Peat Market Size 2024-2028

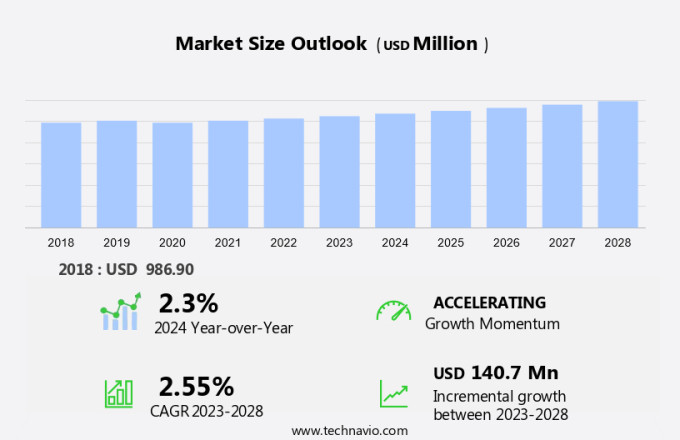

The peat market size is forecast to increase by USD 140.7 million at a CAGR of 2.55% between 2023 and 2028.

- The market is witnessing significant growth due to the increasing demand for electricity generation. Peat is a valuable energy source, particularly in regions with limited access to other fossil fuels. However, the market is also facing challenges due to the negative impact of peat extraction on the environment. Peatlands, which store large amounts of carbon, are being destroyed at an alarming rate, contributing to greenhouse gas emissions. In addition, it serves as a raw material for producing bio-based fuels, medicines, and food additives. Additionally, peatland restoration is gaining importance as a means to mitigate these environmental concerns. As the world shifts towards renewable energy sources, the peat industry must adapt to these trends and find ways to minimize its environmental footprint to remain competitive. The market analysis report provides a comprehensive study of these factors and more, offering insights into the current and future landscape of the market.

What will be the Size of the Peat Market During the Forecast Period?

- The market encompasses various types, including cocopeat, sod peat, sapric peat, hemic peat, fabric peat, and others. This organic material is widely utilized in agriculture and horticulture for seed starting, potting, and soil amendment. In the agriculture sector, peat's water-retaining properties enhance crop growth and yield. In the horticulture industry, it is essential for maintaining optimal growing conditions for various plants. Peat is also employed in whisky distilleries for filtering spirits, contributing to the unique taste of Scotch whiskies. Beyond agriculture and horticulture, peat is used as fuel and energy source in domestic applications, industrialization, and electric power plants.

- In addition, the market is witnessing significant growth due to increasing infrastructure development and industrialization. Companies like Legro and Botanicoir are leading players In the cocothe market, while sod peat, sapric peat, hemic peat, fabric peat, and other types continue to gain traction In their respective applications.

How is this Peat Industry segmented and which is the largest segment?

The peat industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Fuel and energy

- Agriculture and horticulture

- Others

- Geography

- Europe

- Germany

- UK

- North America

- US

- APAC

- South America

- Middle East and Africa

- Europe

By Application Insights

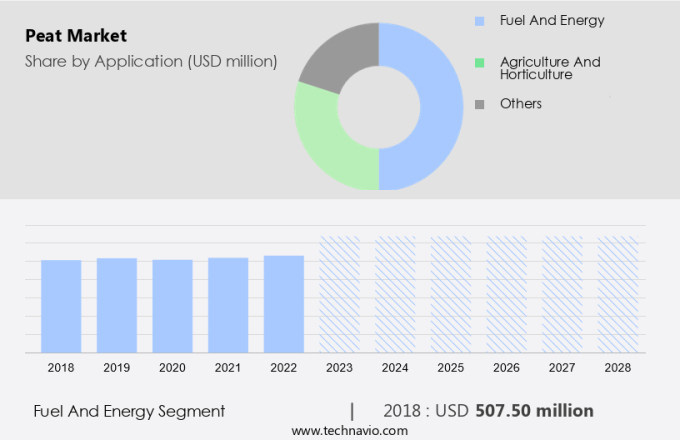

- The fuel and energy segment is estimated to witness significant growth during the forecast period.

Peat, a natural organic material formed from partially decayed vegetation, has historically been used for domestic heating and cooking. However, with the emergence of gas and oil as primary energy sources, the domestic application of peat has declined. Nevertheless, the demand for peat remains significant In the electricity sector, where it is utilized as fuel for large power plants. The depletion of fossil fuels has fueled renewed interest in peat as a sustainable energy source. The market encompasses various types of fuel peat, including milled peat, sod peat, peat pellets, and briquettes. These distinctions are essential for categorization purposes. Peat's role as a fuel source remains a crucial application withIn the market.

