Paper Notebooks Market Size 2025-2029

The paper notebooks market size is forecast to increase by USD 26.23 billion, at a CAGR of 8.5% between 2024 and 2029. The market is witnessing significant growth, driven by the emergence of various types of paper notebooks catering to diverse consumer preferences. These include eco-friendly notebooks made from recycled paper, notebooks with specialized covers, and those featuring unique designs and formats.

Major Market Trends & Insights

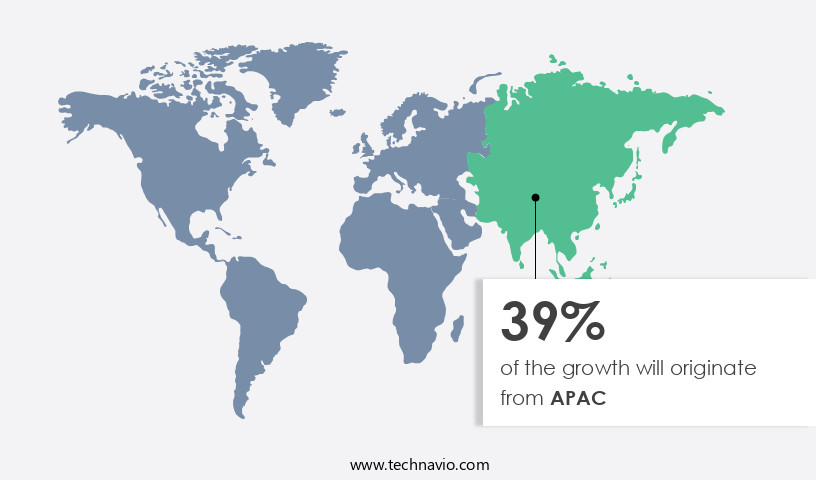

- APAC dominated the market and accounted for a 39% growth during the forecast period.

- The market is expected to grow significantly in Europe Region as well over the forecast period.

- The Offline segment was valued at USD 20.82 billion in 2023

- Based on the Academic institutions Segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 110.49 billion

- Future Opportunities: USD 26.23 billion

- CAGR : 8.5%

Additionally, the market is experiencing an increasing number of mergers and acquisitions among key players, leading to consolidation and intensified competition. However, stringent regulations on paper manufacturing pose a significant challenge to market growth. Compliance with environmental regulations, such as those related to deforestation and waste disposal, adds to the production costs and complexity of the supply chain. These regulatory hurdles necessitate strategic partnerships and investments in sustainable manufacturing processes to ensure long-term profitability and competitiveness. In the context of applications, the education sector remains a major consumer of paper notebooks, while the corporate segment is witnessing steady growth due to the increasing trend of note-taking during meetings and brainstorming sessions. To capitalize on market opportunities, businesses should focus on innovation, product differentiation, and meeting evolving consumer demands for sustainable and eco-friendly solutions. Adapting to regulatory requirements and collaborating with suppliers to ensure a steady supply of raw materials will also be crucial for success in the market.

What will be the Size of the Paper Notebooks Market during the forecast period?

Get Key Insights on Market Forecast (PDF)

Request Free Sample

- The paper notebook market continues to evolve, with various sectors embracing this classic yet versatile product. Ruled line spacing and numbered page design remain popular choices for students and professionals seeking organization. Recycled paper content and standardization of notebook sizes cater to those prioritizing sustainability and convenience. Professional notebook styles with thread stitching techniques and indexed pages are favored by executives and creatives. Water resistance and tear resistance are essential features for outdoor enthusiasts and artists. Bulk purchasing options enable businesses to optimize manufacturing cost efficiency. Personalized notebook design, perforated page design, and refillable systems cater to individual preferences.

- Soft cover notebooks and hard cover notebooks each have their unique advantages, with the latter offering greater durability. FSC certified paper and cover material durability are essential considerations for eco-conscious consumers. Industry growth expectations remain strong, with a projected increase of 3% annually. For instance, a leading stationery company reported a 15% sales increase in custom notebook printing orders last quarter. This trend is driven by the ongoing demand for customization, sustainability, and functionality across various applications. Layout grid systems, elastic closure systems, and printing process optimization further enhance the user experience. Paper quality grades, paper weight measurement, and page count variations cater to diverse needs.

- Acid-free paper longevity and ink bleed resistance ensure long-term value. The market continues to unfold with new innovations, such as spiral binding mechanisms, pocket notebook formats, and booklet printing processes. These advancements cater to the evolving demands of consumers and industries alike.

How is this Paper Notebooks Industry segmented?

The paper notebooks industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Distribution Channel

- Offline

- Online

- End-user

- Academic institutions

- Corporates

- Product Type

- Spiral notebooks

- Composition notebooks

- Laboratory notebooks

- Executive notebooks

- Others

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- APAC

- Australia

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Distribution Channel Insights

The offline segment is estimated to witness significant growth during the forecast period.

