Power And Control Cables Market Size 2025-2029

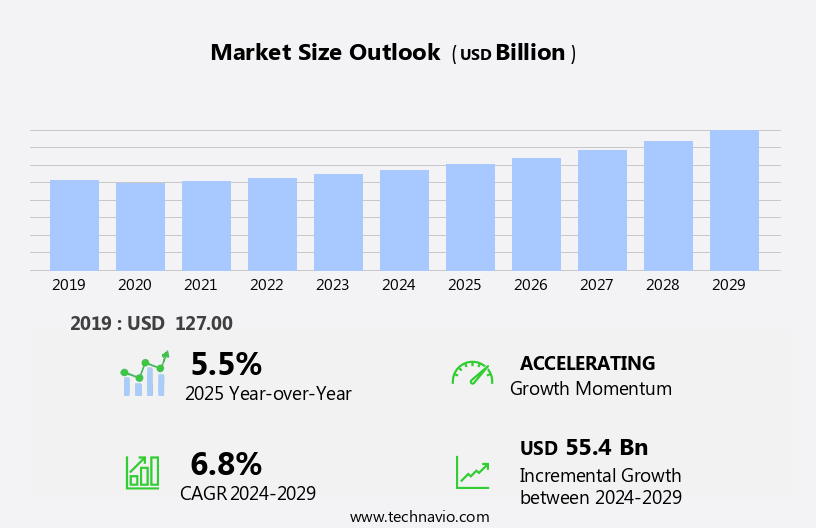

The power and control cables market size is forecast to increase by USD 55.4 billion, at a CAGR of 6.8% between 2024 and 2029.

- The market is experiencing significant growth, driven primarily by the increasing demand from the renewable energy sector. Renewable energy sources, such as wind and solar, are becoming increasingly prevalent, leading to a surge in the requirement for power and control cables to transmit and distribute electricity efficiently. This trend is expected to continue as governments and businesses worldwide invest heavily in renewable energy infrastructure. Another key driver for the market is the growing focus on sustainability. As the world shifts towards more eco-friendly solutions, there is a rising demand for energy-efficient and environmentally friendly power and control cables. Manufacturers are responding to this trend by developing advanced cable technologies that offer improved performance, durability, and reduced carbon footprint.

- However, the market also faces several challenges. Strict regulation is a significant obstacle, with stringent safety and environmental standards limiting the use of certain materials and manufacturing processes. Additionally, the increasing complexity of power and control systems is making it more challenging to design and manufacture cables that meet the specific requirements of various industries. Despite these challenges, companies that can navigate the regulatory landscape and innovate to meet the evolving needs of their customers stand to gain a competitive edge in the market.

What will be the Size of the Power And Control Cables Market during the forecast period?

Explore in-depth regional segment analysis with market size data - historical 2019-2023 and forecasts 2025-2029 - in the full report.

Request Free Sample

The market continues to evolve, driven by the dynamic needs of various sectors. Cable strain relief, cable trays, cable testing, cable glands, flame retardancy, cable lugs, building automation, grid infrastructure, oil resistance, and moisture resistance are integral components of this market. Power distribution systems require cable solutions with high temperature ratings, voltage ratings, and cable termination capabilities for efficient energy transfer. Cable management, cable pulling, and cable installation are crucial for effective cable organization and deployment. Industrial automation and data centers rely on cable assemblies, wire harnesses, and electrical control systems for seamless operation. Renewable energy projects necessitate cable routing and cable documentation to ensure optimal performance.

Cable marking, cable labeling, and cable sizing are essential for cable identification and cable bundling. Cable solutions must meet diverse requirements, including abrasion resistance, chemical resistance, and UV resistance. Applications in oil & gas, renewable energy, and other industries necessitate cable ducting, cable support, and cable documentation. The market's continuous unfolding is shaped by evolving industry standards, technological advancements, and the growing demand for reliable and efficient power and control cable solutions.

How is this Power And Control Cables Industry segmented?

The power and control cables industry research report provides comprehensive data (region-wise segment analysis), with forecasts and estimates in "USD billion" for the period 2025-2029, as well as historical data from 2019-2023 for the following segments.

