Paraffin Inhibitors Market Size 2024-2028

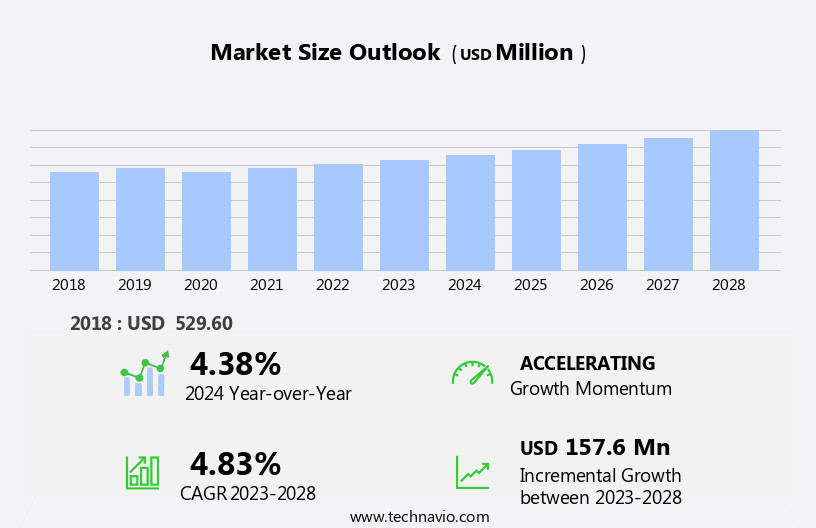

The paraffin inhibitors market size is forecast to increase by USD 157.6 million at a CAGR of 4.83% between 2023 and 2028.

- Paraffin inhibitors play a crucial role In the lubrication of crude oil and natural gas during production and transportation. The offshore drilling industry, in particular, relies heavily on paraffin inhibitors to prevent the formation of paraffin wax, which can cause blockages and reduce the efficiency of drilling operations. The market for paraffin inhibitors is driven by several factors, including the increasing demand for oil and gas, stringent environmental and safety regulations, and the volatility of crude oil and gas prices. Biodegradable polymers are gaining popularity as an alternative to traditional paraffin inhibitors due to their eco-friendly nature. These polymers are effective in preventing wax deposition while minimizing the environmental impact.

- Additionally, the increasing investments in oil storage tanks to meet the growing demand for oil and gas storage is expected to fuel the market growth. However, the high cost of paraffin inhibitors and the availability of alternative methods, such as solvents, pose significant challenges to the market. In summary, the market is driven by the increasing demand for oil and gas, stringent environmental and safety regulations, and the volatility of crude oil and gas prices. The use of biodegradable polymers is a growing trend due to their eco-friendly nature, while the high cost of paraffin inhibitors and the availability of alternative methods present challenges to the market.

- The market analysis report provides a comprehensive assessment of these trends and challenges, along with market size and forecast, segmentation analysis, and competitive landscape.

What will be the Size of the Paraffin Inhibitors Market During the Forecast Period?

- The market plays a crucial role in the oil & gas sector by mitigating the negative effects of paraffin deposition in pipelines and wells. Paraffin, a natural wax derived from crude oil, can solidify under certain conditions, leading to operational inefficiencies and potential damage to infrastructure. Paraffin inhibitors prevent paraffin wax crystals from forming and depositing, ensuring the continued flow of oil and natural gas. The market for Paraffin Inhibitors is driven by the need for operational efficiency and sustainability In the upstream segment of the petroleum industry. Pipeline engineers and industrial sectors rely on these eco-friendly solutions to maintaIn the pumpability of crude oil and natural gas in storage tanks and transportation pipelines.

- The midstream sector, which focuses on the transportation, storage, and processing of hydrocarbons, also benefits from the use of Paraffin Inhibitors. The market encompasses a range of products, including poly acrylate, modified poly carboxylate, and EVA acrylate copolymer. These inhibitors are essential for the oilfield projects that explore and drill for new reserves, as well as for the ongoing maintenance of existing infrastructure. The use of Paraffin Inhibitors contributes to the overall sustainability of the oil & gas sector by reducing downtime, minimizing the need for costly repairs, and ensuring the safe and efficient transportation of hydrocarbons.

How is this Paraffin Inhibitors Industry segmented and which is the largest segment?

