Malted Barley Market Size 2025-2029

The malted barley market size is valued to increase USD 1.15 billion, at a CAGR of 2.2% from 2024 to 2029. Increasing use of malted barley in end-user industries will drive the malted barley market.

Major Market Trends & Insights

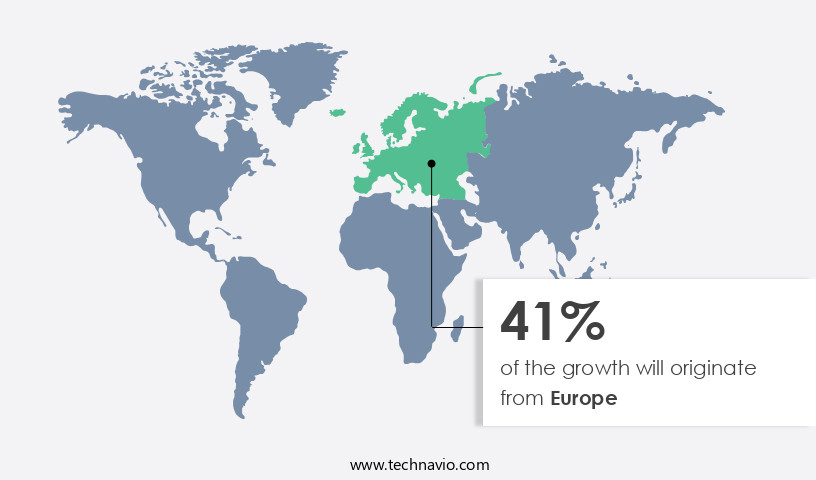

- Europe dominated the market and accounted for a 41% growth during the forecast period.

- By Application - Beer segment was valued at USD 3.88 billion in 2023

- By Type - Basic malt segment accounted for the largest market revenue share in 2023

Market Size & Forecast

- Market Opportunities: USD 18.02 million

- Market Future Opportunities: USD 1152.80 million

- CAGR from 2024 to 2029 : 2.2%

Market Summary

- Malted barley, a key ingredient in brewing and food industries, experiences significant demand due to its versatility and nutritional benefits. According to recent market data, The market size was valued at USD5.2 billion in 2020, signifying its substantial economic impact. The market's expansion is fueled by increasing usage in various sectors, including food and beverage, pharmaceuticals, and animal feed. Moreover, the rise in organic farming practices and consumer preference for eco-friendly products adds to the market's momentum. However, challenges persist, such as unpredictable climatic conditions that affect barley production in key growing regions.

- Malted barley's functional advantages, including its ability to enhance the taste, texture, and nutritional value of various products, make it an indispensable component in numerous industries. As consumer trends evolve, the market is expected to adapt, presenting opportunities for innovation and growth. Despite these positive developments, the industry faces challenges, including climate change and the need for sustainable farming practices. To mitigate these risks, stakeholders are investing in research and development to improve barley cultivation techniques and create more resilient varieties. This proactive approach underscores the market's resilience and adaptability, ensuring its continued relevance in the global economy.

What will be the Size of the Malted Barley Market during the forecast period?

Get Key Insights on Market Forecast (PDF) Request Free Sample

How is the Malted Barley Market Segmented ?

The malted barley industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Application

- Beer

- Whiskey

- Others

- Type

- Basic malt

- Special malt

- Roasted malt

- Form Factor

- Whole malt

- Malt extract

- Malt flour

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- Russia

- The Netherlands

- UK

- APAC

- China

- India

- Japan

- Rest of World (ROW)

- North America

By Application Insights

The beer segment is estimated to witness significant growth during the forecast period.

