Oil Refining Market Size 2025-2029

The oil refining market size is forecast to increase by USD 111.2 billion at a CAGR of 1.3% between 2024 and 2029.

- The market is driven by the surging demand for refined fuel, with increasing global mobility and industrialization fueling this trend. The adoption of modular mini refineries is another key driver, as these facilities offer cost-effective and efficient solutions to meet local fuel demands in regions with limited infrastructure. However, the market faces significant challenges, including the costly and time-consuming nature of oil refinery maintenance operations. The oil refining market is essential for producing various transportation fuels, including fuel oils, gasoil, and liquefied petroleum gas (LPG).

- These complex processes require substantial resources and planning, making it essential for companies to optimize their maintenance strategies to minimize downtime and maximize productivity. Effective implementation of predictive maintenance technologies and strategic partnerships can help refineries navigate these challenges and capitalize on the market's growth opportunities. Process control instrumentation and energy conservation measures are essential components in maintaining profitability and sustainability in the oil refining industry. The demand is driven by sectors such as transportation and power generation, with developing countries in Asia, including India and China, being key contributors.

What will be the Size of the Oil Refining Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the market, process optimization techniques and stream analysis play a pivotal role in enhancing efficiency and reducing costs. Heavy oil upgrading, a significant segment, employs advanced methods like reactor temperature control and catalyst selection to maximize output. Petroleum coke production, a byproduct of refining, is subject to stringent safety management systems and environmental impact assessments. Distillation tower design and heat exchanger efficiency are crucial in optimizing energy consumption. The market is a critical component of oil and gas downstream, focusing on the processing and refining of crude oil into valuable products. Hydrogen production methods, integral to various refining processes, are undergoing innovation to minimize costs and improve yields. Fractionator control systems ensure consistent product quality, while pipeline integrity management and pressure control systems maintain safety and reliability.

Environmental considerations are driving the adoption of waste minimization strategies and desalting process control. Thermal cracking methods, a key refining technology, continue to evolve, with process simulation software aiding in optimizing operations. Reactor temperature control, reactor catalyst selection, and paraffin wax production are areas of ongoing research for improved performance and reduced emissions. Asphalt production methods and bitumen processing are also undergoing technological advancements to meet evolving market demands. Additionally, the growing aviation industry significantly contributes to market expansion, as it requires a substantial supply of jet fuel to support increasing air travel and cargo transportation.

How is this Oil Refining Industry segmented?

The oil refining industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product

- Light distillates

- Middle distillates

- Fuel oil

- Others

- Fuel Type

- Gasoline

- Kerosene

- LPG

- Others

- End-user

- Transportation

- Petrochemicals

- Residential and commercial heating

- Power generation

- Others

- Capacity

- Large-scale refineries

- Medium-scale refineries

- Small-scale refineries

- Geography

- North America

- US

- Canada

- Europe

- Germany

- Italy

- Russia

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Product Insights

The Light distillates segment is estimated to witness significant growth during the forecast period. The market is driven by the demand for light distillates, particularly gasoline, from the transportation sector. Light distillates, which include petrol or gasoline, accounted for the largest market share in 2024. Light crude oil, the primary feedstock for producing light distillates, contains a higher proportion of hydrocarbons and is easier to refine compared to heavier variants. This results in a greater yield of gasoline and diesel from light crude oil. The transportation industry's reliance on gasoline as a fuel source further increases its demand. Crude oil distillation is a crucial process in refining, which separates crude oil into various petroleum products based on their boiling points.

Refineries employ process safety management to ensure safe and efficient operations. Real-time process monitoring and predictive maintenance strategies are integral to refinery process optimization. Sulfur removal processes, such as hydrodesulfurization, are essential to meet fuel quality specifications and environmental regulations. Refineries also utilize catalytic reforming, alkylation, and isomerization processes to enhance the octane rating of gasoline. Refinery automation systems facilitate efficient and accurate control of refining processes. Additionally, hydrocracking technology and emission control systems are employed to process residual oil and reduce emissions, respectively. The product distribution network plays a significant role in the market, ensuring the timely delivery of refined petroleum products to various industries and consumers.

