Online Project Management Software Market Size 2024-2028

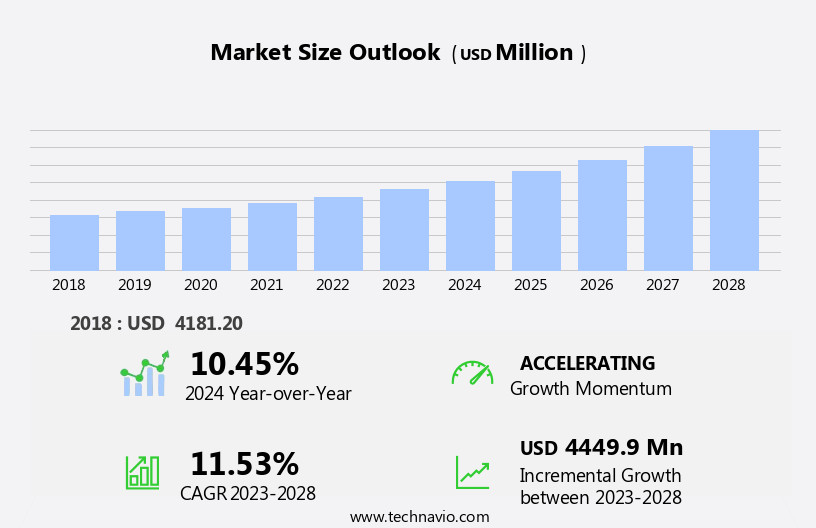

The online project management software market size is forecast to increase by USD 4.45 billion, at a CAGR of 11.53% between 2023 and 2028.

- The market is experiencing significant growth, driven by the increasing demands for large-scale project management and the rise in remote working. With businesses expanding their operations and managing increasingly complex projects, the need for efficient and effective project management solutions i.e digital transformation has become essential. The shift towards remote work has further accelerated this trend, as teams require tools that enable seamless collaboration and real-time project tracking from anywhere. However, this market is not without its challenges. Data security and privacy concerns continue to pose significant obstacles. As more businesses adopt cloud-based project management software, ensuring the security of sensitive project information becomes paramount.

- Companies must invest in robust security measures and transparent data handling practices to build trust with their clients and team members. Addressing these challenges while capitalizing on the market's growth opportunities requires a strategic approach that prioritizes user experience, data security, and scalability. By focusing on these areas, companies can differentiate themselves in the competitive landscape and effectively meet the evolving needs of their customers.

What will be the Size of the Online Project Management Software Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2018-2022 and forecasts 2024-2028 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market activities unfolding across various sectors. Seamlessly integrated solutions enable project planning and version control, ensuring effective project reporting and resource allocation. Mobile accessibility and collaboration tools facilitate real-time communication and agile methodologies, including Scrum master and Agile coaching. Subscription models and project portfolio management streamline operations, while document management and API integrations enhance customization. Project roadmaps and Gantt charts provide clear visualizations, and task management tools ensure progress tracking and workflow automation.

Security features, including data encryption and user permissions, prioritize data protection. Project analytics and third-party integrations offer valuable insights, complementing project management consulting and training services. Cloud-based solutions and on-premise alternatives cater to diverse organizational needs. Continuous improvement is the key driver, with ongoing enhancements in bug tracking, risk management, time tracking, and team communication.

How is this Online Project Management Software Industry segmented?

The online project management software industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- End-user

- Enterprises

- Government

- Deployment

- On-premises

- Cloud

- Geography

- North America

- US

- Europe

- Germany

- UK

- APAC

- China

- Japan

- Rest of World (ROW).

- North America

By End-user Insights

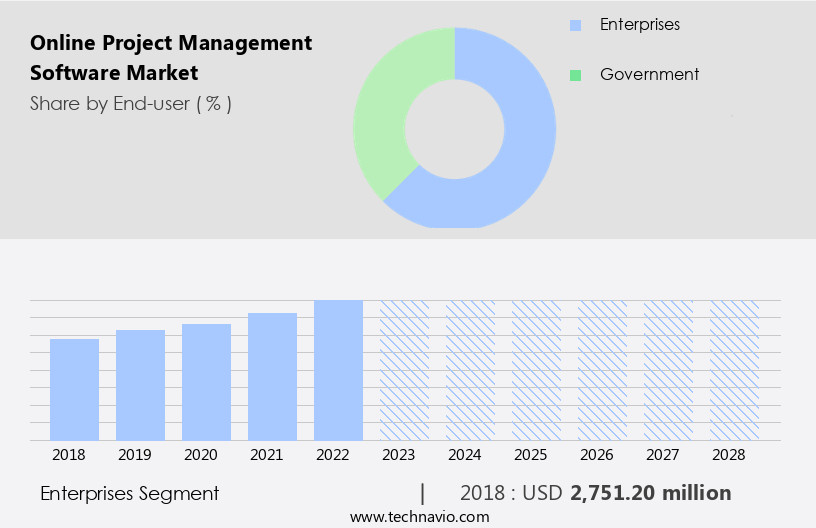

The enterprises segment is estimated to witness significant growth during the forecast period.

Online project management software has gained significant traction among enterprises in various sectors, including IT, manufacturing, construction, marketing/public relations and advertising, management consultancies, BFSI, and others. In the IT sector, effective collaboration among people, processes, and applications is crucial, leading to the widespread adoption of online project management software for software development. This software facilitates project planning, task monitoring, communication, and software quality control. The manufacturing sector faces critical challenges such as inefficient cost, schedule, and quality control. To address these issues, there is a rising demand for online project management software. Manufacturing projects involve a set of interdependent processes, and managing these processes efficiently is essential for ensuring quality at each stage.

Project planning is a fundamental aspect of project management, and online project management software offers customizable options for creating project roadmaps, Gantt charts, and project analytics. Version control and issue management are critical features that enable teams to track changes and resolve problems effectively. Resource allocation and collaboration tools are essential for managing team communication and project progress. Agile methodologies, such as Scrum and Agile coaching, have become popular in software development, and online project management software offers support for these methodologies through features like task management, workflow automation, and burndown charts. Subscription models and freemium options offer flexibility for businesses of all sizes.

Project portfolio management and document management are essential features for managing multiple projects and maintaining project documentation. API integrations and third-party integrations enable seamless data exchange with other tools and systems. Data encryption, security features, and user permissions ensure data privacy and access control. Time tracking and risk management help teams stay on schedule and mitigate potential risks. Cloud-based solutions offer mobility and accessibility, allowing teams to work remotely. Project dashboards provide real-time project insights, enabling teams to monitor progress and identify potential issues. Online project management software caters to the unique needs of different sectors, making it an indispensable tool for effective project management.

The Enterprises segment was valued at USD 2.75 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