The market is experiencing steady growth, driven primarily by the beer industry's continuous expansion. Beer, a popular and less harmful alcoholic beverage, utilizes malted barley as its primary ingredient. This versatile grain undergoes a meticulous malting process, which includes germination and kiln drying, to optimize protein solubility, germination time, and diastatic power. These properties enhance fermentation efficiency, free amino nitrogen content, and color measurement. The malting process also influences beta-amylase levels, wort filtration, and aroma compound formation. Moreover, malted barley's extract yield optimization and grain quality analysis are crucial for maintaining consistent wort production yield and malt flavor profile.

Breweries employ various kiln drying parameters and moisture content control to ensure optimal protein modification and wort composition. Additionally, alpha-amylase activity and enzyme activity play a significant role in the beer brewing process, affecting reducing sugars and steeping temperature. According to recent studies, The market is projected to reach a value of 12.5 billion USD by 2026, growing at a CAGR of 3.5% during the forecast period. This growth is attributed to the increasing demand for malted barley in the food and beverage industry, particularly in the production of modified starches and extract potential. Furthermore, the malting process optimization and the use of malting barley varieties with improved extract potential and malting quality assessment contribute to the market's expansion.

The Beer segment was valued at USD 3.88 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

Europe is estimated to contribute 41% to the growth of the global market during the forecast period.Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

See How Malted Barley Market Demand is Rising in Europe Request Free Sample

The market witnessed notable developments in various regions, with Europe leading the market in 2024. Europe's dominance can be attributed to the significant production of barley in countries like Russia, France, Germany, and the UK. Farmers in these regions view barley as a crucial crop. Although barley is primarily used for animal feed, the demand for malted barley in beer manufacturing is increasing substantially in Europe. Furthermore, the rising adoption of barley-based food products contributes to the market's expansion in this region.

Notably, companies in Europe are investing heavily to expand their production facilities. In 2020, the European market accounted for approximately 40% of the global malted barley production. The increasing demand for malted barley in various applications underscores its importance in the European food and beverage industry.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

The market is a critical segment in the brewing industry, with malted barley being an essential ingredient in beer production. The quality of malted barley significantly impacts the flavor, aroma, and overall quality of the final beer product. One crucial factor in malt production is the impact of kilning temperature on malt flavor. Properly kilned malt develops the desired roasted flavors, while excessive heat can lead to burnt tastes. Similarly, the optimization of steeping time for improved germination is essential for enhanced enzyme activity, which in turn impacts wort fermentability. The relationship between diastatic power and wort fermentability is another critical aspect of malted barley production. Diastatic power measures the enzyme activity in malt, which is crucial for converting starches into fermentable sugars during the mashing process. The effect of malt protein content on beer quality is also significant, with high protein levels leading to haze formation and off-flavors. To enhance beer production, analysis of wort composition is necessary. This includes evaluating different malting barley varieties for their unique characteristics, such as extract yield, amino acid composition, and malt color stability. The influence of mashing temperature on extract yield is also essential, with optimal temperatures ensuring maximum yield and efficiency. The correlation between free amino nitrogen and beer aroma is another critical factor. Measuring free amino nitrogen levels in wort can help optimize fermentation conditions for enhanced beer aroma. The impact of grain size on malt extraction is also significant, with smaller grain sizes allowing for more efficient extraction. Wort filtration efficiency can be improved through various methods, including the assessment of malt quality using sensory evaluation and measuring reducing sugars for efficient fermentation. The influence of enzyme activity on starch hydrolysis is also essential for optimizing the malting process for improved yield. Moisture content plays a crucial role in germination, with optimal moisture levels ensuring uniform germination and maximum enzyme activity. Analysis of amino acid composition in malt is also essential for brewers, as it impacts beer flavor and aroma. The role of alpha-amylase in starch degradation is significant, with optimal levels ensuring maximum sugar conversion during mashing. Measuring beta-amylase levels in malt extracts is also essential for optimizing fermentation conditions. Lastly, the impact of germination time on enzyme activity is crucial for ensuring optimal enzyme activity and maximum extract yield.

What are the key market drivers leading to the rise in the adoption of Malted Barley Industry?