- Type

- Power cable

- Control cable

- Application

- Industrial

- Utility

- Geography

- North America

- US

- Canada

- Europe

- France

- Germany

- UK

- APAC

- China

- India

- Japan

- South Korea

- South America

- Brazil

- Rest of World (ROW)

- North America

.

By Type Insights

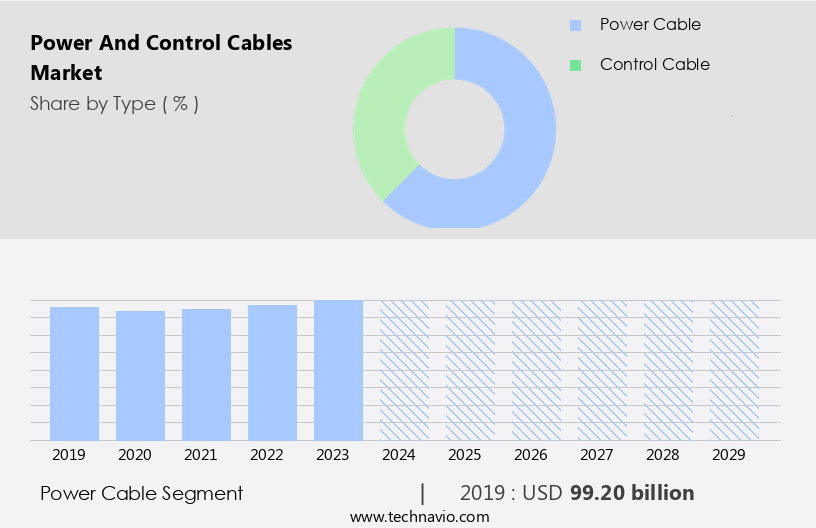

The power cable segment is estimated to witness significant growth during the forecast period.

The market encompasses various segments, with power cables holding a substantial role due to their indispensable function in transmitting and distributing electrical energy. Power cables are instrumental in numerous sectors, including residential, commercial, industrial, and renewable energy. Notably, the successful commissioning of Prysmian Group's inter-array cable system for the Fecamp offshore wind farm in December 2023 underscores the significance of power cables. This project, situated in the English Channel, features 71 wind turbine generators with a combined capacity of nearly 500 MW. Power cables are subjected to rigorous conditions, necessitating specifications such as flame retardancy, oil resistance, moisture resistance, temperature rating, voltage rating, and cable termination.

Cable management, cable installation, and cable documentation are essential for ensuring optimal performance and safety. In the industrial automation and data center sectors, wire harnesses, cable bundling, and cable marking are crucial for efficient cable routing and identification. Building automation and grid infrastructure applications require cable glands and cable lugs for secure cable termination, while cable trays facilitate cable support and cable ducting. Cable assemblies are essential for various applications, including electrical control systems and oil & gas industries. Cable sizing and chemical resistance are essential considerations for ensuring cable durability and reliability. Uv resistance and abrasion resistance are vital for outdoor cable applications, while renewable energy applications require cables with high voltage rating and cable bundling for efficient power transmission.

Cable labeling and cable identification are crucial for maintaining cable organization and traceability. Power cables play a vital role in various industries, with the market witnessing continuous advancements in cable technology to cater to evolving application requirements.

The Power cable segment was valued at USD 99.20 billion in 2019 and showed a gradual increase during the forecast period.

Regional Analysis

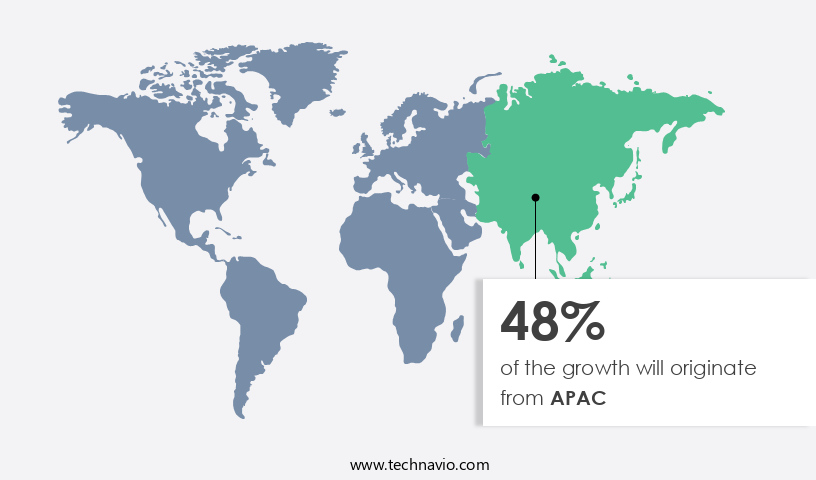

APAC is estimated to contribute 48% to the growth of the global market during the forecast period. Technavio's analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period.

The market in the APAC region is experiencing significant growth due to increasing urbanization and industrialization, leading to a rising demand for a reliable electricity supply. KEI Industries, a key player in the industry, recently expanded its retail presence in India to cater to this demand. The company's product portfolio includes a wide range of wires and cables, from 1 KV to 400 KV, suitable for various applications and industries. This strategic move aims to tap into the growing demand for electrical infrastructure in India, driven by urban development and government initiatives for electrification in rural areas. Power and control cables are essential components of electrical infrastructure, with various applications in building automation, grid infrastructure, industrial automation, data centers, renewable energy, and more.

These cables come in different sizes, voltage ratings, temperature ratings, and material properties, such as oil resistance, moisture resistance, flame retardancy, abrasion resistance, and chemical resistance. Cable management practices, including cable routing, cable labeling, and cable documentation, are crucial for ensuring the efficient and safe use of power and control cables. Cable testing, cable termination, and cable installation are also critical aspects of the industry, ensuring the cables meet the required standards and specifications. KEI Industries' expansion in India reflects the market's evolving trends, with a focus on providing reliable and high-performance cables for various applications and industries. The demand for power and control cables is expected to continue growing, driven by the increasing adoption of electrical control systems, renewable energy, and industrial automation.

Market Dynamics

Our researchers analyzed the data with 2024 as the base year, along with the key drivers, trends, and challenges. A holistic analysis of drivers will help companies refine their marketing strategies to gain a competitive advantage.

What are the key market drivers leading to the rise in the adoption of Power And Control Cables Industry?

- The renewable energy sector's escalating demand serves as the primary market driver.

- The market is witnessing substantial growth, primarily due to the increasing demand from the renewable energy sector. A significant development in this regard is the recent USD468.33 million financing contract signed in July 2024 between the European Investment Bank (EIB) and a leading cable manufacturer. This investment aims to enhance electricity transmission and distribution across Europe, contributing significantly to the clean energy targets of the European Union. Under the terms of the agreement, the cable manufacturer will expand its production capacity for extruded cables at its facilities in Finland, Italy, and France. This expansion will result in a significant increase in production capacity from approximately 2,000 kilometers per year to over 4,000 kilometers per year.

- Power and control cables are essential components in the transmission and distribution of electricity. Their demand is driven by various factors, including the growing need for cable bundling, surge protection, chemical resistance, and abrasion resistance. Renewable energy projects, particularly wind and solar, require large quantities of power and control cables due to their distributed nature and intermittent power generation. Cable marking and identification are also crucial aspects of the market. Proper cable identification and sizing ensure safe and efficient installation, maintenance, and operation of electrical systems. With the increasing complexity of electrical systems, cable identification and marking have become essential to prevent cable misidentification and ensure system reliability.

- In conclusion, the market is experiencing significant growth, driven primarily by the renewable energy sector. The recent EIB financing contract is a testament to this trend, highlighting the importance of power and control cables in enabling the transition to clean energy. The market is expected to continue its growth trajectory, driven by the increasing demand for cable bundling, surge protection, chemical resistance, and abrasion resistance, as well as the need for cable marking and identification.

What are the market trends shaping the Power And Control Cables Industry?

- Sustainability is an increasingly significant market trend that warrants greater focus. Professionals are increasingly prioritizing sustainable practices in their industries.

- The market is witnessing significant focus on sustainability, driven by the global transition towards decarbonized energy systems. Companies are prioritizing extended product life cycles, promoting reuse, and enhancing recycling processes to foster a circular economy. This approach reduces the dependence on virgin resources and minimizes the carbon footprint linked to electrification. For instance, Nexans, a leading player, has initiated a sustainable cycle for its products. This involves thorough cable sorting and recovery processes, partly executed through a joint venture with a waste management company in France. Cable design considerations include cable strain relief, cable trays, cable testing, cable glands, flame retardancy, cable lugs, and moisture resistance.

- These features ensure the durability and functionality of power and control cables in various applications, such as building automation and grid infrastructure. Moreover, oil resistance is a crucial factor for cables used in harsh industrial environments. These cables must withstand exposure to petroleum products and resist electrical failure due to oil contamination. In conclusion, the market is evolving to meet the demands of a sustainable and efficient energy future. Companies are investing in advanced technologies and collaborations to create innovative solutions that prioritize sustainability and reliability.

What challenges does the Power And Control Cables Industry face during its growth?

- The stringent regulatory environment poses a significant challenge to the expansion and growth of the industry.

- The market is subject to intricate regulatory frameworks, with compliance to multiple sets of national regulations being mandatory in many countries. These regulations, derived from IEC 60364 guidelines for low-voltage electrical installations, influence the design, production, and installation processes. Adherence to these regulations can be complex and time-consuming, necessitating a thorough understanding of local requirements before initiating any project. Key factors impacting the market include voltage rating, temperature rating, cable pulling, cable management, cable termination, cable support, cable ducting, and cable installation. Voltage rating determines the maximum voltage that a cable can safely carry, while temperature rating specifies the maximum operating temperature.

- Cable pulling refers to the process of pulling cables through conduits or cable trays, and cable management involves organizing and protecting cables to ensure efficient use of space and prevent damage. Cable termination is the process of connecting the ends of cables to other components, while cable support refers to the means of suspending or securing cables to prevent sagging or damage. Cable ducting involves enclosing cables in protective conduits, and cable installation is the process of laying down and connecting cables to various electrical components. Manufacturers and installers must navigate these factors while adhering to local regulations, ensuring the production and installation of high-quality power and control cables that meet the specific requirements of each project.

- This complexity adds layers of planning and execution to power and control cable projects, making it essential for industry professionals to stay informed and up-to-date with the latest regulations and market trends.

Exclusive Customer Landscape

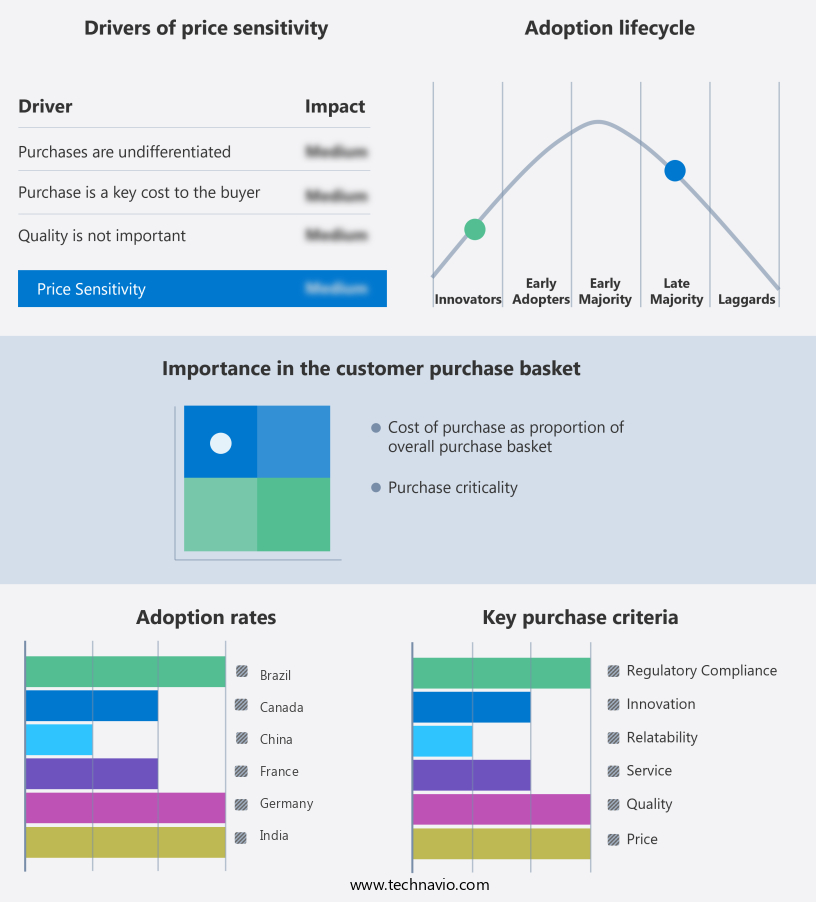

The power and control cables market forecasting report includes the adoption lifecycle of the market, covering from the innovator's stage to the laggard's stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the power and control cables market report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, power and control cables market forecast, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the industry.

Bambach Wires and Cables - This company specializes in manufacturing power and control cables, featuring tinned copper conductors for enhanced corrosion resistance.

The industry research and growth report includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Bambach Wires and Cables

- Belden Inc.

- Cabcon India Ltd.

- EL Sewedy Electric Co.

- Furukawa Electric Co. Ltd.

- GLOSTER CABLES LTD.

- HPL Electric and Power Ltd.

- KEI Industries Ltd.

- LS Cable and System Ltd.

- marinocables

- MSD Wired Solutions

- Nexans SA

- Panasonic Holdings Corp.

- Paras Wires Pvt Ltd

- PLAZA CABLES

- Prysmian S.p.A

- Rolycab industries

- Southwire Co. LLC

- Sterlite Power Transmission Ltd.

- V Guard Industries Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key industry players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Recent Development and News in Power And Control Cables Market

- In February 2024, ABB, a leading technology provider, launched its new range of high-performance power and control cables, the Terra KN XLPE, designed for increased durability and energy efficiency in harsh environments (ABB Press Release). This development underscores ABB's commitment to innovation and addressing the growing demand for reliable power and control solutions in various industries.

- In May 2024, Schneider Electric and Siemens announced a strategic partnership to jointly develop and manufacture medium voltage power and control cables, aiming to enhance their product portfolios and cater to the growing renewable energy sector (Schneider Electric Press Release). This collaboration represents a significant shift in the competitive landscape and is expected to strengthen both companies' positions in the market.

Research Analyst Overview

- The market encompasses a diverse range of products, including Ethernet cables, coiled cables, flat cables, and more. Among these, cable fault detection technology is gaining traction, enabling early identification and resolution of cable issues in industrial applications. Instrumentation cables, shielded cables, and sensor cables are integral to the functioning of automation systems and process control. Cable recycling is an emerging trend, offering cost savings and environmental benefits. Welding cables and motor cables are essential for heavy-duty applications, while twisted-pair cables and fiber optic cables cater to data transmission needs. Medium-voltage and high-voltage cables power industrial processes, requiring rigorous cable termination and maintenance practices.

- Flexible cables, actuator cables, and cable splices ensure efficient power transfer in dynamic applications. Round cables, USB cables, HDMI cables, and signal cables cater to various end-user requirements. Grounding cables play a crucial role in electrical safety, while cable connectors ensure reliable signal transmission. Cable disposal and replacement are ongoing concerns, necessitating effective cable management strategies. Overall, the market is dynamic, with continuous advancements in technology driving innovation and growth. Cable manufacturers must adapt to evolving market demands, focusing on product quality, reliability, and sustainability.

Dive into Technavio's robust research methodology, blending expert interviews, extensive data synthesis, and validated models for unparalleled Power And Control Cables Market insights. See full methodology.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

197 |

|

Base year |

2024 |

|

Historic period |

2019-2023 |

|

Forecast period |

2025-2029 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 6.8% |

|

Market growth 2025-2029 |

USD 55.4 billion |

|

Market structure |

Fragmented |

|

YoY growth 2024-2025(%) |

5.5 |

|

Key countries |

China, US, India, Japan, Germany, UK, South Korea, Canada, France, and Brazil |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

What are the Key Data Covered in this Power And Control Cables Market Research and Growth Report?

- CAGR of the Power And Control Cables industry during the forecast period

- Detailed information on factors that will drive the growth and forecasting between 2025 and 2029

- Precise estimation of the size of the market and its contribution of the industry in focus to the parent market

- Accurate predictions about upcoming growth and trends and changes in consumer behaviour

- Growth of the market across APAC, North America, Europe, Middle East and Africa, and South America

- Thorough analysis of the market's competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the power and control cables market growth of industry companies

We can help! Our analysts can customize this power and control cables market research report to meet your requirements.