Polypropylene Market Size 2025-2029

The polypropylene market size is forecast to increase by USD 28.6 billion at a CAGR of 4% between 2024 and 2029.

- The market is driven by the surging demand for packaging applications due to its lightweight, durable, and versatile properties. This trend is further fueled by the increasing consumer preference for convenient and eco-friendly packaging solutions. Another significant development in the market is the emergence of bio-based polypropylene, derived from renewable resources, which is gaining traction due to its sustainability benefits. Producers must address these concerns through innovation and the adoption of circular economy principles to ensure long-term growth and competitiveness.

- Companies can capitalize on the market's potential by focusing on research and development of eco-friendly polypropylene alternatives and implementing sustainable production processes. Additionally, strategic collaborations and partnerships can help companies navigate the competitive landscape and stay ahead of industry trends. However, the market faces challenges from the harmful effects of polypropylene on the environment, particularly its contribution to plastic waste and pollution.

What will be the Size of the Polypropylene Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

In the dynamic market, quality assurance plays a pivotal role in ensuring the production of superior yarns through rigorous testing methods such as thermogravimetric analysis and differential scanning calorimetry. These tests provide valuable insights into fiber properties like heat deflection temperature, melt flow rate, and crystallinity, which significantly impact product performance. Sheet extrusion and injection molding machines are essential tools in producing high-quality polypropylene sheets and parts, respectively. This versatile plastic's applications span across numerous sectors, including automotive parts, consumer goods, medical devices, packaging films, and more. Flexural testing and impact testing are crucial in evaluating the mechanical properties of these products. Nonwoven manufacturing processes employ various testing techniques, including tensile testing and Vicat softening point determination, to ensure optimal product performance.

Syndiotactic polypropylene, with its unique properties, is gaining popularity in various applications due to its superior heat resistance and improved impact strength. Intellectual property protection is essential in the competitive market, with companies investing in research and development to create innovative solutions. Gas chromatography and nuclear magnetic resonance are essential tools in material characterization, ensuring the production of isotactic and atactic polypropylene with consistent quality. Mold design and application development are ongoing processes in the polypropylene industry, with continuous efforts to optimize production processes and expand the range of applications for this versatile material. Spinning machines play a crucial role in fiber manufacturing, ensuring the production of high-quality polypropylene fibers for various industries.

How is this Polypropylene Industry segmented?

The polypropylene industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Homopolymer

- Copolymer

- Application

- Injection molding

- Extrusion molding

- Blow molding

- Others

- Product Type

- Fiber

- Film and sheet

- Raffia

- Others

- Geography

- North America

- US

- Europe

- France

- Germany

- UK

- APAC

- Australia

- China

- India

- Japan

- South Korea

- Rest of World (ROW)

- North America

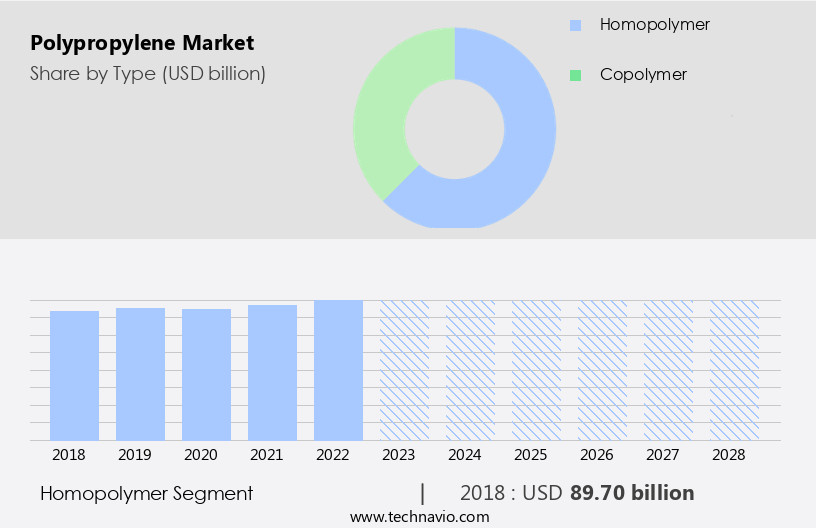

By Type Insights

The Homopolymer segment is estimated to witness significant growth during the forecast period. The homopolymer segment dominates the market due to its wide range of applications and cost-effectiveness. With exceptional mechanical properties and ease of processing, this segment holds a significant market share. In packaging applications, homopolymer polypropylene is extensively used in producing films, containers, and bottles, owing to its high heat resistance and chemical resistance. The automotive industry also relies on homopolymer polypropylene for manufacturing interior components, such as dashboards and door panels, because of its durability and resistance to corrosion. The construction sector utilizes homopolymer polypropylene for pipes and fittings due to its long-lasting nature.