The paraffin inhibitors industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Onshore

- Offshore

- Geography

- North America

- US

- Europe

- Germany

- APAC

- China

- Japan

- Middle East and Africa

- South America

- North America

By Application Insights

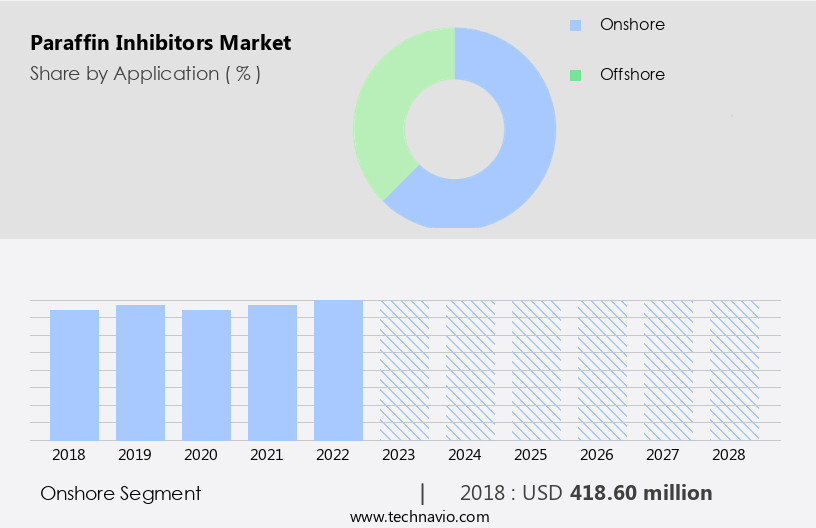

The onshore segment is estimated to witness significant growth during the forecast period. Paraffin inhibitors are essential In the oil and gas sector to prevent paraffin deposition in pipelines, wells, and storage tanks. The demand for paraffin inhibitors is driven by the increase in onshore crude oil exploration and production activities. With the rise of onshore drilling in countries like India, Malaysia, Indonesia, China, South Korea, and Japan, the need to maintain operational efficiency and prevent wax crystallization is becoming increasingly important. Paraffin, a natural component of crude oil, can solidify and cause blockages in pipelines, reducing pumpability and increasing energy costs. Paraffin inhibitors, including crystal modifiers, dispersants, solvents, and hyperbranched polyesters, help prevent these issues and ensure the sustainability of oil and gas production.

Additionally, eco-friendly solutions are gaining popularity in the industry to reduce the environmental impact of paraffin inhibitors. The global demand for paraffin inhibitors is expected to grow In the upstream, midstream, and downstream sectors, including petroleum-based products, exploration, drilling, and transportation.

Get a glance at the Paraffin Inhibitors Industry report of share of various segments. Request Free Sample

The onshore segment was valued at USD 418.60 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

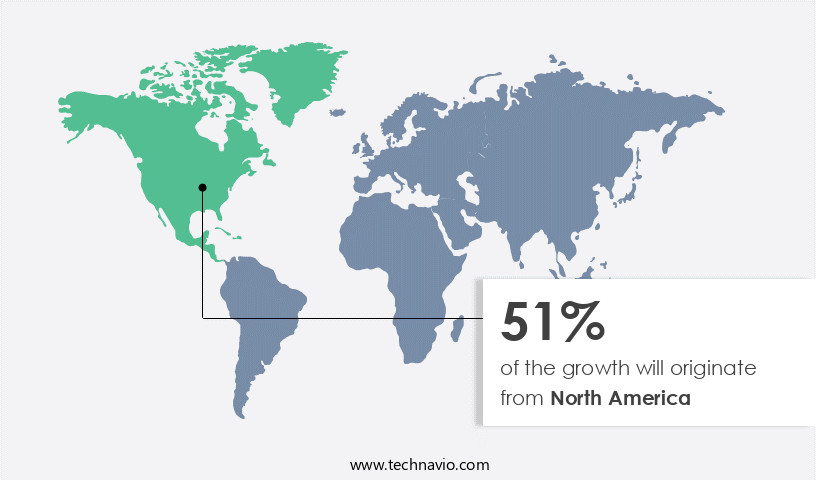

North America is estimated to contribute 51% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market in North America is experiencing growth due to the region's expanding oil and gas production. According to the US Energy Information Administration (EIA), the US produced approximately 11.9 million barrels (bbls) of crude oil daily in 2022. Offshore oil and gas production In the region is also on the rise. As of July 2020, the Gulf of Mexico's federal offshore oil production accounted for 16% of the total US crude oil production, and natural gas production accounted for 2% of the total US gas production. Paraffin deposition is a common challenge in oil and gas production, leading to operational inefficiencies and increased energy costs.