Get a glance at the Peat Industry report of share of various segments Request Free Sample

The fuel and energy segment was valued at USD 507.50 million in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

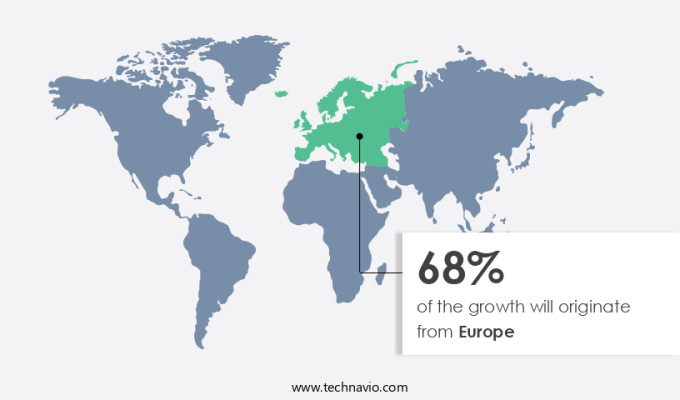

- Europe is estimated to contribute 68% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Peat, an organic material derived from decomposed vegetation, holds significance in Europe's agriculture and energy sectors. Finland, Germany, Ireland, and Sweden are the primary global producers. Peat-based energy generation contributes to European energy security by reducing reliance on fossil fuels. This sector also provides employment opportunities in rural areas. In Europe, over one million houses, schools, and offices utilize peat-based energy for heating. Finland is the leading producer and consumer, with key companies like Oulun Energia and Vapo contributing to the market. The European market caters to various industries, including power generation and horticulture. As Europe undergoes infrastructure growth and population expansion, the demand for peat is expected to increase, making it a vital component In the transition towards renewable energy sources.

Market Dynamics

Our peat market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Peat Industry?

Increase in demand for electricity generation is the key driver of the market.

- Peat, a natural organic material derived from the partial decay of vegetation in wetlands, plays a significant role in various industries, including agriculture, fuel, energy, and medicine. In the agriculture sector, peat is used as a growing medium, particularly in horticulture, under the forms of Coco Peat, Sod Peat, and others. Peat-based products like Legro and Botanicoir are widely used for seed germination and plant cultivation. In the energy sector, peat is used as a fuel in power generation, with countries like Finland, Germany, Ireland, Sweden, and others being major producers. Peat is a renewable and eco-friendly resource for producing electricity, making it an attractive option for electricity generation companies.

- Moreover, peat-fired power plants, such as Oulun Energia in Finland, generate electricity using this organic material. Moreover, peat is used In the production of bio-based fuels, such as Sapric Peat and Hemic Peat, which are used as alternatives to traditional fossil fuels. Peat is also used In the manufacturing of Fabric Peat, which is used in water filtration systems for domestic and industrial applications. In the medical sector, peat is used In the production of various medicines, including those for biofiltration. The increasing population growth and infrastructure development have led to an increase in demand for renewable energy sources, making peat a valuable resource for electricity generation and bio-fuel production.

What are the market trends shaping the Peat Industry?

Peatland restoration is the upcoming market trend.

- Peatlands, rich in organic material, play a crucial role in preserving global biodiversity, carbon storage, and flood risk management. However, the extraction and utilization of peat for various purposes, such as horticulture, whisky distilleries, fuel, and energy, can lead to the damage of these valuable ecosystems. This damage contributes to the emission of greenhouse gases, including carbon dioxide, which negatively impacts the environment and contributes to climatic changes. To mitigate these environmental concerns, peatland restoration has emerged as a vital solution. This process helps create an optimal environment for peat moss to recolonize and secure the integrity of the carbon In the peat soil.

- Furthermore, it significantly reduces greenhouse gas emissions, improving the overall health of the peatlands. Additionally, peatland restoration supports the provision of essential services, such as carbon storage, water retention and water quality, and biodiversity and wildlife habitat. In the agriculture sector, peatlands contribute to the production of Coco Peat, Sod Peat, Sapric Peat, Hemic Peat, Fabric Peat, and other organic materials used for horticulture. In the energy sector, peat is used as a fuel in electric power plants and as a bio-fuel. Peatland restoration not only benefits the environment but also supports the sustainability of these industries. Moreover, peatlands play a significant role in infrastructure growth and industrialization by providing raw materials for various industries and renewable energy sources.

What challenges does the Peat Industry face during its growth?

Negative impact of peat on environment is a key challenge affecting the industry growth.