The manufacturing processes for polypropylene involve melt spinning for producing fibers and melt processing for creating various forms, such as injection molding. The use of reinforcement agents, glass fibers, carbon fibers, aramid fibers, and reinforcing agents enhances the material's mechanical properties, including tensile strength, impact resistance, and flexural strength. Polymer additives, such as UV stabilizers and flame retardants, are incorporated to improve the material's chemical properties and ensure safety standards. Furthermore, advancements in packaging technology, including enhanced barrier properties and customization capabilities, are making polypropylene a popular choice for various applications, including food packaging, pharmaceuticals, and consumer goods.

Injection molding is a common processing method for creating complex parts with high precision and consistency. Polypropylene is widely used in consumer goods, medical applications, textile applications, and building and construction industries due to its versatility and excellent properties. The material's resistance to chemicals, heat, and impact makes it an ideal choice for various applications, including electrical applications and automotive components. The ongoing research and development efforts in the polypropylene industry aim to improve the material's properties and expand its applications, further driving market growth.

The Homopolymer segment was valued at USD 92.20 billion in 2019 and showed a gradual increase during the forecast period.

The global Polypropylene Market is growing steadily, driven by demand in diverse sectors like textiles, packaging, and automotive. Isotactic polypropylene is the most commercially significant variant due to its excellent strength and crystallinity. It's widely used in processes like injection molding machine operations to produce precision components. In the textile sector, spinning machines play a crucial role in transforming polypropylene into threads for yarn manufacturing and eventually fabric manufacturing. Additionally, film extrusion techniques are increasingly utilized for packaging applications, offering lightweight and high-strength solutions. Its unique structure ensures durability and resistance to moisture, enhancing its value in automotive interiors and protective packaging.

The circular economy concept plays a crucial role in the polypropylene industry, with a focus on waste management and recycling. Life cycle assessments are conducted to minimize the carbon footprint and promote sustainable manufacturing processes. The selection of appropriate grades and molecular weights is essential for optimizing the material's properties for various applications. The supply chain is streamlined to ensure quality control and maintain consistency in the final product's properties. Polypropylene resins are produced using various manufacturing processes, including gas phase, slurry, and solution processes. The material's properties, such as melt flow index, thermal stability, and physical properties, vary depending on the manufacturing process and the presence of additives.

Regional Analysis

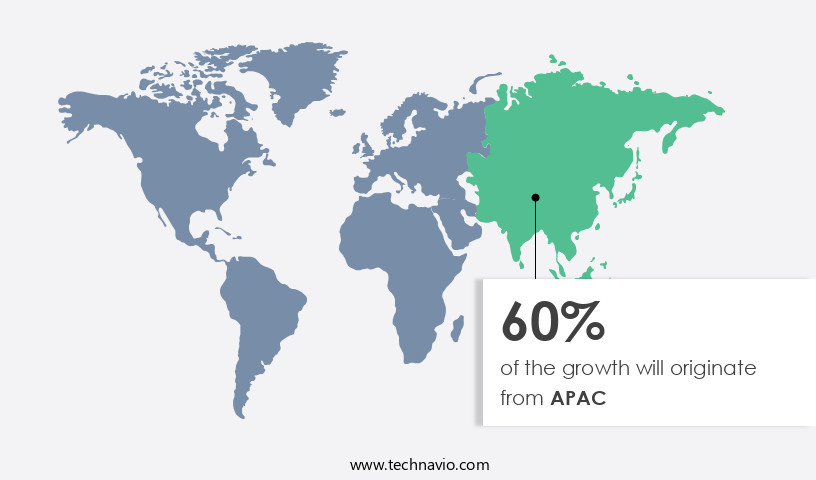

APAC is estimated to contribute 59% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The APAC market is experiencing significant growth due to increasing demand from various industries, particularly automotive, packaging, and construction. As the world's largest consumer of polypropylene, APAC's thriving industries, coupled with urbanization and rising disposable incomes, fuel the demand for lightweight and durable polypropylene products. In the automotive sector, polypropylene is utilized extensively for interior components, reducing vehicle weight and enhancing fuel efficiency. In the packaging industry, it is used for flexible packaging and containers. Sustainability trends are shaping the APAC market, with a growing preference for recycled and eco-friendly polypropylene goods. The material's chemical resistance, impact resistance, and high melt flow index make it suitable for various applications.

