Pharmaceutical Packaging Market Size 2025-2029

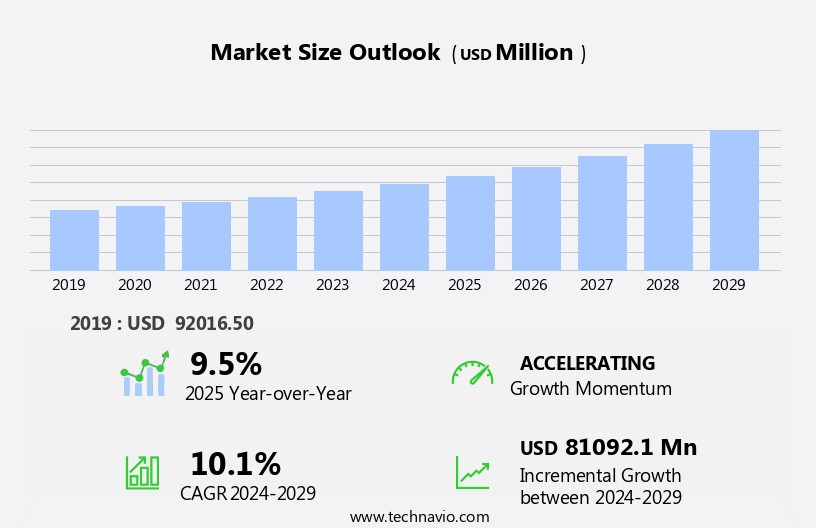

The pharmaceutical packaging market size is forecast to increase by USD 81.09 billion at a CAGR of 10.1% between 2024 and 2029.

The pharmaceutical packaging market is poised for transformative growth, projected to expand by USD 81.09 billion from 2024 to 2029, achieving a robust compound annual growth rate (CAGR) of 10.1%. The market is driven by soaring research and development (R&D) investments, the rise of biopharmaceuticals, and a global push for sustainable solutions. The market is experiencing significant growth due to the rising prevalence of chronic diseases and the increasing demand for advanced drug delivery devices. From Amcor's recyclable blister packs to Gerresheimer's cutting-edge pre-filled syringes, innovative packaging is safeguarding drug efficacy and patient safety across the US, China, and Europe. This comprehensive analysis dives into the drivers, segments, trends, challenges, and recent developments shaping the pharmaceutical packaging market, offering stakeholders a roadmap to thrive in this vital sector. Poverty and financial constraints continue to influence the market, with an emphasis on cost-effective packaging solutions such as glass bottles and non-prescription drugs.

What will be the Size of the Pharmaceutical Packaging Market during the forecast period?

Key Drivers of the Pharmaceutical Packaging Market

A confluence of powerful forces is propelling the pharmaceutical packaging market forward, cementing its role as a cornerstone of global healthcare:

- Escalating R&D Investments: Pharmaceutical giants like Pfizer, Sanofi, and Johnson & Johnson are pouring billions into R&D, with global spending reaching USD 96 billion in 2023. This surge fuels demand for advanced packaging, such as pre-filled syringes and tamper-evident blister packs, to protect novel drugs.

- Biopharmaceutical Boom: The rise of biologics, which require sterile, temperature-controlled packaging, is driving growth in North America and Europe. Companies like Becton Dickinson are expanding syringe production to meet this demand.

- Sustainability Imperatives: Regulatory mandates, such as the European Commission's 2027 tamper-evident packaging rules, are pushing companies like Amcor and WestRock to innovate with recyclable and biodegradable materials.

- Chronic Disease Prevalence: Rising cases of diabetes, cancer, and cardiovascular diseases in APAC (e.g., China, India) are increasing demand for oral drug packaging, including rigid plastic bottles and blister packs.

- Regulatory Compliance: Stringent standards from the FDA and EU's Poison Prevention Packaging Act are driving adoption of child-resistant closures and track-and-trace technologies like RFID and serialization.

Case Study: Amcor's Recyclable Blister Packs

In 2020, Amcor launched its AmSky Blister System, a fully recyclable blister pack that reduced carbon emissions by 64%. Adopted by US and European pharmacies, this innovation has set a new standard for sustainable pharmaceutical packaging, boosting Amcor's market share and consumer trust.