Paraffin inhibitors play a crucial role in preventing paraffin deposition in pipelines, wells, and storage tanks. Eco-friendly solutions, sustainability, and operational efficiency are key drivers in the market. Paraffin, a natural component of crude oil, can solidify and form wax crystals, affecting pumpability and production tree performance. Paraffin deposition also impacts subsea pipelines and the overall energy costs In the upstream, midstream, and downstream sectors. The oil and gas industry relies on paraffin inhibitors to maintain production levels and prevent costly downtime. Paraffin inhibitors are also used in various industrial sectors, including petroleum-based products, and in exploration and drilling processes. The global demand for paraffin inhibitors is expected to increase due to the ongoing exploration and drilling activities, as well as the need for eco-friendly and sustainable solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Paraffin Inhibitors Industry?

- Sustainability of environmental and safety regulations is the key driver of the market.The market is experiencing growth due to the expanding oil and gas industry. Regulatory compliance in this sector has become increasingly stringent in response to environmental concerns and safety incidents, such as the Deepwater Horizon incident In the US in 2010. This has led to the implementation of directives like the EU's safety of offshore oil and gas operations directive, which sets safety standards for offshore activities in Europe. Paraffin inhibitors play a crucial role in maintaining operational efficiency in pipelines and wells by preventing paraffin deposition.

- Paraffin, a component of crude oil, can solidify and form wax crystals under certain conditions, reducing pumpability and increasing water/oil ratio and total fluid volume. Paraffin inhibitors are used to prevent these issues. The market for these solutions is driven by the oil & gas industry's need for eco-friendly and sustainable solutions, as well as the global demand for petroleum-based products in industrial sectors and the petrochemical industry. The market for Paraffin Inhibitors is expected to continue growing as the oil and gas industry explores, drills, and transports oil and natural gas, both onshore and offshore.

What are the market trends shaping the Paraffin Inhibitors Industry?

- Increasing investments in oil storage tanks is the upcoming market trend. The market experiences growth due to the expanding investments in oil storage infrastructure. With numerous countries importing crude oil, there is a rising demand for oil storage tanks and increased storage capacities. For instance, in 2018, the US was the largest importer of crude oil from the Middle East and Africa. In response, oil terminals in this region are expanding their storage tanks to meet the growing demand. For example, in April 2020, Brooge Energy Ltd. Announced a contract with MUC Oil & Gas Engineering Consultancy LLC to complete Phase 3 refinery and storage expansion at BPGIC's existing terminal operations in Fujairah, UAE.

- Paraffin deposition in pipelines and wells can significantly impact operational efficiency and increase energy costs. Paraffin inhibitors are essential in preventing paraffin wax deposition in crude oil, natural gas, and petroleum-based products. These inhibitors play a crucial role In the oil & gas sector, including exploration and drilling, midstream transportation pipelines, and downstream industrial sectors. Paraffin inhibitors come in various forms, such as crystal modifiers, dispersants, solvents, hyperbranched polyesters, poly acrylates, and EVA acrylate copolymers. These solutions not only improve pumpability and reduce wax deposition but also contribute to sustainability and eco-friendly practices In the industry.

What challenges does the Paraffin Inhibitors Industry face during its growth?

- Volatility in oil and gas prices is a key challenge affecting the industry growth. Paraffin inhibitors play a crucial role In the oil and gas industry by preventing paraffin deposition in pipelines, wells, and storage tanks. Paraffin, a natural wax component in crude oil, can solidify under certain conditions, leading to operational inefficiencies and increased energy costs. Paraffin inhibitors mitigate these issues by preventing wax crystals from forming, ensuring pumpability and maintaining production tree efficiency. The oil & gas sector, including natural gas and oilfield projects, heavily relies on eco-friendly and sustainable paraffin inhibitor solutions. Paraffin deposition can negatively impact the environment by increasing greenhouse gas emissions and reducing the efficiency of energy production. Paraffin inhibitors, such as crystal modifiers, dispersants, solvents, hyperbranched polyesters, poly acrylates, and EVA acrylate copolymers, are essential in addressing these challenges.

