Polyacrylate Market Size 2024-2028

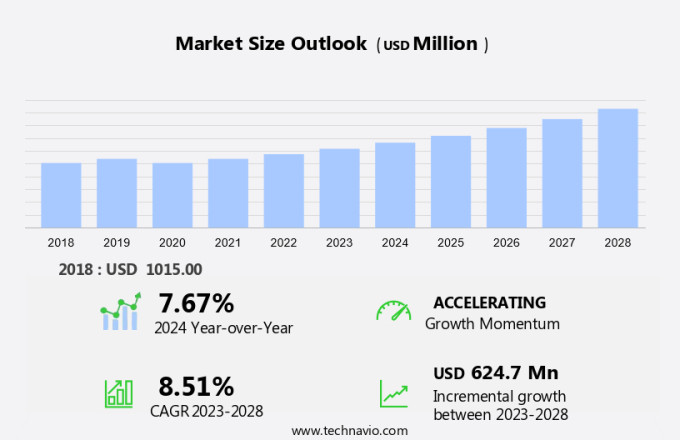

The polyacrylate market size is forecast to increase by USD 624.7 million at a CAGR of 8.51% between 2023 and 2028. The market is experiencing significant growth due to the increasing demand for waterborne coatings in various industries. In particular, the paints and coatings sector, driven by the construction industry, is a major contributor to this trend. Market players are focusing on strategic initiatives to expand their product offerings, including powder-based coatings, and strengthen their market position. However, uncertainties in construction projects and economic fluctuations can pose challenges to market growth. Additionally, the textile industry and the production of oxidant-resistant adhesives and sealants are other key areas where polyacrylates are finding increasing applications. The growing use of adhesives in a range of industries, including automotive and construction, is further driving market expansion. The future of the market looks promising, with continued innovation and development in the field of polymers, coatings, and adhesives, and their diverse applications.

What will the size of the market be during the forecast period?

The use of thickening agents with specific rheological properties is crucial across various industries, including construction activities and the detergent industry. Biodegradable alternatives like thermal poly aspartate are being integrated into water-borne coatings and adhesives and sealants to reduce VOC emissions and enhance environmental sustainability. In residential construction and housing construction, these materials contribute to affordable housing solutions and improve the performance of waterborne coatings. Moreover, the versatility of absorbent polymers, such as sodium polyacrylate and super-absorbing polymer, extends to applications in baby diapers, adult protective underwear, and food packaging. Additionally, liquid sodium polyacrylate and solid sodium polyacrylate play significant roles in the personal care sector, textiles, and water treatment. These innovations in bulk chemical production and chemical distribution are essential for advancing consumer goods and optimizing agricultural soil conditioners and electrical power cables.

Market Segmentation

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Adhesives

- Paints and coatings

- Dispersants

- Others

- Geography

- North America

- Canada

- US

- Europe

- Germany

- APAC

- China

- India

- South America

- Middle East and Africa

- North America

By Application Insights

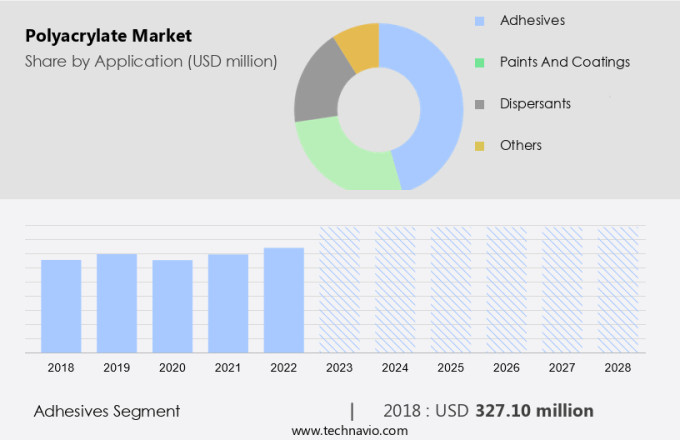

The adhesives segment is estimated to witness significant growth during the forecast period. Polyacrylates, also referred to as acrylic or acrylate polymers, are a type of polymer with the monomer unit being derived from acrylic acid. These polymers can be classified into methyl acrylates, ethyl acrylates, and butyl acrylates, with the choice of polyacrylate used in end-products depending on the specific formulations. In the consumer goods sector, sodium polyacrylate, a super-absorbing polymer, is widely used due to its water-locking properties.

This makes it an essential ingredient in various consumer applications, including diapers, personal care products, and detergent industry formulations. Liquid sodium polyacrylate is commonly used in the detergent industry for enhancing the cleaning power and improving the rinse-off properties of laundry detergents. The personal care sector also benefits from the use of sodium polyacrylate as a thickener and stabilizer in various cosmetic and toiletry products. These applications highlight the versatility and importance of polyacrylates in various industries.

Get a glance at the market share of various segments Request Free Sample

The adhesives segment accounted for USD 327.10 million in 2018 and showed a gradual increase during the forecast period.