Market Segmentation: A Detailed Breakdown

The pharmaceutical packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Material

- Rigid plastic

- Flexible plastic

- Glass

- Others

- Product

- Plastic bottles

- Caps and closures

- Blister packs

- Pre-fillable syringes

- Others

- Route Of Administration

- Oral drugs

- Injectables

- Topical

- Nasal

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

The pharmaceutical packaging market is diverse, with key segments driving its growth trajectory. Here's a granular analysis based on 2025 data and forecasts through 2029:

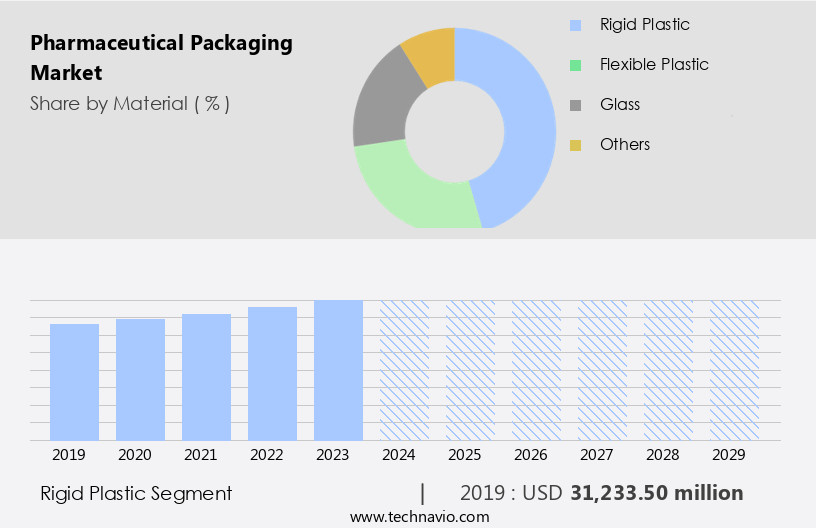

By Material

- Rigid Plastic: Rigid plastics, such as polyethylene terephthalate (PET) and polypropylene, are widely used for bottles and containers due to their durability and cost-effectiveness. They are favored in the US for oral drug packaging, ensuring tamper resistance and extended shelf life. Their lightweight nature reduces transportation costs, making them popular in Asia-Pacific. Advances in barrier technologies enhance their suitability for sensitive drugs. Rigid plastics are also increasingly recyclable, aligning with sustainability goals in Europe.

- Flexible Plastic: Flexible plastics, including polyethylene and PVC, are used in blister packs and pouches for their versatility and cost efficiency. They are prevalent in India for oral medications, offering portability and ease of use. Their ability to conform to various shapes supports innovative packaging designs. Flexible plastics are also lightweight, reducing carbon footprints in logistics. Ongoing R&D focuses on biodegradable options to meet environmental demands in the UK.

- Glass: Glass remains a preferred material for injectables and biologics due to its inert properties, ensuring drug stability. In Germany and Japan, glass vials and ampoules are critical for high-value drugs like vaccines. Its recyclability aligns with sustainability initiatives in Canada. However, its fragility requires careful handling, driving innovations in shatter-resistant glass. Glass packaging is also favored for premium branding in Europe.

- Others: This segment includes materials like aluminum, paperboard, and bio-based polymers. Aluminum is used in foil blisters and aerosol cans, particularly in France for topical drugs. Paperboard supports eco-friendly secondary packaging in the UK. Bio-based polymers are gaining traction in Canada for sustainable solutions. These materials cater to niche applications, driven by regulatory and environmental trends.

By Product

- Plastic Bottles: Plastic bottles are a staple for oral drugs, offering durability and ease of use. In the US, they are widely used for over-the-counter medications, with child-resistant caps ensuring safety. Their versatility supports various sizes and shapes, meeting diverse market needs. Innovations in lightweight designs reduce material usage, particularly in China. Recyclable plastics are driving their adoption in sustainable markets like Canada.

- Caps and Closures: Caps and closures, including screw caps and tamper-evident seals, are critical for drug security and compliance. In Europe, they are essential for regulatory adherence, with Germany leading in smart cap technologies. Their design ensures ease of use for elderly patients in Japan. Advances in materials enhance barrier properties, protecting drug integrity. The segment is growing due to demand for customized solutions in North America.

- Blister Packs: Blister packs are popular for oral drugs, offering unit-dose convenience and compliance tracking. In India, they dominate due to their affordability and portability for generic drugs. Their design supports patient adherence, particularly for chronic conditions in the UK. Innovations in child-resistant blisters enhance safety in the US. Sustainable materials are driving growth in eco-conscious markets like France.