- The volatility of crude oil prices significantly influences the demand for paraffin inhibitors. Fluctuations in crude oil prices can impact the profitability of oil and gas companies, affecting their investment decisions in exploration, drilling, and production. Additionally, the prices of petroleum-based products, such as gasoline and lubricants, are directly linked to crude oil prices, further emphasizing the importance of paraffin inhibitors in maintaining operational efficiency and reducing costs. Paraffin inhibitors are essential in various industrial sectors, including midstream transportation pipelines, upstream exploration and drilling, and downstream oil refining and petrochemical production. The global demand for paraffin inhibitors is expected to continue growing due to the increasing focus on maintaining production efficiency, reducing energy costs, and ensuring the sustainability of oil and gas operations.

Exclusive Customer Landscape

The paraffin inhibitors market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the paraffin inhibitors market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, paraffin inhibitors market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AES Arabia Ltd.

- BASF SE

- Clariant International Ltd.

- Croda International Plc

- Dorf Ketal Chemicals I Pvt. Ltd.

- Dow Inc.

- Ecolab Inc.

- EMEC

- Evonik Industries AG

- FlexChem Corp

- Force Fluids LLC

- General Electric Co.

- Halliburton Co.

- Innospec Inc.

- Kosta Oil Field Technologies Inc.

- Refinery Specialties Inc.

- Rocanda

- Roemex Ltd.

- Schlumberger Ltd.

- Zirax

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Paraffin inhibitors play a crucial role in ensuring the operational efficiency of various industrial processes withIn the oil and gas sector. These substances prevent the formation and deposition of paraffin wax, a natural byproduct of crude oil, in pipelines, wells, and storage tanks. Paraffin deposition can lead to several issues, including reduced pumpability, increased energy costs, and even pipeline failure. The importance of paraffin inhibitors becomes particularly significant In the context of pipelines, where the transport of both oil and natural gas relies on maintaining fluidity and preventing solidification. Paraffin deposition can occur at various stages, from downhole production to surface location, and can impact the overall performance and sustainability of oil and gas industry projects.

Pipeline engineers and operators In the midstream sector are particularly interested in eco-friendly solutions to address paraffin deposition. As the global demand for petroleum-based products continues to grow, so too does the need for sustainable and cost-effective methods to mitigate the negative effects of paraffin wax. Paraffin inhibitors function by altering the behavior of wax crystals, which are responsible for the solidification of crude oil under certain conditions. By modifying the crystal structure, inhibitors prevent the formation of solid wax deposits. Various types of inhibitors are available, including crystal modifiers, dispersants, and solvents. The choice of inhibitor depends on several factors, including the specific properties of the crude oil, the operational conditions of the pipeline or well, and the desired environmental impact.

For instance, hyperbranched polyesters and poly acrylate copolymers have gained popularity due to their effectiveness and relatively low environmental footprint. Paraffin inhibitors are not limited to the oil and gas sector. They are also used in various industrial applications, such as the petrochemical industry, where they help maintaIn the flow of fluids with high paraffin content. In the context of exploration and drilling, paraffin inhibitors can help improve the water/oil ratio and total fluid volume, leading to increased production and reduced operational costs. The global demand for paraffin inhibitors is expected to grow In the coming years, driven by the increasing focus on operational efficiency and sustainability In the oil and gas industry.

As the industry continues to evolve, the development of new and innovative paraffin inhibitor technologies will play a crucial role in addressing the challenges of paraffin deposition and ensuring the long-term viability of oil and gas projects. In conclusion, paraffin inhibitors play a vital role in maintaining the operational efficiency and sustainability of various industrial processes withIn the oil and gas sector. By preventing paraffin deposition in pipelines, wells, and storage tanks, these substances help reduce energy costs, improve production, and minimize environmental impact. The ongoing research and development In the field of paraffin inhibitors will continue to drive innovation and address the evolving needs of the industry.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

144 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.83% |

|

Market growth 2024-2028 |

USD 157.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.38 |

|

Key countries |

US, China, Japan, Germany, and United Arab Emirates |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Paraffin Inhibitors Market Research and Growth Report?

- CAGR of the Paraffin Inhibitors industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the paraffin inhibitors market growth of industry companies

We can help! Our analysts can customize this paraffin inhibitors market research report to meet your requirements.