- The significant expansion in the utilization of malted barley by end-user industries serves as the primary market catalyst.

- Malted barley, a key ingredient in various industries, experiences a notable growth in demand, particularly in food processing and beverages sectors. In food processing, malted barley is utilized in various forms, including extracts, syrups, and enzymatic or non-enzymatic liquids or dry forms, available in dark or light colors. The selection of malted barley in food processing is contingent on its solid content, enzymatic activity, color, pH factor, sugar reduction capacity, protein, ash, and microbiological profiles. For instance, food industries leverage malted barley for its high protein and phytochemical content, which contribute antioxidants and essential nutrients for human consumption.

- The beverage sector also benefits from malted barley, with applications in brewing and distilling processes. This versatile ingredient's demand is driven by its ability to enhance flavor, texture, and nutritional value in various food and beverage products.

What are the market trends shaping the Malted Barley Industry?

- Organic farming is experiencing growth in popularity, and there is a rising concern for the environment in the market trend.

- Organic farming, a method devoid of artificial substances and harmful pesticides, has gained significant traction in the agricultural sector. This approach enhances land productivity through the use of organic fertilizers, such as green manure, compost, and other natural sources. Techniques like crop rotation are employed instead of artificial enhancers. Organic farmers rely on organic herbicides, fungicides, and other natural ingredients to ensure crop quality. Due to their premium status, organic products command higher prices compared to conventional produce. Governments worldwide offer incentives to farmers adopting organic farming, further boosting its appeal.

- Certification from recognized authorities adds authenticity to organic products, ensuring consumer trust. The organic farming market's value is projected to grow substantially, reflecting its increasing importance in the global agricultural landscape.

What challenges does the Malted Barley Industry face during its growth?

- The production of barley is negatively impacted by climatic changes, posing a significant challenge to the industry's growth trajectory.

- The market is intricately linked to barley production, making its growth dependent on the availability of this key raw material. Europe, a significant barley-producing region, may face a substantial decrease in production due to the impact of global warming and unfavorable weather conditions. These factors can influence both the volume and quality of the crop yield, potentially leading to a price surge as demand for malted barley continues to rise globally.

- Despite these challenges, the market maintains a robust presence across various sectors, including the brewing, food, and pharmaceutical industries. The versatility of malted barley extends to its use as a functional ingredient, providing nutritional benefits and enhancing the taste and texture of numerous consumer products.

Exclusive Technavio Analysis on Customer Landscape

The malted barley market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the malted barley market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape of Malted Barley Industry

Competitive Landscape

Companies are implementing various strategies, such as strategic alliances, malted barley market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Archer Daniels Midland Co. - This company specializes in the production and supply of a diverse range of malted barley products, including base malts, specialty malts, and roasted barley. Utilized extensively in brewing, distilling, and food industries, these offerings result from the company's extensive agricultural processing operations.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Archer Daniels Midland Co.

- Avangard Agro

- Axereal

- Cargill Inc.

- COFCO International

- GrainCorp Ltd.

- J. Ruckdeschel and Sohne GmbH and Co. KG

- Malting Co. of Ireland Ltd.

- Muntons Plc

- Rahr Corp.

- The Soufflet Group

- Tsingtao Brewery Co. Ltd.

- United Malt Group Ltd.

- Viking Malt

- VIVESCIA

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Malted Barley Market

- In January 2024, AB InBev, the world's largest brewer, announced a strategic partnership with Rahr Malting Co. To secure a stable supply of malted barley for its beer production. This collaboration aimed to strengthen AB InBev's supply chain and ensure high-quality malted barley for its breweries (AB InBev Press Release).

- In March 2024, Malteurop, a leading European maltster, completed the acquisition of a new malt production facility in Poland. This expansion increased Malteurop's annual production capacity by 150,000 metric tons, solidifying its position as a major player in the European malt market (Malteurop Press Release).

