Polyolefin Market Size 2024-2028

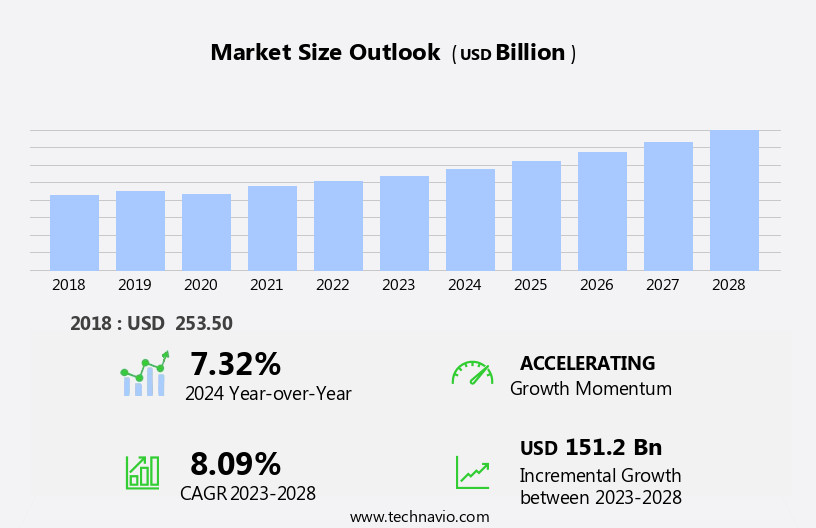

The polyolefin market size is forecast to increase by USD 151.2 billion at a CAGR of 8.09% between 2023 and 2028.

- The polyolefin market is witnessing a growing focus on the circular economy, as sustainability and recycling practices gain increasing importance. This trend is reshaping the industry, driving innovation in product development and encouraging the adoption of eco-friendly solutions, including polyolefin (POF) shrink films.

- However, a critical challenge facing market growth is the fluctuation in the price of crude oil, which directly impacts production costs and market stability. These price variations create uncertainty, complicating long-term planning and investment decisions for businesses operating within the polyolefin sector. Balancing sustainability goals with market volatility will be key to navigating the future of this evolving market.

What will be the Size of the Polyolefin Market During the Forecast Period?

- The market is experiencing significant growth due to its extensive applications in various industries, including automotive, consumer electronics, healthcare, construction, and more. Polyolefins, specifically thermoplastic polyolefins, offer advantages such as durability, weather resistance, and low risk environment, making them a popular choice over conventional materials like rubber and metal in many applications. In the automotive sector, the shift towards lightweight and fuel-efficient vehicles is driving demand for polyolefins, which have a lower density and weight compared to traditional materials. In the healthcare industry, the rising health awareness and focus on infection prevention have led to increased usage of polyolefins in medical masks, gloves, shoe covers, and gowns.

- The stable economy and strong financial sector in several regions are also contributing to the market's growth. Despite the numerous benefits, concerns regarding potential health hazards associated with polyolefins and their production processes continue to be a challenge for market players. Overall, the market is poised for continued growth In the coming years, driven by increasing demand from various end-use industries and the ongoing quest for lightweight, durable, and cost-effective solutions.

How is this Polyolefin Industry segmented and which is the largest segment?

The polyolefin industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2024-2028, as well as historical data from 2018-2022 for the following segments.

