Oil And Gas Engineering Services Market Size 2024-2028

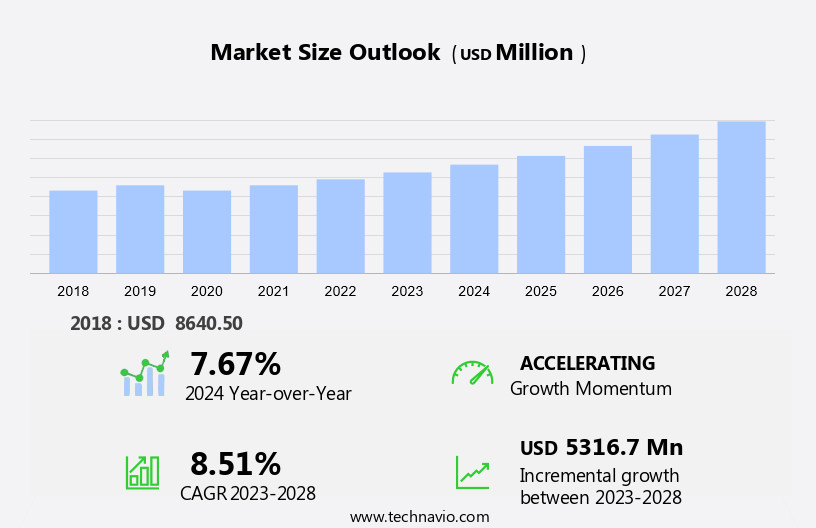

The oil and gas engineering services market size is forecast to increase by USD 5.32 billion at a CAGR of 8.51% between 2023 and 2028.

- The market is experiencing significant growth due to several key factors. The increase in Exploration and Production (E&P) activities, particularly In the shale industry, is driving market growth. Additionally, rising investments In the shale industry are contributing to market expansion. However, the market is also facing challenges from alternative energy sources, which are gaining popularity due to their environmental benefits. The hydrocarbon resources sector is also witnessing the emergence of new pipelines, expanding the energy source network and facilitating the transportation of hydrocarbons to various industries, including aviation, manufacturing, construction, and daily necessities. This trend is expected to intensify In the coming years, posing a significant threat to the market. Despite these challenges, the market is expected to continue growing due to the high demand for engineering services In the oil and gas sector. Companies In the market are focusing on innovation and technology to remain competitive and meet the evolving needs of their clients. Overall, the market is poised for steady growth, driven by increasing E&P activities, rising investments, and the challenges posed by alternative energy sources.

What will be the Size of the Oil And Gas Engineering Services Market During the Forecast Period?

- The market is a dynamic and evolving industry, driven by the need to maximize productivity and efficiency In the extraction and processing of hydrocarbon resources. Automation technologies, such as machine learning and artificial intelligence, are increasingly being adopted to streamline operations and reduce costs. Renewable energy and carbon footprint regulations are also influencing the market, as companies seek to minimize their environmental impact and explore alternative energy sources. Electric vehicles and changing demand patterns are further disrupting traditional business models. Strategic collaborations between multinational engineering firms and specialized niche players are on the rise, as companies seek to leverage each other's expertise and resources.

- Furthermore, mechanical, electrical, civil, and chemical engineering services remain crucial for the design, construction, and maintenance of infrastructure and equipment. Regulatory developments and technological advancements continue to shape the market, as companies navigate complex hydrocarbon sources and adapt to shifting industry dynamics.

How is this Oil And Gas Engineering Services Industry segmented and which is the largest segment?

The oil and gas engineering services industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Type

- Downstream

- Midstream

- Upstream

- Geography

- North America

- Canada

- US

- APAC

- China

- India

- Europe

- Middle East and Africa

- South America

- North America

By Type Insights

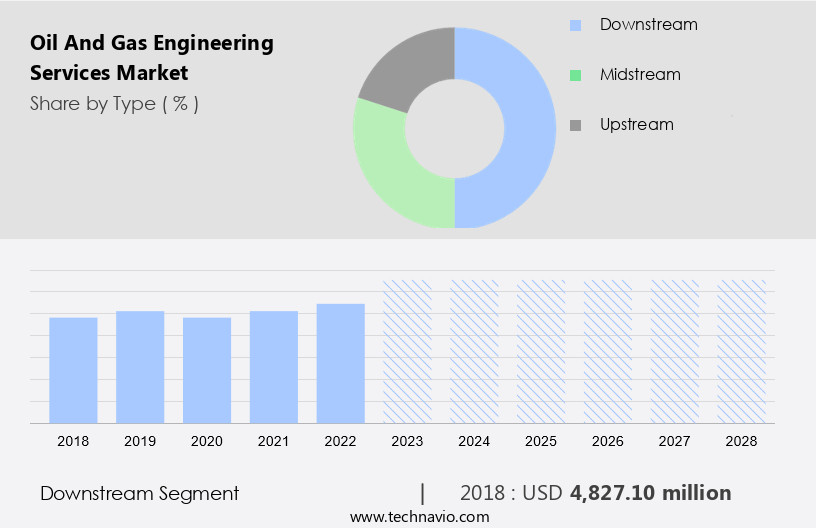

- The downstream segment is estimated to witness significant growth during the forecast period.

The downstream segment of the market is expected to dominate the industry in 2023, driven by the increasing demand for reliable operations and asset integrity management in refining, transportation, and petroleum product sales. Downstream processes, including refining, processing, and transportation, are crucial for optimizing operations and enhancing the marketability of petroleum products. Automation technologies and productivity enhancements are key trends In the market, aiming to reduce costs and improve efficiency. Additionally, renewable energy sources and carbon footprint regulations are influencing the industry, with some companies investing in hydroelectric, wind, and solar power. Machine learning and strategic collaborations between multinational engineering firms and specialized niche players are also shaping the market landscape.

Get a glance at the Oil And Gas Engineering Services Industry report of share of various segments Request Free Sample

The downstream segment was valued at USD 4.83 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

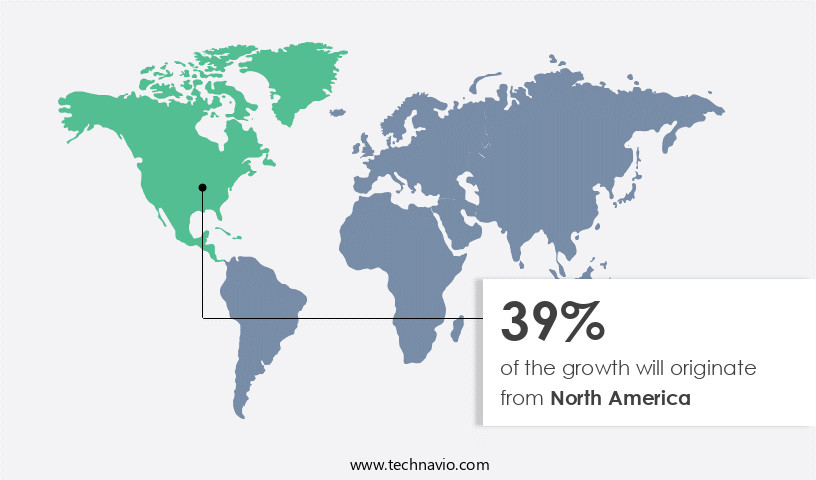

- North America is estimated to contribute 39% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The North American market is experiencing significant growth due to the increasing number of oil and gas projects In the US and Canada. The US, as the world's leading oil and gas producer, according to the US Energy Information Administration (EIA), has the longest pipeline network, with many projects involving substantial capital investments. The US natural gas pipeline grid is a comprehensive transmission and distribution system, enabling the transport of natural gas to and from nearly all states In the region. Automation technologies, productivity, and efficiency are key drivers In the market, with a focus on return on assets and engineering services.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Oil And Gas Engineering Services Industry?

Increase in oil and gas E and P activities is the key driver of the market.

- The market encompasses various activities In the energy sector, including upstream, midstream, and downstream processes. In the upstream segment, advancements in automation technologies have led to increased productivity and efficiency in identifying and extracting hydrocarbon resources. Data-oriented equipment, such as seismic acquisitions, provides accurate information on reserves without requiring actual drilling. Unconventional oil and gas resources, like shale and tight gas, have emerged as alternatives to conventional production in countries like the US, Canada, China, and Argentina. In the midstream and downstream sections, reliable operations and asset integrity management are crucial. Petroleum testing, hazardous location equipment, and Enterprise Asset Management systems are essential for ensuring the safety and efficiency of refining, transportation, and petroleum product manufacturing.

- In addition, renewable energy sources and carbon footprint regulations are driving the need for innovation In the energy ecosystem. Machine learning and strategic collaborations between multinational engineering firms and specialized niche players are key to meeting the demands of a growing population and increasing energy requirements. The energy market is influenced by several factors, including demand patterns, regulatory developments, and technological advancements. Geopolitical factors and environmental considerations also play a significant role in shaping the market dynamics. The energy source landscape is evolving, with natural gas and electricity becoming increasingly important as energy sources for daily necessities like aviation, manufacturing, construction, and electricity.

What are the market trends shaping the Oil And Gas Engineering Services Industry?

Rising investments in shale industry is the upcoming market trend.

- The market encompasses various sectors, including hydrocarbon sources, refining, transportation, and petroleum products. Automation technologies are increasingly being adopted to enhance productivity and efficiency In these areas, with machine learning and Enterprise Asset Management playing crucial roles. Renewable energy and carbon footprint regulations are influencing the industry's shift towards sustainability, with electric vehicles and geothermal energy gaining traction. Strategic collaborations, such as those between Semco Maritime AS and Project Innerspace, are shaping the market's landscape. In the downstream section, asset integrity management and petroleum testing are essential for reliable operations. Hazardous location equipment is vital for ensuring safety In the industry.

- Furthermore, the Midstream and Upstream sectors are witnessing significant investments, driven by increasing demand patterns and regulatory developments. Technological advancements, including the use of AI and data analytics, are transforming the energy ecosystem. Environmental considerations and geopolitical factors are also influencing market dynamics. The US shale industry is experiencing high investments, with multinational engineering firms and specialized niche players focusing on mechanical, electrical, and civil engineering projects. The Short-Term Energy Outlook indicates a rise in natural gas demand, making infrastructure and equipment investments essential. The market's future growth is expected to be driven by factors such as population growth, electricity demand, and the need for energy sources for daily necessities.

What challenges does the Oil And Gas Engineering Services Industry face during its growth?

Competition from alternative energy sources is a key challenge affecting the industry growth.

- The market is experiencing significant changes due to various market dynamics. The increasing global energy demand, coupled with clean energy initiatives and subsidies for renewable energy sources, is driving the shift towards sustainable energy solutions such as solar and wind. Renewable energy sources, which are clean, inexhaustible, and less carbon-intensive, are becoming increasingly popular as countries seek to reduce their carbon footprint and mitigate the environmental impact of traditional hydrocarbon sources. In the oil and gas industry, automation technologies are being adopted to enhance productivity and efficiency, while ensuring reliable operations and asset integrity management. Machine learning and artificial intelligence are being integrated into Enterprise Asset Management systems to optimize maintenance schedules and predict equipment failures, thereby improving return on assets.

- In addition, the Downstream section of the oil and gas industry, including refining, transportation, and petroleum products, is also undergoing transformation. The rise of electric vehicles and increasing demand for natural gas as an energy source for electricity generation are impacting the demand patterns for petroleum products. Geopolitical factors, regulatory developments, and technological advancements are shaping the energy ecosystem, with a focus on sustainability and innovation. New pipelines and infrastructure are being developed to transport hydrocarbon resources, while strategic collaborations and partnerships between multinational engineering firms and specialized niche players are driving growth In the mechanical, electrical, civil, and chemical engineering sectors.

Exclusive Customer Landscape

The oil and gas engineering services market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil and gas engineering services market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil and gas engineering services market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arseal Technologies

- Creaform Inc.

- Element Materials Technology Group Ltd.

- Hatch Ltd.

- John Wood Group PLC

- L and T Technology Services Ltd.

- LeMar Industries Inc.

- Lloyds Register Group Services Ltd

- M and H

- Mannvit

- Quest Global Services Pte. Ltd.

- Raveon Technologies Corp.

- Rockwell Automation Inc.

- Sentiec Oyj

- Stantec Inc.

- Stress Engineering Services Inc.

- Tetra Tech Inc.

- Toyo Engineering Corp.

- TRC Companies Inc.

- WSP Global Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses a broad spectrum of specialized disciplines that play a crucial role In the exploration, production, processing, and transportation of hydrocarbon resources. This dynamic industry is driven by several key factors, including productivity and efficiency, return on assets, and the integration of automation technologies. Productivity and efficiency are paramount In the oil and gas sector, where the focus is on maximizing output while minimizing costs. Engineering services providers offer solutions in mechanical, electrical, civil, and chemical engineering to optimize operations and ensure reliable operations. Asset integrity management, petroleum testing, and hazardous location equipment are essential components of these services, ensuring the safety and longevity of infrastructure and equipment.

In addition, the energy landscape is undergoing significant changes, with renewable energy sources gaining prominence and carbon footprint regulations becoming increasingly stringent. The oil and gas industry is responding to these challenges by exploring strategic collaborations and technological advancements. For instance, machine learning and artificial intelligence are being employed to improve efficiency, reduce costs, and enhance safety. The energy ecosystem is evolving, with demand patterns shifting towards natural gas and electricity. Regulatory developments, geopolitical factors, and sustainability considerations are shaping the market dynamics. Multinational engineering firms and specialized niche players are collaborating to address the complex challenges of the industry, providing comprehensive engineering services for upstream, midstream, and downstream sectors.

Furthermore, the oil refining, transportation, and petroleum products segments are undergoing significant transformation, with the adoption of enterprise asset management systems and short-term energy outlooks becoming increasingly important. Project Innerspace and Element Materials are examples of innovative solutions that enable real-time monitoring and optimization of operations, ensuring the efficient use of resources and reducing downtime. Population growth and population density are driving the demand for energy, with natural gas emerging as a preferred energy source due to its lower carbon footprint compared to oil.

Therefore, the market is a dynamic and complex ecosystem, driven by productivity, efficiency, and the integration of automation technologies. The industry is undergoing significant changes, with renewable energy sources, carbon footprint regulations, and sustainability considerations shaping the market dynamics. Engineering services providers are collaborating to address these challenges, offering comprehensive solutions for upstream, midstream, and downstream sectors. The focus is on optimizing operations, reducing costs, and ensuring reliable and sustainable energy solutions for the future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

135 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 5.32 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Key countries |

US, Canada, China, India, and Russia |

|

Competitive landscape |

Leading Companies, market growth and forecasting, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil And Gas Engineering Services Market Research and Growth Report?

- CAGR of the Oil And Gas Engineering Services industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil and gas engineering services market growth of industry companies

We can help! Our analysts can customize this oil and gas engineering services market research report to meet your requirements.