Nuclear Reactor Construction Market Size 2024-2028

The nuclear reactor construction market size is forecast to increase by USD 9 billion at a CAGR of 3.2% between 2023 and 2028.

- The market is experiencing significant growth due to several key trends. The increasing focus on clean energy technologies is driving the demand for nuclear power as a low-carbon energy source. Technological advances in nuclear reactor designs, such as small modular reactors and advanced pressurized water reactors, are making nuclear power more efficient and cost-effective. However, competition from other energy sources, such as wind and solar, and public perception issues related to safety concerns continue to pose challenges to the market. To stay competitive, market participants are investing in research and development to improve the safety and efficiency of nuclear reactors.

- Overall, the market is expected to grow steadily In the coming years, driven by these trends and the need for reliable, low-carbon energy sources.

What will be the Nuclear Reactor Construction Market Size During the Forecast Period?

- The market is experiencing significant activity as aging infrastructure necessitates upgrades and potential replacements in numerous countries worldwide. Evolving safety standards and a focus on efficiency drive investments in this sector, which contributes substantially to global electricity production. With carbon emissions becoming a pressing concern, nuclear power remains a key player in low-carbon electricity generation. KEPCO Engineering & Construction and SKODA JS A are among the notable players in this market, executing new power reactor construction projects in over 30 countries. As energy demands continue to rise, the nuclear power programmes' importance In the global electricity mix is underscored. This information library provides insights into market dynamics, trends, and the role of nuclear power In the energy transition landscape.

How is this Nuclear Reactor Construction Industry segmented and which is the largest segment?

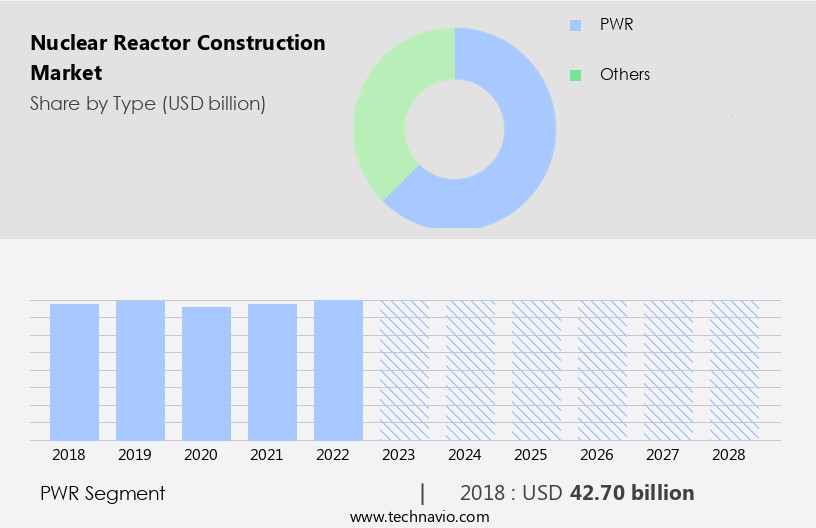

The nuclear reactor construction industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- PWR

- Others

- Service

- Equipment

- Installation

- Geography

- APAC

- China

- Japan

- Europe

- France

- North America

- US

- Middle East and Africa

- South America

- APAC

By Type Insights

- The pwr segment is estimated to witness significant growth during the forecast period.

The market is driven by the aging infrastructure requiring upgrades and potential replacements, as well as the increasing demand for low-carbon energy sources to meet rising energy demands and sustainability objectives. Advanced reactor technologies, innovative designs, and next-generation nuclear projects are attracting significant financial resources from investors. Evolving safety standards, efficiency improvements, and carbon emissions reduction are key factors influencing the market. The construction of new nuclear power reactors is a critical component of the world's electricity production, with over 30 countries having nuclear power programs. PWRs, which use separate circulation systems for the turbine and reactor, remaIn the dominant technology.

However, digitalization, automation, and enhanced project management are transforming the industry through the use of digital tools, precise planning, monitoring, resource allocation, and project timelines to minimize errors and ensure reliable operation. Despite the high initial cost and licensing challenges, nuclear power remains a dependable baseload generation source for many countries, particularly those experiencing rapid urbanization and government support. However, the financial risk and uncertainty associated with nuclear projects, as well as the widespread adoption of renewable energy sources, present challenges to the market's growth.

Get a glance at the Nuclear Reactor Construction Industry report of share of various segments Request Free Sample

The PWR segment was valued at USD 42.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 58% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The APAC region leads The market, driven by China, India, and South Korea's significant investments in nuclear power to meet escalating energy demands and decrease carbon emissions. China, the world's largest market, aims to expand its nuclear power capacity to 70 GW by 2025, with numerous new projects underway. India, having gained independence In the nuclear fuel cycle, focuses on power generation and waste management. Evolving safety standards, efficiency improvements, and the adoption of advanced reactor technologies are also key market trends. Investments in nuclear power generation are influenced by sustainability objectives and rising energy requirements. However, the high initial cost, licensing, engineering, and safety measures pose financial risks and uncertainties.

Innovative designs, next-generation technologies, and digitalization, including automation, precise planning, monitoring, and resource allocation, are crucial to reliable operation and maintaining existing infrastructure as a dependable baseload generation source.

Market Dynamics

Our nuclear reactor construction market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Nuclear Reactor Construction Industry?

Rising focus on clean energy technologies is the key driver of the market.

- The market is experiencing significant growth as nations prioritize clean energy solutions to decrease carbon emissions and align with sustainability objectives. Advanced nuclear reactor technologies, such as small modular reactors (SMRs) and Generation IV reactors, are at the forefront of this trend. These designs offer enhanced safety, improved efficiency, and reduced environmental impact. The increasing recognition of nuclear power as a dependable baseload generation source, capable of complementing renewable energy sources like solar and wind, is driving investments in this sector. Government support, rising energy requirements due to rapid urbanization, and the need for reliable power sources are further fueling the market's expansion.

- Digitalization, automation, and enhanced project management are also playing crucial roles In the nuclear power generation industry, with digital tools and precise planning, monitoring, and resource allocation contributing to more efficient construction processes and reliable operation. Despite the high initial cost and licensing challenges, the potential for reducing carbon emissions and ensuring energy security make nuclear power an attractive option for many countries.

What are the market trends shaping the Nuclear Reactor Construction Industry?

Technological advances is the upcoming market trend.

- The market is experiencing a notable trend due to technological advancements. Innovative reactor designs, such as small modular reactors (SMRs) and Generation IV reactors, are leading this trend. SMRs provide enhanced safety features, increased efficiency, and greater flexibility in deployment, making them an appealing choice for countries aiming to expand their nuclear power capacity. Moreover, the integration of digital technologies and automation In the construction process is streamlining project management, ensuring safety, and reducing costs. Progress in materials science and engineering enables the fabrication of larger and more potent reactor components, thereby augmenting the capabilities of nuclear power plants.

- Evolving safety standards and sustainability objectives are driving investments in nuclear power generation to meet rising energy demands and address environmental concerns. Despite the high initial cost and financial risk associated with nuclear projects, the reliable operation of existing infrastructures and their role as a dependable baseload generation source make them an essential part of the global electricity production landscape. The Information Library reports that over 30 countries have nuclear power programs, and new power reactors are under construction in various parts of the world. The adoption of advanced reactor technologies and innovative designs, along with next-generation technologies, is expected to continue shaping the market.

- Enhanced project management through digitalization, automation, and precise planning, monitoring, and resource allocation contribute to more efficient and error-free construction processes, ensuring reliable operation and optimal resource utilization.

What challenges does the Nuclear Reactor Construction Industry face during its growth?

Competition for nuclear power from other energy sources is a key challenge affecting the industry growth.

- The market is experiencing intense competition from other low-carbon alternatives, such as renewable energy and natural gas, due to evolving energy demands and sustainability objectives. The nuclear power industry is grappling with aging infrastructure and the need for upgrades and potential replacements, which requires substantial financial resources and licensing processes. Evolving safety standards and the adoption of advanced reactor technologies, innovative designs, and next-generation technologies are driving investments in nuclear power generation. However, the high initial cost and uncertainty associated with nuclear projects pose financial risks. In the US, the electricity production sector is undergoing a significant transformation, with electricity demand continuing to rise due to rapid urbanization and increasing energy requirements.