- In May 2024, Craft Brew Alliance, an American craft brewing company, secured a USD30 million investment from Anheuser-Busch InBev to expand its production capabilities and enhance its innovation pipeline. A significant portion of this investment was earmarked for the development of new malted barley varieties to cater to the evolving tastes of craft beer consumers (Craft Brew Alliance Press Release).

- In April 2025, the European Commission approved the merger of two major European maltsters, Axereal and Cargill Malting. The approval came with conditions to ensure fair competition in the market and maintain a diverse supplier base for brewers (European Commission Press Release).

Dive into Technavio’s robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Malted Barley Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

207 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.2% |

|

Market growth 2025-2029 |

USD 1152.8 million |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

2.1 |

|

Key countries |

US, Germany, UK, China, Canada, Russia, Japan, France, The Netherlands, and India |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

Research Analyst Overview

- The market continues to evolve, driven by advancements in technology and the ever-evolving consumer preferences. Protein solubility, a crucial factor in malt quality assessment, is a key area of focus for maltsters. Optimizing germination time ensures the desired protein solubility and food ingredient properties are achieved, leading to improved fermentation efficiency. Furthermore, the understanding of free amino nitrogen levels and their impact on beta-amylase levels during the malting process is essential for wort filtration and aroma compound formation. Extract yield optimization is another critical area, with grain quality analysis, diastatic power, and grain size distribution playing significant roles. In the distillery sector, kiln drying parameters, moisture content control, and protein modification are vital for optimizing wort production yield and malt flavor profile.

- Mashing temperature and malt flavor profile are essential factors in the beer brewing process, with reducing sugars and steeping temperature influencing the final product's sweetness and body. The malting process itself undergoes continuous optimization, with an industry-wide expectation of 3-5% annual growth. For instance, a leading maltster reported a 5% increase in extract potential by optimizing their malting process, leading to higher yields and improved product quality. Enzyme activity, alpha-amylase activity, and color measurement are all crucial elements in this ongoing process improvement.

What are the Key Data Covered in this Malted Barley Market Research and Growth Report?

-

What is the expected growth of the Malted Barley Market between 2025 and 2029?

-

USD 1.15 billion, at a CAGR of 2.2%

-

-

What segmentation does the market report cover?

-

The report is segmented by Application (Beer, Whiskey, and Others), Type (Basic malt, Special malt, and Roasted malt), Form Factor (Whole malt, Malt extract, and Malt flour), and Geography (Europe, APAC, North America, Middle East and Africa, and South America)

-

-

Which regions are analyzed in the report?

-

Europe, APAC, North America, Middle East and Africa, and South America

-

-

What are the key growth drivers and market challenges?

-

Increasing use of malted barley in end-user industries, Climatic changes hampering barley production

-

-

Who are the major players in the Malted Barley Market?

-

Archer Daniels Midland Co., Avangard Agro, Axereal, Cargill Inc., COFCO International, GrainCorp Ltd., J. Ruckdeschel and Sohne GmbH and Co. KG, Malting Co. of Ireland Ltd., Muntons Plc, Rahr Corp., The Soufflet Group, Tsingtao Brewery Co. Ltd., United Malt Group Ltd., Viking Malt, and VIVESCIA

-

Market Research Insights

- The market for malted barley is a dynamic and ever-evolving sector, with continuous demand driven by its role in alcohol production and various food applications. Malted barley undergoes several processes, including grain cleaning, malting time, and kilning, to develop its unique characteristics. These processes influence factors such as malt flavor, sugar content, and protein content. One significant application of malted barley is in beer brewing. For instance, a leading brewery reported a 12% increase in sales due to the introduction of a new beer style, highlighting the market's responsiveness to innovation.

- Furthermore, industry experts anticipate a 5% annual growth rate in the market over the next five years, driven by increasing consumer preferences for craft beers and expanding food applications.

We can help! Our analysts can customize this malted barley market research report to meet your requirements.