- Pre-fillable Syringes: Pre-fillable syringes are critical for injectables, especially biologics and vaccines, ensuring precise dosing. In Germany, they are widely used for insulin and monoclonal antibodies, driven by biologics growth. Their ease of use supports self-administration in Japan. Advanced barrier coatings improve drug stability, particularly in the US. The segment is expanding due to rising chronic disease prevalence in Europe.

- Others: This segment includes vials, ampoules, and pouches, catering to niche applications. Vials are used for injectables in China, while ampoules support liquid drugs in Italy. Pouches are gaining traction for topical drugs in France. These products address specialized needs, such as high-barrier packaging for sensitive drugs. Their growth is driven by innovation and regulatory requirements in North America.

By Route of Administration

- Oral Drugs: Oral drugs, including tablets and capsules, dominate packaging demand due to their widespread use. In the US, blister packs and plastic bottles ensure compliance and safety for oral medications. India's generic drug market drives demand for cost-effective packaging like flexible plastics. Innovations in tamper-evident designs enhance consumer trust in Europe. The segment is fueled by rising chronic disease prevalence globally.

- Injectables: Injectables, such as vaccines and biologics, require specialized packaging like pre-fillable syringes and glass vials. In Germany, they are critical for high-value drugs, ensuring sterility and stability. Japan's aging population drives demand for user-friendly syringes. Regulatory requirements in the US mandate high-barrier materials. The segment is growing due to biologics and vaccine development.

- Topical: Topical drugs, including creams and gels, rely on tubes and pouches for easy application. In France, aluminum tubes are popular for dermatological products, offering barrier protection. The UK's focus on eco-friendly packaging drives demand for bio-based materials. Innovations in dispensing systems improve patient experience in the US. The segment is expanding due to rising skincare product demand.

- Nasal: Nasal drugs, such as sprays and drops, require precise delivery systems like aerosol cans and droppers. In China, nasal packaging supports allergy and respiratory treatments, driven by urbanization. The US focuses on child-resistant designs for nasal sprays. Innovations in metered-dose systems enhance dosing accuracy in Europe. The segment is growing due to rising respiratory disease prevalence.

- Others: This segment includes packaging for ocular, pulmonary, and transdermal drugs. Ocular drugs use dropper bottles in Japan for precision delivery. Pulmonary drugs rely on inhalers in the UK, driven by asthma treatment needs. Transdermal patches are gaining traction in the US for pain management. These niche applications are supported by regulatory and patient-centric innovations.

The Rigid plastic segment was valued at USD 31.23 billion in 2019 and showed a gradual increase during the forecast period.

By Geography

- North America (US, Canada): North America, led by the US, is a key market due to its advanced pharmaceutical industry and stringent regulations. The US drives demand for pre-fillable syringes and blister packs for biologics and oral drugs, supported by companies like WestRock. Canada's focus on sustainability fuels adoption of recyclable glass and plastics. High R&D investments in biologics enhance packaging innovation. The region's robust healthcare infrastructure supports market growth.

- Europe (France, Germany, Italy, Spain, UK): Europe is a hub for innovative packaging, driven by Germany's biologics sector using glass vials and pre-fillable syringes. The UK emphasizes sustainable materials like bio-based plastics for blister packs. France leads in topical drug packaging with aluminum tubes. Stringent EU regulations boost demand for tamper-evident solutions. Collaborative research in Italy and Spain drives advancements in smart packaging.

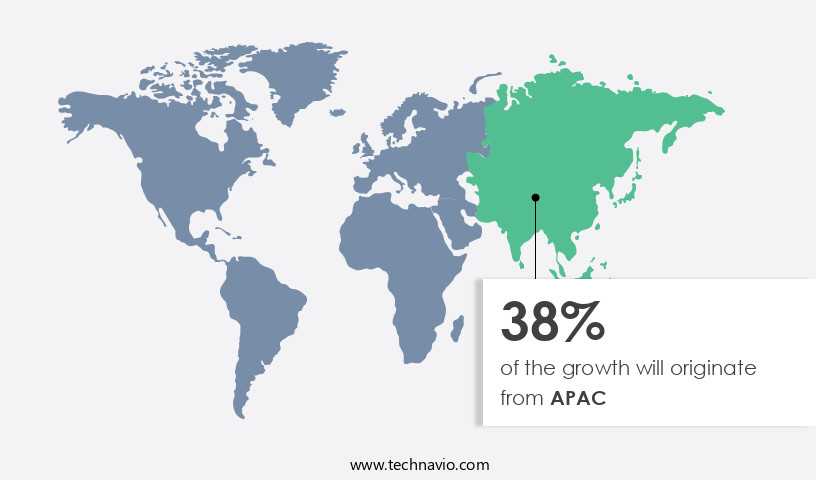

- APAC (China, India, Japan): APAC is a fast-growing market, with China's generic drug production driving demand for cost-effective blister packs and plastic bottles. India's pharmaceutical exports rely on flexible plastics for oral drugs. Japan's aging population fuels demand for pre-fillable syringes for injectables. Rapid urbanization increases healthcare access, boosting packaging needs. The region's focus on affordability drives innovation in lightweight materials.

