Wax Market Size 2024-2028

The wax market size is forecast to increase by USD 1.11 billion, at a CAGR of 2.09% between 2023 and 2028.

Major Market Trends & Insights

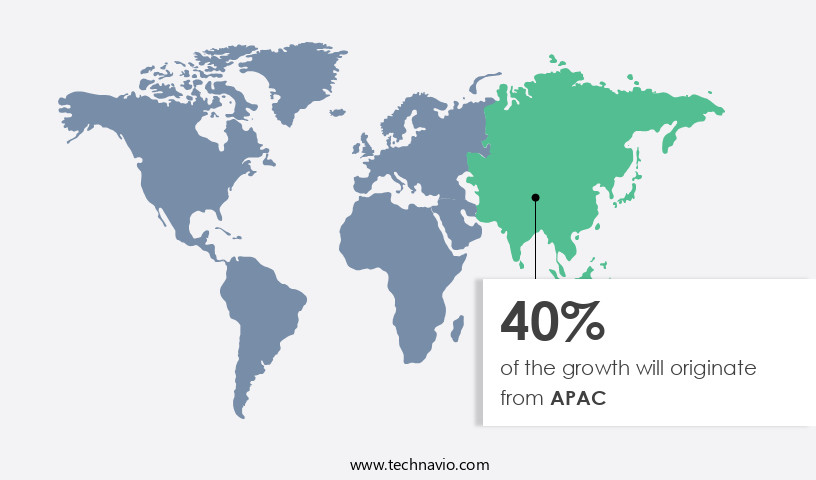

- APAC dominated the market and accounted for a 40% growth during the forecast period.

- By the Application - Candle segment was valued at USD 3.43 billion in 2022

- By the Type - Mineral wax segment accounted for the largest market revenue share in 2022

Market Size & Forecast

- Market Opportunities: USD 15.25 million

- Market Future Opportunities: USD 1109.50 million

- CAGR : 2.09%

- APAC: Largest market in 2022

Market Summary

- The market is a dynamic and evolving industry, characterized by continuous growth and innovation. Synthetic and bio-based waxes are increasingly preferred due to their environmental sustainability and cost-effectiveness. According to recent market studies, the global synthetic the market is projected to grow at a steady pace, with a significant increase in demand from the packaging and automotive industries. In contrast, the bio-based the market is experiencing a surge in adoption, particularly in the cosmetics sector, due to its eco-friendly attributes. Recycled plastics are also gaining popularity in wax production, contributing to the reduction of waste and the promotion of circular economy principles.

- However, price volatility of crude oil, a key raw material for wax production, poses a challenge to market stability. Despite this, the market remains a resilient and adaptive industry, with players continually exploring new applications and technologies to meet the evolving demands of various sectors.

What will be the Size of the Wax Market during the forecast period?

Explore market size, adoption trends, and growth potential for wax market Request Free Sample

- The market encompasses a diverse range of applications, from agricultural to industrial sectors. In 2020, the global demand for plant-derived waxes was estimated at 1.2 million metric tons, with agricultural waxes accounting for approximately 70% of the total market share. In contrast, industrial waxes represented the remaining 30%, primarily used in various industries such as packaging, cosmetics, and pharmaceuticals. Plant physiology plays a crucial role in the production of waxes, influencing nutrient cycling, grain yield, and quality parameters. Label requirements, carbon footprint, and certification standards are essential considerations in the market, driving the need for sustainable production methods and formulations.

- For instance, lipid metabolism and protein synthesis are key processes in the biosynthesis of waxes, with biomass accumulation and secondary metabolites significantly impacting product quality. Quality control, gene expression, and storage conditions are essential aspects of wax production, ensuring consistency, shelf life, and environmental impact. Application methods, testing protocols, and sustainability metrics are also critical factors, as the market continues to evolve and adapt to emerging trends and regulations.

How is this Wax Industry segmented?

The wax industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Candle

- Packaging

- Rubber

- Personal care

- Others

- Type

- Mineral wax

- Synthetic

- Natural

- Form

- Liquid

- Solid

- Emulsion

- End-use Industry

- Industrial

- Consumer Goods

- Pharmaceutical

- Automotive

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- Egypt

- KSA

- Oman

- UAE

- APAC

- China

- India

- Japan

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Application Insights

The candle segment is estimated to witness significant growth during the forecast period.