- Nuclear power remains a dependable baseload generation source, but its share In the energy mix is declining as renewable energy sources become more cost-effective and efficient. The construction of new power reactors is a complex process that involves precise planning, monitoring, resource allocation, and project timelines to ensure reliable operation. Digitalization, automation, and enhanced project management through digital tools are essential for optimizing construction processes and reducing errors. The global electricity production landscape is undergoing a seismic shift, with 30 countries actively pursuing nuclear power programmes. However, the nuclear technology industry must address environmental concerns and public perception challenges to secure widespread adoption.

- The future of nuclear power generation lies In the development and implementation of advanced reactor technologies, which offer increased efficiency, safety measures, and reduced carbon emissions. The market dynamics of the nuclear reactor construction industry are complex, with numerous factors influencing its growth trajectory.

Exclusive Customer Landscape

The nuclear reactor construction market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the nuclear reactor construction market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, nuclear reactor construction market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

AECOM - Nuclear reactor construction is a critical aspect of the energy sector, providing clients with cleaner, more efficient solutions for generating power. Our company specializes in delivering full life-cycle support for nuclear reactor projects, encompassing design, engineering, procurement, construction, and commissioning services. By leveraging advanced technologies and proven expertise, we help clients navigate the complexities of nuclear reactor construction and meet the challenges of this industry. Our comprehensive approach ensures that projects are completed on time, within budget, and to the highest safety standards.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AECOM

- Ansaldo Energia Spa

- AREVA SA

- Bechtel Corp.

- BOUYGUES

- China National Nuclear Corp.

- EDF Energy Holdings Ltd

- Emirates Nuclear Energy Corp.

- General Electric Co.

- Hindustan Construction Co. Ltd

- Hitachi Ltd.

- Korea Electric Power Corp.

- Larsen and Toubro Ltd.

- Mitsubishi Heavy Industries Ltd.

- NTPC Ltd.

- Siemens AG

- SKODA JS AS

- State Atomic Energy Corp. Rosatom

- Toshiba Corp.

- Westinghouse Electric Co. LLC

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market is experiencing significant dynamics due to various factors shaping the energy landscape. Aging infrastructure calls for upgrades and potential replacements, driving investments in nuclear power generation. Evolving safety standards and efficiency requirements are key considerations for nuclear projects, as carbon emissions remain a concern for governments and industries alike. Nuclear power, as a low-carbon alternative, continues to be a viable energy source despite the high initial cost and licensing complexities. The rising energy demands and environmental concerns necessitate the adoption of advanced reactor technologies and innovative designs. Next-generation technologies, such as small modular reactors and advanced pressurized water reactors, are gaining traction due to their enhanced safety measures and resource utilization.

Financial resources and energy sources are essential factors influencing the nuclear power sector. Financial risk and uncertainty can impact the widespread adoption of nuclear technology, necessitating robust project management and digitalization. Digitalization, automation, and enhanced project management tools are increasingly being adopted to optimize construction processes, ensure precise planning, and monitor resource allocation and project timelines. The nuclear power industry faces challenges In the form of errors and maintaining a reliable operation. A robust track record and reliable operation are crucial for the industry's reputation and sustainability objectives. Existing infrastructures require continuous maintenance and upgrades to meet evolving energy demands and sustainability objectives.

Baseload generation remains a dependable power source, and nuclear power plays a significant role in electricity production, contributing to global electricity production in over 30 countries. Kepco Engineering & Construction and Skoda JS A are among the key players In the reactor technologies sector, providing engineering, safety measures, and construction services for nuclear projects. The nuclear power sector is subject to rapid urbanization and rising energy requirements, necessitating government support and regulatory frameworks to ensure safe and efficient construction processes. The industry's future lies in its ability to adapt to evolving energy demands and sustainability objectives while maintaining a focus on safety and reliability.

|

Nuclear Reactor Construction Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 3.2% |

|

Market growth 2024-2028 |

USD 9 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

3.03 |

|

Key countries |

US, China, France, Russia, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Nuclear Reactor Construction Market Research and Growth Report?

- CAGR of the Nuclear Reactor Construction industry during the forecast period

- Detailed information on factors that will drive the Nuclear Reactor Construction growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the nuclear reactor construction market growth of industry companies

We can help! Our analysts can customize this nuclear reactor construction market research report to meet your requirements.