- Rest of World (ROW): ROW includes Latin America, the Middle East, and Africa, with Brazil leading in oral drug packaging for generics using blister packs. Saudi Arabia's healthcare investments drive demand for glass vials for injectables. South Africa's focus on affordable packaging supports nasal and topical drugs. Emerging economies prioritize cost-effective solutions, fueling growth. Regulatory harmonization in the Middle East enhances market expansion.

APAC is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the US is witnessing significant growth due to several factors. The country's leading position in the global pharmaceutical industry, with companies such as Johnson & Johnson, Pfizer, Abbott Laboratories, and Bristol Myers Squibb, contributes substantially to the market. The increasing value of US pharmaceutical exports, rising healthcare spending, and a growing aging population are major drivers. Additionally, the expansion of government healthcare insurance programs and the intellectual property system's strengthening influence on patented drug sales are attracting venture capital investments. Sterile packaging, inspection systems, and regulatory compliance are crucial aspects of the market. Biodegradable materials, child-resistant closures, and sustainable packaging are gaining popularity due to environmental concerns.

Topical products, clinical trials, and drug delivery systems require specialized packaging solutions. Flexible packaging and recyclable materials are essential for cost-effective and eco-friendly solutions. Dosage forms, secondary packaging, and barrier properties are essential considerations for maintaining drug safety and shelf life. Unit-dose packaging, track and trace, and tamper-evident seals ensure product authenticity and patient compliance. EU regulations, automated packaging, and cold chain logistics are essential for ensuring regulatory compliance. Pre-filled syringes, filling machines, and labeling machines streamline production processes. The market trends include the adoption of digital printing for personalized packaging, the integration of packaging lines for efficiency, and the use of sustainable and recyclable materials.

Supply chain security and bulk packaging are also significant concerns for pharmaceutical companies. Hospital pharmacies and blister packs are essential for managing and distributing oral solids and other medications. Overall, the market in the US is dynamic and evolving, driven by various factors and trends.

Emerging Trends Shaping the Pharmaceutical Packaging Market

The pharmaceutical packaging market is evolving rapidly, with trends redefining safety, sustainability, and patient experience:

- Smart Packaging Technologies: Smart caps with sensors, adopted by Amcor in the US, track patient adherence for oral drugs, improving outcomes for chronic conditions. These technologies integrate with mobile apps, enhancing compliance monitoring in Europe. They are particularly valuable for elderly patients in Japan, ensuring accurate dosing. The trend is driven by rising demand for patient-centric solutions. Ongoing R&D aims to reduce costs for broader adoption.

- Sustainable Materials: Eco-friendly materials like recyclable PET and bio-based plastics, led by Gerresheimer in Canada, reduce environmental impact. The UK's push for net-zero goals drives adoption of biodegradable blister packs. These materials maintain drug stability while meeting regulatory standards. Consumer demand for green packaging fuels innovation in Europe. The trend is critical for long-term market sustainability.

- Advanced Barrier Coatings: High-barrier coatings for pre-fillable syringes, developed by Schott in Germany, protect biologics from degradation. These coatings extend shelf life, critical for vaccines in Japan. They also reduce leaching risks, ensuring safety in the US. The trend supports the growing biologics market, particularly in Europe. Innovations in nanotechnology enhance coating performance.

- Child-Resistant Packaging: Child-resistant blister packs and caps, mandated in the US, enhance safety for oral drugs. The UK is adopting similar designs for over-the-counter medications, driven by regulatory requirements. These solutions balance accessibility for adults with safety for children, particularly in France. The trend is fueled by rising consumer awareness. Innovations focus on user-friendly designs for elderly patients.

- Anti-Counterfeiting Technologies: Tamper-evident seals and QR codes, implemented by WestRock in China, combat drug counterfeiting. These technologies ensure authenticity, critical for India's generic drug exports. Europe's serialization requirements drive adoption of track-and-trace systems. The trend enhances supply chain security, particularly in APAC. Blockchain integration is emerging for real-time verification.

- Pre-fillable Inhalers for Pulmonary Drugs: Pre-fillable inhalers, adopted in the UK for asthma treatments, offer precise dosing and ease of use. They are gaining traction in China due to rising respiratory issues. Innovations in propellant-free designs improve environmental impact in Canada. The trend supports patient convenience and compliance. R&D focuses on compact, cost-effective inhalers.

- 3D-Printed Packaging: 3D-printed packaging, piloted by AptarGroup in the US, enables customized designs for nasal and topical drugs. This technology supports rapid prototyping, reducing development time in Germany. It also allows for lightweight, sustainable designs in the UK. The trend is driven by demand for personalized healthcare solutions. Its scalability remains a focus for future growth.

Case Study: Sustainable Packaging in the UK

A UK-based pharmaceutical company collaborated with Amcor to implement recyclable blister packs for oral drugs, reducing plastic waste by 30%. The initiative aligned with EU sustainability goals, enhancing brand reputation and meeting consumer demand for eco-friendly solutions.

Challenges Facing the Pharmaceutical Packaging Market

The pharmaceutical packaging market faces significant hurdles that could impede its growth trajectory:

- High Material Costs: Advanced materials like high-barrier glass and bio-based plastics are expensive, increasing production costs for manufacturers in India and Brazil. These costs strain budgets in cost-sensitive markets, limiting adoption of sustainable solutions. Smaller companies struggle to compete with larger players like Amcor. The challenge is compounded by fluctuating raw material prices, particularly in APAC. Ongoing R&D aims to develop cost-effective alternatives.

- Regulatory Complexity: Diverse regulations across the FDA, EMA, and China's NMPA create compliance challenges, delaying product launches in Europe and North America. For example, serialization requirements in Germany require significant investment in tracking systems. Non-compliance risks hefty fines, impacting profitability. Manufacturers must navigate varying child-resistance standards, particularly in the US. Harmonization efforts are slow, complicating global operations.

- Counterfeiting Risks: Drug counterfeiting remains a major issue in China and India, undermining consumer trust and brand integrity. Existing anti-counterfeiting measures, like tamper-evident seals, are costly to implement at scale. Smaller manufacturers in ROW struggle to afford advanced technologies like blockchain. The challenge threatens supply chain security, particularly for generics. Regulatory enforcement is critical to addressing this issue.

- Environmental Pressures: Growing demand for sustainable packaging in Canada and the UK strains manufacturers' ability to balance cost and eco-friendliness. Recyclable materials often require complex production processes, increasing expenses. Consumer pressure for zero-waste solutions clashes with regulatory requirements for drug stability, especially in Europe. The challenge is particularly acute for small-scale producers in APAC. Innovations in biodegradable materials are needed to bridge this gap.

- Supply Chain Disruptions: Global supply chain issues, exacerbated by geopolitical tensions, disrupt material availability in the US and Europe. For instance, glass shortages in Germany impact vial production for injectables. Logistics delays increase costs and delay product delivery, particularly in Japan. Manufacturers must invest in resilient supply chains, straining resources. The challenge is critical for time-sensitive biologics packaging.

- Technological Integration Costs: Implementing smart packaging technologies, such as NFC-enabled caps, requires significant investment, challenging manufacturers in India and ROW. These technologies demand compatible infrastructure, which is limited in emerging markets. High costs deter small players, creating a competitive disadvantage in the US. The challenge is compounded by the need for consumer education on smart packaging use. Scalability remains a barrier to widespread adoption.

Exclusive Customer Landscape

The pharmaceutical packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pharmaceutical packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Competitive Landscape: Key Players and Strategies

The pharmaceutical packaging market is fiercely competitive, with leading players driving innovation and expansion:

- Amcor Plc: A leader in recyclable blister packs and flexible packaging, Amcor reported USD 14.5 billion in revenue in 2022.

- Gerresheimer AG: Specializes in pre-fillable syringes and glass vials, expanding through acquisitions like Sensile Medical.

- AptarGroup Inc.: Innovates in child-resistant closures and nasal spray packaging, targeting North America and Europe.

- WestRock Co.: Focuses on sustainable paperboard and secondary packaging, serving hospital pharmacies.

- Becton Dickinson and Co.: Leads in injectable packaging, with a focus on biologics and automated systems.