The market exhibits remarkable growth, with the candle segment experiencing substantial expansion. Paraffin wax, a dominant player in candle manufacturing, holds a significant market share. This popularity is attributed to the increasing demand for aromatherapy and stress relief through scented candles, which have become a staple in households. Approximately 70% of households use scented candles as home fragrances and for stress management, according to the National Candle Association. Moreover, the market encompasses various types, including beeswax, spermaceti, soy wax, palm, carnauba, bayberry, and tallow. The industry's dynamism is driven by the versatility of these waxes, which cater to diverse applications.

For instance, soy wax is preferred for its biodegradability and eco-friendliness, making it a popular choice for organic farming and sustainable agriculture. Additionally, mineral nutrition, nutrient uptake, and pest control are crucial aspects of the market. Waxes play a significant role in enhancing soil health and improving crop production by facilitating mineral absorption and nutrient uptake. Furthermore, they contribute to pest control by providing a protective barrier around plants, thereby ensuring optimal plant health. The market's future growth is promising, with expectations of continued expansion in sectors such as sustainable agriculture, organic farming, and horticulture. The demand for biostimulants, enzyme activity, and humic acid is on the rise due to their role in improving yield, stress tolerance, and disease resistance.

Furthermore, the market is witnessing increased adoption of microbial inoculants, plant growth regulators, and fungal diseases solutions to address biotic and abiotic stress. The market's growth is also influenced by factors such as salinity tolerance, drought tolerance, antioxidant production, cold tolerance, potassium mobilization, and phosphorus solubilization. These properties enable waxes to enhance plant metabolism, root development, and overall plant health, making them indispensable in modern agriculture. In conclusion, the market's continuous growth is fueled by its diverse applications, including candle manufacturing, sustainable agriculture, and horticulture. The industry's future prospects are bright, with increasing demand for biostimulants, enzyme activity, and other value-added solutions.

The Candle segment was valued at USD 3.43 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 40% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Wax Market Demand is Rising in APAC Request Free Sample

In The market, China, Malaysia, India, and Indonesia emerge as significant contributors to the industry's consumption. Among these countries, China holds the leading position due to the escalating use of both synthetic and natural waxes. The burgeoning packaging industry, particularly in China and India, has been a primary driver for consumer goods, subsequently fueling the demand for advanced packaging solutions in the Asia Pacific region. Moreover, the production expansion in rubber industries across Malaysia, Indonesia, and other Southeast Asian nations will propel the consumption of wax. P.B. Wax, a widely adopted wax type, is extensively utilized in the rubber sector for internal lubrication and metal surface release.

The Asia Pacific market is expected to witness substantial growth, with an increasing demand for wax in various sectors such as automotive, food, and pharmaceuticals. The automotive industry's continuous expansion, driven by the rising demand for fuel-efficient vehicles, will contribute to the market's growth. Furthermore, the food industry's increasing focus on food preservation and packaging will also boost the market's expansion. In the pharmaceutical sector, waxes are employed in the production of tablets and capsules, making it a crucial component in the pharmaceutical industry's growth. The market's growth is also influenced by the increasing demand for personal care products, which use waxes in their formulation.

In conclusion, the market is witnessing significant growth, with the Asia Pacific region leading the charge. The increasing demand for wax in various sectors, including automotive, food, pharmaceuticals, and personal care, is driving the market's expansion. China and India, in particular, are expected to contribute significantly to the market's growth due to their burgeoning industries and rising demand for advanced packaging solutions.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market continues to evolve as producers and researchers emphasize biological inputs that enhance crop performance and soil health. The humic acid impact crop yield has become a key area of focus, supported by innovations in plant growth regulators application techniques that optimize plant responses throughout the production cycle. Increasing attention to soil microbial communities influence nutrient uptake and the rhizosphere biology role disease suppression highlights how natural processes can strengthen crop resilience and reduce chemical dependency. Advances in nitrogen fixation enhancing fertilizer efficiency, phosphorus solubilization improving root development, and potassium mobilization promoting stress tolerance are shaping nutrient management strategies that improve both productivity and sustainability.

Physiological improvements are driven by plant hormone modulation improving crop quality, along with studies on enzyme activity improving photosynthesis rates and antioxidant production enhancing disease resistance. Crops are also benefiting from targeted research into abiotic stress tolerance mechanisms plants, including drought tolerance improving water use efficiency, salinity tolerance enhancing crop productivity, heat tolerance improving grain yield, and cold tolerance enhancing plant survival.

Disease and pest control remain critical, with fungal diseases biological control agents, bacterial diseases management strategies, and insect damage integrated pest management being integrated into broader programs. Together, these innovations align with crop production sustainable practices, positioning biostimulants as a core enabler of efficiency, resilience, and profitability in modern agriculture.

What are the key market drivers leading to the rise in the adoption of Wax Industry?

- The increasing demand for synthetic and bio-based waxes, driven by their superior performance and environmental sustainability, is the primary growth factor for the market.

- The market encompasses three main categories: mineral, synthetic, and natural or bio-based waxes. Mineral waxes, derived from crude oil, have traditionally held a significant market share. However, their demand is anticipated to decrease due to several factors. Firstly, the fluctuating prices of crude oil impact the supply of mineral waxes. Secondly, growing environmental concerns, particularly regarding the use of paraffin-based (P.B.) waxes, further reduce their demand. In contrast, synthetic and vegetable waxes are experiencing a surge in popularity. Synthetic waxes, including polyethylene and polypropylene waxes, are increasingly used in industries such as automotive and metal for polishing purposes.

- Their demand is expected to escalate significantly during the forecast period. Natural or bio-based waxes, derived from renewable resources, are gaining traction due to their eco-friendly nature. These waxes are widely used in the cosmetics and personal care sectors, contributing to their growing demand. The market dynamics are continuously evolving, with new applications and technological advancements shaping the industry landscape. In summary, the market is undergoing significant changes, with synthetic and natural waxes gaining prominence over mineral waxes. The demand for synthetic waxes is driven by their versatility and applications in various industries, while natural waxes benefit from the increasing focus on sustainability and eco-friendly practices.

- The market's ongoing transformation offers ample opportunities for businesses to innovate and expand their offerings.

What are the market trends shaping the Wax Industry?

- The use of recycled plastics in wax production is becoming increasingly popular in the market trend. A significant market trend emerges in the wax industry, emphasizing the effective utilization of recycled plastics.

- Wax, derived from recycled plastics, has emerged as a sustainable alternative to traditional waxes in various industries. Two primary types of wax are manufactured from recycled plastics: a candle wax-like oil and a thick brown wax oil. The former is commonly used in ship engines, while the latter is suitable for shoe polishing and cosmetics. Both types are produced by breaking down the hydrocarbon content in crude oil. The adoption of recycled plastic waxes has gained traction due to their environmental benefits. By recycling plastics, the hazardous effects on the environment are significantly reduced. The market has shown continuous growth as industries increasingly prioritize sustainability.

- The demand for these eco-friendly alternatives is particularly strong in sectors such as cosmetics, where consumers are increasingly conscious of the environmental impact of their purchases. Compared to traditional waxes, recycled plastic waxes offer several advantages. They are renewable, reducing reliance on non-renewable resources. Additionally, they offer improved performance characteristics, such as better heat resistance and longer burn times for candle wax. Furthermore, the production process of recycled plastic waxes generates fewer greenhouse gas emissions compared to traditional wax production. In conclusion, the market is evolving, with recycled plastic waxes gaining popularity due to their environmental benefits and improved performance characteristics.

- The use of recycled plastics in wax production offers a sustainable solution, reducing the environmental impact of traditional waxes while offering superior performance.

What challenges does the Wax Industry face during its growth?

- The price volatility of crude oil poses a significant challenge to the growth of the industry, requiring professionals to closely monitor and adapt to market fluctuations.

- Waxes are essential components in various industries, including cosmetics, pharmaceuticals, food, and manufacturing. They are available in different forms, including mineral, synthetic, and natural. Mineral wax is derived from lube-oil refining, which is obtained from crude oil. The price of mineral wax is influenced by the fluctuations in crude oil prices, which can significantly impact the costs of raw materials. In 2020, the COVID-19 pandemic led to a substantial decrease in the demand for oil and gas, resulting in a significant drop in oil prices. Consequently, many oil companies faced revenue declines and had to lower oil prices in the region due to decreased consumer demand from countries like India.

- This situation affected the production and pricing of mineral wax. Synthetic waxes, on the other hand, are produced from petrochemicals and other raw materials. Their production is less dependent on crude oil prices and can be more stable. Natural waxes, such as beeswax and soy wax, are derived from renewable resources and have gained popularity due to their eco-friendliness. The market is continuously evolving, with new applications and technologies emerging. For instance, the use of waxes in renewable energy, particularly in solar panels, is growing. Additionally, advancements in wax formulation and production techniques are improving the performance and sustainability of waxes in various industries.