Pour point determination is crucial in refining to ensure the proper handling and storage of petroleum products. The pipeline transport system facilitates the movement of crude oil and refined products between refineries and markets. The viscosity index calculation and API gravity measurement are essential metrics for evaluating the quality of crude oil and refined products. The market also includes the vacuum distillation unit, which separates heavy residual oil into lighter fractions, and the coking unit operation, which converts heavy residual oil into lighter products through thermal cracking.

The Light distillates segment was valued at USD 655.80 billion in 2019 and showed a gradual increase during the forecast period.

The Oil Refining Market is evolving rapidly with increasing demand for efficiency and sustainability. Key advancements in the bitumen production process are driving innovation in road construction materials. Refineries are enhancing operations with an automated fractionator control system, ensuring precise separation of hydrocarbons. Optimized heat exchanger design improves energy recovery, contributing to lower operational costs. Comprehensive process stream analysis enables accurate monitoring and performance adjustments, while stringent product quality control ensures compliance with global standards. As environmental regulations tighten, environmental impact assessment has become integral to refinery planning, driving shifts toward greener practices.

The Oil Refining Market continues to evolve with a focus on cleaner fuels and improved efficiency. One critical development is the catalytic reforming process, which enhances the octane rating of gasoline while maximizing valuable aromatic compounds. Safety standards are upheld through flash point measurement, ensuring products meet stringent transportation and storage requirements. With environmental concerns gaining traction, the integration of advanced wastewater treatment plants has become essential, reducing pollutants and conserving water resources. Additionally, oil and gas refinery maintenance services requires substantial time, leading to extended periods of downtime that adversely impact revenue generation.

Regional Analysis

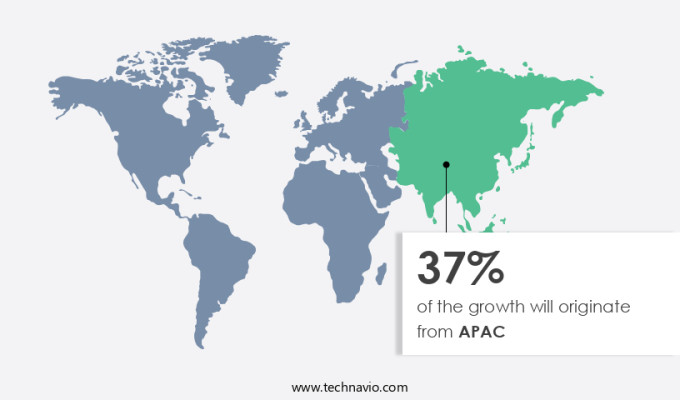

APAC is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in North America is experiencing significant growth due to the increasing demand for energy and the abundance of shale gas in the US. This has led to a rise in investments in petroleum refineries, with many operating in the US and Canada. The focus on refinery process optimization and energy efficiency metrics is crucial to maintain competitiveness in the market. Crude oil distillation, petroleum product blending, and residual oil processing are essential refinery operations. Process safety management and refinery automation systems ensure efficient and safe production. Sulfur removal processes, such as hydrodesulfurization units and emission control systems, are vital for meeting fuel quality specifications and environmental regulations.

Real-time process monitoring and predictive maintenance strategies are also crucial for optimizing refinery operations and minimizing downtime. The market also includes various unit operations, including catalytic reforming, alkylation, gas processing, fractional distillation columns, and isomerization processes. Product distribution networks are essential for the efficient transport of refined petroleum products via pipeline transport systems. Pour point determination and viscosity index calculation are critical in ensuring the quality of the final products. The market also includes advanced technologies like fluid catalytic cracking, hydrocracking, and coking unit operations. The market in North America is dynamic and evolving, with a focus on increasing production capacity, optimizing processes, and meeting fuel quality specifications and environmental regulations.