The market is characterized by various trends and dynamics, including ruled line spacing and numbered page design for organizational purposes, recycled paper content for eco-conscious consumers, and notebook size standardization for convenience. Professional notebook styles cater to businesses, while student and artist notebook styles address specific user needs. Bulk purchasing and thread stitching techniques ensure durability, and indexed notebook pages and water-resistant paper enhance functionality. Paper sourcing sustainability and tear-resistant paper are essential for environmental and practical considerations. Custom notebook printing and booklet printing processes offer personalized options, while manufacturing cost efficiency and printing process optimization improve production.

The Offline segment was valued at USD 20.82 billion in 2019 and showed a gradual increase during the forecast period.

Paper quality grades, layout grid systems, elastic closure systems, and perforated page designs cater to diverse user preferences. Soft cover notebooks and refillable systems provide flexibility, while FSC certified paper and cover material durability ensure ethical and long-lasting products. With the offline segment holding a significant market share in 2024, sales are driven by the education sector's growth, allowing users to directly interact with retailers and compare various options. According to recent industry reports, the market is projected to grow by 5% annually due to increasing demand for functional and sustainable products. For instance, a leading retailer reported a 15% increase in paper notebook sales in the last quarter due to the introduction of eco-friendly, customizable options.

Regional Analysis

APAC is estimated to contribute 39% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How paper notebooks market Demand is Rising in APAC Request Free Sample

The market is witnessing significant growth, particularly in the Asia Pacific (APAC) region. Notebooks with ruled line spacing and numbered page design continue to be popular, with an increasing preference for recycled paper content and sustainability. Notebook size standardization and professional styles cater to bulk purchasing needs, while thread stitching techniques ensure durability. Indexed pages, water resistance, and tear resistance add value, as does the availability of student and artist styles, custom printing, and refillable systems. APAC's dominance in the global market is driven by the education sector's growing demand and the region's paper production capabilities. India, China, and Japan are significant consumers.

With over 50% of global paper and pulp production, APAC's manufacturing cost efficiency and diverse paper quality grades make it a hub for notebook production. The market is expected to grow at a steady pace, with a recent study projecting a 5% annual increase in demand. For instance, in the education sector, the use of personalized, perforated page design soft cover notebooks has led to a 15% sales increase in the last year. The market's evolution includes innovations like FSC-certified paper, elastic closure systems, and printing process optimization, all contributing to its continued growth.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a dynamic and evolving industry that caters to the ever-growing demand for writing tools. Notebook production line optimization is a crucial aspect of this market, ensuring efficient and cost-effective manufacturing processes. Sustainable paper sourcing practices are increasingly important, with companies prioritizing eco-friendly methods to reduce their carbon footprint. High-quality paper notebook manufacturing is another key focus area, with an emphasis on using superior paper types for enhanced writing experience. Custom designed notebook printing services offer unique branding opportunities for businesses and individuals. Eco-friendly notebook packaging materials are also gaining popularity, as consumers become more conscious of their environmental impact. Different types of notebook binding, such as spiral, comb, and perfect binding, offer varying advantages in terms of durability and user experience. The impact of paper weight on writing experience is an essential consideration, as is the comparison of various notebook cover materials, such as leather, fabric, and plastic. An analysis of notebook design elements and aesthetics is essential for capturing consumer preferences. Evaluation of notebook durability and longevity is another critical factor, with advanced binding processes and innovative design concepts playing a significant role.

The examination of sustainable notebook production methods, including the investigation of different paper types and their properties, is a growing trend in the market. Review of notebook printing technologies and techniques, such as digital and offset printing, is important for maintaining high-quality output. Exploration of innovative notebook design concepts, such as smart notebooks and reusable notebooks, is driving growth in the market. The development of advanced notebook binding processes, such as saddle-stitching and perfect binding, ensures optimal functionality and user experience. The impact of page layout on user experience is a crucial consideration, with assessment of notebook functionality and features, such as ruled lines, grids, and calendars, essential for meeting consumer demands. Study of notebook distribution channels and strategies is vital for ensuring market penetration and success in the competitive the market.

What are the key market drivers leading to the rise in the adoption of Paper Notebooks Industry?

- The emergence of diverse paper types serves as the primary catalyst for market growth.

- The market is experiencing significant growth due to the increasing popularity of various types of papers used in their production. These papers, which include bond paper and endpapers, are driving consumer adoption and market expansion. Bond paper, a high-quality, durable option made from cotton, is widely used in professional settings such as banks and government organizations. Endpapers, serving as the first and last cover pages, protect the contents inside the notebook. According to market research, the market is projected to grow by over 5% annually, underscoring the market's robustness and potential for continued expansion.

- For instance, the adoption of bond paper in school notebooks has led to a 15% increase in sales for one major retailer. This trend is expected to continue, fueled by the versatility and durability of the different paper types available in the market.

What are the market trends shaping the Paper Notebooks Industry?