- In terms of market size, The market was valued at approximately USD17.5 billion in 2020 and is projected to reach around USD22.5 billion by 2026, growing at a steady pace during the forecast period. The market's growth is driven by factors such as increasing demand from the cosmetics and pharmaceuticals industries, rising awareness of eco-friendly alternatives, and advancements in wax technology. Despite the challenges posed by the COVID-19 pandemic, the market is expected to recover and continue its growth trajectory. Companies in the wax industry are focusing on innovation, sustainability, and cost-effective production to stay competitive and meet the evolving needs of their customers.

Exclusive Customer Landscape

The wax market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the wax market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Wax Industry

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, wax market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Company - This company specializes in providing high-quality waxes and wax emulsions, including Poligen Wax V Flakes, catering to various industries with innovative solutions. Their offerings ensure optimal performance and durability, contributing significantly to the market.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Company

- BASF SE

- Calumet Specialty Products Partners

- Cargill

- CEPSA

- Clariant AG

- ExxonMobil

- HollyFrontier Corporation

- Honeywell International Inc.

- Indian Oil Corporation

- Kerax Limited

- Koster Keunen

- Lukoil

- Nippon Seiro Co. Ltd.

- PetroChina

- Rosneft

- Royal Dutch Shell

- Sasol Limited

- Strahl & Pitsch Inc.

- The International Group Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Wax Market

- In January 2024, Sasol, a leading integrated energy and chemical company, announced the successful commercialization of its Eco-friendly Paraffin Wax production process at its Secunda Operations in South Africa. This new process reduces greenhouse gas emissions by up to 30% compared to traditional methods (Sasol Press Release, 2024).

- In March 2024, L'Oréal, the world's largest cosmetics company, entered into a strategic partnership with Renewable Wax Co., a leading producer of renewable waxes. This collaboration aimed to develop sustainable wax solutions for L'Oréal's cosmetic products (L'Oréal Press Release, 2024).

- In May 2024, INEOS Styrolution, the world's leading styrenics supplier, completed the acquisition of BASF's wax business. This acquisition significantly expanded INEOS Styrolution's product portfolio and market reach (INEOS Styrolution Press Release, 2024).

- In February 2025, the European Union approved the use of microplastic-free waxes in cosmetic products. This regulatory approval marked a significant milestone in the global shift towards more sustainable and eco-friendly cosmetic products (European Commission Press Release, 2025).

Research Analyst Overview

- The market encompasses a wide range of applications in agriculture, particularly in enhancing soil health and improving crop productivity. One of the key areas of research and development is the role of enzyme activity and humic acid in phosphorus solubilization. This process is crucial for sustainable agriculture as it increases the availability of this essential nutrient to plants, thereby promoting nutrient uptake and yield improvement. Moreover, the market is witnessing significant advancements in the production of biostimulants, which play a vital role in enhancing plant metabolism, stress tolerance, and disease resistance. For instance, humic acid-based biostimulants have been shown to increase chlorophyll content and improve antioxidant production, contributing to plant health under biotic and abiotic stress conditions.

- The market's growth is driven by the increasing demand for sustainable farming practices and the need to address the challenges of insect damage, drought tolerance, and cold tolerance. According to a recent industry report, the global biostimulants market is expected to grow at a rate of 11% annually over the next decade. In the realm of sustainable agriculture, microbial inoculants and soil amendments have gained significant attention. These products enhance soil health by promoting beneficial microbial activity, which in turn leads to improved nutrient uptake and crop production. For example, potassium mobilization through mycorrhizal fungi has been shown to increase crop yields by up to 30%.

- Furthermore, the use of plant growth regulators and bacterial diseases management solutions is becoming increasingly popular in modern agriculture. These products help optimize mineral nutrition and improve root development, ultimately leading to healthier plants and higher yields. In conclusion, the market is a dynamic and evolving landscape, with ongoing research and development focused on enhancing soil health, improving crop productivity, and addressing the challenges of biotic and abiotic stress. The integration of enzyme activity, humic acid, phosphorus solubilization, and various other technologies is driving the market's growth and shaping its future applications in sustainable agriculture.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Wax Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

185 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.09% |

|

Market growth 2024-2028 |

USD 1109.5 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.03 |

|

Key countries |

US, Canada, Germany, UK, Italy, France, China, India, Japan, Brazil, Egypt, UAE, Oman, Argentina, KSA, UAE, Brazil, and Rest of World (ROW) |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Wax Market Research and Growth Report?

- CAGR of the Wax industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the wax market growth of industry companies

We can help! Our analysts can customize this wax market research report to meet your requirements.