- Product

- PE

- PP

- Functional polyolefin

- Application

- Film and sheet

- Injection molding

- Blow molding

- Others

- Geography

- North America

- US

- APAC

- China

- Japan

- Europe

- Germany

- UK

- South America

- Middle East and Africa

- North America

By Product Insights

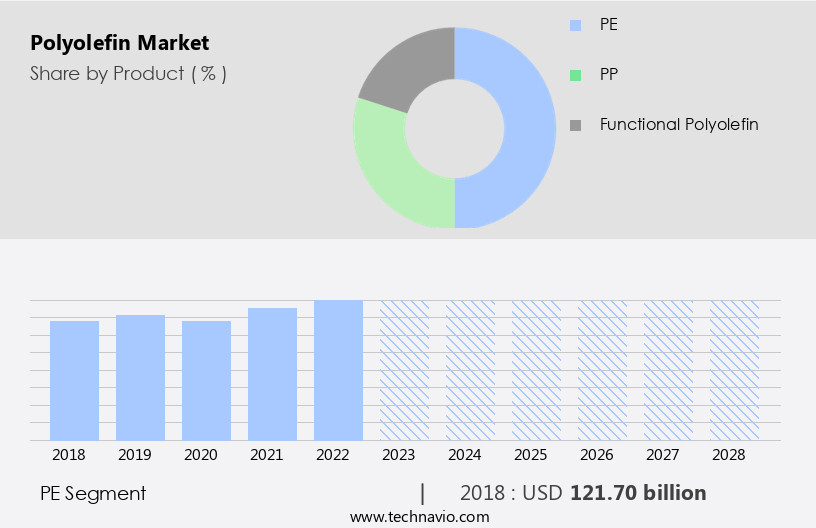

- The pe segment is estimated to witness significant growth during the forecast period.

Polyolefins, specifically polyethylene (PE), are produced through the polymerization of ethylene, resulting in high-molecular-weight hydrocarbons. PE polymers are categorized based on molecular structure branching, with low-density PE (LDPE) and high-density PE (HDPE) being the primary types. LDPE, with a less-compact structure, is utilized in various applications such as shrink films, carrier bags, containers, computer parts, and playground equipment. HDPE, with minimal branching, is more rigid and less porous, making it suitable for crates and boxes, bottles, industrial wrapping, and chemical- and heat-resistant piping and containers. PE's versatility extends to various industries, including automotive, electronics, healthcare, construction, and packaging. The global market for polyolefins is driven by factors like rising health awareness, hygiene, and infection prevention, as well as a stable economy and strong financial sector.

Applications include automotive parts, medical masks, gloves, shoe covers, gowns, and construction materials. PE's desirable properties, such as durability, weather resistance, and easy processability, contribute to its widespread use. Industries like construction, furniture, and biomedical engineering utilize PE in various forms, including thermoplastic polyolefins, living hinges, and high-performance films and sheets. The market is expected to grow due to increasing demand for sustainable engineering polymers and production expansion.

Get a glance at the Polyolefin Industry report of share of various segments Request Free Sample

The PE segment was valued at USD 121.70 billion in 2018 and showed a gradual increase during the forecast period.

Regional Analysis

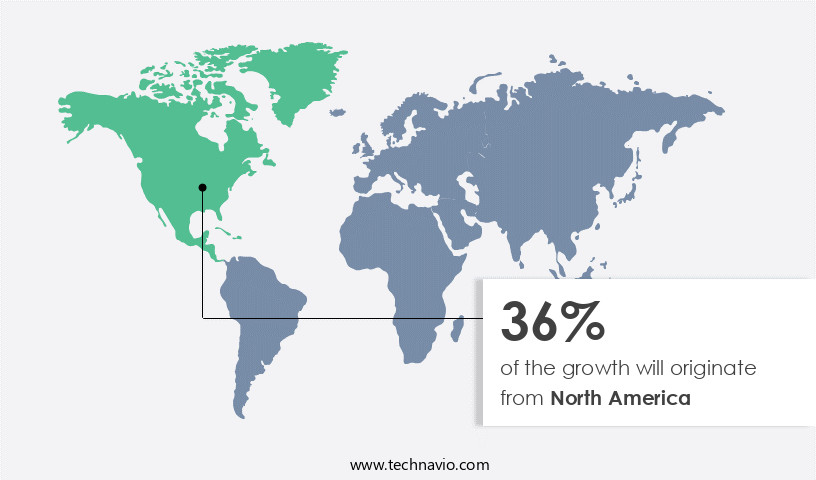

- North America is estimated to contribute 36% to the growth of the global market during the forecast period.

Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

For more insights on the market share of various regions, Request Free Sample

Polyolefins, specifically thermoplastic polyolefins such as polyethylene (PE) and polypropylene, are essential materials in various industries due to their durability, weather resistance, easy processability, and versatility. In the automotive sector, polyolefins are used for automobile parts and fuel tanks, contributing to weight reduction and improved fuel efficiency. In the healthcare sector, they are utilized in medical masks, gloves, shoe covers, and gowns, ensuring a low risk environment for consumers. In electronics, they are used in keyboards, connectors, and housing components. The global market for polyolefins is expanding due to rising health awareness, hygiene, and infection prevention. The construction industry is a significant consumer, utilizing polyolefins in roofing, wall panels, and pipes.

In the packaging business, they offer sustainability and reduced carbon footprint. Key applications include exteriors and interiors, biomedical engineering, and thermoplastic elastomers. Polyethylene and polypropylene account for significant revenue share In the market. Utilization includes prototype development using 3D printers and CNC machines, as well as injection molding and blow molding. In the automotive sector, polyolefins are used in automobile parts and medical devices, while In the industrial output sector, they are used in containers and hot melt adhesives. The market is influenced by factors such as skilled labor availability, low cost, and regulatory changes. Strategic initiatives, such as new product launches and production expansion, are driving market growth.

Sustainable engineering polymers are gaining popularity due to their strength and thermal resistance. Despite these opportunities, supply chain disruptions and regulatory changes pose challenges.

Market Dynamics

Our researchers analyzed the data with 2023 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise In the adoption of Polyolefin Industry?

Increasing demand for bio-based polyolefin is the key driver of the market.

- Polyolefins, specifically thermoplastic polyolefins such as polyethylene (PE) and polypropylene, play a significant role in various industries, including automotive applications, electronics, healthcare, construction, and packaging. In the automotive sector, polyolefins offer advantages such as durability, weather resistance, easy processability, and versatility, making them suitable for exteriors and interiors, automobile parts, and even fuel tanks. In the healthcare industry, polyolefins are used in medical masks, gloves, shoe covers, gowns, and other medical devices due to their low risk environment and infection prevention properties. In the electronics industry, polyolefins are utilized in wire and cable insulation, providing excellent insulation and electrical properties.

- In the construction sector, polyolefins are used in various applications, including roofing membranes, pipes, and insulation materials. The global market for polyolefins is expected to grow due to rising health awareness, hygiene, and infection prevention, as well as a stable economy and strong financial sector. Polyolefins are also used in various applications In the packaging business, such as bottles, edible products, and liquid soaps, due to their low cost, versatility, and ease of processing. In the manufacturing sector, polyolefins are used in various applications, including 3D printers, CNC machines, and hot melt adhesives. In the healthcare industry, polyolefins are used in biomedical engineering, film and sheet, and shrink films, providing properties such as clarity, appearance, puncture resistance, and FDA approval.

- Polyolefins also offer advantages in various industries due to their low chlorine content, sustainability, and carbon footprint. For instance, In the automotive sector, polyolefins are used in automobile parts, such as living hinges, due to their flexibility and low temperatures resistance. In the aerospace sector, polyolefins are used due to their high strength and thermal resistance. In the industrial output sector, polyolefins are used due to their versatility and production expansion capabilities. Despite the benefits of polyolefins, there are challenges facing the industry, including supply chain disruptions, regulatory changes, and strategic initiatives. For instance, the automotive sector is facing supply chain disruptions due to the ongoing COVID-19 pandemic, which is impacting the availability of raw materials and labor.

- Regulatory changes, such as stricter regulations on the use of certain chemicals in polyolefin production, are also impacting the industry. Strategic initiatives, such as new product launches and production expansion, are being undertaken to address these challenges and maintain competitiveness In the market. In conclusion, the market is a dynamic and growing industry, offering advantages in various applications across multiple industries, including automotive, electronics, healthcare, construction, and packaging. Despite challenges, such as supply chain disruptions, regulatory changes, and strategic initiatives, the industry is expected to continue growing due to its sustainability, carbon footprint reduction, and low cost advantages.

What are the market trends shaping the Polyolefin Industry?

Focus on circular economy is the upcoming market trend.

- The market encompasses thermoplastic polymers, including Polyethylene (PE) and Polypropylene (PP), widely utilized in various industries due to their durability, weather resistance, easy processability, and versatility. In the Automotive sector, polyolefins are employed in exteriors and interiors, fueling a decrease in vehicle weight and enhancing fuel consumption efficiency, as they possess lower density compared to conventional materials like rubber and metal. The Electronics, Healthcare, and Construction industries also leverage polyolefins for wire and cable insulation, medical masks, gloves, shoe covers, gowns, and construction materials, respectively. Rising health awareness and the need for hygiene and infection prevention have fueled the demand for polyolefin products in healthcare applications.

- Bio-based polyolefins, derived from renewable resources, are gaining traction due to their low risk environment and sustainability benefits. The Global market for these eco-friendly materials is projected to expand significantly, driven by strategic initiatives, new product launches, and production expansion. Polyolefin's versatility is evident in its application in diverse sectors, such as the Furniture sector, where it is used for its gloss, softness, flexibility, and low temperatures resistance in living hinge applications. In the Packaging business, polyolefins are utilized for their clarity, appearance, puncture resistance, and FDA approval in edible products, liquid soaps, and redispersible polymers. The market's growth is influenced by factors such as the strength and thermal resistance of polyolefins, which are crucial in industries like Hot melt adhesives and Biomedical engineering.

- Low cost and skilled labor availability In the Automotive and Aerospace sectors contribute to their extensive utilization of polyolefin components. However, supply chain disruptions and regulatory changes may pose challenges to market growth. In conclusion, the market's growth is underpinned by its wide applicability across various industries, the development of custom polyolefin materials, and the increasing demand for sustainable engineering polymers. As the global economy remains stable, with a strong financial sector, the market is poised for continued expansion.

What challenges does the Polyolefin Industry face during its growth?

Fluctuation in crude oil prices is a key challenge affecting the industry growth.

- The market faces significant challenges due to the volatile pricing of raw materials, primarily polymers and resins, which are derived from petroleum and natural gas. The price instability of these resources, influenced by the global crude oil industry's demand-supply imbalance, directly impacts the manufacturing costs of polyolefins. This volatility can lead to uncertainty in market forecasts and potential supply chain disruptions. Polyolefins are widely used in various industries, including automotive applications, electronics, healthcare, construction, and packaging. In the automotive sector, polyolefins are used for exteriors and interiors due to their durability, weather resistance, and easy processability. In healthcare, they are utilized In the production of medical masks, gloves, shoe covers, gowns, and other medical devices, prioritizing hygiene, infection prevention, and maintaining a low risk environment.

- In construction, thermoplastic polyolefins are employed In the furniture sector for their versatility, moldability, and resistance to chemical change. Polyethylene (PE) and polypropylene (PP) are the most commonly used polyolefins. PE is known for its puncture resistance, clarity, and softness, while PP offers high strength, thermal resistance, and living hinge properties. These materials are used in various applications, such as bottling, edible products, liquid soaps, and free-flowing powder, as well as In the production of films and sheets, shrink films, and hot melt adhesives. The market's growth is influenced by factors such as increasing health awareness, hygiene, and infection prevention, as well as a stable economy and strong financial sector.