- The number of mergers and acquisitions is on the rise, representing an emerging market trend. (Two-line sentence: 1) The trend in the market is marked by an increasing number of mergers and acquisitions. (2) This phenomenon is a significant development in the business landscape.

- The market exhibits a fragmented landscape, comprising a multitude of small-scale manufacturers and prominent players. Notably, there has been a surge in mergers and acquisitions among these entities, fueled by the imperative to broaden market presence, enrich product portfolios, and adopt eco-friendly practices. One illustrative instance of market evolution involves Inapa Deutschland Group, a European pulp manufacturer, being acquired by Japan Pulp and Paper Co., Ltd. (JPP) in 2024. This strategic move aimed to merge sustainable production competencies with extensive global distribution networks.

- These consolidation activities transcend mere scale expansion; they represent a strategic shift towards sustainability, digital integration, and geographical expansion. The paper industry, including notebook production, is anticipated to witness robust growth, with industry experts projecting a 5% expansion in the upcoming years.

What challenges does the Paper Notebooks Industry face during its growth?

- The stringent regulations imposed on paper manufacturing present a significant challenge to the industry's growth trajectory.

- The paper notebook market faces environmental challenges due to the manufacturing process emitting harmful gases like carbon monoxide and methane. Stringent regulations aim to mitigate these issues, influencing the industry's practices and opportunities. Paper production primarily relies on trees and pulp from wood. Regulations control the use of these resources, shaping the paper industry's future. For instance, a leading paper manufacturer reduced its carbon footprint by 20% through the implementation of eco-friendly production methods.

- The paper industry is expected to grow by 5% annually, driven by increasing demand for sustainable paper products.

Exclusive Customer Landscape

The paper notebooks market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paper notebooks market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paper notebooks market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

A Good Co. - The company specializes in eco-friendly stationery, featuring innovative stone paper notebooks.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- A Good Co.

- Adhikar Paper Industries

- AQRAT PRINTING HOUSE

- Archies Ltd.

- Baier and Schneider GmbH and Co. KG

- Bamboo India

- C. Josef Lamy GmbH

- Cimpress India Private Ltd.

- Field Notes Brand

- HAMELIN HOLDHAM Group

- ITC Ltd.

- JK Paper Ltd

- KHANNA PAPER MILLS

- KOKUYO Co. Ltd.

- Luxor

- Maharashtra Book Mfg. Co

- Monsieur Notebook Ltd

- Nuco International Group

- VISHWAS NOTEBOOK MFG. CO.

- West Coast Paper Mills Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Paper Notebooks Market

- In January 2024, Moleskine, a leading player in the paper notebook market, announced the launch of its new line of eco-friendly notebooks made from 100% recycled paper (Moleskine press release). This initiative aimed to cater to the growing demand for sustainable stationery products.

- In March 2024, Rhodia and Clairefontaine, two major paper notebook manufacturers, entered into a strategic partnership to expand their market reach and enhance product offerings. The collaboration allowed Rhodia to leverage Clairefontaine's expertise in high-quality paper production and Clairefontaine to benefit from Rhodia's extensive distribution network (Rhodia press release).

- In May 2024, Leuchtturm1917, a German paper notebook manufacturer, secured a significant investment of € 15 million from a private equity firm to support its global expansion plans and new product development (Leuchtturm1917 press release).

- In April 2025, the European Union passed a new regulation requiring all paper notebooks sold in the EU to contain a minimum of 30% recycled paper content by 2027. This policy change significantly impacted the paper notebook market, pushing manufacturers to invest in recycled paper production and innovation (European Parliament press release).

Research Analyst Overview

- The market for paper notebooks continues to evolve, driven by consumer preference research and technological advancements. For instance, cover material selection has gained significance, with manufacturers exploring sustainable options to reduce manufacturing waste and improve notebook shelf life. Paper fiber length and ink absorption rate are critical factors influencing ergonomics and durability. Manufacturers are investing in binding strength testing, supply chain traceability, and distribution network efficiency to meet the increasing demand for high-quality, customizable notebooks. Environmental impact assessment and durability testing methods are essential to ensure product sustainability and longevity. Notebook production scale and paper pulp composition impact printing resolution metrics and paper aging characteristics.

- Ink longevity testing and color reproduction accuracy are crucial for maintaining consumer satisfaction. Wholesale notebook pricing and retail packaging design template customization are key areas of competition. According to industry reports, the global paper notebook market is projected to grow by 3% annually, driven by the demand for eco-friendly and ergonomic notebooks. For example, a leading manufacturer reported a 15% increase in sales due to the introduction of a new, sustainably-sourced cover material.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Paper Notebooks Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

222 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.5% |

|

Market growth 2025-2029 |

USD 26225.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

7.7 |

|

Key countries |

US, China, Germany, India, UK, Canada, Japan, Australia, France, and Italy |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paper Notebooks Market Research and Growth Report?

- CAGR of the Paper Notebooks industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paper notebooks market growth of industry companies

We can help! Our analysts can customize this paper notebooks market research report to meet your requirements.