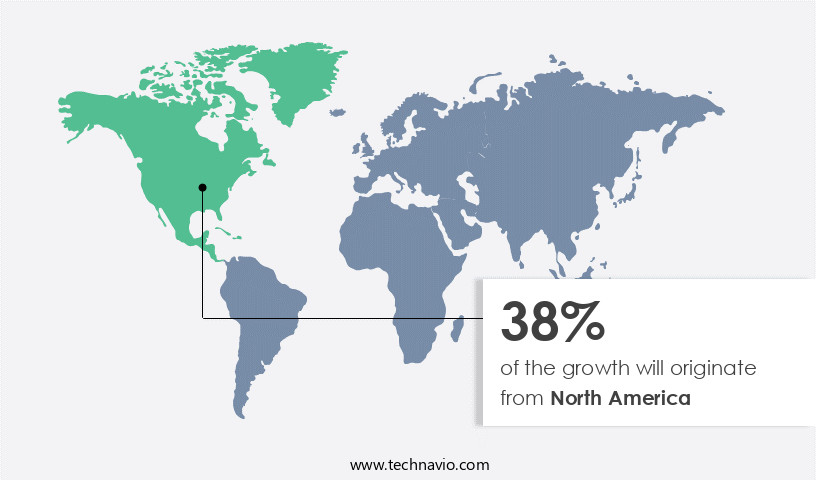

North America is estimated to contribute 38% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Project Management Software market in North America is a significant contributor to the global industry revenue, with the US being a hub for numerous providers and the headquarters of many multinational corporations. The adoption of online project management tools is on the rise due to their cost-effectiveness and user-friendly features, leading key players to offer industry-specific solutions across the region. In Canada, the preference for cloud-based services is high due to the centralization of businesses. Agile methodologies, such as Scrum and Waterfall, are popular project management approaches that are well-integrated into these solutions. Customization options, collaboration tools, and role-based access control are essential features that cater to diverse business requirements.

Freemium models, subscription plans, and project portfolio management are other popular trends. Document management, API integrations, and Gantt charts facilitate efficient project planning and reporting. Time tracking, risk management, and data encryption ensure project security. Team communication, project dashboards, workflow automation, and progress tracking are essential for effective collaboration. Cloud-based and on-premise solutions cater to various business needs, while third-party integrations and issue management streamline workflows. Agile coaching and project management consulting and training services further enhance the value proposition of these solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Online Project Management Software Industry?

- The escalating demands for effective large-scale project management are the primary market drivers, necessitating the continuous development and implementation of advanced project management solutions.

- Online project management software has become an essential tool for businesses aiming to streamline large-scale project management. The increasing focus on resource allocation and efficient utilization has fueled the demand for advanced project management solutions. This software automates processes, enabling organizations to manage resources effectively and maintain regular project follow-ups. The benefits of implementing online project management software extend beyond process management. It offers features like version control, project reporting, and collaboration tools that enhance team productivity and project outcomes.

- Additionally, agile methodologies and mobile accessibility ensure flexibility and adaptability. Customization options cater to unique business requirements, while bug tracking and project planning tools ensure project success. Freemium models offer cost-effective solutions for small teams, making it an accessible choice for businesses of all sizes. Overall, the adoption of online project management software is a strategic investment towards efficient project management and optimal resource utilization.

What are the market trends shaping the Online Project Management Software Industry?

- The increasing prevalence of remote work is a significant market trend.

- In response to the shift towards remote work due to the pandemic, online project management software has become an essential tool for businesses. According to recent research, over 70% of companies plan to continue with remote work post-COVID-19. This software enables project managers to effectively oversee projects with hybrid or remote workforces, ensuring tasks are completed on time and projects stay on track. Role-based access control allows for secure data management, while project roadmaps and Gantt charts provide clear visualizations of project timelines. Scrum masters can utilize the software to manage Agile methodologies such as Scrum, and API integrations enable seamless data exchange with other business systems.

- Document management features enable easy access to important project documents, and task management tools help teams prioritize and complete tasks efficiently. Project portfolio management allows organizations to manage multiple projects simultaneously, and subscription models offer flexible pricing options. Online project management software is a valuable investment for businesses adapting to the new normal of remote work. It offers project managers the ability to effectively manage projects in real-time, regardless of shift timings and locations.

What challenges does the Online Project Management Software Industry face during its growth?

- Data security and privacy pose significant challenges to the industry's growth, as ensuring the confidentiality, integrity, and availability of information is essential for businesses to maintain trust with their customers and protect against potential data breaches.

- Online project management software has become a popular choice for businesses due to its cost-effectiveness and accessibility. However, security is a significant concern when implementing such solutions. The potential risk of corporate project information being exposed due to web security vulnerabilities is a major concern. One potential issue is that clients may overlook checking the server certification authority (CA) credentials during a secure socket layer (SSL) connection. This lack of transparency in data storage locations can lead to legal and security concerns for an organization's infrastructure. Agile coaching, project management consulting, and training are essential components of successful project management.

- Open source solutions offer flexibility and cost savings, but they may not provide the same level of security features as proprietary software. Time tracking, risk management, team communication, project dashboards, and workflow automation are crucial functionalities for effective project management. Data encryption and robust security features are essential to protect sensitive project information. As project management software becomes increasingly immersive and harmonious, it is vital to prioritize security to maintain a harmonious work environment. Businesses must carefully evaluate the security features of online project management software before adoption to mitigate potential risks and ensure the confidentiality and integrity of their project data.

