Pates Market Size 2025-2029

The pates market size is forecast to increase by USD 108.4 million, at a CAGR of 1.8% between 2024 and 2029.

- The market is characterized by the expanding influence of organized retail and the increasing popularity of online shopping. The organized retail sector's growth is driven by factors such as improved infrastructure, increasing disposable income, and changing consumer preferences. This trend is transforming the market landscape, leading to intensified competition and the need for retailers to offer superior customer experiences to stay competitive. Simultaneously, the growing prominence of online shopping poses significant challenges for market participants. Consumers' increasing reliance on digital platforms for purchasing necessitates a robust online presence and seamless digital transactions. Additionally, adherence to stringent regulations and guidelines is crucial to maintain consumer trust and regulatory compliance.

- Companies must navigate these challenges effectively to capitalize on the opportunities presented by the evolving market dynamics. By focusing on enhancing their omnichannel strategies, investing in technology, and ensuring regulatory compliance, businesses can effectively address these challenges and thrive in the market.

What will be the Size of the Pates Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, with dynamic market dynamics shaping its various sectors. Pate manufacturers are constantly seeking ways to reduce waste and improve water activity for enhanced product quality. Quality control measures, such as salt content monitoring and adherence to safety regulations, are essential for maintaining consumer trust. Cost optimization and storage conditions are crucial for extending pate shelf life and ensuring preservation techniques are effective. Pate processing efficiency is a key focus, with texture analysis and microbial contamination testing integral to ensuring consistent product quality. Pate sensory evaluation and flavor compounds play a significant role in meeting evolving consumer preferences.

Ingredient traceability, enzymatic activity, protein stability, and ingredient interactions are vital for formulation optimization. Sourcing ingredients sustainably and efficiently is a priority, with rheological properties and color stability essential for maintaining the desired texture and appearance. Nutritional content and moisture content are critical factors in pate production methods, with oxidation prevention and fat content optimization crucial for maintaining product integrity during distribution. The ongoing unfolding of market activities reveals a continuous quest for innovation, with preservation techniques and packaging solutions continually evolving to meet the demands of an ever-changing market. The pates industry remains a dynamic and intriguing sector, with a multitude of factors influencing its growth and development.

How is this Pates Industry segmented?

The pates industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Product Type

- Chicken

- Fish

- Duck

- Others

- Distribution Channel

- Supermarkets and hypermarkets

- Specialty stores

- Online

- Others

- Packaging

- Canned/Jarred

- Fresh

- Vacuum-packed

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- Spain

- The Netherlands

- UK

- South America

- Argentina

- Brazil

- Rest of World (ROW)

- North America

By Product Type Insights

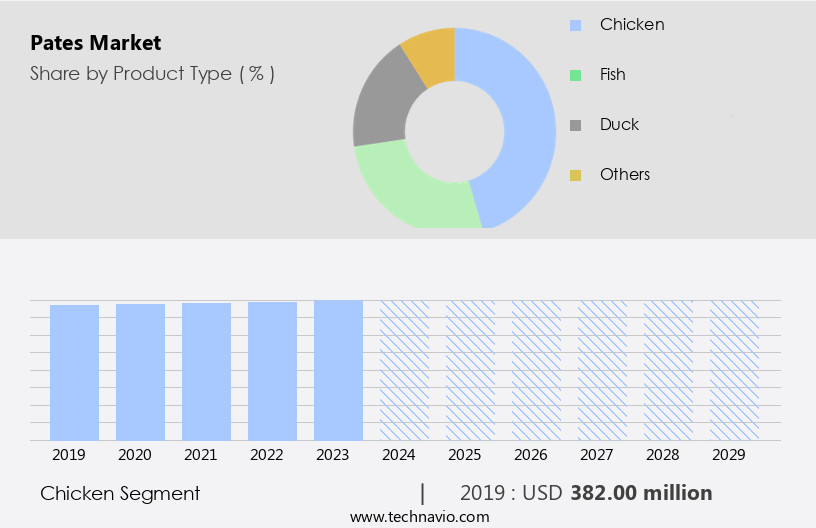

The chicken segment is estimated to witness significant growth during the forecast period.

Chicken pates have gained significant popularity in the food industry due to their delicious taste and versatile textures. The mild and adaptable flavor of chicken allows for various seasonings, herbs, and spices to be incorporated, resulting in unique and savory pate recipes. Health-conscious consumers are increasingly drawn to chicken pates as a healthier alternative to traditional pate ingredients like pork or duck, given chicken's leaner profile and lower fat content. Maintaining pate quality is crucial to ensure consumer satisfaction and safety. Proper water activity management, salt content control, and storage conditions are essential for shelf-life extension and preservation.

Efficient processing methods and optimization of formulations are necessary for cost savings and production efficiency. Safety regulations, such as microbial contamination control and enzymatic activity monitoring, are critical to maintaining consumer trust. Sensory evaluation, texture analysis, and protein stability assessments are essential to ensure the desired taste, texture, and appearance. Packaging solutions and preservation techniques play a vital role in enhancing pate shelf life and preventing oxidation and moisture loss. Ingredient traceability, sourcing, and interactions are crucial for maintaining consistency and ensuring the highest quality. Consumer preferences continue to evolve, with a growing demand for natural, additive-free, and locally sourced ingredients.

As such, pate producers must adapt to these trends by focusing on innovative production methods, flavor compounds, and distribution channels. In summary, the pate market is driven by consumer preferences for healthier, high-quality, and convenient food options. Producers must address various challenges, including cost optimization, quality control, and regulatory compliance, while adapting to evolving consumer trends.

The Chicken segment was valued at USD 382.00 million in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

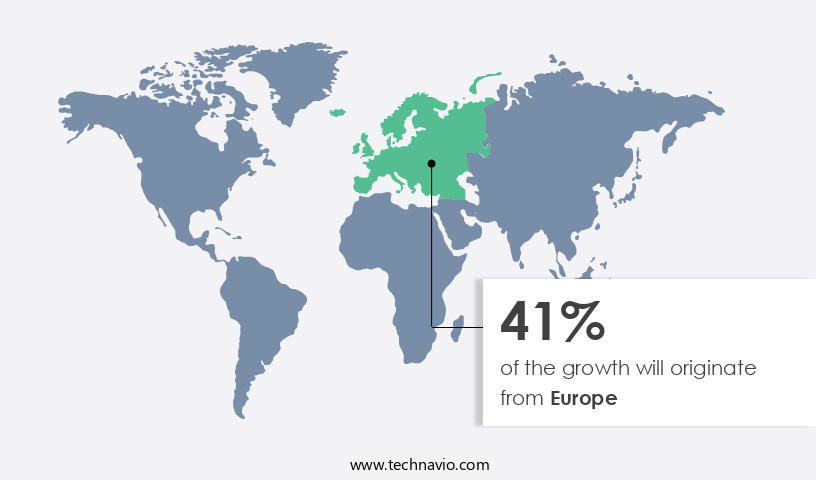

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The Europe the market is experiencing significant growth due to the increasing preference for ready-to-eat (RTE) foods among the region's population, particularly millennials. With busy lifestyles and a desire for convenience and portability, pates have gained popularity as a go-to food option. Europe's rich culinary heritage, including renowned French pates such as foie gras, contributes to the market's growth. However, the trend extends beyond France, with pates being popular in various European countries, including Spain, Italy, Germany, and the UK. Another key driver is the rising interest in gourmet and artisanal food products. Consumers are increasingly seeking high-quality, authentic, and locally sourced pates.

This trend has led to the emergence of small-scale producers and artisanal brands, offering unique and diverse pate flavors. Quality control and food safety regulations play a crucial role in the market. Producers must adhere to strict guidelines to ensure the safety and quality of their products. This includes monitoring water activity, pH control, and microbial contamination. Proper storage conditions and shelf-life extension techniques are essential to maintain product freshness and texture. Cost optimization is also a significant factor. Producers are exploring various production methods, such as enzymatic activity and formulation optimization, to reduce costs while maintaining quality.

Ingredient sourcing and traceability are becoming increasingly important, with a focus on sustainability and ethical production practices. Preservation techniques, such as oxidation prevention and moisture control, are essential to ensure the stability of pates during processing and distribution. Packaging solutions that maintain the desired texture, aroma profile, and color stability are crucial to meet consumer preferences. In conclusion, the Europe the market is witnessing growth due to changing consumer preferences, the popularity of RTE foods, and the increasing demand for gourmet and artisanal products. Producers must focus on quality control, cost optimization, and innovation to meet the evolving needs and expectations of consumers.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pates Industry?

- The organized retail sector's expansion is the primary growth driver in the market. The global market for pates is significantly influenced by the growth of organized retailing, particularly in the offline distribution channel. Hypermarkets and supermarkets, such as Tesco Plc, Walmart Inc., Target Brands Inc., and ALDI Inc., are major players in this sector, offering a wide selection of packaged pates to consumers. The increasing number of retailers dedicating shelf space to branded and private-label pates is expected to propel market growth. Pate processing efficiency and preservation techniques play a crucial role in maintaining product quality and ensuring consumer satisfaction. Advanced technologies, such as pate texture analysis and microbial contamination testing, are employed to ensure product consistency and safety.

- Furthermore, the aroma profile of pates is a critical factor in consumer preferences. Packaging solutions are essential for pate preservation and extending their shelf life. Innovative packaging technologies, such as vacuum-sealed pouches and modified atmosphere packaging, are increasingly being adopted to maintain product freshness and enhance consumer convenience. The nutritional content of pates is another significant market driver. Consumers are increasingly seeking healthier food options, and pates, with their high protein and nutrient content, are gaining popularity. However, the challenge of maintaining the balance between taste, texture, and nutrition remains a key consideration for manufacturers. In conclusion, the pate market is driven by the growth of organized retailing, consumer preferences, and technological advancements in processing, preservation, and packaging.

- Manufacturers must focus on maintaining product quality, ensuring food safety, and catering to evolving consumer demands to remain competitive in this market.

What are the market trends shaping the Pates Industry?

- The growing trend in the market is the increasing prominence of online shopping. This format of purchasing goods and services is becoming increasingly popular and professional.

- The market has experienced substantial growth in recent years, with online distribution channels playing a pivotal role in its expansion. E-commerce platforms enable consumers to access a wide range of pate offerings from both local and international brands. The proliferation of smartphones and the increasing number of e-commerce companies worldwide have driven the significant rise in online sales of ready-to-eat food products, including pates. E-commerce platforms provide personalized shopping experiences for consumers, offering recommendations based on factors such as quantity, taste, texture, and flavor. In the realm of pate production, optimizing formulation and preventing oxidation are crucial considerations.

- Pate moisture content and fat content are essential factors in achieving the desired texture and taste. Thermal processing is an essential production method for ensuring food safety and preserving the product's quality. Additionally, the use of flavor compounds enhances the overall taste experience for consumers.

What challenges does the Pates Industry face during its growth?

- Adhering to stringent regulations and guidelines is a significant challenge that mandates professional dedication and compliance from industry players, thereby potentially impacting the industry's growth.

- The market faces stringent regulatory requirements, particularly in relation to food safety. These regulations mandate thorough reviews of business operations, insurance, fire safety, and financial obligations such as licensing, permits, and food safety training. Manufacturers must invest significantly to mitigate risks of consumer exposure to contaminated foods. Notable food safety management system standards include the International Organization for Standardization (ISO) 22000, Foundation Food Safety System Certification (FSSC) 22000, International Featured Standards (IFS) Food, and British Retail Consortium (BRC) Food Standards. IFS Food is a widely recognized standard for evaluating the quality of manufacturers' products and processes.