The integration of various refinery operations, from crude oil distillation to product distribution, plays a significant role in the market's growth and success.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Oil Refining market drivers leading to the rise in the adoption of Industry?

- The rise in demand for refined fuel serves as the primary driver for the market's growth. The market experiences continuous growth due to the increasing global demand for refined petroleum products, particularly gasoline, petrol, and diesel. The rising middle-class population in these regions is leading to an increase in the number of in-use vehicles, thereby fueling the demand for refined products. The refining process involves various unit operations such as fractional distillation columns, alkylation units, and gas processing units. These operations help in separating and converting crude oil into different products based on their boiling points and chemical properties.

- The isomerization process design is crucial in producing high-octane gasoline, while the viscosity index calculation and API gravity measurement help determine the quality of the refined products. Fluid catalytic cracking is a critical refining process that converts heavy crude oil fractions into lighter products such as gasoline and diesel. Emission control systems are also essential in refineries to reduce the environmental impact of the refining process by minimizing the release of harmful pollutants. The market dynamics are influenced by several factors, including crude oil prices, government regulations, and technological advancements. Despite these challenges, the market continues to grow, offering significant opportunities for investors and stakeholders.

What are the Oil Refining market trends shaping the Industry?

- The adoption of modular mini refineries is an emerging market trend. This approach to refining oil is gaining popularity due to its efficiency and cost-effectiveness. Modular mini refineries have gained popularity among oil producers in remote areas, particularly in developing economies, due to their flexibility and cost-effectiveness. The oil refining industry has undergone significant rationalization in the last three decades, driven by rapidly changing environmental regulations and investment incentives to secure energy supply. For oil companies with crude oil wells that do not produce in large quantities, high operational and transportation costs make it challenging to sell their crude oil in the global market. The catalytic cracking process, a key refining technology, enhances the conversion of heavy crude oil into lighter products, meeting fuel quality specifications.

- Environmental regulations necessitate the adoption of advanced technologies like hydrocracking and vacuum distillation units to reduce emissions and improve fuel efficiency. Cetane number analysis is crucial to ensure optimal engine performance and meet diesel fuel quality standards. Storage tank management is essential to maintain product quality and prevent contamination. Advanced technologies like automated tank gauging and remote monitoring systems enable efficient inventory management and reduce operational costs. Compliance with environmental regulations and adherence to fuel quality specifications are critical factors influencing the growth of the oil refining industry.

How does Oil Refining market face challenges during its growth?

- The costly and time-consuming nature of oil refinery maintenance operations poses a significant challenge to the industry's growth, requiring substantial resources and careful planning to minimize disruptions and maximize efficiency. Oil refining is a complex process that involves various activities, including crude oil distillation, petroleum product blending, residual oil processing, and refinery process optimization. These processes require significant investment in maintenance services, making it one of the largest cost components for refinery operators. Every year, refineries spend between USD 40-USD 70 million on maintenance. For instance, Marathon Petroleum's refining operating costs averaged USD 5.74 per barrel in Q1 2025, a slight improvement from USD 6.06 per barrel in the same quarter the previous year. This reduction is a result of continuous efforts to enhance energy efficiency metrics and manage costs effectively, despite a heavy planned maintenance schedule.

- However, the time-consuming nature of refinery maintenance leads to prolonged downtime in production activities, negatively impacting revenue. Moreover, refineries must prioritize process safety management to ensure the safe and efficient operation of their facilities. Octane rating determination and pour point determination are critical processes that require precise measurements and adherence to industry standards. Effective product distribution network management is also essential to ensure the timely delivery of petroleum products to customers. Oil refining is a capital-intensive industry that demands continuous optimization and improvement to maintain profitability and competitiveness.

