Microbial Products Market Size 2024-2028

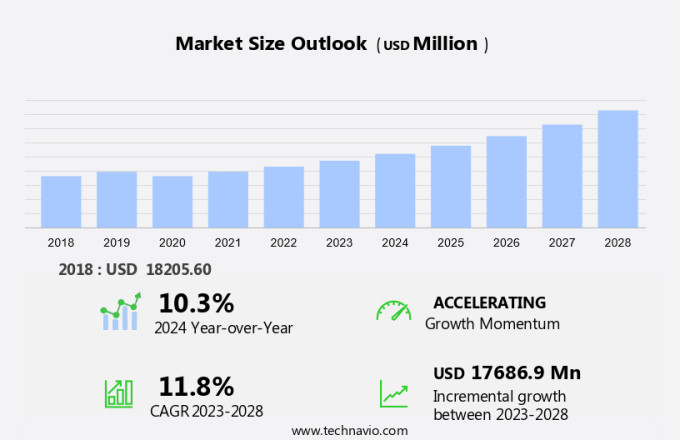

The microbial products market size is forecast to increase by USD 17.69 billion at a CAGR of 11.8% between 2023 and 2028.

- The market is experiencing significant growth due to the increasing demand for microbiology solutions in various sectors, including healthcare and agriculture. Planet Earth is home to an abundant array of microorganisms that play crucial roles in biological systems, from maintaining soil health and purifying water to enhancing animal and plant growth. In the healthcare industry, the rising prevalence of diseases necessitates the development of advanced microbial products for diagnosis, treatment, and prevention. Microorganisms play a crucial role in the fermentation process, which is essential for producing alcoholic beverages like beer, wine, and spirits.

- However, manufacturing and formulation challenges persist, including ensuring product stability, maintaining sterility, and addressing regulatory requirements. As the market continues to evolve, innovation and collaboration between industry stakeholders will be essential to addressing these challenges and unlocking the full potential of microbial products for the benefit of humans, animals, and the environment.

What will be the Size of the Market During the Forecast Period?

- The Unseen Force Driving Industrial Processes and Product Development Microorganisms, including algae, bacteria, fungi, protozoa, and viruses, are an essential component of various biological systems on Planet Earth. These microscopic organisms play a significant role in maintaining the balance of ecosystems, breaking down organic matter in soil, purifying water and air, and contributing to the health of the body, animals, and plants. Industrial microbiology and biotechnology have harnessed the power of these microorganisms to develop numerous products and industrial processes. The applications of microorganisms span across diverse industries, including food additives, alcoholic and non-alcoholic beverages, biofuels, and chemicals.

- Microorganisms are used in the production of various food additives, such as enzymes, bioactive molecules, and fermented foods. These additives enhance the taste, texture, and shelf life of food products, making them safer and more appealing to consumers. Similarly, non-alcoholic beverages like yogurt, kefir, and kombucha are produced using microorganisms, providing health benefits to consumers. Biofuels: Microorganisms are used to produce biofuels, such as biodiesel and bioethanol, which are renewable and eco-friendly alternatives to fossil fuels.

- These biofuels help reduce greenhouse gas emissions and contribute to energy sustainability. Chemicals: Microorganisms are used to produce a wide range of chemicals, including antibiotics, enzymes, and biofertilizers. These chemicals are essential in various industries, including pharmaceuticals, agriculture, and textiles, and help improve productivity and efficiency. Biotechnology: The use of microorganisms in biotechnology has led to the development of vaccines, which are essential for preventing diseases in humans and animals. Additionally, microorganisms are used to produce bioactive molecules, which have therapeutic applications in medicine. In conclusion, microorganisms are an integral part of various biological systems on Planet Earth, and their applications in industrial processes and product development are vast and diverse. From food additives and beverages to biofuels and chemicals, microorganisms contribute significantly to numerous industries, driving innovation and sustainability.

How is this market segmented and which is the largest segment?

The market research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Pharmaceutical

- Diagnostics

- Biotechnology

- Geography

- North America

- Canada

- US

- Europe

- Germany

- UK

- Asia

- China

- Rest of World (ROW)

- North America

By Application Insights

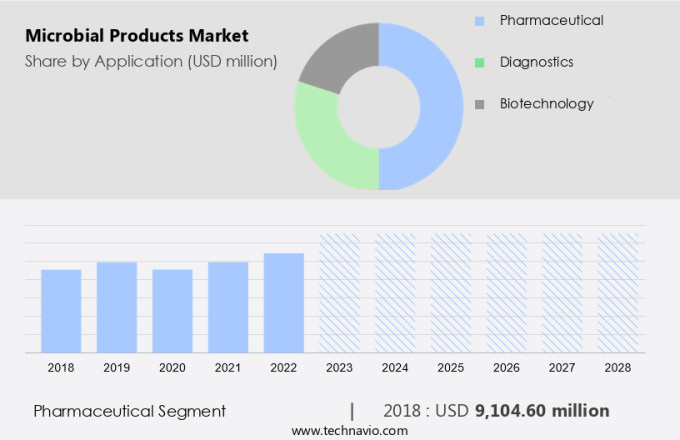

- The pharmaceutical segment is estimated to witness significant growth during the forecast period.

