Power Drill Market Size 2024-2028

The power drill market size is forecast to increase by USD 405.9 million, at a CAGR of 4.5% between 2023 and 2028. The market is experiencing significant growth, driven by increased innovations in power drill technology. Advanced features such as brushless motors, cordless functionality, and improved ergonomics are becoming increasingly popular among consumers. The advent of cordless power drills, offering greater mobility and convenience, has led to a shift away from traditional corded models. However, high maintenance costs associated with cordless drills, particularly in terms of battery replacement, pose a challenge to market growth. Overall, the market is expected to continue expanding, fueled by consumer demand for efficient, powerful, and versatile tools.

What will be the Size of the Market During the Forecast Period?

For More Highlights About this Report, Request Free Sample

Market Dynamic and Customer Landscape

The market has experienced significant growth in recent years, particularly in the DIY segment and the commercial automotive sector. Lockdowns due to the global pandemic have led to an increase in home improvement projects, driving demand for cordless Power Drills. Key players in the market include Bosch, Dewalt, Stanley Black & Decker, and others. Their Flexvolt battery and Li-ion batteries have been influential in the market's growth. Technological features such as Extreme protection technology and mobility have been emphasized in new product launches. The market is diverse, catering to various applications on Walls, Surfaces, and for Nails and Screws. PEST analysis reveals that the Demand side is driven by DIY trends and the Supply side is influenced by advancements in battery technology. Cordless Power Drills have gained popularity due to their convenience and rechargeable batteries. Brands like Bosch, Dewalt, and Stanley Black & Decker offer a range of Cordless Power Drills with advanced technological features. The markets continue to evolve, offering consumers efficient and reliable solutions for their home improvement and commercial projects.

Key Market Driver

Increased innovations in power drills through advanced technologies is notably driving market growth. The market has witnessed significant advancements in response to the evolving needs of consumers in various sectors, including the automotive industry and DIY applications. Lockdowns and mobility restrictions have led to an increase in demand for cordless power tools and electric fastening devices for construction and manufacturing projects. Market competitors, such as Hilti, Panasonic, Stanley Black and Decker, Robert Bosch, and Techtronic Industries, have responded by introducing technologically advanced power drills with features like variable speed, LED spotlights, and Li-ion rechargeable batteries.

For instance, Makita's power drills incorporate extreme protection technology (XPT) for enhanced resistance to dust and water in harsh job site conditions. PEST analysis reveals that regulations and industry landscape are key factors shaping the market. Organic growth strategies, such as product innovation and improved technological features, and inorganic growth strategies, like mergers and acquisitions, are driving market competition. Traditional power drills, including impact and corded models, continue to coexist with their cordless counterparts, with the latter gaining popularity due to their mobility and lower maintenance costs. Thus, such factors are driving the growth of the market during the forecast period.

Significant Market Trends

The advent of cordless power drills is the key trend in the market. The market has experienced significant growth in recent years, particularly in the cordless power drill segment. This trend is driven by the increasing demand for mobility and convenience in various sectors, including the automotive industry for passenger and commercial cars, and the DIY market. Manufacturers such as Bosch, Dewalt, Stanley Black & Decker, and others are shifting their focus towards cordless power drills, which utilize advanced technological features and extreme protection technology, along with rechargeable lithium-ion batteries. The corded power drills market is witnessing a decline due to the numerous advantages of cordless power drills, including portability, no requirement for a power supply, and lower maintenance costs. The market landscape is undergoing significant changes, with regulations playing a crucial role in shaping the industry. PEST analysis reveals that the demand side is being driven by the construction sector's developing needs, while the supply side is being influenced by manufacturing advancements and technology.

Organic growth strategies, such as product innovation and improved customer service, are being adopted by key players to sustain their market position. Inorganic growth strategies, such as mergers and acquisitions, are also being employed to expand market presence. Electric fastening devices, including power drills, are becoming increasingly popular due to their ability to drive nails and screws into various surfaces, such as walls, with ease and precision. The market is expected to continue growing at a CAGR of 6.72% during the forecast period, making it an attractive investment opportunity for businesses and individuals alike. Thus, such trends will shape the growth of the market during the forecast period.

Major Market Challenge

Battery runtime and high maintenance costs associated with cordless power drills is the major challenge that affects the growth of the market. The market has experienced significant changes in recent years, with the shift towards cordless power tools gaining momentum. However, the market growth is not without challenges. One of the major concerns is the battery runtime and high maintenance costs associated with cordless power drills. Users must frequently charge the rechargeable batteries, increasing the overall time spent on drilling operations. The cost of replacing a cordless power drill battery, which is typically over USD60, is comparable to that of a corded power drill. Additionally, cordless power drills have weight, vibration, and noise issues that are more pronounced than their corded counterparts. These challenges may hinder the expansion of the market during the forecast period. In the automotive sector, including passenger and commercial cars, the power tool markets have seen a surge in demand due to the DIY trend.

Companies like Bosch, Dewalt with their Flexvolt battery, Stanley Black & Decker, and others have introduced technological features such as extreme protection technology and Li-ion batteries to cater to the needs of the industry. The market landscape is developing, with regulations playing a crucial role in shaping the industry. Organic growth strategies, such as product innovation and improved performance, and inorganic growth strategies, such as mergers and acquisitions, are being employed by key players to gain a competitive edge. Despite these challenges, the market continues to grow, driven by the increasing demand for electric fastening devices in construction and manufacturing. PEST analysis reveals that technological advancements and mobility are key drivers, while high maintenance costs and regulations pose significant challenges. Hence, the above factors will impede the growth of the market during the forecast period

Customer Landscape

The market forecasting report includes the adoption lifecycle of the market, covering from the innovator’s stage to the laggard’s stage. It focuses on adoption rates in different regions based on penetration. Furthermore, the report also includes key purchase criteria and drivers of price sensitivity to help companies evaluate and develop their market growth analysis strategies.

Customer Landscape

Key Companies & Market Insights

Companies are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market.

Atlas Copco AB - The company offers power drill product named such as EBB26 as battery type, multi speed and wi fi tethering.

The market research and growth report also includes detailed analyses of the competitive landscape of the market and information about key companies, including:

- Apex Tool Group LLC

- C. and E. Fein GmbH

- Chervon Holdings Ltd.

- Emerson Electric Co.

- Enerpac Tool Group Corp.

- Festool GmbH

- Hilti AG

- Husqvarna AB

- Ingersoll Rand Inc.

- Jiangsu Dongcheng M and E Tools Co Ltd

- Josch Group

- Koki Holdings Co. Ltd.

- Makita Corp.

- Nemo Power Tools Ltd.

- Panasonic Holdings Corp.

- Robert Bosch GmbH

- Snap On Inc.

- Stanley Black and Decker Inc.

- Techtronic Industries Co. Ltd.

Qualitative and quantitative analysis of companies has been conducted to help clients understand the wider business environment as well as the strengths and weaknesses of key market players. Data is qualitatively analyzed to categorize companies as pure play, category-focused, industry-focused, and diversified; it is quantitatively analyzed to categorize companies as dominant, leading, strong, tentative, and weak.

Market Segmentation

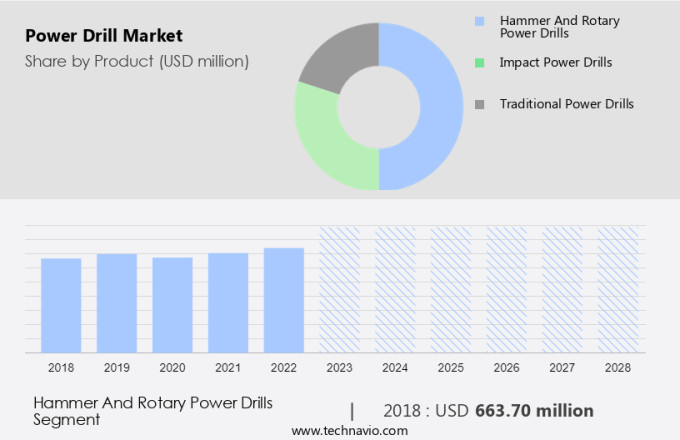

By Product

The hammer and rotary power drills segment is estimated to witness significant growth during the forecast period. The market has witnessed significant growth in the past few years, particularly in the context of Lockdowns, which led to an increase in DIY projects and home improvements. The Automotive sector, including commercial cars and passenger vehicles, has also contributed to the market's development due to the increasing popularity of Cordless Power Drills and Electric fastening devices in Manufacturing and Construction. Technological features such as Extreme protection technology, Li-ion batteries, and Rechargeable batteries have been key drivers in the market's mobility and demand. Bosh Power Drill, Dewalt's Flexvolt battery, Stanley Black & Decker, and other leading brands offer a range of Power Drills with Nails and Screws capabilities for drilling into Walls and Surfaces.

Get a glance at the market share of various regions Download the PDF Sample

The hammer and rotary power drills segment was valued at USD 663.70 million in 2018. Hammer and rotary power drills, with their technological advancements, provide the industry landscape with high-performance tools for drilling into tough materials like brick, concrete, and stone. PEST analysis reveals that the market's Demand side is driven by Organic growth strategies, such as product innovation and customer satisfaction, while the Supply side is influenced by Regulations and Inorganic growth strategies, such as mergers and acquisitions. Despite the high maintenance cost, the market continues to Develop, with Traditional power drills, Impact power drills, and Corded power drills still holding a significant share.

Regional Analysis

For more insights on the market share of various regions Download PDF Sample now!

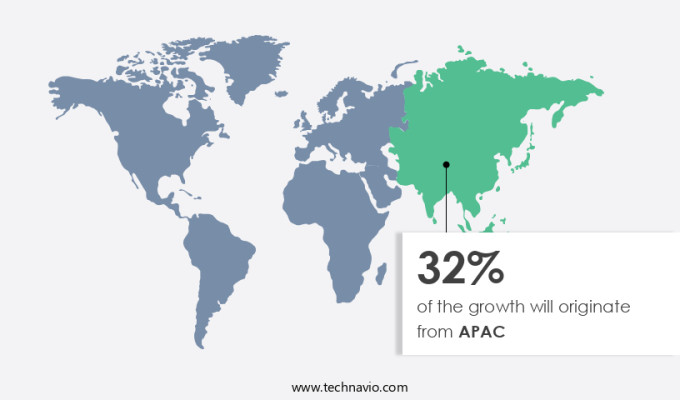

APAC is estimated to contribute 32% to the growth of the global market during the forecast period. Technavio’s analysts have elaborately explained the regional trends and drivers that shape the market during the forecast period. The market is witnessing significant growth due to various strategic initiatives such as acquisitions, partnerships, and collaborations among key players. These strategies enable companies to expand their product offerings, broaden their customer base, and enhance their market presence. Furthermore, customization options have become increasingly important in the market, as manufacturers cater to the unique requirements of different industries and applications. By offering customized solutions, companies can differentiate themselves from competitors and meet the specific needs of their customers. These trends are expected to continue shaping the market in the coming years.

Segment Overview

The market research report provides comprehensive data (region wise segment analysis), with forecasts and estimates in "USD million" for the period 2024 to 2028, as well as historical data from 2018 to 2022 for the following segments.

- Product Outlook

- Hammer and rotary power drills

- Impact power drills

- Traditional power drills

- Technology Outlook

- Cordless power drills

- Corded power drills

- Region Outlook

- North America

- The U.S.

- Canada

- South America

- Chile

- Brazil

- Argentina

- Europe

- U.K.

- Germany

- France

- Rest of Europe

- APAC

- China

- India

- Middle East & Africa

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- North America

You may also interested in below market reports:

- Europe - Power Tools Market by Application and Technology - Forecast and Analysis

- Portable Power Tools Market Analysis North America, Europe, APAC, South America, Middle East and Africa - US, China, Germany, UK, Japan - Size and Forecast

- Power Tool Accessories Market by End-user, Type, and Geography - Forecast and Analysis

Market Analyst Overview

The market has witnessed significant changes in the last few years, with the shift from traditional corded power drills to cordless and rechargeable options. The period of lockdowns due to the global pandemic has led to a surge in DIY projects, boosting the demand for power drills in the residential sector. In the Automotive sector, commercial cars have seen a decline due to the lockdowns. However, the market continues to develop, driven by the demand for cordless power tools and electric fastening devices in the Construction industry. Technological features, such as Extreme protection technology and Li-ion batteries, have been influential in the growth of the market. Brands like Bosh Power drill, Dewalt's Flexvolt battery, Stanley Black & Decker, and others, have emphasized mobility and power in their power drills.

The market landscape is diverse, with regulations playing a crucial role in its growth. PEST analysis reveals that the Demand side is driven by the DIY trend, while the Supply side is influenced by the high maintenance cost and manufacturing technology. Organic growth strategies, such as product innovation and customer satisfaction, and inorganic growth strategies, like mergers and acquisitions, are being employed by key players to stay competitive. The market includes Impact power drills, Corded power drills, and Cordless power drills. Nails and screws are the primary surfaces used with power drills, and walls are a common application area. In conclusion, the market is an evolving industry, with technological advancements and changing market dynamics shaping its future.

|

Market Scope |

|

|

Report Coverage |

Details |

|

Page number |

165 |

|

Base year |

2023 |

|

Historic period |

2018-2022 |

|

Forecast period |

2024-2028 |

|

Growth momentum & CAGR |

Accelerate at a CAGR of 4.5% |

|

Market growth 2024-2028 |

USD 405.9 million |

|

Market structure |

Fragmented |

|

YoY growth 2023-2024(%) |

4.23 |

|

Regional analysis |

North America, Europe, APAC, Middle East and Africa, and South America |

|

Performing market contribution |

APAC at 32% |

|

Key countries |

US, Germany, China, Canada, and France |

|

Competitive landscape |

Leading Companies, Market Positioning of Companies, Competitive Strategies, and Industry Risks |

|

Key companies profiled |

Apex Tool Group LLC, Atlas Copco AB, C. and E. Fein GmbH, Chervon Holdings Ltd., Emerson Electric Co., Enerpac Tool Group Corp., Festool GmbH, Hilti AG, Husqvarna AB, Ingersoll Rand Inc., Jiangsu Dongcheng M and E Tools Co Ltd, Josch Group, Koki Holdings Co. Ltd., Makita Corp., Nemo Power Tools Ltd., Panasonic Holdings Corp., Robert Bosch GmbH, Snap On Inc., Stanley Black and Decker Inc., and Techtronic Industries Co. Ltd. |

|

Market dynamics |

Parent market analysis, Market growth inducers and obstacles, Fast-growing and slow-growing segment analysis, COVID-19 impact and recovery analysis and future consumer dynamics, Market condition analysis for market forecast period |

|

Customization purview |

If our market report has not included the data that you are looking for, you can reach out to our analysts and get segments customized. |

What are the Key Data Covered in this Market Research Report?

- CAGR of the market during the forecast period

- Detailed information on factors that will drive the market growth and forecasting between 2024 and 2028

- Precise estimation of the size of the market and its contribution of the market in focus to the parent market

- Accurate predictions about upcoming market growth and trends and changes in consumer behavior

- Growth of the market across North America, Europe, APAC, Middle East and Africa, and South America

- Thorough analysis of the market’s competitive landscape and detailed information about companies

- Comprehensive analysis of factors that will challenge the growth of market companies