Regional Insights

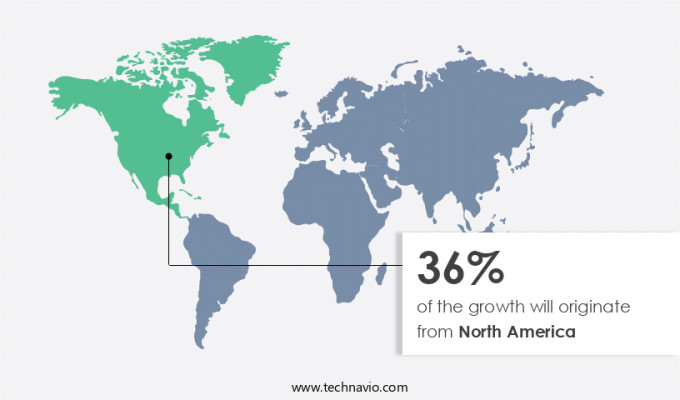

North America is estimated to contribute 36% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The expansion of various industries, including building and construction, automotive, and textile, in the United States and Canada has driven the growth of the market in North America. For example, the construction sector in the US experienced a growth rate of approximately 6.3% in 2023. The US is the primary consumer of polyacrylates in North America due to the increasing demand for paints and coatings and adhesive applications in the building and construction industry. Notable upcoming residential construction projects in the US include the next-generation housing apartments in Manhattan, New York, the Valco Town Center SB 35 project in California, a mixed-use building at Tenth Avenue in New York, the Dallas Midtown mixed-use development in North Texas, and Dominion Square in Virginia.

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

Market Driver

Growing demand for paints and coatings from the construction sector is the key driver of the market. In the realm of paints, coatings, adhesives, and construction materials, polyacrylates play a pivotal role due to their unique rheological properties. These materials are extensively employed in various applications within the building and construction industry. For instance, they are utilized in the manufacturing of concrete blocks, pillars, and slabs, as well as in the execution of construction projects such as roadways, highways, bridges, and structures. In coatings, polyacrylates are applied to molds during concrete production to minimize adhesion between the mold and the concrete. This results in less damage to concrete blocks, reduced concrete wastage, enhanced efficiency, and decreased production costs.

The escalating investments in infrastructure development and the expansion of the global building and construction sector are expected to fuel the demand for paints and coatings, thereby driving the usage of polyacrylates in the forecast period.

Market Trends

Strategic initiatives of market players is the upcoming trend in the market. The market is characterized by intense competition among companies. To maintain a competitive edge, companies are implementing strategies such as product innovations, collaborations, partnerships, mergers and acquisitions, and facility expansions. These strategies enable companies to increase their market presence and meet the evolving needs of various industries, including paints and coatings, waterborne coatings, automotive coatings, textiles, adhesives and sealants, and oxidant-resistant adhesives. By staying ahead of the competition through continuous innovation and strategic partnerships, companies aim to strengthen their market position and capitalize on the growing opportunities in this industry.

Market Challenge

Uncertainties in construction projects is a key challenge affecting the market growth. The construction industry in the US and Gulf Cooperation Council (GCC) countries experienced a significant slowdown due to various reasons. The COVID-19 pandemic led to the cancellation or postponement of 88% of construction projects in the US as per a survey by the Associated General Contractors of America (AGC). This disruption also affected the GCC region, with total contract awards for construction projects dropping 35% in 2020 to USD69 billion. Other factors, such as economic downturns or regulatory changes, can also cause temporary halts in construction activities. In response to the increasing environmental concerns, there is a growing demand for biodegradable alternatives to traditional construction materials.

For instance, thermal poly aspartate is a biodegradable polymer that can be used as an alternative to conventional thermal insulation materials. This eco-friendly option reduces volatile organic compound (VOC) emissions, making it an attractive choice for water-borne coatings used in residential and housing construction. As the market shifts towards sustainable and affordable housing solutions, the demand for biodegradable alternatives is expected to increase.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Arkema Group: The company offers polyacrylate such as Ecodis, a full range of polyacrylic dispersing agents focused on flat, matt to semi gloss paints.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Evonik Industries AG

- Kao Corp.

- LG Chem Ltd.

- Mitsubishi Chemical Corp.

- Nippon Shokubai Co. Ltd.

- RSD Polymers Pvt. Ltd.

- Sanyo Chemical Industries Ltd.

- Sasol Ltd.

- SIBUR Holding PJSC

- Sumitomo Seika Chemicals Co. Ltd.

- Dow Chemical Co.

- Yixing Danson Technology

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyacrylate is a type of polymer widely used as a thickening agent in various industries, including paints, coatings, adhesives, and textiles. Its unique rheological properties make it an essential ingredient in these applications, enabling the desired consistency and performance. In the construction sector, polyacrylate is used in residential and housing construction to enhance the properties of paints and coatings, reducing VOC emissions and improving the overall quality of water-borne coatings. Moreover, polyacrylate is finding increasing use in biodegradable alternatives to traditional polymers, such as thermal poly aspartate, which is gaining popularity due to environmental concerns. The automotive coatings industry also utilizes polyacrylate for its oxidant resistance and fast-setting properties.

Further, in the adhesives and sealants sector, polyacrylate-based products are used for various applications, including oxidant-resistant and fast-setting adhesives, dispersants, and absorbent polymers. Beyond industrial applications, polyacrylate is used in consumer goods such as super-absorbing polymers in baby diapers, adult protective underwear, and water lock in detergents. Additionally, it is used in food packaging, agricultural soil conditioners, water treatment, and electrical power cables. The market is expected to grow significantly due to its versatility and wide range of applications in various industries.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.51% |

|

Market growth 2024-2028 |

USD 624.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.67 |

|

Regional analysis |

North America, Europe, APAC, South America, and Middle East and Africa |

|

Performing market contribution |

North America at 36% |

|

Key countries |

US, China, India, Germany, and Canada |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Arkema Group, BASF SE, Evonik Industries AG, Kao Corp., LG Chem Ltd., Mitsubishi Chemical Corp., Nippon Shokubai Co. Ltd., RSD Polymers Pvt. Ltd., Sanyo Chemical Industries Ltd., Sasol Ltd., SIBUR Holding PJSC, Sumitomo Seika Chemicals Co. Ltd., Dow Chemical Co., and Yixing Danson Technology |

|

Market dynamics |

Parent market analysis, market growth inducers and obstacles, market forecast, fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, market condition analysis for the forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch