Pipeline Pigging Systems Market Size 2024-2028

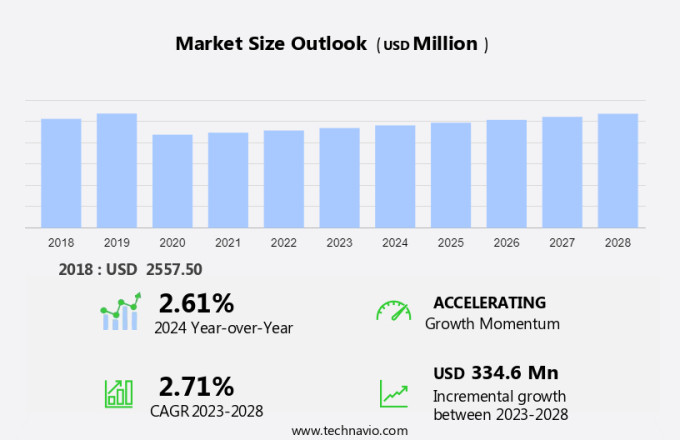

The pipeline pigging systems market size is forecast to increase by USD 334.6 million at a CAGR of 2.71% between 2023 and 2028.

- The market is experiencing significant growth due to the economic benefits of pipeline transportation and the development of intelligent pigs. These advanced pigging systems enable the detection and correction of weld defects in thin-walled pipelines, ensuring improved pipeline integrity. Additionally, pipeline profiling, leak detection, temperature, bend measurement, curvature monitoring, and product sampling are crucial functions of pigging systems, enhancing operational efficiency and safety. One primary role of pipeline pigs is the removal of wax deposits and other debris that can hinder the flow of oil in harsh environments, particularly in regions with colder climates. However, the complexities associated with small-diameter pipelines pose challenges to market growth.

How is this Pipeline Pigging Systems Industry segmented and which is the largest segment?

The pipeline pigging systems industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD million" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Application

- Oil

- Gas

- Type

- Magnetic flux leakage (MFL)

- Ultrasonic test (UT)

- Utility pigging

- Caliper pigging

- Geography

- APAC

- China

- North America

- Canada

- US

- Europe

- UK

- Middle East and Africa

- South America

- APAC

By Application Insights

- The oil segment is estimated to witness significant growth during the forecast period.

Pipeline pigging systems are essential tools in the exploration and production sector for maintaining the efficiency and integrity of crude oil and petroleum product pipelines. These systems utilize specialized pigs, which are large, cylindrical objects moved through pipelines, to perform various cleaning and inspection functions. Photographic inspection pigs are used to identify cracks and other damage, ensuring pipeline safety. Liquid removal pigs separate and eliminate water, condensate, or other liquids that can negatively impact oil quality and promote corrosion.

Furthermore, the heating element or mechanical pig designs are employed to tackle wax and paraffin buildup, ensuring optimal flow rates and pipeline productivity. Pipeline pigging systems play a crucial role in the electricity generating, exploration, and production industries, enhancing extraction techniques and ensuring the consistent delivery of crude oil and petroleum products.

Get a glance at the Pipeline Pigging Systems Industry report of share of various segments Request Free Sample

The Oil segment was valued at USD 2.04 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

- APAC is estimated to contribute 47% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

The market is poised for growth in the coming years due to the escalating need for pipeline safety and environmental protection in the oil and gas industry. The authorized lifespan of pipelines is a significant concern, as faults can lead to pipeline spills, which pose a threat to the environment and can result in substantial capital budgets for remediation. Intelligent pigs, a type of pipeline pigging system, are increasingly being adopted to detect and address these issues. These pigs utilize advanced technologies to identify and locate faults, reducing the likelihood of pipeline failures and associated risks. Furthermore, the implementation of pipeline pigging systems contributes to minimizing a company's carbon footprint by optimizing pipeline operations and reducing the need for frequent maintenance. As developing countries like China and India continue to invest in their oil and gas industries, the demand for pipeline pigging systems will rise to ensure pipeline integrity and efficiency.

Market Dynamics

Our pipeline pigging systems market researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Pipeline Pigging Systems Industry?

The economic benefits of pipeline transportation is the key driver of the market.

- Pipeline transportation plays a crucial role in ensuring the secure and efficient movement of products through pipelines to their destinations. This method offers numerous advantages, including cost effectiveness, reduced safety risks, and job creation. In Canada, the pipeline industry is a significant source of employment, with thousands of people working in the sector nationwide. Approximately one-third of these positions are located in Alberta, one-fourth in Ontario, and one-fifth in Saskatchewan. The remaining jobs are distributed across the rest of the country. Pipeline networks require regular maintenance activities to ensure their optimal performance and longevity. Pipeline pigging systems, a critical component of pipeline maintenance programs, facilitate the cleaning, inspection, and enhancement of pipeline efficiency.

- These systems, often referred to as "pigs," are driven through pipelines to perform various tasks, such as removing debris, preparing pipelines for inspection, and applying coatings. Two types of pigging systems are commonly used: the first pig and the second pig. The first pig, also known as a cleaning pig, is designed to remove debris and contaminants from the pipeline. The second pig, also called an intelligent pig or data pig, collects valuable data during its journey through the pipeline. This data is crucial for pipeline network management and maintenance planning. Advancements in technology have led to the development of intelligent pigging systems, which offer enhanced data interpretation capabilities.

What are the market trends shaping the Pipeline Pigging Systems Industry?

The development of intelligent pigs is the upcoming trend in the market.

- Intelligent pigging systems, also known as smart pigs or in-line inspection pigs, are utilized extensively in the pipeline industry for detecting and measuring various defects. These systems employ innovative methods for pipeline inspection, including the use of notched metal plates as gauges and advanced sensors to record data for subsequent analysis. The sizing pigs, which use metal plates as gauges, can identify internal or external corrosion, laminations, cracks, and other defects. Additionally, sensors integrated into the pigging systems employ technologies such as magnetic flux leakage (MFL), transverse flux leakage (TFL), and ultrasonic testing (UT) to perform pipeline inspections. MFL and UT are the two primary techniques used for in-line pipeline inspections.

- While both methods are effective, ultrasonic testing is often preferred due to its higher accuracy and ease of mobilization, provided the pipeline parameters allow for it. Intelligent pigging systems are essential for maintaining pipeline integrity and ensuring the safe and efficient transportation of fluids. These systems can detect weld defects, measure geometry, monitor temperature, and carry out bend and curvature measurements, among other functions. Furthermore, product sampling is an integral part of pipeline inspections, which is facilitated by these advanced pigging systems.

What challenges does Pipeline Pigging Systems Industry face during the growth?

Complexities associated with small-diameter pipelines is a key challenge affecting the industry growth.

- Unpiggable pipelines have posed a considerable challenge to the pipeline industry for several years. These pipelines become unpiggable due to various reasons, including small diameters, bends, and complex configurations. Inserting and removing pigs in these pipelines can be difficult, and insufficient flow of materials to overcome friction and propel pigs forward is another challenge. Physical barriers, such as valves, elbows, and other obstructions, can also prevent pigs from moving past them. The unpiggability of pipelines can vary depending on their diameter range and the type of fluid they carry. Pipelines can be joined in various configurations, including valve, horizontal, diameter, elbow, vertical, and T-section.

- Corrosion, cracks, and irregularities on the inner walls of pipelines can also make them unpiggable. Ultrasonic pigging, a non-destructive testing method, is commonly used to inspect pipelines and detect irregularities. This technique uses sound waves to examine the pipeline's inner walls and identify metal loss, cracks, and other defects. By addressing these issues, pipelines can be made piggable, ensuring their efficient operation and maintenance.

Exclusive Customer Landscape

The pipeline pigging systems market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

The pipeline pigging systems industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- 3P Services GmbH and Co KG

- Baker Hughes Co.

- Dacon Inspection Technologies Co. Ltd.

- Diamond Edge Services

- Eddyfi NDT Inc.

- Enduro Pipeline Services Inc.

- ERGIL

- GeoCorr LLC

- IKM Instrutek AS

- International Pipeline Products Ltd.

- Italmatch Chemicals Spa

- NDT Global GmbH and Co. KG

- Oil States International Inc.

- Pigs Unlimited International LLC

- Pigtek Ltd.

- PIPECARE Group AG

- ROSEN Swiss AG

- Russell NDE Systems Inc.

- STATS Group

- T.D. Williamson Inc.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Pipeline pigging systems play a crucial role in maintaining the efficiency and integrity of pipeline networks in various industries, including exploration and production, electricity generation, natural gas, petrochemicals, and water utilities. With the increasing age of pipelines, maintenance activities have become essential to ensure the safe and reliable transportation of fluids. Pipeline pigging involves the use of specialized tools, known as pigs, which are inserted into pipelines to clean, inspect, and maintain the inner walls. Intelligent pigging technologies, such as ultrasonic pigging and temperature measurement, enable the detection of irregularities, including corrosion, cracks, weld defects, and wax deposits. These advanced pigging systems help in identifying faults, improving pipeline safety, and protecting the environment by reducing the carbon footprint and preventing pipeline spills.

Furthermore, pipeline pigging services are essential for pipeline projects during construction and routine maintenance. The services include product sampling, photographic inspection, and debris removal. Pipeline pigging is also crucial for thin-walled pipelines, which require regular monitoring for geometry measurement, bend measurement, and curvature monitoring to ensure product quality and flow constraints. Pipeline infrastructure in harsh environments, such as those used for crude oil and petroleum products, requires specialized pigging systems to withstand extreme conditions. These pipelines are subjected to various extraction techniques and can be exposed to high temperatures, pressures, and chemicals, making pigging a complex and critical process.

|

Pipeline Pigging Systems Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

167 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 2.71% |

|

Market Growth 2024-2028 |

USD 334.6 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

2.61 |

|

Key countries |

US, China, Russia, Canada, and UK |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Market Research and Growth Report?

- CAGR of the Pipeline Pigging Systems industry during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of industry companies

We can help! Our analysts can customize this market research report to meet your requirements. Get in touch