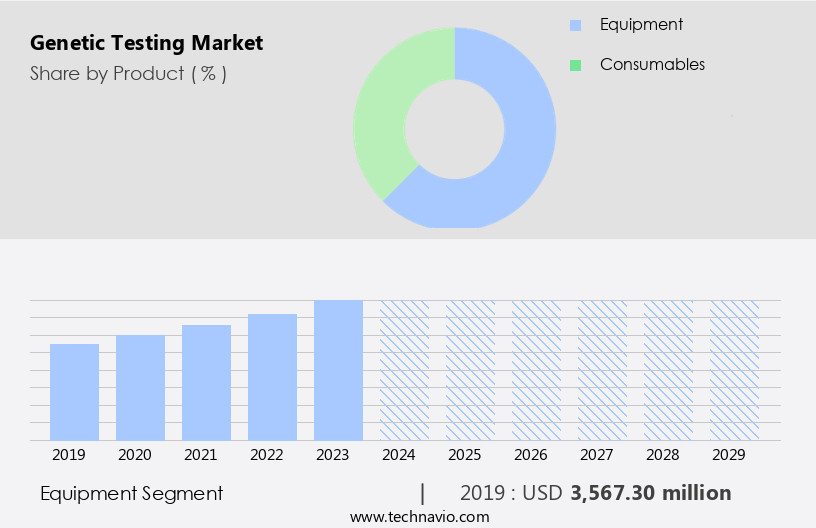

By Product Insights

The equipment segment is estimated to witness significant growth during the forecast period. Genetic testing is a rapidly evolving field that utilizes advanced technologies such as microarray analysis, Genome Sequencing, Exome Sequencing, and liquid biopsy for Disease Risk Assessment, Clinical Interpretation, and Predictive Testing. The market is driven by the increasing demand for Personalized Medicine, precision medicine, and Consumer Adoption. Genetic Engineering, Gene Editing, and Gene Therapy are also significant contributors. The equipment segment includes analyzers, PCR systems, and Next-Generation Sequencing (NGS) machines. The growing workload for high-throughput tests in clinical diagnostic facilities necessitates advanced products like automated analyzers and real-time PCR (RT-PCR) systems. Companies are updating their portfolios with advanced automated analyzers like QIAxcel Advanced System from QIAGEN, ZAG DNA Analyzer Systems from Agilent Technologies, and 3730xl DNA Analyzer from Thermo Fisher Scientific.

This gold-standard equipment offers high-throughput genetic analysis with multiple automation features, reducing human errors during testing. Genetic testing services encompass Clinical Genetic Testing, Prenatal Diagnosis, Hereditary Disease Testing, Cancer Genetics, and newborn screening. Pharmaceutical Companies are increasingly using genetic data interpretation for Drug Development and personalized nutrition. Ethical Considerations, Genetic Information Sharing, Insurance Coverage, and Data Management are critical challenges. data analytics, Data Security, and Genetic Privacy are essential for effective data handling. The market dynamics include the rise of Lifestyle Genetics, Direct-to-Consumer Testing, and Ancestry Testing. Gene Expression Profiling, Genetic Markers, Family History, Tumor Sequencing, Wellness Testing, and Personalized Cancer Treatment are other significant trends.

The regulatory landscape is complex, with ongoing debates on data sharing, patient consent, and data privacy. gene therapy, Rare Disease Testing, and carrier screening are emerging areas. The market costs are decreasing due to advancements in NGS and Data Analytics.

Get a glance at the market report of share of various segments Request Free Sample

The Equipment segment was valued at USD 3.57 billion in 2019 and showed a gradual increase during the forecast period.

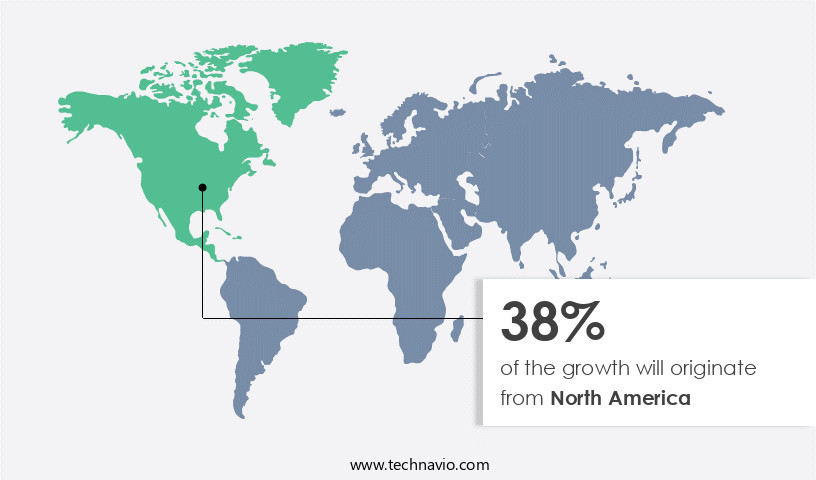

Regional Analysis

North America is estimated to contribute 38% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market size of various regions, Request Free Sample

The market in North America is experiencing significant growth due to increasing concerns about early disease diagnosis and the rising number of commercial approvals for advanced genetic testing products. Pharmaceutical companies are also increasingly utilizing genetic testing services for pharmacogenomic applications. Chromosome enumeration probes, such as those offered by Abbott Laboratories, are among the advanced products driving market expansion. Additionally, the use of predictive testing, cancer genetics, and prenatal diagnosis is on the rise. Genetic testing reports and laboratory services are essential components of this market, with clinical genetic testing, lifestyle genetics, and direct-to-consumer testing gaining popularity. Data management, genetic data interpretation, and genetic privacy are critical concerns, as is the regulatory landscape.

Gene therapy, gene editing, and gene expression profiling are emerging areas of focus. Personalized nutrition, personalized medicine, and precision medicine are also driving demand. Ethical considerations and genetic screening for rare diseases are essential topics in the market discourse. Genetic testing costs and data analytics are significant factors influencing market dynamics. Data security is another critical concern, as is genetic information sharing among healthcare providers and consumers. Overall, the market in North America is dynamic and evolving, with a focus on innovation and personalized healthcare solutions.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Genetic Testing Industry?

- The rising prevalence of genetic diseases and disorders is the key driver of the market. Genetic testing is experiencing significant demand in laboratories and hospitals due to the rising prevalence of genetic diseases. According to current research, conditions such as Alzheimer's disease, Down syndrome, cystic fibrosis, and inherited cancers are on the rise. For instance, the Centers for Disease Control and Prevention (CDC) anticipates that the number of Alzheimer's patients will increase to 14 million by 2060. In the UK, approximately 5% of individuals aged 40-65 years have Alzheimer's, and around 5% of those under 40 experience Parkinson's symptoms.

- In Japan, the prevalence of Alzheimer's is projected to swell by 40% by 2028. These statistics underscore the importance of genetic testing in diagnosing and managing these conditions. As a skilled assistant, I can help you gain a better sense of this market dynamic and its implications. Such factors will increase the demand for market analysis and report during the forecast period.

What are the market trends shaping the Genetic Testing Industry?

- Advancements in next-generation sequencing are the upcoming market trend. The Human Genome Project and the emergence of next-generation sequencing (NGS) technologies have significantly impacted the market. NGS has revolutionized genetic research by facilitating large-scale sequencing of the human genome, allowing for the detection of mutations and gene variants associated with various diseases and disorders. This technological advancement has led to a substantial reduction in the cost of sequencing, genomic analysis, and database management, transforming the global genetic testing landscape. NGS enables the identification of genetic variations of intermediate to large size, contributing to a better genomic disorders.

- As a skilled assistant, I am committed to providing accurate and reliable information. The Human Genome Project and NGS technologies have provided market players with valuable resources for organizing and analyzing the complete set of human genomes, leading to significant advancements in genetic research. Such factors will increase the market trends and analysis during the forecast period.