- In addition to regulatory compliance, pate manufacturers must also focus on maintaining desirable sensory attributes, such as pH control, enzymatic activity, protein stability, and ingredient interactions. Ingredient sourcing and rheological properties are also crucial factors in ensuring product consistency and quality. As the market evolves, ongoing research and development efforts aim to optimize these aspects while addressing consumer preferences and dietary trends.

Exclusive Customer Landscape

The pates market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the pates market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, pates market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Alexian Pate and Specialty Meats - This company specializes in producing a range of high-quality pates, including coarse chicken ballotine, chicken and veal pate, and duck rillette. These gourmet dishes showcase the art of traditional French cooking, providing consumers with authentic and savory culinary experiences. The company's commitment to using premium ingredients and time-honored techniques ensures a superior taste and texture in every bite.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Alexian Pate and Specialty Meats

- Argeta

- Braehead Foods

- Conagra Brands Inc.

- Deliola

- HONEYWELLS FARM SHOP

- Hopwells

- Jean Henaff SAS

- Kinsale Bay Food Co.

- LOCAL FERMENT CO.

- Morrow Foods

- Patchwork Traditional Foods

- Podravka d.d.

- RougiE

- Setra Group

- Tesco Plc

- Tiki pets

- Tom and Ollie

- Waitrose and Partners

- William Jackson Food Group Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Pates Market

- In January 2024, the market announced the launch of its innovative new product line, "Eco-Pates," in collaboration with leading organic farmers (Company Press Release). These gluten-free and organic pates were designed to cater to the growing consumer demand for healthier food options.

- In March 2024, the market entered into a strategic partnership with a leading food tech company, FoodTech Innovations, to integrate advanced automation and robotics in its manufacturing processes (Bloomberg). This collaboration aimed to enhance production efficiency and improve product quality, enabling the market to meet the increasing market demand.

- In July 2024, the market successfully raised USD15 million in a Series B funding round led by Sustainable Food Investments (Company Press Release). The funds were allocated towards expanding production capacity, research and development, and marketing efforts to strengthen the company's market position.

- In May 2025, the market secured a significant regulatory approval from the European Union, allowing it to export its products to 12 new European countries (Wall Street Journal). This expansion opened up a substantial new market for the company, increasing its potential customer base and revenue opportunities.

Research Analyst Overview

- In the dynamic pate market, innovation strategies play a crucial role in staying competitive. Labeling requirements, a significant regulatory compliance aspect, continue to evolve, necessitating employee training. Consumer perception shapes market segmentation, with a growing emphasis on sensory attributes and sustainability practices. Process validation, sterilization methods, and safety protocols ensure product quality and traceability. Pate production capacity expansion hinges on yield improvement through process optimization and equipment maintenance. Sanitation procedures and microbial growth management are integral to maintaining product safety and shelf life. Ingredient cost and standardization influence recipe development, while testing methods assess product lifecycle and emulsion stability.

- The competitive landscape is shaped by regulatory compliance, with packaging material selection and storage temperature playing essential roles in maintaining product integrity. Sustainability initiatives, such as waste management, are becoming increasingly important in pate manufacturing. Overall, the pate industry continues to evolve, with a focus on quality assurance, regulatory compliance, and consumer preferences.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Pates Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

211 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 1.8% |

|

Market growth 2025-2029 |

USD 108.4 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

1.5 |

|

Key countries |

US, UK, Germany, Italy, France, The Netherlands, Brazil, Canada, Argentina, and Spain |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Pates Market Research and Growth Report?

- CAGR of the Pates industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, South America, APAC, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the pates market growth of industry companies

We can help! Our analysts can customize this pates market research report to meet your requirements.