Microorganisms play a crucial role in various biological systems on Planet Earth, including soil, water, air, the human body, animals, and plants. The use of microorganisms in producing products, particularly in the pharmaceutical industry, is a growing trend. In the US, the Centers for Disease Control and Prevention (CDC) reports that rare diseases affected approximately 25 million people in the country and 400 million people globally by 2019. This rising prevalence of rare diseases has led to an increase in demand for novel drugs, driving growth in the pharmaceutical segment. Expanding markets in developing countries, with their lower labor and manufacturing costs, are another significant factor fueling industry growth.

Developing a new drug is a complex process that necessitates substantial capital investments, technological expertise, and human resources. The pharmaceutical industry's expansion will primarily be driven by these factors. Microbial products have a wide range of applications, including food and beverage, agriculture, and environmental industries. The food and beverage sector uses microorganisms for fermentation, preservation, and production of probiotics. In agriculture, microbial products are used as biofertilizers and biopesticides. In the environmental sector, microorganisms are used for wastewater treatment and bioremediation. In conclusion, the market is witnessing significant growth due to the increasing demand for microbial-derived products in various industries, including pharmaceuticals, food and beverage, agriculture, and environmental applications.

The market's expansion is driven by factors such as the rising prevalence of rare diseases, the low labor and manufacturing costs in developing countries, and the complex process of developing new drugs. The potential applications of microbial products are vast, making them an essential component of numerous industries.

Get a glance at the market report of share of various segments Request Free Sample

The pharmaceutical segment was valued at USD 9.1 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

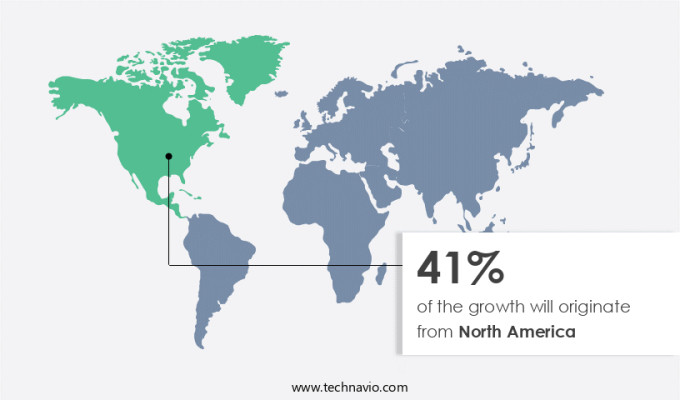

- North America is estimated to contribute 41% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions Request Free Sample

The market in North America is experiencing significant growth, with the United States being a major contributor. The increasing importance of microbial-based research in the clinical sector and the emergence of new infectious diseases are primary factors fueling market expansion in this region. Moreover, the presence of numerous leading companies who are investing in research and development through strategic collaborations and joint ventures is further boosting revenue generation in the North American market. In response to the escalating health concerns and rising disease burden, the demand for microbial-based therapeutic and diagnostic products is on the rise in the US and Canada. These products offer numerous benefits, including the production of food additives, alcoholic and non-alcoholic beverages, biofuels, metabolites, biofertilizers, chemicals, enzymes, and bioactive molecules. Market players are focusing on innovation and product development to cater to evolving consumer needs and preferences.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in adoption of Microbial Products Market?

High demand for microbiology products in the pharmaceutical industry is the key driver of the market.

- Microorganisms hold significant value in the pharmaceutical sector, with their exploitation leading to the creation of various microbial products. These products play a pivotal role in the manufacturing of pharmaceuticals such as vaccines, antibiotics, insulin, and steroids. For example, insulin production for diabetes mellitus patients earlier relied on insulin extracted from animal pancreases. However, due to concerns over contamination and ethical dilemmas associated with animal slaughter for drug production, genetically modified microorganisms like bacteria are now extensively utilized to produce insulin in its purest form. This insulin variant boasts fewer adverse effects for patients. Microbial products find extensive applications in pharmaceutical manufacturing. Vaccines, for instance, are produced using either dead or weakened microorganisms, their toxins, or surface proteins. Similarly, antibiotics are derived from microorganisms or their by-products, while fermentation processes are employed in the production of insulin, steroids, and various other pharmaceuticals.

- Furthermore, microbial products extend to the creation of fermented beverages, malted cereals, broths, and fruit juices. Yeasts, such as Saccharomyces cerevisiae, are widely used in the fermentation process for the production of these beverages and food items. The pharmaceutical industry's reliance on microbial products is a testament to their versatility and importance in the industry. In summary, microorganisms and their derived products play a crucial role in the pharmaceutical industry, contributing to the production of vaccines, antibiotics, insulin, steroids, and various other pharmaceuticals. Additionally, microbial products find applications in the creation of fermented beverages, malted cereals, broths, and fruit juices. The versatility and importance of microbial products in the pharmaceutical sector are evident through their extensive usage.

What are the market trends shaping the Microbial Products Market?

The increasing prevalence of diseases is the upcoming trend in the market.