Manufacturing processes, such as melt spinning and injection molding, enable the production of composite materials and fiber reinforcement. Polypropylene resins, with their unique physical properties, are essential in building and construction, automotive applications, electrical applications, and textile applications. The market's evolution includes the use of additives like flame retardants, UV stabilizers, and carbon fibers to enhance material properties. Waste management and life cycle assessment are crucial considerations in the production and consumption of polypropylene, ensuring safety standards and quality control.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the Polypropylene market drivers leading to the rise in the adoption of Industry?

- The packaging market is driven primarily by the rising demand for efficient and effective packaging solutions from various industries. The market is experiencing significant growth due to the increasing demand for efficient packaging solutions, particularly in the e-commerce sector. This trend is driven by the rise in online shopping, which necessitates materials that can effectively address logistical challenges. At the same time, there is a growing emphasis on sustainable packaging solutions, as regulatory measures, such as bans on single-use plastics, encourage industries to adopt eco-friendly materials. The market is witnessing an upward trend in the use of biodegradable and recycled polypropylene, catering to consumer preferences for sustainable options.

- Polypropylene resins are known for their impact resistance and UV stabilizers, which preserve material properties during processing and use. Manufacturing processes, such as fiber reinforcement through melt spinning and the production of composite materials, further augment the mechanical properties of polypropylene, making it a versatile material for numerous industries. The increasing demand for lightweight, long-lasting materials across various industries fuels the popularity of homopolymers, making it a preferred choice and boosting its demand in the market.

What are the Polypropylene market trends shaping the Industry?

- The emergence of bio-based polypropylenes is a significant market trend, gaining increasing attention in the plastics industry due to growing consumer demand for eco-friendly alternatives. Bio-based polypropylenes offer reduced carbon footprints and enhanced sustainability, making them an attractive choice for businesses seeking to meet environmental regulations and consumer preferences. The market is experiencing significant shifts due to increasing environmental concerns and consumer preferences. The awareness of healthier lifestyles and the need for sustainable manufacturing processes are driving the demand for safer and renewable alternatives to fossil fuel-derived polypropylene. This trend is propelling manufacturers to explore bio-based feedstocks, such as sugarcane-derived ethanol, corn, and soybean, for the production of polypropylene.

- Moreover, the production of bio-based polypropylene has a lower carbon footprint, making it an attractive option for waste management and eco-conscious consumer goods, medical applications, and textile industries. A life cycle assessment (LCA) of bio-based polypropylene reveals its potential to reduce greenhouse gas emissions by up to 70% compared to petroleum-based polypropylene. Additionally, the use of polymer additives can further enhance the performance and durability of bio-based polypropylene. With the commercialization of bio-based polypropylene from sugarcane-derived ethanol imminent, the market is expected to witness significant growth in the near future. Another factor fueling this shift is the volatility in the price of petroleum-based chemicals. Bio-based polypropylene offers several advantages, including similar physical properties, such as tensile strength and flexural strength, to their synthetic counterparts.

How does Polypropylene market face challenges during its growth?

- The growth of the industry is negatively impacted by the harmful effects of polypropylene, a common challenge that necessitates continuous research and innovation to mitigate its potential risks. Polypropylene, a thermoplastic material, is widely used in various industries due to its desirable chemical properties. However, concerns regarding its potential health hazards have emerged. Endocrine disruption is a significant issue associated with polypropylene, as it can interact with hormones in the body and cause an imbalance, potentially leading to tumor growth in the breast, uterus, or prostate. Moreover, during the manufacturing process, volatile organic compounds (VOCs) may outgas from polypropylene, posing health risks.

- In the automotive sector, carbon fibers reinforced with polypropylene are utilized for their strength and lightweight properties in various applications. Furthermore, polypropylene is employed in electrical applications due to its thermal stability and resistance to electricity. Aramid fibers, a high-performance material, are also reinforced with polypropylene for enhanced durability and strength. Despite these benefits, it is crucial to address the environmental and health concerns associated with polypropylene to ensure its continued use in a sustainable and responsible manner. Additionally, the production of polypropylene involves the use of hydrocarbon fuels, contributing to unsustainable manufacturing practices. In industries such as building and construction, polypropylene fibers are used as reinforcing agents.

Exclusive Customer Landscape

The polypropylene market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the polypropylene market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, polypropylene market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

BASF SE - The company specializes in the production and supply of polypropylene, including Neopolen foam, utilized extensively in the automotive, packaging, and construction sectors.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- BASF SE

- Borealis AG

- Braskem SA

- Ducor Petrochemicals B.V.

- Exxon Mobil Corp.

- Formosa Plastics Corp.

- Haldia Petrochemicals Ltd.

- HPCL-Mittal Energy Ltd.

- Indian Oil Corp. Ltd.

- INEOS Group Holdings S.A.

- Koch Industries Inc.

- LyondellBasell Industries NV

- Mitsubishi Chemical Group Corp.

- Mitsui Chemicals Inc.

- Reliance Industries Ltd.

- Saudi Basic Industries Corp.

- Saudi Polymers LLC

- Sinopec Shanghai Petrochemical Co. Ltd.

- TotalEnergies SE

- Westlake Plastics Co.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Polypropylene Market

- In January 2024, LyondellBasell Industries N.V., a leading polypropylene (PP) producer, announced the successful start-up of its new 450,000 metric tonnes per annum (mtpa) PP plant in the United States. This expansion underscores the company's commitment to meeting the growing demand for PP and strengthening its market position (LyondellBasell press release, January 10, 2024).

- In March 2024, INEOS Styrolution, the world's leading styrenics supplier, and TotalEnergies, a major energy player, signed a strategic collaboration agreement to jointly develop and commercialize innovative solutions based on PP and other polymers. This partnership aims to enhance their combined competitiveness and address the evolving market requirements (INEOS Styrolution press release, March 15, 2024).

- In May 2024, Braskem, the largest biopolymer producer in the Americas, completed the acquisition of Ineos Oxide's PP business. This deal significantly expanded Braskem's PP capacity and broadened its product portfolio, making it a more comprehensive solutions provider in the market (Braskem press release, May 12, 2024).

- In January 2025, Covestro AG, a leading polymer manufacturer, obtained regulatory approval from the European Commission for its new PP production site in Poland. This investment will create an annual capacity of 750,000 mtpa, making Covestro a major player in the European PP market (Covestro press release, January 26, 2025).

Research Analyst Overview

Polypropylene (PP), a versatile thermoplastic, continues to garner attention in various sectors due to its evolving market dynamics. Its applications span waste management, tensile strength in textiles, injection molding in consumer goods, medical applications, and flexural strength in building and construction. The ongoing unfolding of market activities reveals a focus on enhancing PP's carbon footprint reduction through circular economy initiatives and product design. Melt flow index and molecular weight play crucial roles in grade selection, ensuring optimal processing temperature and safety standards. PP's chemical resistance and impact resistance make it a preferred choice for automotive applications, electrical components, and composite materials.

The integration of glass fibers, carbon fibers, and reinforcing agents further bolsters its mechanical properties. Polymer additives, such as UV stabilizers and flame retardants, expand PP's applications in diverse industries. Raw material sourcing and quality control remain essential components of the supply chain, ensuring consistent material properties. In the textile industry, PP fibers exhibit superior tensile strength and flexibility, while in the medical field, they offer biocompatibility and sterilizability. The continuous evolution of PP's physical properties, such as high melt flow index and excellent thermal stability, fuels its adoption in various sectors. The unfolding market activities underscore the importance of understanding the intricacies of PP's manufacturing processes, from melt spinning to fiber reinforcement, to fully harness its potential.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Polypropylene Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

214 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4% |

|

Market growth 2025-2029 |

USD 28.6 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

3.8 |

|

Key countries |

China, US, India, Japan, South Korea, Germany, Australia, UK, France, and Saudi Arabia |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Polypropylene Market Research and Growth Report?

- CAGR of the Polypropylene industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, Europe, North America, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the polypropylene market growth of industry companies

We can help! Our analysts can customize this polypropylene market research report to meet your requirements.