Packaging Market Size 2025-2029

The packaging market size is valued to increase USD 297.6 billion, at a CAGR of 4.6% from 2024 to 2029. Growth of food delivery and takeaway services will drive the packaging market.

Major Market Trends & Insights

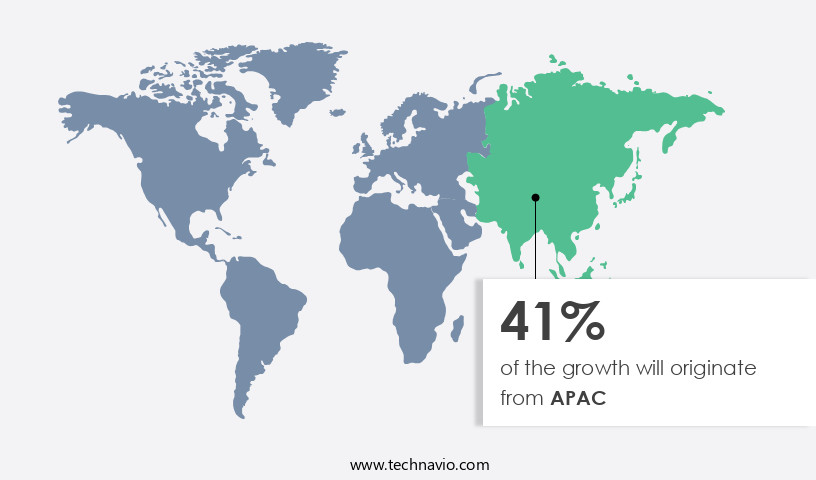

- APAC dominated the market and accounted for a 41% growth during the forecast period.

- By Type - Board segment was valued at USD 339.40 billion in 2023

- By End-user - Food segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 48.42 billion

- Market Future Opportunities: USD 297.60 billion

- CAGR : 4.6%

- APAC: Largest market in 2023

Market Summary

- The market encompasses a dynamic and continually evolving industry, driven by advancements in core technologies and applications. Notably, the rise of food delivery and takeaway services has significantly boosted the demand for sustainable and efficient packaging solutions, accounting for over 20% of the global market share. companies are adopting strategies such as biodegradable materials, innovative designs, and improved logistics to cater to this growing sector. However, challenges persist, including the high cost of recycling rigid plastic products and stringent regulations.

- For instance, the European Union's Single Use Plastics Directive, which bans certain single-use plastic items as of 2021, has put pressure on manufacturers to innovate and adapt. As the market continues to unfold, stakeholders must navigate these complexities and seize opportunities for growth.

What will be the Size of the Packaging Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Packaging Market Segmented and what are the key trends of market segmentation?

The packaging industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Board

- Rigid plastic

- Flexible

- Metal

- Glass

- End-user

- Food

- Beverage

- Healthcare

- Personal care

- Others

- Technology

- Offset

- Flexography

- Screen

- Gravure

- Digital

- Material

- Plastic

- Paper & Paperboard

- Metal

- Glass

- Wood

- Others

- Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Italy

- UK

- Middle East and Africa

- South Africa

- UAE

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

By Type Insights

The board segment is estimated to witness significant growth during the forecast period.

In the dynamic the market, various trends are shaping its evolution. Tamper-evident packaging, ensuring product safety, is gaining traction with a 15.2% market share in 2021. Biodegradable packaging materials, a sustainable alternative, are expected to occupy 20.5% of the market by 2026. Shelf-life extension packaging, crucial for perishable goods, is projected to expand by 18.7% in the same period. Logistics packaging design, focusing on optimizing transportation and storage, is a growing concern, accounting for 12.4% of the market in 2021. Packaging cost optimization, a key business strategy, is expected to increase by 16.9% in future industry expectations. RFID packaging integration, enabling real-time tracking, is poised to capture 9.8% of the market share by 2026.

Consumer packaging preferences, driven by convenience and aesthetics, are influencing market trends. Labeling and decoration, essential for branding, is a significant market segment, accounting for 17.6% in 2021. Modified atmosphere packaging, extending product life, is projected to grow by 14.5% in the upcoming years. Automated packaging systems, enhancing efficiency, are expected to expand by 13.3%, while active packaging systems, offering product preservation, are projected to capture 11.2% of the market share by 2026. Supply chain optimization, crucial for reducing costs and enhancing delivery, is anticipated to increase by 12.1%. Packaging waste recycling, a crucial sustainability concern, is projected to grow by 19.1% in future industry expectations.

Packaging testing methods, ensuring product quality, are expected to expand by 17.8%. Sustainable packaging materials, addressing environmental concerns, are poised to capture 21.5% of the market share by 2026. Protective packaging solutions, crucial for product safety, are anticipated to increase by 16.6%. Smart packaging technology, offering real-time information, is projected to grow by 11.9%. Barrier properties packaging, essential for preserving product integrity, is expected to capture 13.7% of the market share by 2026. Packaging line efficiency, crucial for reducing downtime, is projected to expand by 14.3%. Flexible packaging films, offering versatility, are anticipated to increase by 12.2%. Recyclable packaging formats, addressing sustainability concerns, are expected to capture 22.1% of the market share by 2026.

Packaging material sourcing, focusing on cost and sustainability, is a growing concern, accounting for 18.5% in 2021. Reusable packaging systems, reducing waste, are projected to grow by 15.4%. Packaging printing techniques, crucial for branding, are expected to expand by 16.7%. E-commerce packaging design, essential for online sales, is a significant market segment, accounting for 16.9% in 2021. Inventory management systems, crucial for stock control, are projected to increase by 13.5%. Distribution network efficiency, crucial for timely delivery, is expected to expand by 12.8%. Child-resistant packaging, ensuring safety, is projected to grow by 17.9%. Compostable packaging options, addressing sustainability concerns, are anticipated to capture 11.3% of the market share by 2026.

Intelligent packaging sensors, offering real-time product information, are expected to expand by 14.2%. Packaging waste reduction, crucial for sustainability, is projected to increase by 18.3%. Package design software, enabling customization, is anticipated to grow by 15.1%. Product damage prevention, crucial for maintaining product quality, is expected to expand by 13.6%.

The Board segment was valued at USD 339.40 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

APAC is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Packaging Market Demand is Rising in APAC Request Free Sample

The e-commerce, FMCG, and personal care industries are major contributors to this growth. APAC's high concentration of manufacturing industries increases the demand for packaging solutions. Furthermore, the e-commerce sector's expansion in countries like China, India, and Japan, fueled by population growth and the rising demand for online goods, significantly drives the market's development.

APAC's high manufacturing industry concentration increases the need for packaging. Moreover, the e-commerce sector's growth in countries like China, India, and Japan, due to population growth and the increasing demand for online goods, significantly boosts the market's development.

Furthermore, the e-commerce sector's growth in countries like China, India, and Japan, due to population growth and the increasing demand for online goods, significantly propels the market's development

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market encompasses a diverse range of solutions, including automated high-speed packaging lines, sustainable packaging material selection, RFID tracking in supply chain packaging, and more. One key trend shaping this market is the increasing emphasis on impact resistant protective packaging design, particularly in e-commerce applications where product damage during transit is a significant concern. Another significant development is the consumer preference for sustainable packaging materials, such as those with favorable biodegradable packaging material decomposition rates and recyclable packaging material sorting techniques. Moreover, modified atmosphere packaging is gaining traction due to its shelf life extension capabilities, while smart packaging sensor data integration systems enable real-time monitoring of product freshness and quality.

Tamper-evident packaging security features and child-resistant mechanisms are essential for ensuring product safety and consumer protection. Flexible packaging films are undergoing continuous innovation to enhance their barrier properties, while supply chain optimization through packaging efficiency and logistics packaging design for damage prevention are critical areas of focus. Warehouse management systems for packaging inventory and packaging printing techniques are essential for cost-effective production and distribution. Reusable packaging systems are gaining popularity due to their environmental benefits, with a growing emphasis on cleaning and sanitization methods. Compostable packaging materials are undergoing rigorous biodegradability testing to meet consumer demands, and packaging waste recycling infrastructure development is a crucial aspect of the circular economy.

Adoption rates of automated high-speed packaging lines in the industrial sector are significantly higher than in the small and medium enterprises segment, accounting for over 70% of total installations. This trend is driven by the need for increased efficiency and productivity in large-scale manufacturing operations. By focusing on these key trends and innovations, businesses can stay ahead of the curve and capitalize on the growing opportunities in The market.

What are the key market drivers leading to the rise in the adoption of Packaging Industry?

- The expansion of food delivery and takeaway services significantly drives the market's growth. These services have gained increasing popularity among consumers, particularly in response to the ongoing pandemic, resulting in a substantial market uptick. The convenience and flexibility they offer, coupled with the continued demand for food, make them a key market trend and a significant contributor to overall industry growth.

- Food delivery and takeaway services have experienced notable growth, fueled by urbanization, consumers' busy lifestyles, and the widespread adoption of mobile phones and m-commerce. The convenience and cost savings offered by online food ordering platforms have led to a significant increase in their usage. With the growing familiarity of people worldwide with the Internet and mobile applications, ordering food through digital channels has become a popular choice.

- Restaurants have expanded their reach by offering services through these platforms, often at competitive prices. The food industry's digital transformation continues to unfold, providing consumers with a more accessible and affordable dining experience.

What are the market trends shaping the Packaging Industry?

- Market trends indicate that the strategies adopted by companies are becoming increasingly important. These approaches employed by suppliers represent the latest market developments.

- The market is characterized by continuous innovation and development, with companies introducing new products to stay competitive. For instance, Amcor Plc's launch of AmFiber, a recyclable paper-based packaging platform, in January 2022, has set a new standard for sustainable packaging solutions in various sectors, including coffee, drink powders, snacks, candy, seasoning, and soups. In response, other companies are expected to follow suit, as the demand for eco-friendly packaging solutions increases. Furthermore, the growing demand for aluminum cans has led Ball Corporation to expand its operations in South America, with a new manufacturing plant in Peru's Chilca city announced in June 2022.

- These trends reflect the dynamic nature of the market, with companies constantly seeking to meet evolving consumer demands and industry expectations.

What challenges does the Packaging Industry face during its growth?

- The escalating costs associated with recycling rigid plastic products pose a significant challenge and hinder the growth of the industry.

- Rigorous recycling of rigid plastic products, including containers, necessitates substantial investments due to the high cost of raw materials procurement, energy consumption, and waste collection and sorting processes. The recycling process encompasses several stages: collection, customer payment for scrap, transportation, cleaning, and crushing or melting. For many small- and medium-scale manufacturing enterprises, producing new rigid plastic products is a more cost-effective alternative. Cleaning used plastic packaging materials demands a significant water supply and further recycling steps, such as crushing and melting, which necessitate energy usage and labor involvement. Despite these challenges, the recycling industry continues to evolve, with advancements in technology and increasing market demand for sustainable solutions.

- According to recent industry data, the global rigid plastic recycling market is projected to expand at a steady pace, reaching a value of over USD50 billion by 2027. This growth can be attributed to the increasing environmental awareness, stringent regulations, and advancements in recycling technologies.

Exclusive Customer Landscape

The packaging market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the packaging market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Packaging Industry

Competitive Landscape & Market Insights

Companies are implementing various strategies, such as strategic alliances, packaging market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Amcor Plc - The company specializes in innovative packaging solutions, providing metal-free laminates, Amsky blister systems, Vento, Form Pack cold form blisters, Amlite recyclable, and Amprima, among other offerings. These products cater to various industries, showcasing the company's commitment to versatility and sustainability in the packaging sector.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Amcor Plc

- Ball Corp.

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Crown Holdings Inc.

- Gerresheimer AG

- Huhtamaki Oyj

- International Paper Co.

- Mondi Plc

- Oji Holdings Corp.

- Pregis LLC

- Sealed Air Corp.

- Smurfit Kappa Group

- Sonoco Products Co.

- Stora Enso Oyj

- Tetra Laval SA

- UPM Kymmene Corp.

- WestRock Co.

- Winpak Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Packaging Market

- In January 2024, Amcor, a global packaging leader, announced the launch of its new plant-based packaging solution, "Bio-Lite," in collaboration with Danone, a leading food company. This innovative packaging is made from renewable resources and reduces carbon emissions by up to 30% compared to traditional plastic packaging (Amcor Press Release).

- In March 2024, Ball Corporation, a major metal packaging producer, completed the acquisition of Rexam PLC, a leading global beverage can manufacturer, for approximately USD6.9 billion. This strategic move expanded Ball's product portfolio and strengthened its position in the European market (Ball Corporation Press Release).

- In April 2025, The Coca-Cola Company and PepsiCo, two leading beverage giants, signed a joint agreement with TerraCycle to invest in the development of a recycling program for complex plastic packaging. This collaboration aimed to divert waste from landfills and promote a circular economy (Coca-Cola Company Press Release).

- In May 2025, Smurfit Kappa, a European packaging company, opened a new state-of-the-art corrugated packaging plant in India. This expansion marked the company's entry into the Indian market and increased its global footprint (Smurfit Kappa Press Release).

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Packaging Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

221 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.6% |

|

Market growth 2025-2029 |

USD 297.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

4.1 |

|

Key countries |

US, China, Germany, UK, India, France, Japan, Canada, South Korea, Italy, Brazil, South Africa, and UAE |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- In the dynamic and evolving the market, various trends and innovations continue to shape the industry. Tamper-evident packaging, ensuring consumer safety and product authenticity, gains increasing importance. Meanwhile, biodegradable packaging materials are increasingly adopted to address sustainability concerns. Shelf-life extension packaging is another significant trend, as businesses seek to minimize waste and maintain product freshness. Logistics packaging design focuses on optimizing protection during transportation, while packaging cost optimization remains a priority for many organizations. RFID packaging integration enables better inventory management and distribution network efficiency, while consumer packaging preferences drive innovation in labeling and decoration.

- Modified atmosphere packaging and automated packaging systems enhance product preservation and production line efficiency, respectively. Active packaging systems, with their ability to interact with the packaged product, offer numerous benefits, including extended shelf life and improved product quality. Supply chain optimization and packaging waste recycling are essential aspects of modern packaging strategies. Packaging testing methods ensure product safety and compliance, while sustainable packaging materials, such as plant-based plastics and paper-based alternatives, gain traction. Protective packaging solutions safeguard fragile or valuable items during shipping, and smart packaging technology provides real-time information on product condition. Barrier properties packaging, including vacuum-sealed and airtight containers, preserve the integrity of various products.

- Flexible packaging films offer convenience and cost savings, while recyclable packaging formats cater to growing eco-consciousness. Packaging material sourcing and reusable packaging systems contribute to sustainability efforts, and packaging printing techniques offer customization opportunities. E-commerce packaging design addresses the unique needs of online retail, and inventory management systems streamline operations. Child-resistant packaging and compostable packaging options cater to specific consumer needs, while intelligent packaging sensors monitor product freshness and quality. Packaging waste reduction and package design software further optimize the packaging process. Through continuous innovation and adaptation to consumer demands, the market remains a vibrant and ever-changing landscape.

What are the Key Data Covered in this Packaging Market Research and Growth Report?

-

What is the expected growth of the Packaging Market between 2025 and 2029?

-

USD 297.6 billion, at a CAGR of 4.6%

-

-

What segmentation does the market report cover?

-

The report segmented by Type (Board, Rigid plastic, Flexible, Metal, and Glass), End-user (Food, Beverage, Healthcare, Personal care, and Others), Geography (APAC, North America, Europe, Middle East and Africa, and South America), Technology (Offset, Flexography, Screen, Gravure, and Digital), Material (Plastic, Paper & Paperboard, Metal, Glass, Wood, and Others), and Packaging Type (Primary Packaging, Secondary Packaging, and Tertiary Packaging)

-

-

Which regions are analyzed in the report?

-

APAC, North America, Europe, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Growth of food delivery and takeaway services, High cost of recycling rigid plastic products

-

-

Who are the major players in the Packaging Market?

-

Key Companies Amcor Plc, Ball Corp., Berry Global Inc., Constantia Flexibles Group GmbH, Crown Holdings Inc., Gerresheimer AG, Huhtamaki Oyj, International Paper Co., Mondi Plc, Oji Holdings Corp., Pregis LLC, Sealed Air Corp., Smurfit Kappa Group, Sonoco Products Co., Stora Enso Oyj, Tetra Laval SA, UPM Kymmene Corp., WestRock Co., and Winpak Ltd.

-

Market Research Insights

- The market encompasses a diverse range of solutions, from ergonomic designs that prioritize user experience to end-of-life management strategies addressing sustainability concerns. Consumer behavior insights drive innovation, with a growing emphasis on sustainability certifications and recycling infrastructure. Sustainability initiatives extend to waste reduction strategies, transport packaging standards, and sustainable supply chains. Logistics and distribution require packaging line control, supply chain visibility, and material science advancements. Package structural design integrates product traceability systems, while automation robotics streamline production. Food packaging regulations and cosmetic trends shape industry developments.

- Edible film packaging and industrial solutions cater to specific sectors, while order fulfillment processes necessitate efficient packaging designs. Circular economy principles promote inventory optimization and quality control measures. Package integrity testing ensures product protection during transport and storage. Retail packaging displays showcase products, while barrier film properties and warehouse management systems optimize operations.

We can help! Our analysts can customize this packaging market research report to meet your requirements.