- Schott AG: Dominates glass packaging for high-value drugs, with a strong presence in Germany.

Other notable players include Berry Global, Catalent, Constantia Flexibles, Nipro Corp., and West Pharmaceutical Services, competing through R&D, sustainability, and strategic partnerships.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- AptarGroup Inc.

- Ball Corp.

- Becton Dickinson and Co.

- Berry Global Inc.

- Catalent Inc.

- Constantia Flexibles Group GmbH

- Datwyler Holding Inc.

- Gerresheimer AG

- International Paper Co.

- Jabil Inc.

- James Alexander Corp.

- KP Holding GmbH and Co. KG

- Nipro Corp.

- O I Glass Inc.

- SCHOTT AG

- Vitro S.A.B. de C.V.

- West Pharmaceutical Services Inc.

- WestRock Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Developments in the Pharmaceutical Packaging Market

The market is buzzing with fresh initiatives, reflecting its dynamic growth:

- In January 2024, Amgen Inc., a leading biotechnology company, announced the launch of its new automated, prefillable syringe system for its Neulasta Onpro Kit, used for the prevention of infection in neutropenic patients receiving myelosuppressive chemotherapy. This innovative packaging solution enhances patient safety and convenience (Amgen Press Release).

- In March 2025, Pfizer Inc. And Schreiner MediPharm GmbH & Co. KG, a global leader in pharmaceutical labeling and packaging solutions, entered into a strategic partnership to develop and commercialize advanced, tamper-evident labeling solutions for Pfizer's pharmaceutical products. This collaboration aims to strengthen Pfizer's commitment to patient safety and security (Pfizer Press Release).

- In July 2024, Gerresheimer AG, a global partner for pharma and healthcare, completed the acquisition of Sensile Medical AG, a Swiss company specializing in the development and manufacturing of drug delivery systems. This acquisition significantly expands Gerresheimer's capabilities in the growing area of drug delivery systems and injectable packaging (Gerresheimer Press Release).

- In October 2025, the European Commission approved a new regulation mandating the use of tamper-evident packaging for certain prescription medicines, effective from 2027. This regulatory development is expected to boost the demand for advanced pharmaceutical packaging solutions across Europe (European Commission Press Release).

Why the Pharmaceutical Packaging Market Matters

Pharmaceutical packaging is more than a protective shellâit's a lifeline for patient safety and drug efficacy. In hospitals, it ensures sterile delivery of life-saving biologics. In pharmacies, it simplifies patient compliance with user-friendly blister packs. Across the globe, it's driving sustainability with recyclable materials and reducing counterfeiting with smart technologies. From Pfizer's tamper-evident labels to Amcor's eco-friendly bottles, this market is safeguarding health and shaping a greener, safer future for healthcare.

Unlock Deeper Insights into the Pharmaceutical Packaging Market

Ready to explore the pharmaceutical packaging market further? Download Free Sample Report for exclusive data on market size, segment trends, and key players like Amcor and Gerresheimer. Contact our team to learn how packaging innovations can elevate your business.

Conclusion: A Market Poised for Innovation

The pharmaceutical packaging market is a dynamic force, driven by R&D, biopharmaceuticals, and sustainability across the US, China, and Europe. With a projected growth of USD 81.09 billion by 2029, it offers immense opportunities for companies like Amcor, Gerresheimer, and AptarGroup. By embracing smart technologies, navigating regulatory challenges, and prioritizing eco-friendly solutions, stakeholders can thrive in this vital industry. Stay informed, stay competitive, and seize the potential of the pharmaceutical packaging market.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pharmaceutical Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

240 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 10.1% |

|

Market growth 2025-2029 |

USD 81092.1 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

9.5 |

|

Key countries |

US, Germany, China, Canada, UK, France, Japan, Spain, Italy, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pharmaceutical Packaging Market Research and Growth Report?

- Pharmaceutical Packaging Industry CAGR Forecast for 2025-2029

- Key Drivers of Pharmaceutical Packaging Market Growth, 2025-2029

- Accurate Market Size Estimation and Industry Contribution Analysis

- Precise Predictions of Pharmaceutical Packaging Trends and Consumer Behavior Shifts

- Regional Growth Insights: North America, Europe, APAC, Middle East, Africa, and South America

- Competitive Landscape Analysis with Detailed Company Profiles

- Comprehensive Challenges Impacting Pharmaceutical Packaging Market Growth

Talk with the Author

Have questions about our market research report? Connect with our Principal Consultant for exclusive insights.