Exclusive Customer Landscape

The oil refining market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the oil refining market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, oil refining market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Abu Dhabi National Oil Co. - This company leads the oil refining industry with a capacity of 30,000 tons per year, utilizing advanced technology to process used oils.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Abu Dhabi National Oil Co.

- Alexandria Petroleum Co.

- Bharat Petroleum Corp. Ltd.

- BP Plc

- Chevron Corp.

- China Petrochemical Corp.

- CTCI Corp.

- Essar

- Exxon Mobil Corp.

- PJSC Gazprom

- Hindustan Petroleum Corp. Ltd.

- Indian Oil Corp. Ltd.

- Kuwait Petroleum Corp.

- Marathon Petroleum Corp.

- Oil and Natural Gas Corp. Ltd.

- PJSC LUKOIL

- Reliance Industries Ltd.

- Saudi Arabian Oil Co.

- Shell plc

- Valero Energy Corp.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Oil Refining Market

- In January 2024, ExxonMobil and SABIC announced a strategic collaboration to build a new crude-to-chemicals complex in San Patricio, Texas. This joint venture aims to convert 1 million tons per year of crude oil into ethylene and other chemical products, marking a significant expansion in the market's chemical segment (ExxonMobil press release, 2024).

- In March 2024, Shell's Prelude Floating LNG project in Australia received approval from the Australian Competition and Consumer Commission, allowing the company to begin production. This development underscores the growing importance of liquefied natural gas (LNG) in the market as a cleaner alternative fuel source (ABC News Australia, 2024).

- In April 2025, Valero Energy completed the acquisition of Diamond Shamrock's refining and marketing business for USD 1.1 billion. This strategic move strengthens Valero's market position and expands its refining capacity by approximately 100,000 barrels per day (Valero Energy press release, 2025).

- In May 2025, Saudi Aramco and TotalEnergies signed a memorandum of understanding to explore potential collaborations in the hydrogen sector. This agreement marks a significant step towards decarbonizing the oil refining industry and highlights the growing importance of hydrogen as a clean energy source (TotalEnergies press release, 2025).

Research Analyst Overview

The market continues to evolve, with dynamic market conditions shaping the industry's landscape. The catalytic cracking process plays a pivotal role in transforming crude oil into valuable petroleum products. However, the focus on energy efficiency and improving fuel quality specifications necessitates ongoing refinery process optimization. Environmental regulations are a significant catalyst for change, driving the adoption of sulfur removal processes and emission control systems. The hydrodesulfurization unit and vacuum distillation unit are integral components in meeting these regulatory requirements. Moreover, hydrocracking technology is gaining traction due to its ability to convert heavy feedstocks into lighter, more valuable products.

This technology, coupled with real-time process monitoring and predictive maintenance strategies, enhances refinery efficiency and productivity. Fuel quality specifications are continually evolving, necessitating the use of advanced techniques such as cetane number analysis and API gravity measurement. These analyses ensure the production of high-quality fuels that meet the demands of various sectors. Storage tank management is another critical aspect of the market. Proper management of these tanks is essential for maintaining product quality and ensuring safety. Furthermore, the refining process encompasses various units, including the coking unit operation, alkylation unit operation, gas processing unit, and fractional distillation columns.

Each unit plays a unique role in the overall refining process, contributing to the production of a diverse range of petroleum products. The market is characterized by continuous change and evolution. From process optimization and safety management to fuel quality specifications and environmental regulations, various factors influence the industry's dynamics. The integration of advanced technologies and techniques is essential to remain competitive and adapt to the evolving market landscape.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Oil Refining Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

234 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.3% |

|

Market growth 2025-2029 |

USD 111.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.2 |

|

Key countries |

US, Russia, China, Germany, India, Canada, Saudi Arabia, Italy, UK, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Oil Refining Market Research and Growth Report?

- CAGR of the Oil Refining industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the oil refining market growth of industry companies

We can help! Our analysts can customize this oil refining market research report to meet your requirements.