- However, the market faces regulatory changes and strategic initiatives, including new product launches, production expansion, and sustainable engineering polymers. As the demand for polyolefins continues to grow, the industry is expected to adapt to these challenges and innovate to meet the evolving needs of various industries.

Exclusive Customer Landscape

The polyolefin market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polyolefin market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polyolefin market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence In the industry.

Arkema SA - The company introduces a range of thermoplastic materials derived from soft polyolefins under the brand name Apolhya. These materials cater to various applications, including film casting, calendar and blown extrusion, and injection molding.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Arkema SA

- BASF SE

- Carlisle Companies Inc.

- China Petrochemical Corp.

- Dow Inc.

- Exxon Mobil Corp.

- Filtration Group Corp.

- Holcim Ltd.

- Koster Bauchemie AG

- Lanxess AG

- LyondellBasell Industries N.V.

- RPM International Inc.

- Saudi Arabian Oil Co.

- Sika AG

- SOPREMA SAS

- Standard Industries Inc.

- Suzhou GWELL machinery co. LTD.

- Wacker Chemie AG

- Zylog ElastoComp

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Research Analyst Overview

Polyolefins are a significant class of thermoplastic materials, known for their versatility and wide range of applications. These materials, which include polyethylene (PE) and polypropylene (PP), offer several advantages over conventional materials such as rubber and metal. Polyolefins exhibit superior density and weight characteristics, making them ideal for various industries. In the automotive sector, for instance, their lightweight properties contribute to fuel efficiency and reduced environmental impact. In the construction industry, their durability and weather resistance make them a preferred choice for exteriors and interiors. The use of polyolefins extends beyond automotive and construction applications. In the electronics industry, they are utilized in various components due to their excellent electrical insulation properties.

In healthcare, they are essential In the production of medical masks, gloves, shoe covers, and gowns, where hygiene and infection prevention are paramount. The global market for polyolefins is driven by several factors. Rising health awareness and the need for a low-risk environment have led to increased demand for these materials in healthcare applications. The construction industry's strong financial sector and stable economy have also contributed to the growth of the market. Polyethylene and polypropylene offer various benefits, depending on their specific applications. PE, for instance, is known for its easy processability and versatility. It is used in various industries, including packaging, where its clarity, appearance, and puncture resistance make it a popular choice.

PE is also used In the production of low-temperature applications, such as hot melt adhesives and biomedical engineering. PP, on the other hand, offers excellent strength and thermal resistance. It is used in various industries, including the automotive and aerospace sectors, where its high-performance properties are essential. PP is also used In the production of living hinges, which are essential in various consumer products, such as bottles, edible products, and liquid soaps. The market for polyolefins is expected to continue growing, driven by the increasing demand for sustainable engineering polymers and the need for production expansion. Strategic initiatives, such as new product launches and regulatory changes, are also expected to impact the market's growth trajectory.

Polyolefins offer several advantages over conventional materials, including their ease of processing, versatility, and low cost. They are used in various industries, including construction, furniture, and electronics, among others. The market for these materials is expected to continue growing, driven by various factors, including the increasing demand for sustainable engineering polymers and the need for production expansion. Polyolefins are essential materials in various industries, offering several advantages over conventional materials. Their lightweight properties make them ideal for the automotive sector, while their durability and weather resistance make them a preferred choice for the construction industry. Their versatility and ease of processing make them a popular choice in various industries, including electronics, healthcare, and packaging. The global market for polyolefins is expected to continue growing, driven by various factors, including the increasing demand for sustainable engineering polymers and the need for production expansion.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

184 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 8.09% |

|

Market growth 2024-2028 |

USD 151.2 billion |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

7.32 |

|

Key countries |

US, China, UK, Germany, and Japan |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polyolefin Market Research and Growth Report?

- CAGR of the Polyolefin industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across North America, APAC, Europe, South America, and Middle East and Africa

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polyolefin market growth of industry companies

We can help! Our analysts can customize this polyolefin market research report to meet your requirements.