Exclusive Customer Landscape

The online project management software market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the online project management software market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, online project management software market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

ActiveCollab LLC - This company specializes in Workflow software solutions, designed to streamline team and client management, project planning, and resource forecasting. The software offers a user-friendly interface for efficient collaboration and organization, enhancing productivity and ensuring deadlines are met. By implementing advanced features, such as automated workflows and real-time data analysis, this software empowers businesses to effectively manage their projects and optimize their resources. Additionally, seamless integration with various applications and platforms ensures a cohesive work environment. With a focus on innovation and continuous improvement, the company's software is an essential tool for businesses seeking to streamline their operations and drive success.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- ActiveCollab LLC

- Apptio Inc

- Atlassian Corp. Plc

- Basecamp LLC

- Citrix Systems Inc.

- Clarizen Inc.

- LiquidPlanner Inc.

- Mavenlink Inc.

- Microsoft Corp.

- monday.com Ltd.

- Planbox Inc.

- Premiere Global Services Inc.

- ProjectManager.com Inc.

- Redbooth

- Scoro Software

- TeamGantt

- Teamwork Crew Ltd.

- Workfront Inc.

- Wrike Inc.

- Zoho Corp. Pvt. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Online Project Management Software Market

- In February 2024, Asana, a leading online project management software provider, announced the launch of its new product, Asana Business, catering to larger organizations with advanced features such as customizable workflows, unlimited dashboards, and advanced reporting. This expansion signified Asana's commitment to catering to a broader market segment (Asana Press Release, 2024).

- In June 2024, Microsoft Teams, a popular collaboration platform, integrated Project Online, Microsoft's project management solution, deeper into its ecosystem. This strategic partnership allowed users to manage projects directly within Microsoft Teams, enhancing productivity and streamlining workflows for teams (Microsoft Press Release, 2024).

- In October 2024, Trello, a Trello Corporation brand, secured a USD425 million funding round, bringing its valuation to USD4.15 billion. This significant investment will be used to accelerate product development and expand its global presence (Trello Corporation Press Release, 2024).

- In March 2025, Monday.Com, an online project management software company, announced its entry into the Indian market. This strategic expansion aimed to tap into the growing demand for project management solutions in the region, as more businesses adopt digital tools to manage their operations (Monday.Com Press Release, 2025).

- These developments demonstrate the ongoing competition and innovation within the market, with new product launches, strategic partnerships, significant investments, and geographic expansions shaping the industry landscape.

Research Analyst Overview

- In the dynamic the market, organizations prioritize tools that facilitate effective project execution and enable continuous improvement. Project failure analysis and project lessons learned are crucial elements for organizations, driving the demand for advanced project management software. Project management careers thrive in this sector, with opportunities in consulting, training, and risk assessment. Notifications and alerts, project success metrics, and real-time updates are essential features for project managers, ensuring they stay informed and agile. Project management standards, principles, and techniques are evolving, with customizable workflows and team collaboration becoming increasingly important. Project budgets, task dependencies, and resource management are core components of project management tools, ensuring efficient allocation of resources and adherence to deadlines.

- Project audits, post-mortems, and quality management are integral parts of project closure, providing valuable insights for future projects. Project prioritization, sprint planning, and project management frameworks enable effective project execution, while project cost management and risk mitigation strategies help organizations minimize losses. Project documentation, knowledge management, and leadership are essential skills for project managers, with certifications offering credibility and career advancement opportunities. Kanban boards and project milestones provide visual representations of project progress, enhancing team productivity and project transparency.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Online Project Management Software Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.53% |

|

Market growth 2024-2028 |

USD 4449.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.45 |

|

Key countries |

US, UK, China, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Online Project Management Software Market Research and Growth Report?

- CAGR of the Online Project Management Software industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the online project management software market growth of industry companies

We can help! Our analysts can customize this online project management software market research report to meet your requirements.