What challenges does the Genetic Testing Industry face during its growth?

- Varying regulations on genetic testing and research globally are a key challenge affecting the industry's growth. The market is subject to various regulatory standards and compliance, making it a complex landscape for market participants. These regulations, enforced by authorities such as the US FDA, EMEA, EAEMP, ATGA, WHO, ISO, and CFDA, prioritize the accuracy, safety, and reliability of genetic testing procedures due to their direct impact on healthcare decision-making for critical health conditions.

- Ensuring compliance with these regulations is essential for market players, as the consequences of inaccurate or unreliable test results can be significant. The intricacy of these regulations adds to the market's challenges, requiring substantial resources and expertise from companies to navigate and adhere to them. Such factors will hinder the market during the forecast period.

Exclusive Customer Landscape

The genetic testing market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the genetic testing market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, genetic testing market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abbott Laboratories - The company offers genetic testing, such as Vysis Fish technology, which has ability to test metaphase chromosomes from cultured samples and interphase cells from specimens that cannot be cultured.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abbott Laboratories

- Agilent Technologies Inc.

- ARUP Laboratories

- Asper Biogene

- ATS GENETECH PVT. LTD.

- Bio Rad Laboratories Inc.

- BioMerieux SA

- CENTOGENE NV

- Color Health Inc.

- Danaher Corp.

- F. Hoffmann La Roche Ltd.

- Genea Ltd.

- Illumina Inc.

- Invitae Corp.

- MedGenome Labs Ltd.

- Myriad Genetics Inc.

- QIAGEN N.V.

- Quest Diagnostics Inc.

- Siemens Healthineers AG

- The Cooper Companies Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a range of technologies and applications, all focused on analyzing genetic information to inform healthcare and research. Microarray analysis, a technique that allows for the simultaneous measurement of thousands of genetic markers, plays a significant role in this domain. Clinical interpretation of the resulting data is a critical step in disease risk assessment and predictive testing. Genome sequencing, which involves determining the complete DNA sequence of an organism, is another essential technology in the market. It is used in various applications, including newborn screening, cancer genetics, and rare disease testing. Pharmaceutical companies also utilize genome sequencing for drug discovery and development.

Patient engagement is a crucial aspect of the market, with personalized nutrition and lifestyle genetics gaining popularity. Exome sequencing, which focuses on the protein-coding regions of the genome, is another advanced technology that offers more comprehensive genetic information. Genetic engineering, gene editing, and gene therapy are emerging areas of the market, holding significant potential for transforming healthcare. Clinical genetic testing services are increasingly being adopted by healthcare providers to improve patient care and outcomes. Data management and data analytics are essential components of the market, as the volume of genetic data generated continues to grow. Ethical considerations, including genetic privacy and data security, are also crucial in this domain.

The regulatory landscape for genetic testing is complex and evolving, with various regulatory bodies overseeing different aspects of the market. Consumer adoption of genetic testing is influenced by factors such as insurance coverage, consumer education, and the availability of genetic counseling. Next-generation sequencing (NGS) is a game-changer in the market, offering faster, more cost-effective, and more comprehensive genetic analysis. Liquid biopsy, which involves analyzing DNA and other genetic material found in bodily fluids, is another innovative technology gaining traction in the market. The market is diverse and dynamic, with various applications, technologies, and stakeholders. Market growth is driven by advances in technology, increasing awareness and acceptance of genetic testing, and the potential for personalized and precision medicine. Despite the challenges, the future of the market is promising, with significant opportunities for innovation and growth.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

239 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 15.2% |

|

Market growth 2025-2029 |

USD 11.05 Billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

12.9 |

|

Key countries |

US, Germany, Canada, UK, France, China, Japan, Italy, India, and South Korea |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Genetic Testing Market Research and Growth Report?

- CAGR of the Genetic Testing industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the genetic testing market growth of industry companies

We can help! Our analysts can customize this genetic testing market research report to meet your requirements.