- Peatlands, comprising approximately 3% of the global land surface, serve as the largest natural terrestrial carbon stores. This organic material, including Coco Peat, Sod Peat, Sapric Peat, Hemic Peat, Fabric Peat, and others, holds significant value in various sectors. In agriculture, it is used as a growing medium for horticulture and agriculture, while in industry, it is utilized as a fuel and energy source. Unfortunately, the benefits of peatlands are often overlooked, leading to their damage through activities such as drainage, agricultural conversion, burning, mining, and fuel extraction. The consequences of these actions are far-reaching, contributing to 10% of global greenhouse gas emissions from the land-use sector.

- Moreover, damaged peatlands negatively impact biodiversity, with species such as the Sumatran Orangutan experiencing an 80% decline in population over the past 75 years. The market encompasses various applications, including whisky distilleries, electric power plants, and water filtration systems. New product developments, launches, contracts, mergers, and acquisitions continue to shape the market landscape. Companies like Legro, Botanicoir, Lambert Peat Moss, T & J Enterprises, Cocogreen, and Bogs are key players In the cocothe market. As the demand for renewable energy sources grows with infrastructure development, population expansion, and industrialization, the market is expected to continue its expansion. Additionally, peat is increasingly used in biofiltration and water filtration systems, making it an essential component of various industries.

Exclusive Customer Landscape

The peat market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the peat market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, peat market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- AB Rekyva

- Aswini Multiagro Industries Pvt Ltd.

- Berger Peat Moss Ltd.

- Bord na Mona

- Coco Coir Global.

- Cocogreen Ltd.

- Compaqpeat

- GloÂbal PeÂat Ltd.

- HQPower

- Klasmann-Deilmann GmbH

- Kumaran Fibres

- Lambert Peat Moss

- Mikskaar

- Neova Oy

- Oulun Energia Oy

- Premier Tech Ltd.

- Sai Cocopeat Export PVT Ltd.

- Sri Jayanthi Coirs

- Sun Gro Horticulture

- Ventspils SIA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

The market encompasses various types, including cocopeat, sod peat, sapric peat, hemic peat, fabric peat, and others. This market caters to diverse industries such as agriculture, fuel, energy, medicine, and horticulture, among others. The market is influenced by several factors. The agriculture sector is a significant consumer of peat, with its use in cultivating crops and improving soil quality. In horticulture, peat is widely employed in seedling production and potting mixes.

Moreover, the food industry also utilizes peat in various applications, such as filtration and animal feed. In the energy sector, peat is used as a fuel in power generation, particularly in regions with abundant peat resources. Renewable energy sources, including bio-based fuels, are gaining popularity, leading to increased demand for peat as a sustainable alternative. Industrialization and infrastructure growth in developing economies are also contributing to the market's expansion. The medicine industry utilizes peat in various applications, including pharmaceuticals and biofiltration. Peat's unique properties make it an effective adsorbent, making it an essential component in water filtration systems. The market is witnessing several new product developments and launches.

For instance, companies are focusing on producing peat-based products that cater to specific industries, such as hemic peat for horticulture and sapric peat for energy applications. Additionally, there have been mergers and acquisitions In the market, leading to consolidation and increased competition. The use of peat in whisky distilleries is another niche application. Peat is used to dry and smoke malted barley, imparting a distinct flavor to Scotch whiskies. This application is unique to Scotland and Ireland and is an essential part of their cultural heritage. The market is influenced by various trends, including population growth and the increasing awareness of sustainable practices.

Furthermore, as the world's population continues to grow, the demand for food and other resources is increasing, leading to a greater need for peat in agriculture and horticulture. Additionally, the shift towards renewable energy sources and sustainable practices is driving demand for peat as a bio-based fuel and industrial raw material. Therefore, the market is a dynamic and diverse industry that caters to various applications in agriculture, fuel, energy, medicine, and horticulture. The market is influenced by several factors, including industrialization, population growth, and the shift towards renewable energy sources. The market is expected to continue growing, driven by the increasing demand for sustainable and eco-friendly products.

|

Peat Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

143 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.55% |

|

Market growth 2024-2028 |

USD 140.7 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.3 |

|

Key countries |

Finland, Ireland, Germany, US, and UK |

|

Competitive landscape |

Leading Companies, market growth and forecasting , Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Peat Market Research and Growth Report?

- CAGR of the Peat industry during the forecast period

- Detailed information on factors that will drive the Peat growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across Europe, North America, APAC, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the peat market growth of industry companies

We can help! Our analysts can customize this peat market research report to meet your requirements.