- The global health landscape is witnessing a significant increase in the prevalence of various diseases, including endocrine and metabolic disorders, cancer, inflammatory diseases, and gastrointestinal disorders. According to the World Health Organization, approximately 20% of men and 16.66% of women worldwide are at risk of developing cancer during their lifetime. Furthermore, the incidence of gastrointestinal disorders, such as Clostridioides difficile infection (C. Difficile) and inflammatory bowel disease (IBD), is on the rise. The Centers for Disease Control and Prevention (CDC) reports that around 400,000 C. Difficile infections occur annually in the United States, leading to nearly 30,000 deaths. These diseases pose a substantial burden on healthcare systems and patients, leading to increased healthcare expenditures. Microbial products, such as curd and baker's yeast, have gained significant attention due to their potential therapeutic and diagnostic applications. These products are derived through the process of fermentation, which involves the growth of microorganisms. The nutritional value of these microbial products offers numerous health benefits, making them essential for human welfare.

- In the household products sector, microbial products are used extensively in food and beverage industries for the production of various fermented foods, such as yogurt, cheese, and sauerkraut. Additionally, they are used in the pharmaceutical industry for the development of therapeutics and vaccines. The increasing demand for efficient and effective therapeutics and diagnostic technologies to address the rising burden of diseases is driving the growth of the market.

What challenges does Microbial Products Market face during the growth?

Challenges related to manufacturing and formulation are key challenges affecting the market growth.

- In the realm of microbial product manufacturing, companies encounter various complexities during the clinical development, production, and technological aspects. Creating stable engraftments, identifying suitable biosensors, engineering reliable gene circuits, adhering to safety and biocontainment regulations, and designing efficient microbial therapies are some of the hurdles microbial product manufacturers face during the manufacturing and formulation processes. A significant challenge in microbial product development arises during the cultivation of microorganisms. This challenge is particularly evident during the isolation, screening, and upscaling of specific strains or species. Furthermore, the downstream processing of the culture employed in producing microbial and diagnostic products is an under-explored area, adding to the intricacy of the manufacturing process. Living organisms, such as microbes, play a crucial role in various biological systems, including the human body. Nutritive media and other conditions are essential for their growth and development. However, maintaining the stability and viability of these microbes during the production process can be challenging. Viroids, which are infectious RNA molecules, can also pose a threat to the manufacturing process, necessitating stringent safety measures.

- However, manufacturing microbial products involves a delicate balance between maintaining the biological integrity of the microorganisms and ensuring the production of high-quality, stable, and safe products. The challenges faced during the manufacturing process necessitate a deep understanding of the microbiology involved and the development of innovative solutions to overcome these hurdles. Microbial product manufacturers must invest in research and development to address these challenges and create robust processes for the production of microbial and diagnostic products. The use of advanced technologies, such as automation and bioreactors, can help streamline the manufacturing process and improve product quality. In conclusion, the manufacturing of microbial products presents unique challenges, particularly during the cultivation and downstream processing of microorganisms. Ensuring the stability, safety, and bio-contentment of these products requires a deep understanding of microbiology and the development of innovative solutions to overcome the challenges faced during the manufacturing process.

Exclusive Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

The market research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Altogen Biosystems

- Biological Products Industry Alliance

- BioMerieux SA

- Earthrise Nutritionals LLC

- GlaxoSmithKline Plc

- JH Biotech Inc.

- Kan biosys

- Kyowa Hakko Bio Co. Ltd.

- Lallemand Inc.

- Merck KGaA

- NovaMedica

- Novartis AG

- Novozymes AS

- Pfizer Inc.

- Ruchi Biochemicals.

- Sanofi SA

- Thermo Fisher Scientific Inc.

- Valent BioSciences LLC

- Vedanta Biosciences Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Microorganisms, including algae, bacteria, fungi, protozoa, viruses, and viroids, play a crucial role in various biological systems on planet Earth. They are present in soil, water, air, and even in the human body, animals, and plants. Industrial microbiology and biotechnology have leveraged the unique properties of these microscopic organisms to develop numerous products. In industrial processes, microbes are used to produce food additives, alcoholic and non-alcoholic beverages, biofuels, metabolites, biofertilizers, chemicals, enzymes, bioactive molecules, vaccines, and antibiotics. The fermentation process is a key technique used in the production of these products. Fermented beverages like wine, beer, and fermented fruit juices are produced using yeasts such as Saccharomyces cerevisiae.

Malted cereals, broths, and milk are also used as nutritive media for the growth of these microbes. Unrefrigerated dairy products like curd also rely on living organisms to maintain their nutritive value. Microbes are also essential for human welfare, as they help in the production of baker's yeast and are used in the treatment of diseases. Household products like cleaning agents and detergents also utilize microbes for their unique properties. However, microbes can also cause diseases, and research continues to focus on understanding their mechanisms and developing countermeasures. Overall, the role of microorganisms in various industries and biological systems is vast and diverse, offering significant opportunities for innovation and development.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

139 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 11.8% |

|

Market growth 2024-2028 |

USD 17.69 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

10.3 |

|

Key countries |

US, Canada, Germany, China, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across North America, Europe, Asia, and Rest of World (ROW)

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch